Independent Contractor Agreement For Truck Drivers

Description

How to fill out Independent Contractor Agreement For Truck Drivers?

Individuals commonly link legal documentation with a complicated issue that can solely be handled by an expert.

In a sense, this holds some truth, as formulating an Independent Contractor Agreement For Truck Drivers requires considerable expertise in the relevant criteria, which includes state and county laws.

Nonetheless, with the US Legal Forms, the process has become simpler: a collection of pre-made legal templates for various life and business scenarios tailored to state regulations has been gathered in one online repository and is now accessible to everyone.

Create an account or Log In to continue to the payment screen. Submit payment for your subscription using PayPal or your credit card. Choose the format for your file and click Download. You can print your document or upload it to an online editor for a faster fill-in process. All templates in our library can be reused: once obtained, they are stored in your profile. Access them anytime you require through the My documents tab. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and application area, making the search for an Independent Contractor Agreement For Truck Drivers or any specific template quick and easy.

- Users who have previously registered with an active subscription must Log In to their account and click Download to access the document.

- New users to the platform are required to create an account and subscribe before they can download any paperwork.

- Here is a guide on how to obtain the Independent Contractor Agreement For Truck Drivers.

- Review the page content thoroughly to confirm it satisfies your requirements.

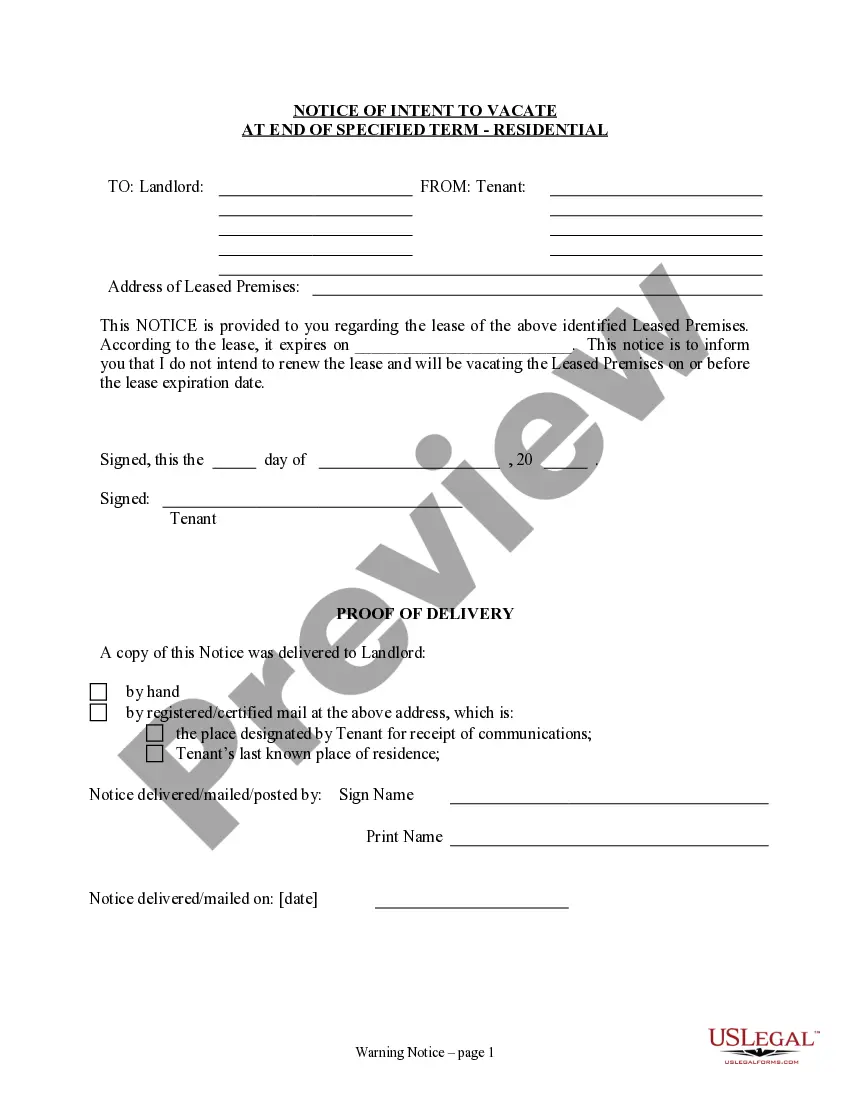

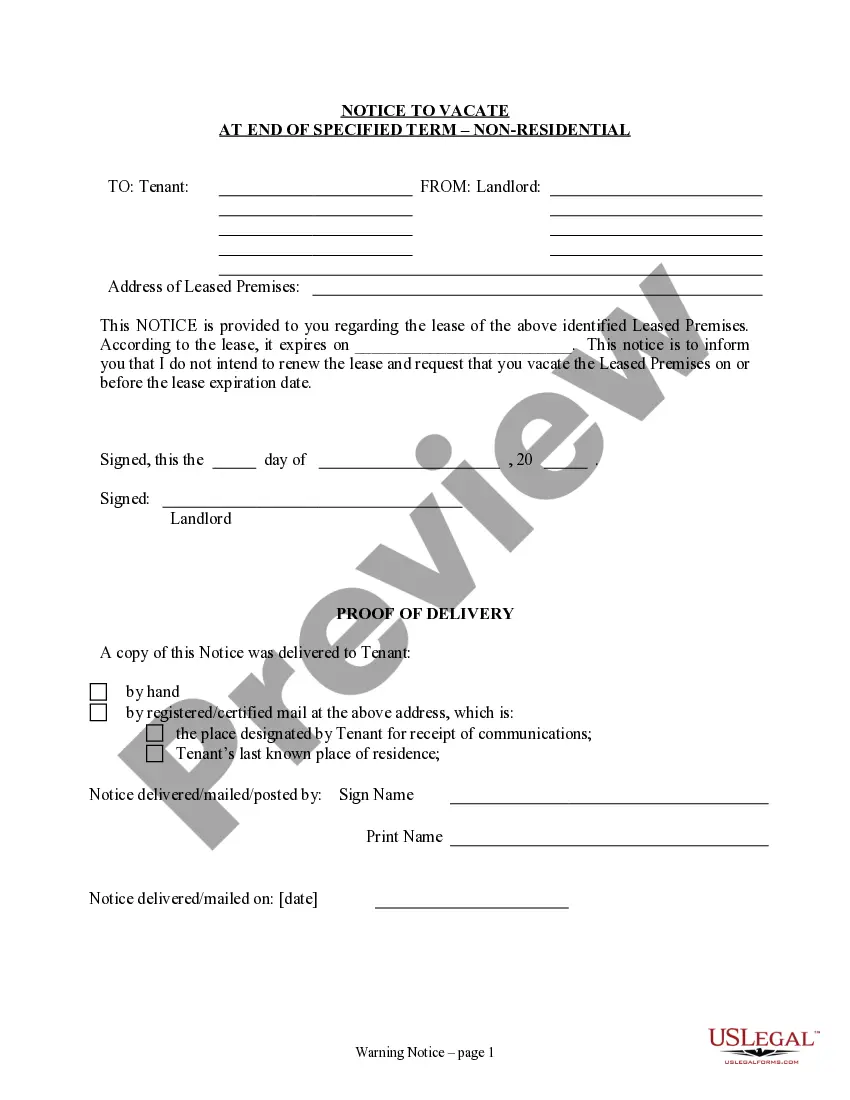

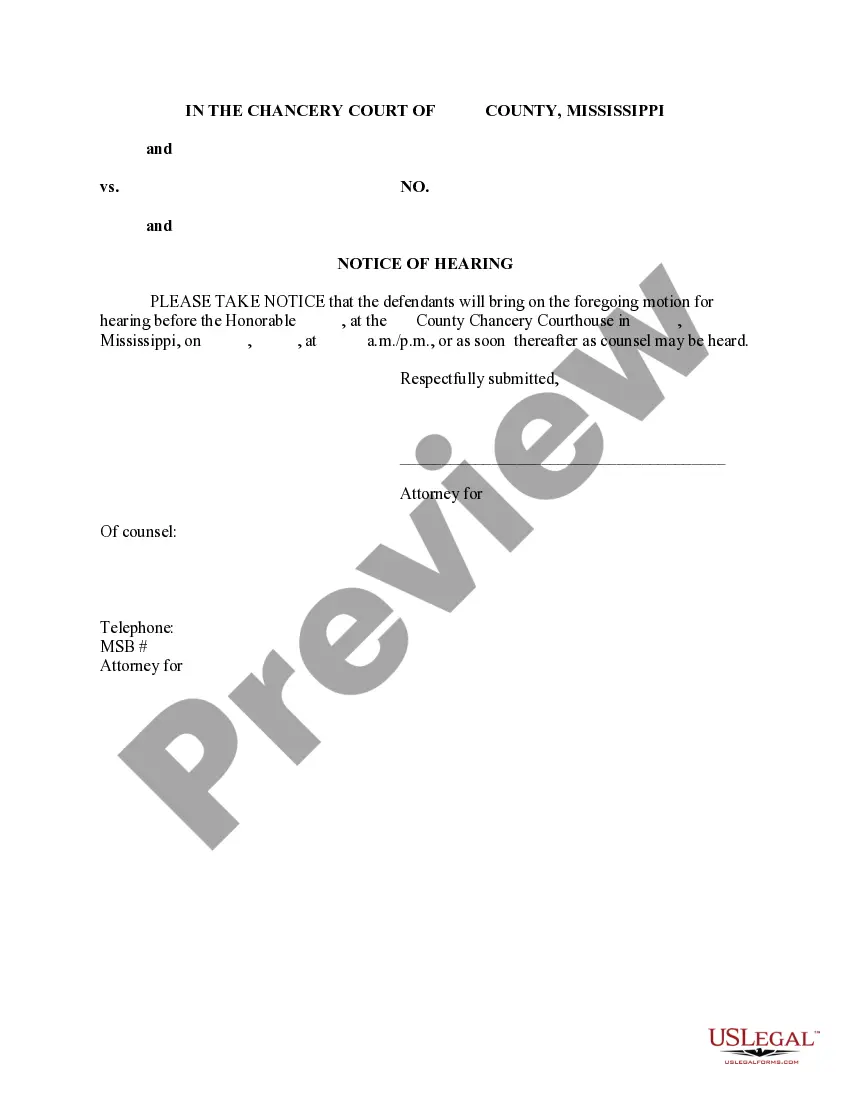

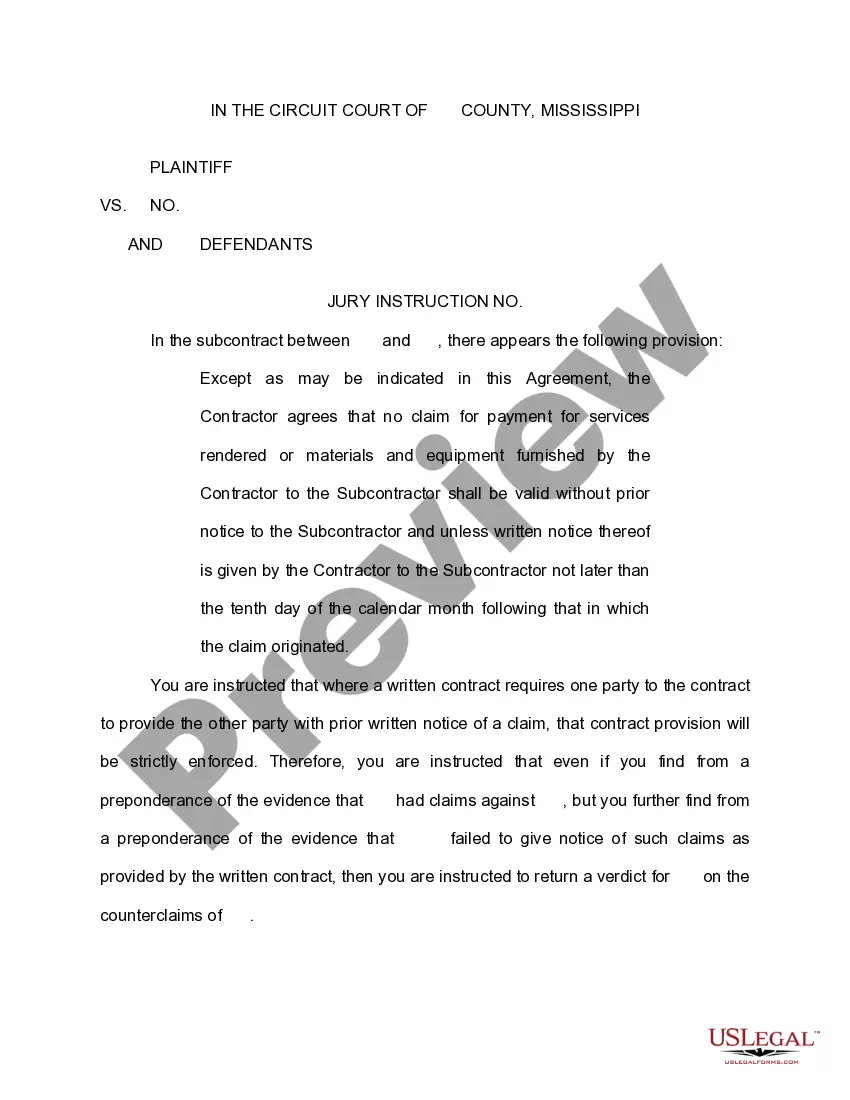

- Examine the form description or check it through the Preview option.

- If the prior document isn't suitable, search for another example using the Search field above.

- When you identify the appropriate Independent Contractor Agreement For Truck Drivers, click Buy Now.

- Select a pricing plan that aligns with your needs and financial capability.

Form popularity

FAQ

Truck drivers' employment status is classified based on a variety of factors. Generally speaking, companies can only classify truck drivers as independent contractors if the truckers have control over how and when they perform their duties.

An independent contractor truck driver works for his own business and provides his services to carrier companies. An independent contractor can also be an owner-operator if they have their own truck and equipment, but these can also be leased.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Generally speaking, companies can only classify truck drivers as independent contractors if the truckers have control over how and when they perform their duties.

Final thoughts on paying a truck driver as a 1099If a worker meets the requirements to be an employee, they cannot opt-out of it. Even if they ask to opt-out. If a worker does insist on filing 1099 that should be a red flag for you since they would pay more in taxes with 1099.