A silent partnership agreement template with multiple partners is a legally binding document that outlines the terms and conditions of a business arrangement wherein one or more partners remain silent or passive investors while the other partner(s) actively manage the business operations. This agreement provides clear guidelines and protects the rights and interests of all parties involved. The primary purpose of a silent partnership agreement is to define the roles and responsibilities of each partner, establish the capital contribution and profit-sharing arrangements, clarify decision-making processes, and ensure the smooth functioning of the business. By using a template, partners can save time and effort in drafting an agreement from scratch, but it is crucial to customize the template to suit their specific requirements. Silent partnership agreements come in different types based on the specific details and arrangements made between the partners. Some common variations include: 1. General silent partnership agreement template: This template is a basic agreement that outlines the key aspects of the partnership, such as the business name, capital contributions, profit-sharing ratios, and rights and obligations of silent and active partners. It may also cover dispute resolution mechanisms and duration of the partnership. 2. Limited silent partnership agreement template: This type of agreement limits the involvement of the silent partners to a specific time frame or project, beyond which they may have the option to exit the partnership. It includes provisions related to the term of the partnership, investment limits, and exit strategies. 3. Silent partnership agreement with investment protection template: This template focuses on protecting the investments of the silent partners by incorporating specific provisions related to risk mitigation, return on investment guarantees, and mechanisms for resolving conflicts arising from acts of mismanagement. 4. Silent partnership agreement with profit distribution template: This template is commonly used when there are multiple silent partners involved, each with different capital contributions. It outlines the profit distribution mechanism, including how profits will be divided among the partners based on their investment ratios or predetermined percentages. 5. Silent partnership agreement with exit and buyout rights template: In situations where a partner wishes to exit the partnership or buy out the shares of other partners, this template provides provisions for the process of valuation, buyout terms, and the rights and obligations of parties involved in such transactions. By utilizing a silent partnership agreement template with multiple partners, businesses can establish clear expectations and safeguards, thereby minimizing the risk of misunderstandings and legal disputes. It is essential to consult with legal professionals when drafting and modifying such agreements to ensure compliance with applicable laws and regulations in the relevant jurisdiction.

Silent Partnership Agreement Template With Multiple Partners

Description

How to fill out Silent Partnership Agreement Template With Multiple Partners?

Legal document managing might be mind-boggling, even for experienced specialists. When you are interested in a Silent Partnership Agreement Template With Multiple Partners and do not get the time to commit looking for the right and up-to-date version, the procedures could be demanding. A robust online form library could be a gamechanger for anybody who wants to take care of these situations effectively. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any requirements you may have, from individual to business documents, in one place.

- Use innovative resources to finish and control your Silent Partnership Agreement Template With Multiple Partners

- Gain access to a resource base of articles, instructions and handbooks and materials related to your situation and needs

Save effort and time looking for the documents you need, and utilize US Legal Forms’ advanced search and Review feature to find Silent Partnership Agreement Template With Multiple Partners and acquire it. For those who have a subscription, log in to the US Legal Forms account, look for the form, and acquire it. Review your My Forms tab to view the documents you previously saved as well as control your folders as you see fit.

Should it be your first time with US Legal Forms, make an account and obtain unrestricted use of all advantages of the library. Here are the steps to consider after getting the form you need:

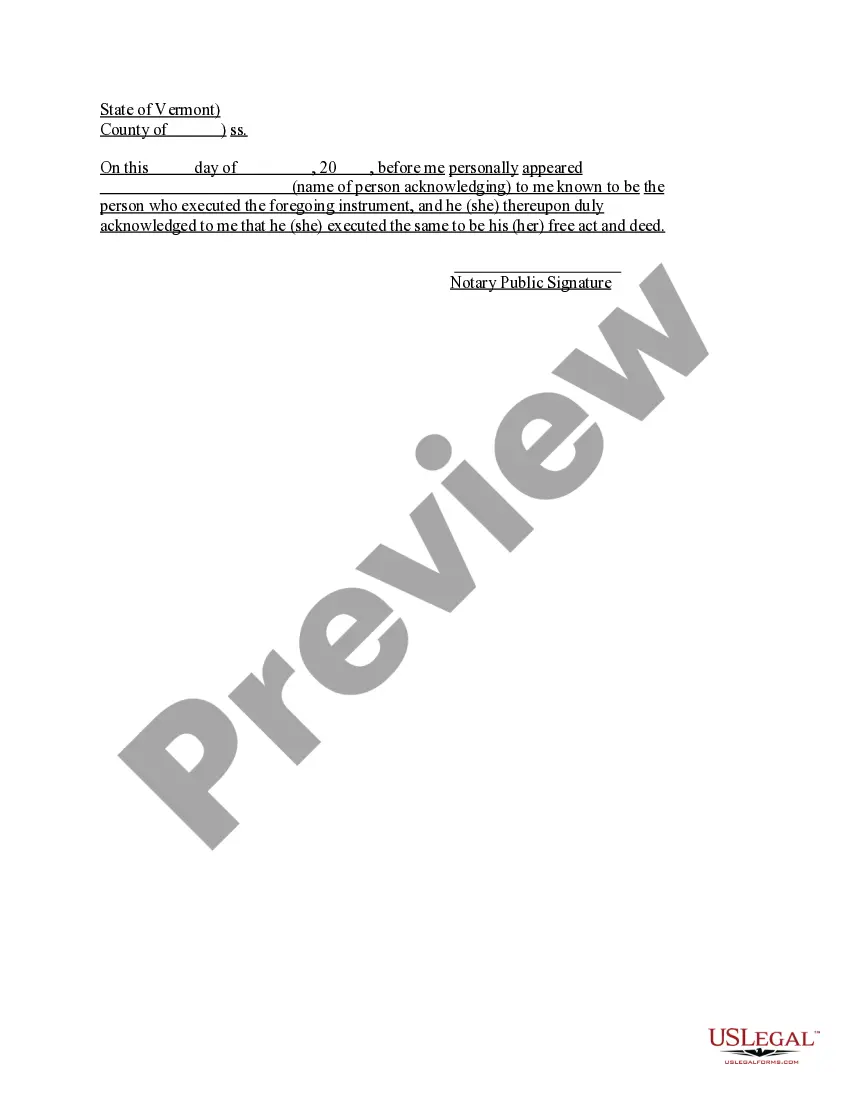

- Validate it is the proper form by previewing it and reading its information.

- Ensure that the sample is approved in your state or county.

- Choose Buy Now once you are ready.

- Choose a subscription plan.

- Pick the format you need, and Download, complete, sign, print out and send your document.

Take advantage of the US Legal Forms online library, backed with 25 years of expertise and stability. Change your everyday document management into a smooth and user-friendly process today.

Form popularity

FAQ

How to Use a 50/50 Partnership Agreement Template Set the partnership terms. The first step is to decide on the partnership terms. ... Define the roles and responsibilities. The next step is to clearly define the roles and responsibilities of each partner. ... Outline profit and loss sharing. ... Create a timeline.

Silent Partners and Liability Thanks to their limited liability, however, silent partners are not liable for company losses beyond the percentage that they invested. So if a silent partner has a 10% stake in a business, for example, he or she would only be accountable for 10% of the incurred losses and debts.

A silent partner is also known as a dormant partner; an investor who becomes a member of a partnership by virtue of capital contribution, but plays an inactive role in the daily operation and management of the business.

As with other partnership agreements, a silent partnership generally calls for a formal agreement in writing. Prior to the formation of a silent partnership, the business must be registered either as a general partnership or a limited liability partnership per state regulations.

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.