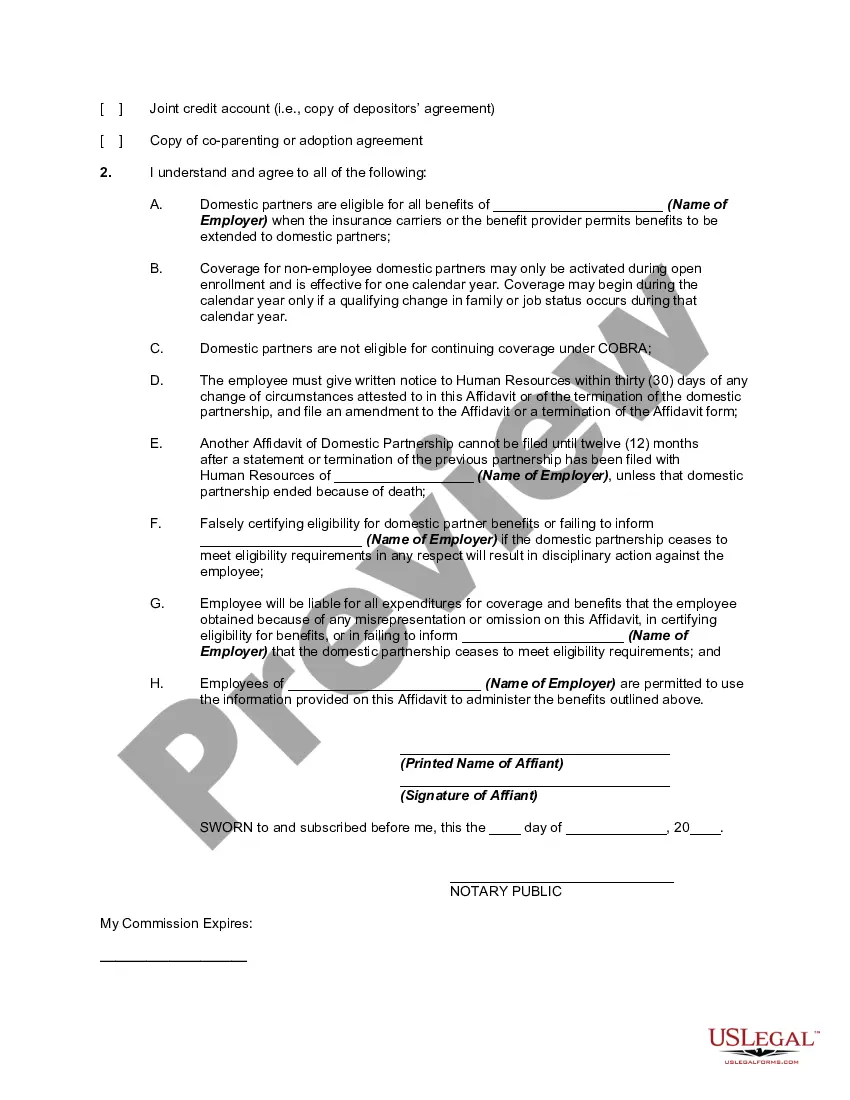

Domestic Partner Affidavit With Insurance

Description domestic partners health insurance

How to fill out Domestic Partner Affidavit With Insurance?

Maneuvering through the red tape of official documents and formats can be challenging, particularly if one is not engaged in that profession.

Locating the appropriate template for a Domestic Partner Affidavit With Insurance may also prove to be labor-intensive, as it must be valid and accurate to the last digit.

However, you will likely spend significantly less time selecting a feasible template from a trusted source.

Obtain the correct form in a few simple steps: Enter the name of the document in the search box. Locate the suitable Domestic Partner Affidavit With Insurance from the results. Review the sample's description or view its preview. If the template meets your needs, click Buy Now. Proceed to select your subscription plan. Use your email and create a secure password to register an account at US Legal Forms. Choose a credit card or PayPal payment method. Download the template file onto your device in your preferred format. US Legal Forms will save you time and energy verifying whether the form you found online meets your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of locating the correct documents online.

- US Legal Forms is a one-stop shop for obtaining the latest templates, consulting their application, and downloading these templates for completion.

- This resource boasts over 85,000 documents relevant to various sectors.

- When searching for a Domestic Partner Affidavit With Insurance, there’s no need to question its validity, as all documents are verified.

- Having an account with US Legal Forms ensures you have all essential templates at your fingertips.

- You can store them in your history or add them to the My documents collection.

- Retrieve your saved documents from any device by clicking Log In/">Log In on the library's website.

- If you haven't created an account yet, you can always start a new search for the template you require.

Form popularity

FAQ

Domestic partner health insurance is the extension of a health insurance plan to one's domestic partner. In granting domestic partner coverage, insurance providers or employers recognize these relationships and provide the same health insurance benefits as they would to a married couple.

You can always ask your employer to add domestic partners to their group health insurance plan, however. Studies have shown that the costs of offering domestic partner health insurance are negligible for most employers.

The California Family Code defines a domestic partnership as: 1) two adults of the same sex who have chosen to share one another's lives in an intimate and committed relationship of mutual caring; or 2) two equally committed adults of the opposite sex if one or both partners are over age 62 and one or both partners

Learn more about steps unmarried partners can take to purchase automobile, life, health, and homeowners insurance. Generally speaking, unmarried couples can purchase most insurance types at competitive rates, which is usually easy to do, especially if you co-own property.