Example Of An Annual Report With Msme Disclosure

Description

How to fill out Example Of An Annual Report With Msme Disclosure?

Regardless of whether you frequently handle documents or occasionally need to send a legal paper, it is essential to have a valuable resource where all the examples are pertinent and current.

The first action you should take with a Sample of an Annual Report Featuring MSME Disclosure is to verify that it is the most recent version, as this determines its eligibility for submission.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

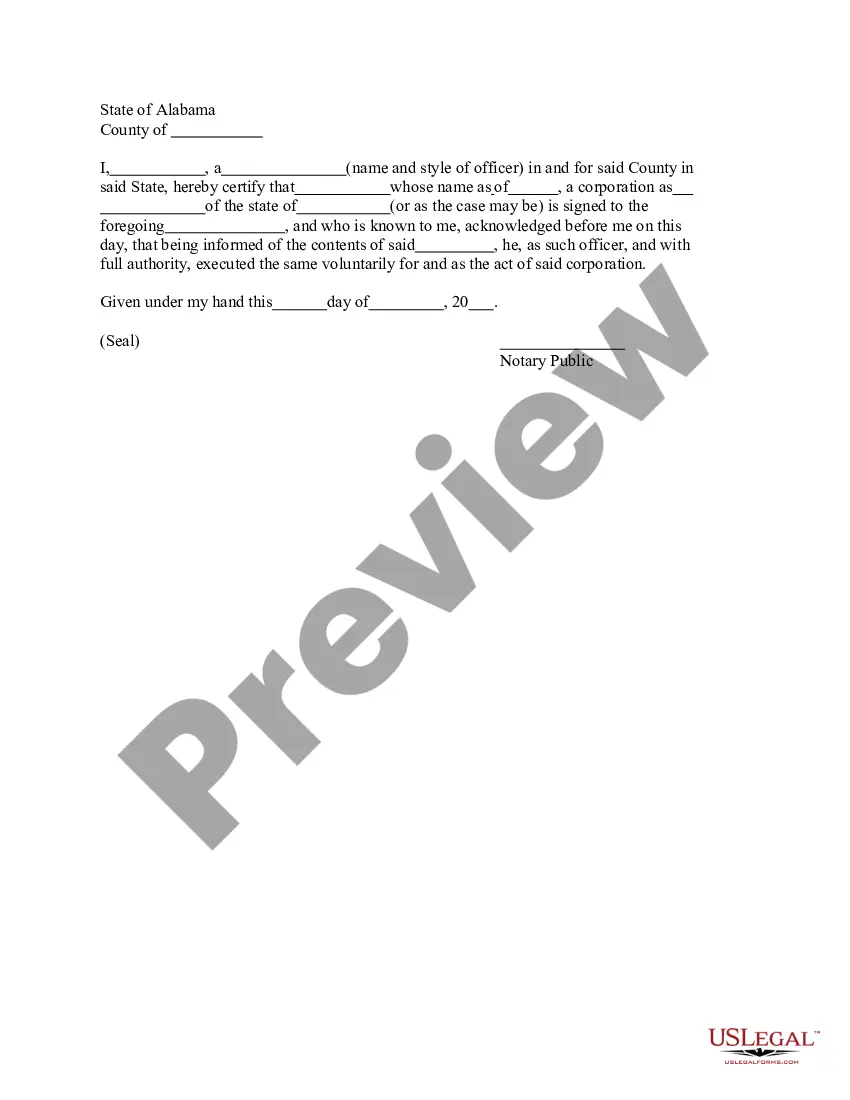

To acquire a form without an account, follow these steps: Use the search menu to locate the necessary form. Check the Sample of an Annual Report Featuring MSME Disclosure preview and description to ensure it is the exact one you seek. After double-checking the form, click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Utilize your credit card details or PayPal account to complete the transaction. Select the document format for download and confirm it. Say goodbye to the confusion of managing legal paperwork. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a database of legal templates that encompasses nearly every document example you could need.

- Search for the forms you require, instantly evaluate their applicability, and learn more about their usage.

- With US Legal Forms, you have access to over 85,000 document templates spanning various fields.

- Obtain the Sample of an Annual Report Featuring MSME Disclosure in just a few clicks and store them anytime in your account.

- Having a US Legal Forms account will allow you to access all necessary samples with greater ease and less trouble.

- Simply click Log In in the site header and navigate to the My documents section containing all the forms you need at your fingertips, eliminating the need to spend time searching for the right template or assessing its relevance.

Form popularity

FAQ

To file MSME, you need to complete the registration process through the appropriate government portal or agency. This process often requires documentation that outlines your business activities and size. For an effective example of an annual report with MSME disclosure, using platforms like US Legal Forms can simplify the filing by providing necessary templates and guidance for accurate submissions.

The form of MSME refers to the structure under which Micro, Small, and Medium Enterprises operate. Typically, it includes registration documents and compliance forms tailored to the specific needs of MSMEs. Understanding the structure is essential for creating an effective example of an annual report with MSME disclosure, as it allows businesses to highlight their growth and contributions accurately.

Uttar Pradesh ranks among the top states in India for MSME growth and registrations. The state government has launched various initiatives to support and promote these enterprises, significantly enhancing their contributions to the local economy. An example of an annual report with MSME disclosure will often feature data from Uttar Pradesh to illustrate its success.

In 2024, the number of MSMEs in India is projected to exceed 6 million, reflecting steady growth since 2021. Government policies, along with digital transformation, have fueled this expansion. This projected growth can be captured well in an example of an annual report with MSME disclosure, showcasing future trends and potential.

The most profitable MSMEs in India often belong to sectors like information technology, food processing, and textiles. These industries continue to innovate and adapt, increasing their profitability over time. If you're looking to understand these dynamics better, consider exploring an example of an annual report with MSME disclosure for insights.

Uttar Pradesh is recognized as the number one state in terms of MSME registrations in India. This state has implemented various initiatives to encourage entrepreneurship, resulting in a thriving MSME sector. The annual report you can create will benefit from including an example of an annual report with MSME disclosure from this leading state.

As of recent estimates, India has over 6 million registered MSMEs across various sectors. These enterprises play a pivotal role in creating jobs and fostering innovation. An example of an annual report with MSME disclosure will provide detailed insights into their contribution to the economy.

Maharashtra currently leads in the number of MSMEs in India. This state boasts a vibrant business ecosystem, supporting diverse industries from textiles to information technology. This example of an annual report with MSME disclosure can highlight how states like Maharashtra contribute significantly to India's economy.

An annual report typically includes information about financial performance, management discussions, and details on company operations. Additionally, it features disclosures on corporate governance and sustainability practices. You may also find an example of an annual report with MSME disclosure, which outlines specifics relevant to micro, small, and medium enterprises.

The new rule mandates that payments to MSMEs must be completed within 45 days of the invoice date. This regulation aims to improve the liquidity of MSMEs, helping them thrive in a competitive market. Companies are encouraged to adjust their practices accordingly. Reviewing an example of an annual report with MSME disclosure can help you see how compliance is tracked.