Equipment Lease Regarding For Less

Description

How to fill out Equipment Lease Regarding For Less?

Traversing through the red tape of official documents and forms can be challenging, particularly when someone isn’t engaging in that as their profession.

Even selecting the appropriate template to acquire an Equipment Lease Concerning For Less will be labor-intensive, as it must be accurate and precise to the last digit.

Nonetheless, you will need to spend significantly less time searching for a suitable template from a reliable source.

Acquire the correct form in a few straightforward steps: Enter the document title in the search field. Select the appropriate Equipment Lease Concerning For Less from the results. Review the description of the sample or open its preview. When the template meets your needs, click Buy Now. Continue to choose your subscription plan. Utilize your email and create a secure password to create an account at US Legal Forms. Choose a credit card or PayPal payment method. Download the template document on your device in the format you prefer. US Legal Forms can save you time and effort in determining whether the form you discovered online is suitable for your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the process of locating the correct forms on the internet.

- US Legal Forms is a single destination you require to obtain the latest examples of forms, learn their usage, and download these examples to complete them.

- It is a repository containing over 85K forms applicable in various professional fields.

- When seeking an Equipment Lease Concerning For Less, you won’t have to question its authenticity as all the forms are checked.

- Having an account at US Legal Forms will guarantee you have all the essential templates at your fingertips.

- Save them in your history or add them to the My documents catalog.

- You can retrieve your saved documents from any device by simply clicking Log In at the library site.

- If you do not have an account yet, you can always search again for the template you require.

Form popularity

FAQ

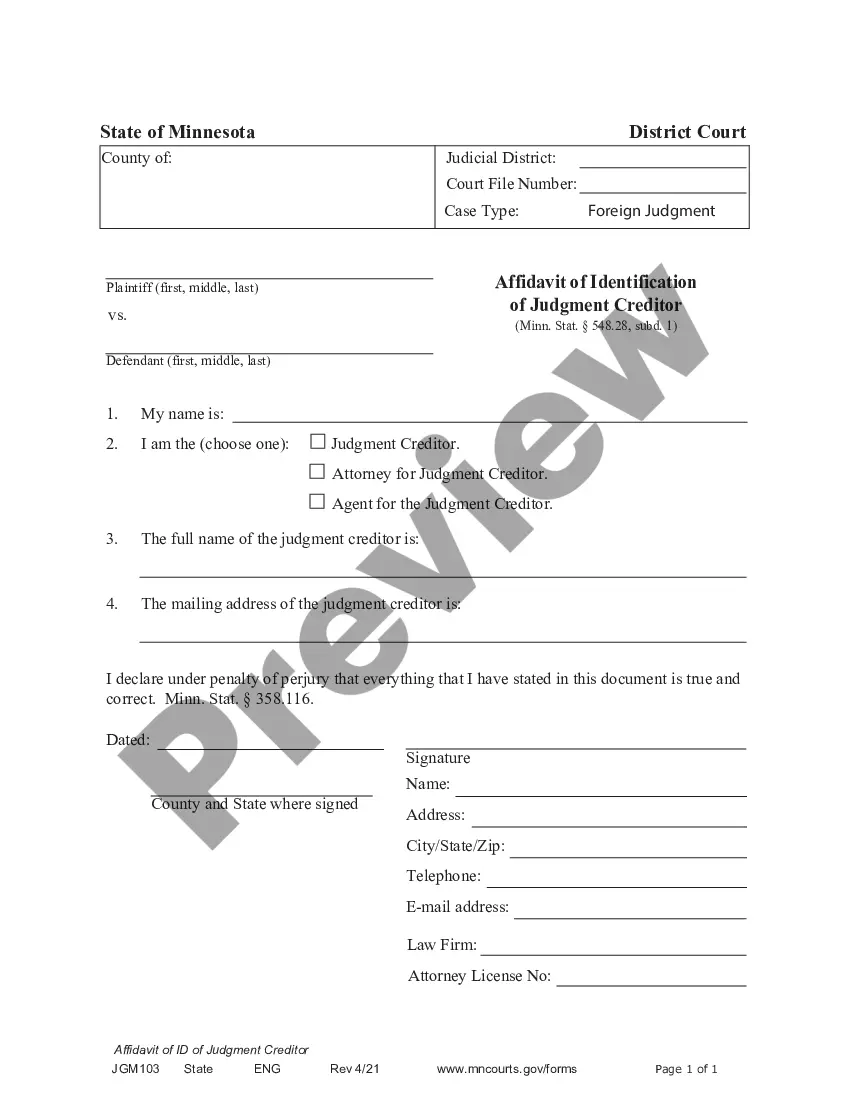

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

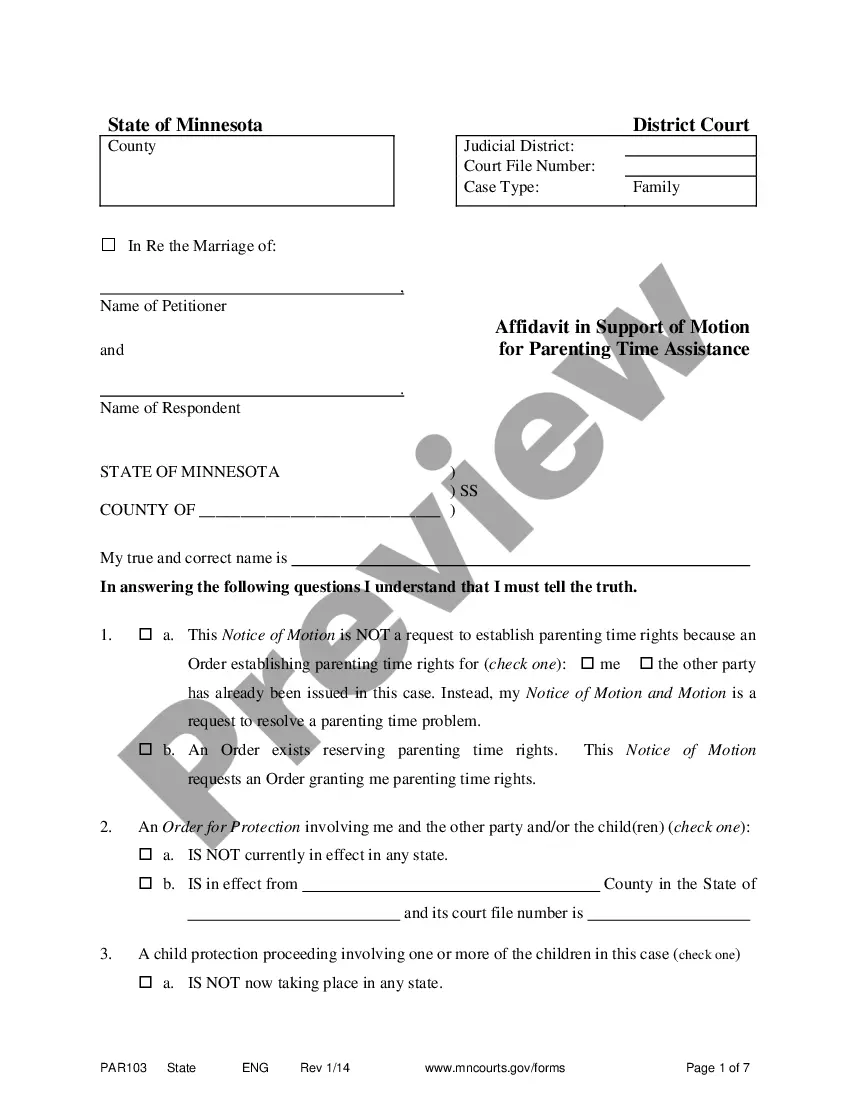

What is an Equipment Lease Agreement? An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments.

Leasing works like a rental agreement. You pay the equipment's owner a set fee every agreed period and you can use the asset as though it was your own. Under a lease, nobody else can use the equipment without your permission and for all intents and purposes, it's as though you own the piece of equipment.

Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both operating and net income. Other characteristics include: Ownership: Retained by the lessor during and after the lease term.

Lease payments. As the company receives lease invoices from the lessor, record a portion of each invoice as interest expense and use the remainder to reduce the balance in the capital lease liability account. Eventually, this means that the balance in the capital lease liability account should be brought down to zero.