Sample Letter Of Intent For Grant Funding

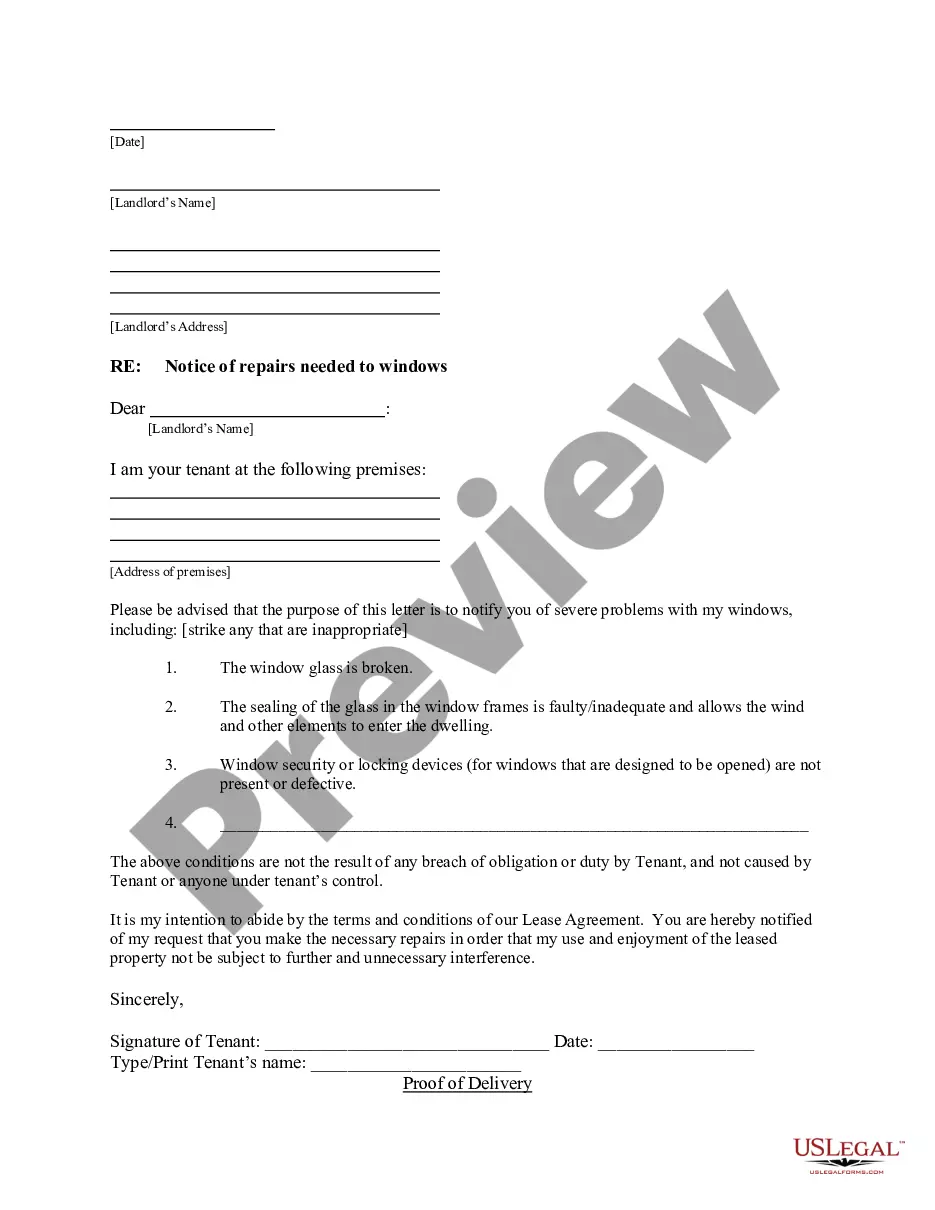

Description letter of intent for funding

How to fill out Sample Letter Of Intent For Grant Funding?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of working with bureaucracy. Discovering the right legal papers calls for accuracy and attention to detail, which explains why it is crucial to take samples of Sample Letter Of Intent For Grant Funding only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and view all the information about the document’s use and relevance for the situation and in your state or county.

Consider the following steps to complete your Sample Letter Of Intent For Grant Funding:

- Make use of the catalog navigation or search field to find your sample.

- Open the form’s description to check if it fits the requirements of your state and region.

- Open the form preview, if available, to ensure the form is definitely the one you are looking for.

- Go back to the search and look for the proper template if the Sample Letter Of Intent For Grant Funding does not fit your needs.

- When you are positive about the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Select the pricing plan that fits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading Sample Letter Of Intent For Grant Funding.

- When you have the form on your device, you can alter it with the editor or print it and complete it manually.

Eliminate the hassle that accompanies your legal documentation. Discover the extensive US Legal Forms catalog where you can find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

The penalty for failure to timely pay the amount of tax shown due on an Alabama business privilege tax return equals to 1% of the amount of tax shown due on the return for each month the tax is unpaid ? not to exceed 25% of the amount shown due on the return.

All LLCs in Alabama need to pay an annual business privilege tax. The Alabama Business Privilege Tax rate ranges from $0.25 to $1.75 per $1,000 of net worth, with the minimum tax being $100. You'll need to pay this tax when filing the AL Business Privilege Tax Return, which is combined with the Alabama Annual Report.

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year.

Maximum privilege tax is $15,000 for all years after 2000, unless otherwise stated. The maximum privilege tax for financial institutions and insurance companies is $3,000,000 for each tax year. The maximum privilege tax for an electing Family Limited Liability Entity is $500.

Form PPT is to be filed by Pass-through Entities only. BUSINESS PRIVILEGE TAX PAYMENT. Payment of the total tax due must be received on or before the original due date of the return.

Business Privilege Tax Cap The maximum business privilege tax for most business entities is $15,000.

FORM 20C-C Alabama Consolidated Corporate Income Tax Return. The Form 20C-C must be filed by or on behalf of the members of the Alabama affiliated group in ance with Alabama Code Section 40-18-39, when a Consolidated Filing elec- tion has been made pursuant to Code Section 40-18-39(c).

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.