Letter Foreclosure Sample Without Notice

Description

How to fill out Letter Foreclosure Sample Without Notice?

When you need to fulfill Letter Foreclosure Sample Without Notice in accordance with your local state's statutes and regulations, there can be numerous options to select from.

There's no need to scrutinize every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a trustworthy service that can assist you in acquiring a reusable and current template on any subject.

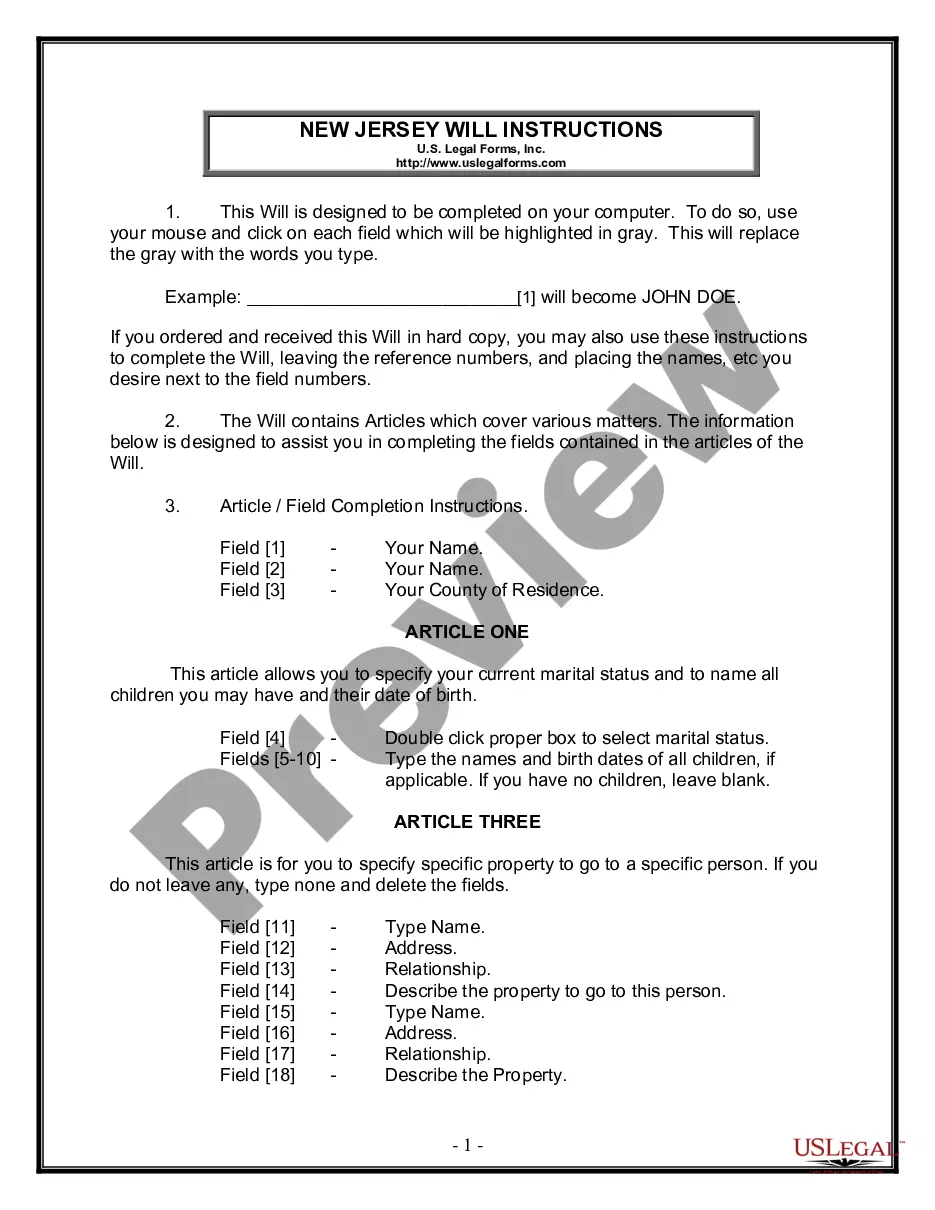

Utilizing the Preview mode and reviewing the form description if available will assist you.

Search for another sample using the Search bar located in the header if necessary.

Once you find the suitable Letter Foreclosure Sample Without Notice, click Buy Now.

Select the most appropriate subscription plan, Log In to your account, or create a new one.

Make payment for a subscription (both PayPal and credit card options are available).

- US Legal Forms is the most comprehensive online directory with a collection of over 85k ready-to-use documents for both business and personal legal situations.

- All templates are verified to comply with each state's laws.

- Thus, when downloading Letter Foreclosure Sample Without Notice from our website, you can be assured that you have a legitimate and current document.

- Acquiring the necessary sample from our platform is very simple.

- If you already have an account, just Log In to the system, verify your subscription is active, and save the selected file.

- In the future, you can access the My documents section in your profile and have access to the Letter Foreclosure Sample Without Notice at any moment.

- If it's your initial experience with our website, please follow the guide below.

- Browse through the suggested page and ensure it aligns with your criteria.

Download the sample in your preferred file format (PDF or DOCX).

You can print the document or complete it electronically in an online editor.

Acquiring correctly drafted formal documents becomes easy with US Legal Forms.

Additionally, Premium users can also take advantage of the substantial integrated solutions for online document editing and signing.

Try it out today!

Form popularity

FAQ

Your letter should start with an introduction of who you are and what kind of loan you are applying for. Lead into your story with something like "We want to explain our foreclosure from six years ago." Then, launch right into the details that led you to lose your home. This is not the time to be shy or modest.

Foreclosure definition Foreclosure occurs when a homeowner can't make mortgage payments and the bank seizes the home, which was acting as the collateral or security on the loan. The bank then sells the home to try to recover their losses.

Notice of Default and Foreclosure. Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.

Your mortgage letter of explanation should address any issues your lender has asked you to clarify, such as missed payments, an employment gap, or a bankruptcy. Explain why the situation happened, how you corrected it, and how your financial situation has changed since that time.

When a borrower repays the entire outstanding loan amount in one payment rather than in EMIs, they need to write a letter for the foreclosure of the loan, which is known as the foreclosure letter.