Inheritance tax waiver forms for California are legal documents that individuals or estates must complete in order to claim an exemption or waive the payment of inheritance taxes imposed on the transfer of property and assets to beneficiaries after the death of the original owner. These forms are essential for ensuring proper compliance with California's inheritance tax laws and regulations. There are primarily two types of Inheritance tax waiver forms used in California: 1. Affidavit for Transfer of Property of Decedent (Form BOE-502-A): This form is used when the total value of the decedent's property does not exceed a certain threshold determined by the California State Board of Equalization (BOE). The form is filed by the person or entity responsible for distributing the decedent's assets and waives the requirement to pay any inheritance taxes. 2. Estate Tax Waiver Certificate Application (Form ET-706): This form applies to larger estates with a value exceeding the threshold set by the California Franchise Tax Board (FT). It must be completed by the estate's personal representative, executor, or administrator, and submitted to the FT along with other necessary documents. Upon approval, an estate tax waiver certificate is issued, providing an exemption from paying inheritance taxes. Both forms require accurate information regarding the deceased individual, including their name, date of death, social security number, address, and a list of all assets and their corresponding values. Additionally, the forms may also require details about the beneficiaries and their relationship to the decedent. Completing these forms correctly is crucial to avoid any penalties or additional tax obligations. It is advisable to consult with an attorney or tax professional experienced in estate planning and inheritance tax matters to ensure accurate and thorough compliance with California's inheritance tax laws.

Inheritance Tax Waiver Form For California

Description inheritance tax waiver states

How to fill out Inheritance Tax Waiver Form For California?

It’s no secret that you can’t become a legal professional overnight, nor can you grasp how to quickly prepare Inheritance Tax Waiver Form For California without the need of a specialized set of skills. Creating legal forms is a time-consuming venture requiring a specific education and skills. So why not leave the preparation of the Inheritance Tax Waiver Form For California to the professionals?

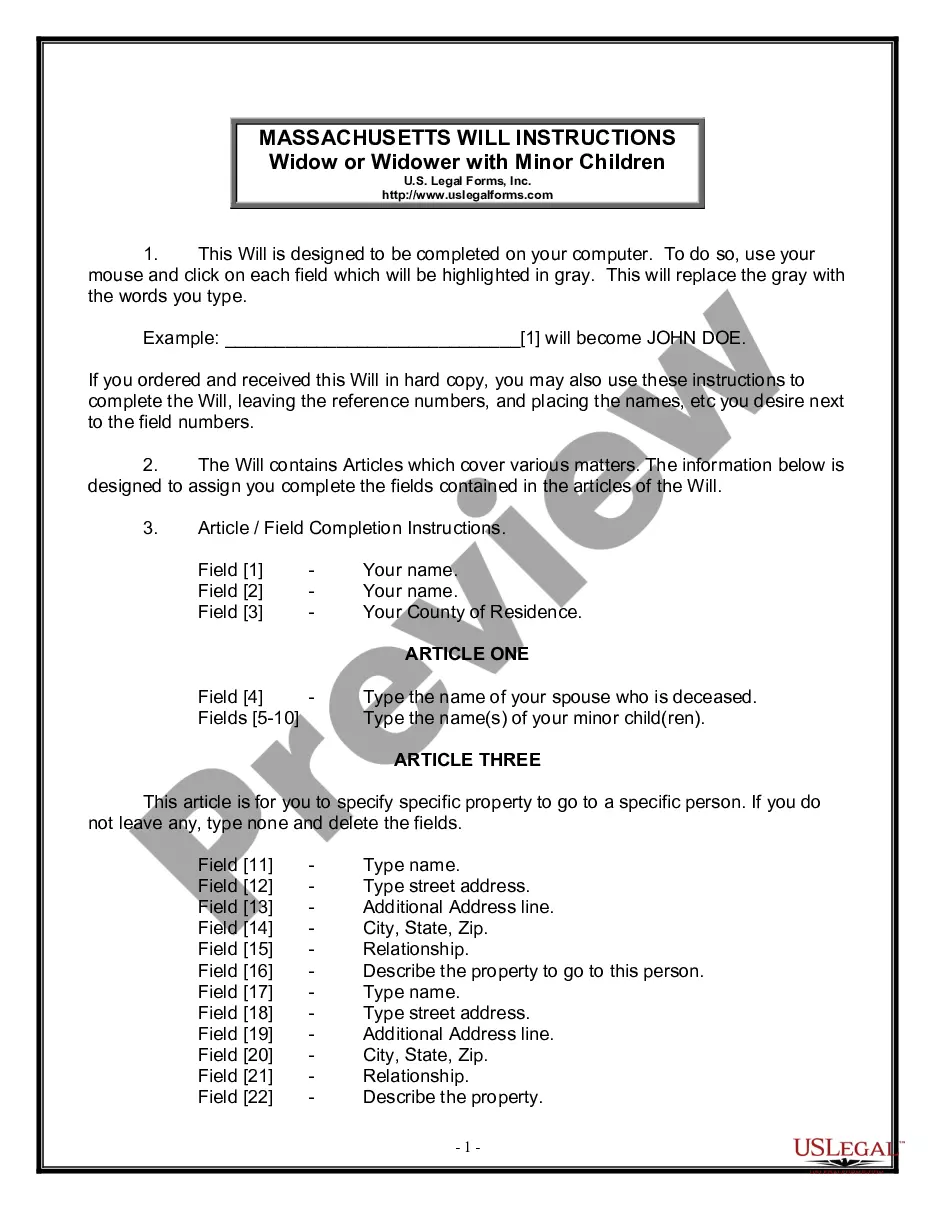

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court paperwork to templates for in-office communication. We know how important compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and obtain the form you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Inheritance Tax Waiver Form For California is what you’re looking for.

- Begin your search over if you need a different template.

- Set up a free account and select a subscription plan to buy the template.

- Choose Buy now. Once the payment is complete, you can get the Inheritance Tax Waiver Form For California, complete it, print it, and send or mail it to the necessary individuals or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

To avoid paying taxes on inherited property in California, you can utilize the inheritance tax waiver form for California. This document helps you navigate the tax implications of your inheritance. Additionally, you may want to consider strategies such as setting up a living trust or gifting the property to beneficiaries before transferring ownership. Using a legal platform like uslegalforms can simplify this process and ensure you understand your options.

To clarify, California does not levy an inheritance tax, so you do not need to worry about avoiding such taxes in the state. This offers a significant benefit for those inheriting property or assets. If you wish to minimize potential federal estate taxes, seeking professional advice is advisable. Tools like US Legal Forms can help you navigate estate planning effectively.

California does not require a form specifically for inheritance tax, as there is no inheritance tax imposed within the state. Therefore, the topic of an inheritance tax waiver form for California does not apply. However, it's crucial to manage any estate tax issues that may arise at the federal level. Utilizing services like US Legal Forms can streamline documentation.

Since California does not have an inheritance tax, you do not need to submit an inheritance tax waiver form for California. This simplifies the process for beneficiaries as there is no state-level taxation involved. Nevertheless, ensure you are aware of any potential federal estate tax liabilities instead. Consulting with an expert can help clarify your specific situation.

In California, there is no state inheritance tax, so you do not need an inheritance tax waiver form for California. This means that if you receive an inheritance, you generally do not owe any tax to the state. However, federal estate tax might apply if the estate exceeds certain thresholds. It is important to consult with a tax professional for personalized advice.

Writing a letter to disclaim an inheritance is a straightforward process. You should begin by clearly stating your intention to decline the inheritance, include your full name, the date, and details about the estate. It is advisable to mention that you are completing an inheritance tax waiver form for California to formalize your decision. This letter should be sent to the executor of the estate or as directed by legal counsel.

Yes, individuals have the right to decline an inheritance if they choose to do so. This decision may stem from various reasons, such as tax implications or unwanted responsibilities associated with the estate. To formally decline the inheritance, one must fill out an inheritance tax waiver form for California. Taking this step ensures that your decision is clear and legally recognized.

Yes, a beneficiary can waive their inheritance under certain circumstances. This waiver allows them to forgo their right to receive assets from the estate. To do this formally, the beneficiary typically needs to complete an inheritance tax waiver form for California. This form ensures that the waiver is documented correctly, which can help avoid potential legal issues in the future.

Waiving inheritance typically involves formal agreements or legal documentation. You may need to file specific forms or create estate plans to express your intent clearly. The inheritance tax waiver form for California can provide necessary information on handling inheritance and understanding your options.

A common tax loophole for inherited property is the step-up in basis rule, which adjusts the asset's value to its market value at the time of the owner's death. This adjustment helps heirs avoid large capital gains taxes when selling the inherited property. To navigate these nuances, the inheritance tax waiver form for California might provide additional insights.