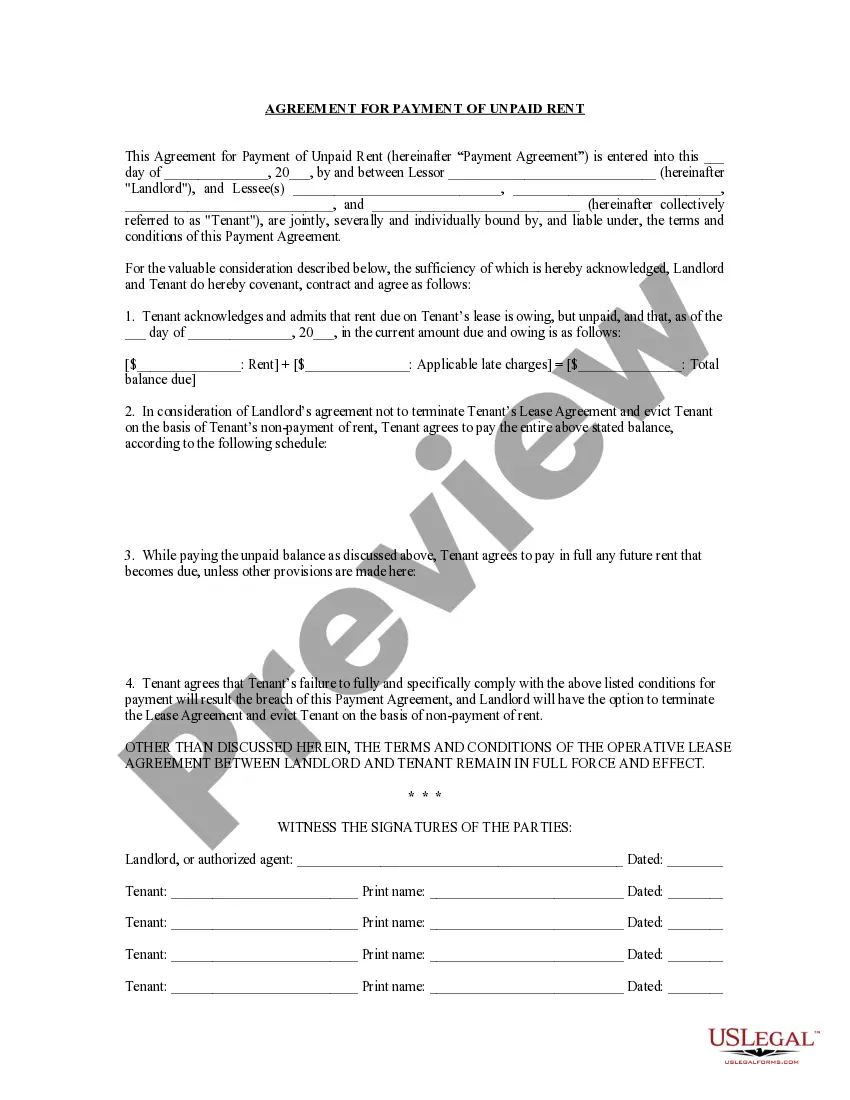

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Notice capital call is a crucial aspect of private equity transactions, functioning as a formal request made by the general partner (GP) to the limited partners (LPs) for additional funds to be invested in a private equity fund. This process ensures that the fund has sufficient capital available to seize lucrative investment opportunities. Private equity funds often adopt a capital call mechanism to manage their investment activities efficiently. When an attractive investment opportunity surfaces, the private equity fund requires additional funding beyond the committed capital from LPs. It is at this point that a notice capital call is initiated. The notice capital call is typically issued by the GP to the LPs, notifying them of the need for additional capital to be contributed to the fund. This notice outlines the specific details, including the amount of capital required, the purpose of the capital call, the deadline for the LPs to submit their contributions, and any other relevant instructions or conditions. The purpose of a notice capital call is to ensure that LPs are aware of their obligations and can timely contribute their share of the additional capital. This process is essential for maintaining the fund's ability to make investments promptly and take advantage of favorable market conditions. There are two primary types of notice capital calls in private equity: 1. Initial Capital Call: This type of capital call is made to LPs at the inception of a private equity fund or when new LPs join an existing fund. It enables the fund to begin operating and initiates the investment process. 2. Follow-On Capital Call: Once a private equity fund is operational, the GP may issue follow-on capital calls to existing LPs to secure additional capital for investment opportunities that emerge later in the life of the fund. This ensures that the fund can seize potential deals without delay. Private equity funds must adhere to strict legal and contractual procedures when initiating notice capital calls. The terms and conditions of capital calls are typically outlined in the limited partnership agreement (PA), which governs the relationship between the GP and the LPs. Compliance with these regulations and procedures is crucial for maintaining transparency, trust, and accountability between the GP and the LPs. In summary, notice capital call is an essential process in private equity that enables funds to secure additional capital from LPs to pursue attractive investment opportunities. The two main types of notice capital calls are initial capital calls and follow-on capital calls, each serving different purposes within the lifecycle of a private equity fund. Strict adherence to legal and contractual requirements is vital to ensure transparency and maintain strong relationships between the GP and the LPs.