An inheritance letter is a document that outlines the distribution of assets, properties, or possessions from one individual to another after their passing. It serves as a formal announcement or notification made by the executor or the deceased person's representative to inform the beneficiaries about the inheritance they are entitled to receive. These letters are crucial as they provide legal clarity and ensure a smooth transfer of assets. There are primarily two types of inheritance letters: 1. Testamentary Letter: This type of letter is specified in the Last Will and Testament of the deceased person. It states how the assets and properties should be distributed among the beneficiaries. The testamentary letter is an official document that holds legal significance, and it is essential for the executor to follow the instructions precisely to fulfill the wishes of the deceased. 2. Intestate Letter: In cases where the deceased person did not leave behind a valid will, the inheritance is governed by the state's laws of intestacy. The intestate letter, also known as a letter of administration, is granted by the court to the rightful heirs or their legal representatives. This letter outlines the division of assets according to the legal requirements of the state, which may vary based on factors like marital status, children, and other blood relatives. In both types of inheritance letters, the content should cover the following essential elements: 1. Introductory Information: Properly identify the deceased person by stating their full name, date of birth, and date of death. It is recommended to mention their relationship with the beneficiaries. 2. Executor/Administrator Details: Include the full name and contact information of the executor or administrator responsible for handling the deceased person's estate. 3. Asset Description: Provide an exhaustive list of the assets and properties to be inherited. This may include real estate, bank accounts, investments, personal belongings, and any other valuable possessions. 4. Beneficiaries: Clearly state the full names and contact details of the beneficiaries who are entitled to receive the inheritance. If there are minor beneficiaries involved, mention their guardians or trustees. 5. Distribution Instructions: Outline the specific details of how the assets will be divided among the beneficiaries. Be clear about percentages, specific items, or monetary amounts assigned to each beneficiary. 6. Legal Procedures: If applicable, mention any legal steps required for the beneficiaries to claim their inheritance or provide a deadline for any actions that must be taken. 7. Signature and Witness: The letter should be signed by the executor or administrator, attested by witnesses, and include their contact information. It is crucial to remember that an inheritance letter should always be prepared by a legal professional to ensure accuracy, adherence to state laws, and overall validity.

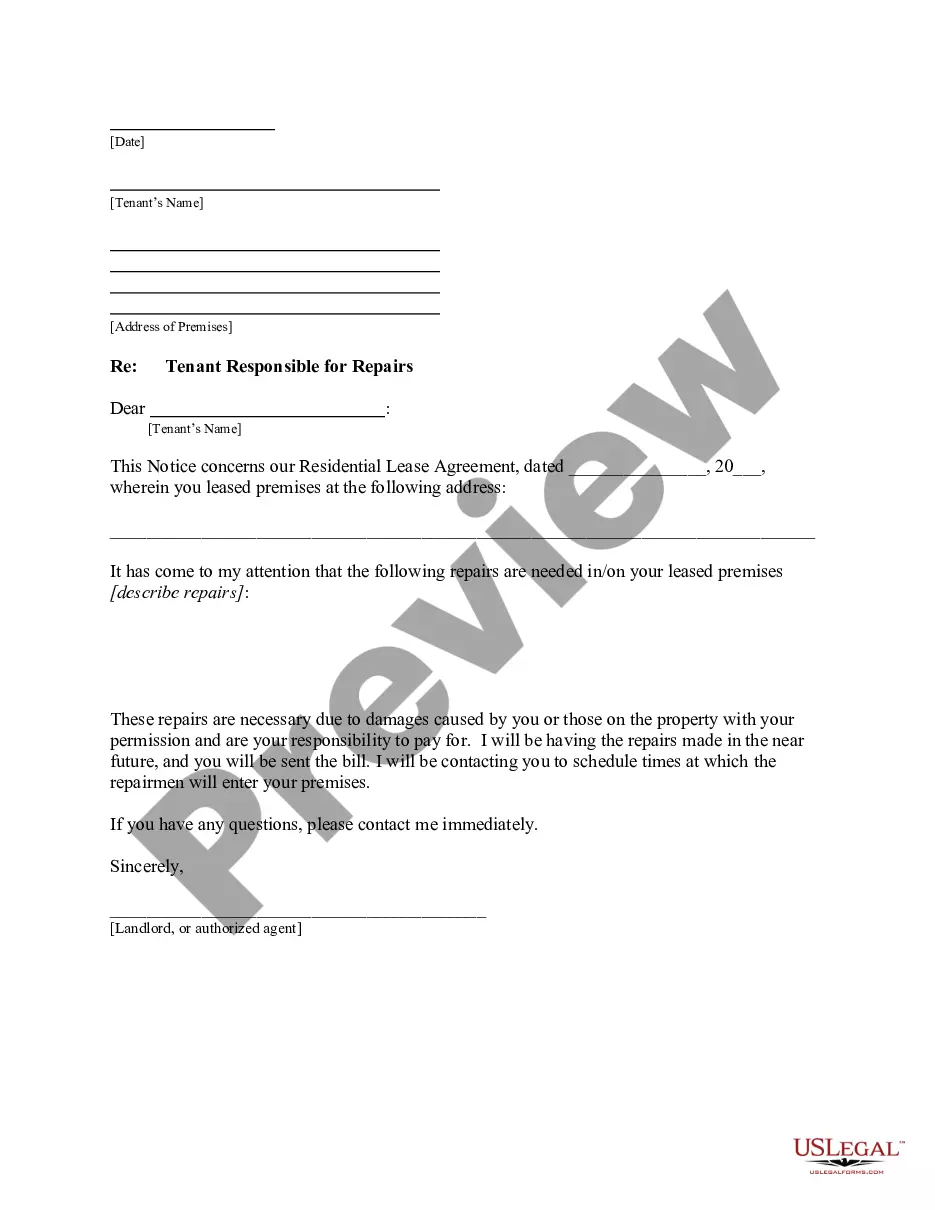

Example Of Inheritance Letter

Description Purchase Letter Draft

How to fill out Sample Letter Sale Contract?

Getting a go-to place to take the most current and appropriate legal samples is half the struggle of dealing with bureaucracy. Discovering the right legal documents needs accuracy and attention to detail, which explains why it is crucial to take samples of Example Of Inheritance Letter only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the details regarding the document’s use and relevance for the situation and in your state or county.

Take the listed steps to finish your Example Of Inheritance Letter:

- Utilize the catalog navigation or search field to find your template.

- Open the form’s information to check if it suits the requirements of your state and region.

- Open the form preview, if there is one, to make sure the template is the one you are searching for.

- Go back to the search and locate the correct template if the Example Of Inheritance Letter does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Select the pricing plan that suits your preferences.

- Go on to the registration to complete your purchase.

- Complete your purchase by picking a payment method (bank card or PayPal).

- Select the file format for downloading Example Of Inheritance Letter.

- When you have the form on your device, you may modify it using the editor or print it and finish it manually.

Eliminate the headache that comes with your legal paperwork. Check out the comprehensive US Legal Forms catalog where you can find legal samples, examine their relevance to your situation, and download them on the spot.