Beneficiary Letter Of Instruction For Bank Of America

Description

How to fill out Beneficiary Letter Of Instruction For Bank Of America?

Getting a go-to place to take the most recent and appropriate legal samples is half the struggle of dealing with bureaucracy. Finding the right legal files requirements accuracy and attention to detail, which is the reason it is vital to take samples of Beneficiary Letter Of Instruction For Bank Of America only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the details about the document’s use and relevance for the situation and in your state or county.

Take the listed steps to finish your Beneficiary Letter Of Instruction For Bank Of America:

- Use the catalog navigation or search field to find your sample.

- Open the form’s information to ascertain if it fits the requirements of your state and area.

- Open the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Go back to the search and locate the proper template if the Beneficiary Letter Of Instruction For Bank Of America does not fit your needs.

- If you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Choose the pricing plan that fits your needs.

- Proceed to the registration to complete your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Beneficiary Letter Of Instruction For Bank Of America.

- Once you have the form on your device, you can modify it with the editor or print it and complete it manually.

Eliminate the headache that accompanies your legal documentation. Explore the extensive US Legal Forms catalog to find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

If the account is already open, it's usually easy to go to the bank in person and add one or more beneficiaries to the existing account. Make sure you have your photo ID and the beneficiary's information. Finally, you should not name a minor as a beneficiary for any bank account.

An account with a named beneficiary is a payable-on-death (POD) account. Your financial institution can give you a form for each account. The person you choose to inherit your account is a beneficiary. After your death, the account beneficiary can immediately claim ownership.

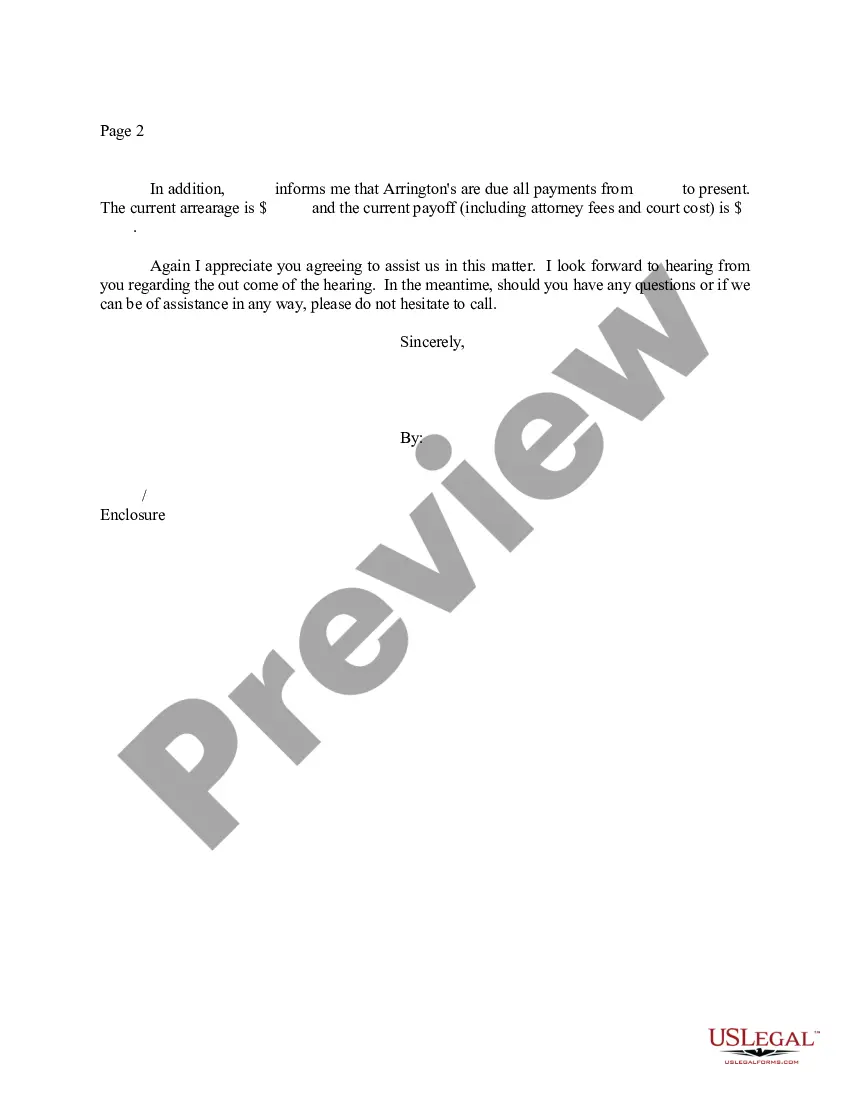

? Notarized Beneficiary Letter of Instruction is completed by the named beneficiary(s) listed on an account and provides instruction on where the disbursed funds should be sent or transferred.

While banks do not require accounts to have named beneficiaries, it's very common for them to have what's known as a Payable on Death (POD) account. And the good news is, even if you have an existing bank account, it's easy to convert it into a POD account at any time.

The most important thing for family members and other heirs to know is that they should never forge the signature of the deceased to pay bills or use the person's ATM or debit card to get cash. That's fraud.