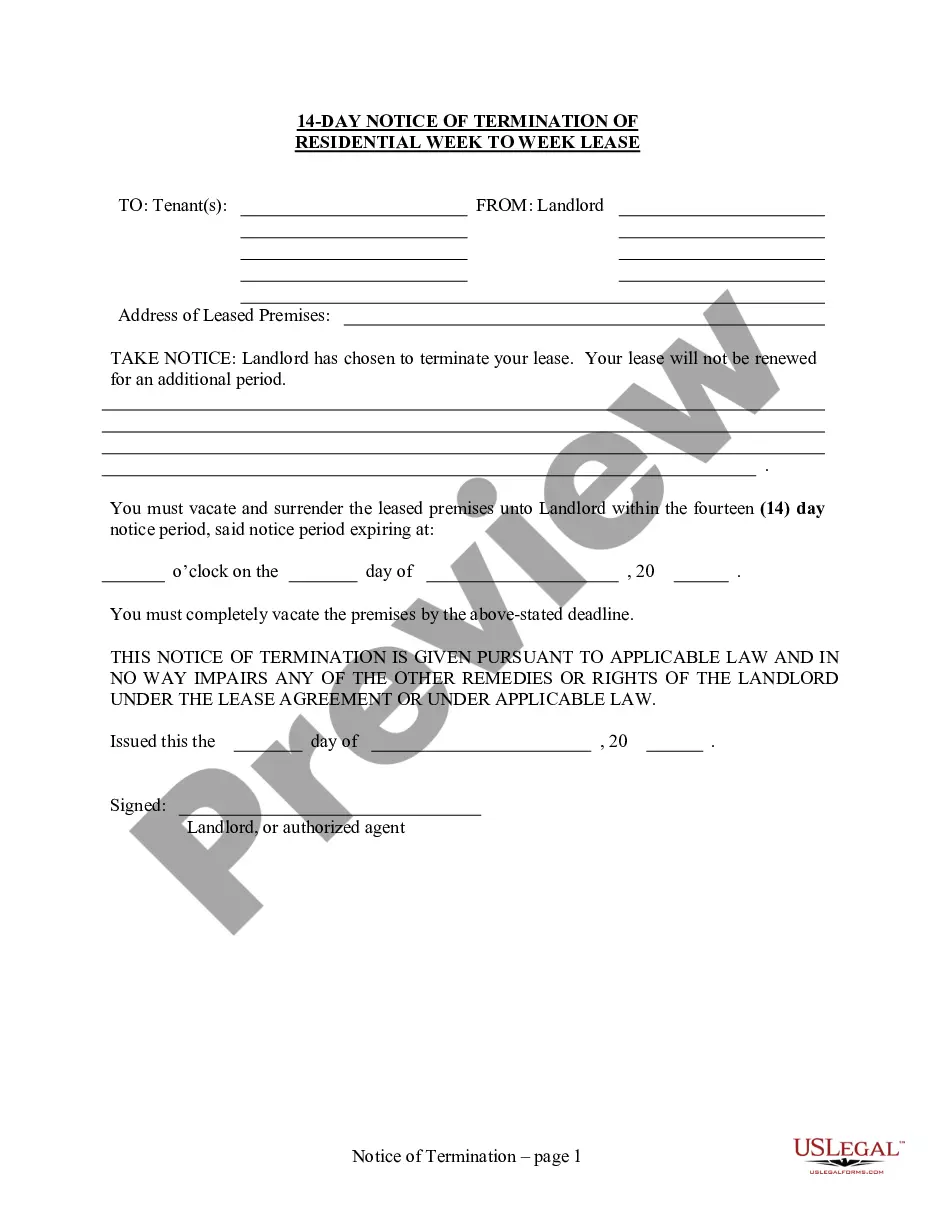

Receipt payment format excel is a spreadsheet template that allows users to create and maintain a systematic record of payments received. It is a useful tool for individuals, businesses, and organizations to ensure accurate tracking and documentation of financial transactions. This format is designed to simplify the process of generating professional-looking receipts, making it suitable for various purposes, such as sales transactions, rental payments, service fees, and more. The Receipt payment format excel usually consists of several key elements. These include the header section, which typically contains the business or organization's name, logo, and contact details. It may also include a unique receipt number or tracking code to easily identify each transaction. The body of the receipt format captures essential information about the payment transaction, such as the date of payment, the name and contact information of the payer, a description of the goods or services provided, unit prices, quantities, and the total payment amount. Some formats may also include additional fields to specify payment method, terms, or any applicable taxes or discounts. There are various types of Receipt payment format excel available, each tailored to meet specific requirements: 1. Sales Receipt Format: This type of format is commonly used by businesses or individuals involved in sales transactions. It includes details like product descriptions, prices, and quantities, allowing for easy tracking and reconciliation of sales. 2. Rental Receipt Format: Designed specifically for landlords or property managers, this format focuses on documenting rental payments. It includes fields to capture the tenant's name, property details, rental period, and any additional charges or deposits. 3. Service Receipt Format: Suitable for service-based businesses, this format allows service providers to outline the services rendered and corresponding charges. It may include details like labor hours, hourly rates, job descriptions, and taxes if applicable. 4. Payment Voucher Format: This format is often used by organizations to issue payment vouchers for various purposes, such as reimbursements, petty cash expenses, or employee expenses. It typically includes details like the recipient's name, purpose of payment, amount, and any supporting documents or signatures required. In conclusion, Receipt payment format excel is a versatile tool that streamlines the process of generating receipts and tracking payments. With various formats available, it can accommodate different types of transactions, such as sales, rentals, services, and vouchers, making it a valuable asset for efficient financial management.

Receipt Payment Format Excel

Description

How to fill out Receipt Payment Format Excel?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more affordable way of preparing Receipt Payment Format Excel or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of more than 85,000 up-to-date legal forms addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-compliant templates diligently prepared for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can quickly locate and download the Receipt Payment Format Excel. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes little to no time to set it up and navigate the catalog. But before jumping directly to downloading Receipt Payment Format Excel, follow these recommendations:

- Check the form preview and descriptions to make sure you have found the form you are searching for.

- Make sure the template you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Receipt Payment Format Excel.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and turn form execution into something easy and streamlined!

Form popularity

FAQ

Normally an Orthodox Church is divided into three distinct parts: narthex (entry way); nave (main body); and Altar.

7 Steps Toward a Successful Church Construction Project Let Ministry Be Your Foundation. ... Consider All Your Resources. ... Understand Your Areas of Funding. ... Carefully Count the Cost. ... Know Your Parameters. ... Phase Your Master Plan. ... Count the Cost Again.

The first step once your church realizes the need to construct a church is to form a building committee. This should be a group of members with experience in construction, finance, or other related industries. The committee should also include members with a comprehensive understanding of the needs of the church.

Charitable Organization Registration. Charitable organizations that solicit funds in or from Georgia must register with the Secretary of State unless they are exempt from registration as set forth in the Charitable Solicitations Act.

The process of how to incorporate a church in Georgia include the following 12 steps: Name your church. Recruit incorporators and directors. Appoint a registered agent. File articles of incorporation. Publish. Get an EIN. Establish initial governing documents and policies. Hold meetings of the board.

The final step to start a nonprofit in Georgia is applying for tax-exempt status. Here are some things you must know about this process: You'll need to complete Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. For this, you'll need to pay a $600 filing fee.

Structures may vary, but most have some form of elder board or board of deacons to handle administrative duties while the pastor is responsible for preaching and teaching. In a congregational model, the pastor is hired by the church board or by a vote of the members.

Here's How to Start a Church in seven steps. Decide on the basics. ... Write your bylaws. ... Get an Employer Identification Number (EIN) ... Open a bank account for your church. ... Get ready to fundraise. ... Obtain a certificate of formation or articles of incorporation. ... Apply for official 501(c)(3) status.