A waiver is the voluntary surrender of a known right or privilege granted under an agreement, or the failure to take advantage of some failure of performance or other wrong.

Agreement Contract Breach Withholding Payment

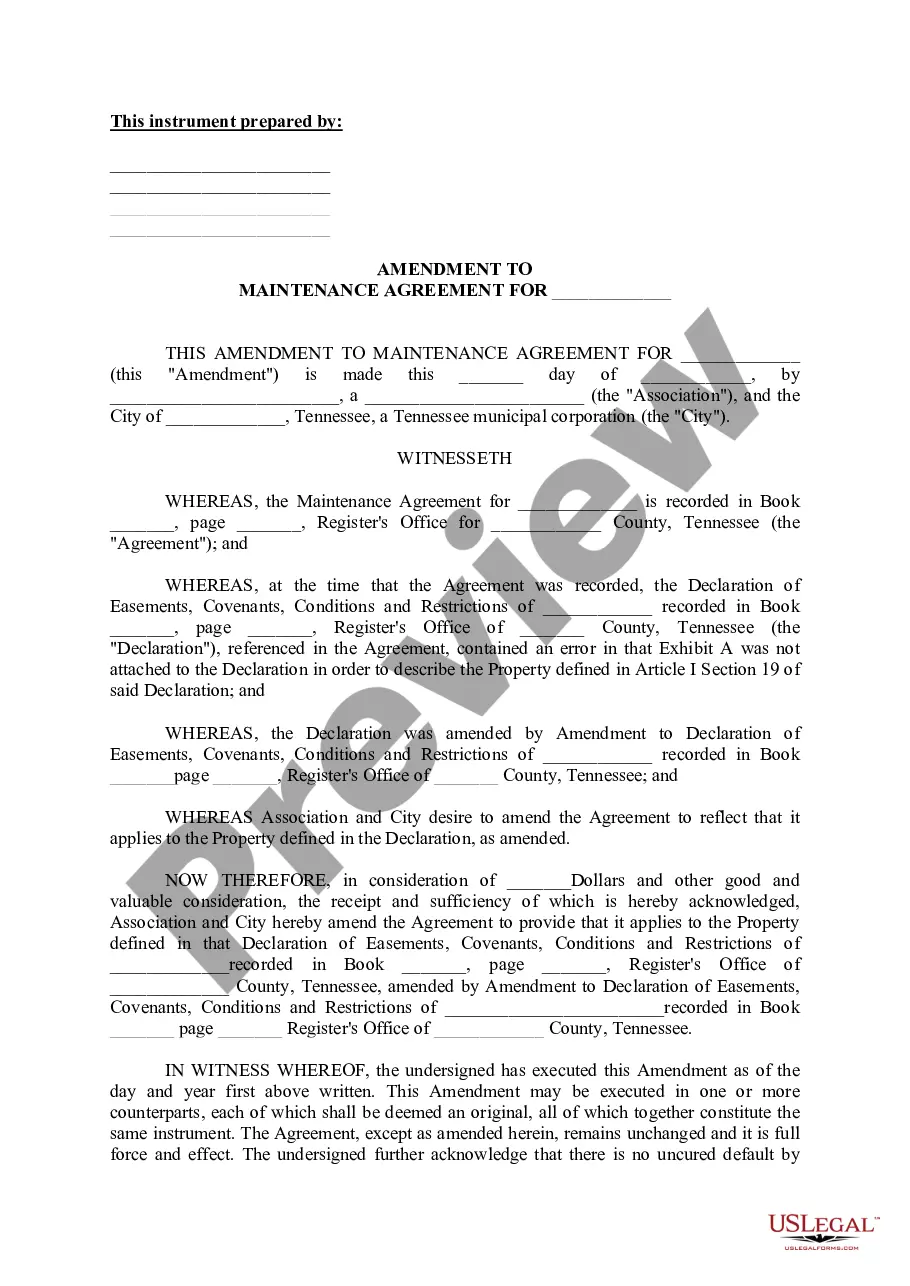

Description

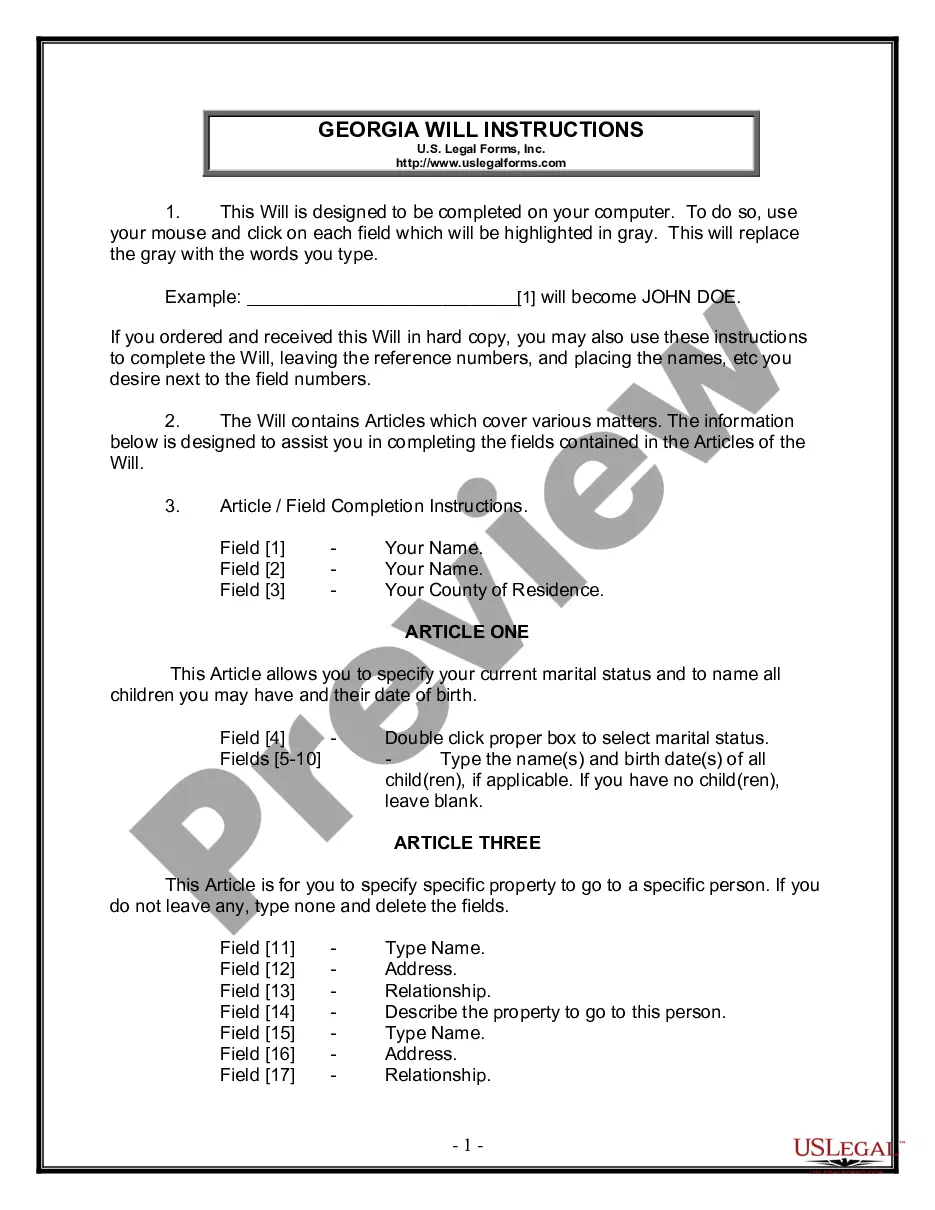

How to fill out Agreement Contract Breach Withholding Payment?

There's no further justification to waste time hunting for legal documents to adhere to your local state regulations.

US Legal Forms has assembled all of them in a single location and enhanced their availability.

Our website provides over 85k templates for any business and personal legal matters, categorized by state and usage area.

Utilize the Search field above to look for another example if the current one doesn't meet your needs.

- All forms are accurately drafted and validated for authenticity, so you can trust in obtaining a current Agreement Contract Breach Withholding Payment.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by accessing the My documents tab in your profile.

- If you haven't interacted with our platform previously, the process will require additional steps to finalize.

- Here's how new users can locate the Agreement Contract Breach Withholding Payment in our collection.

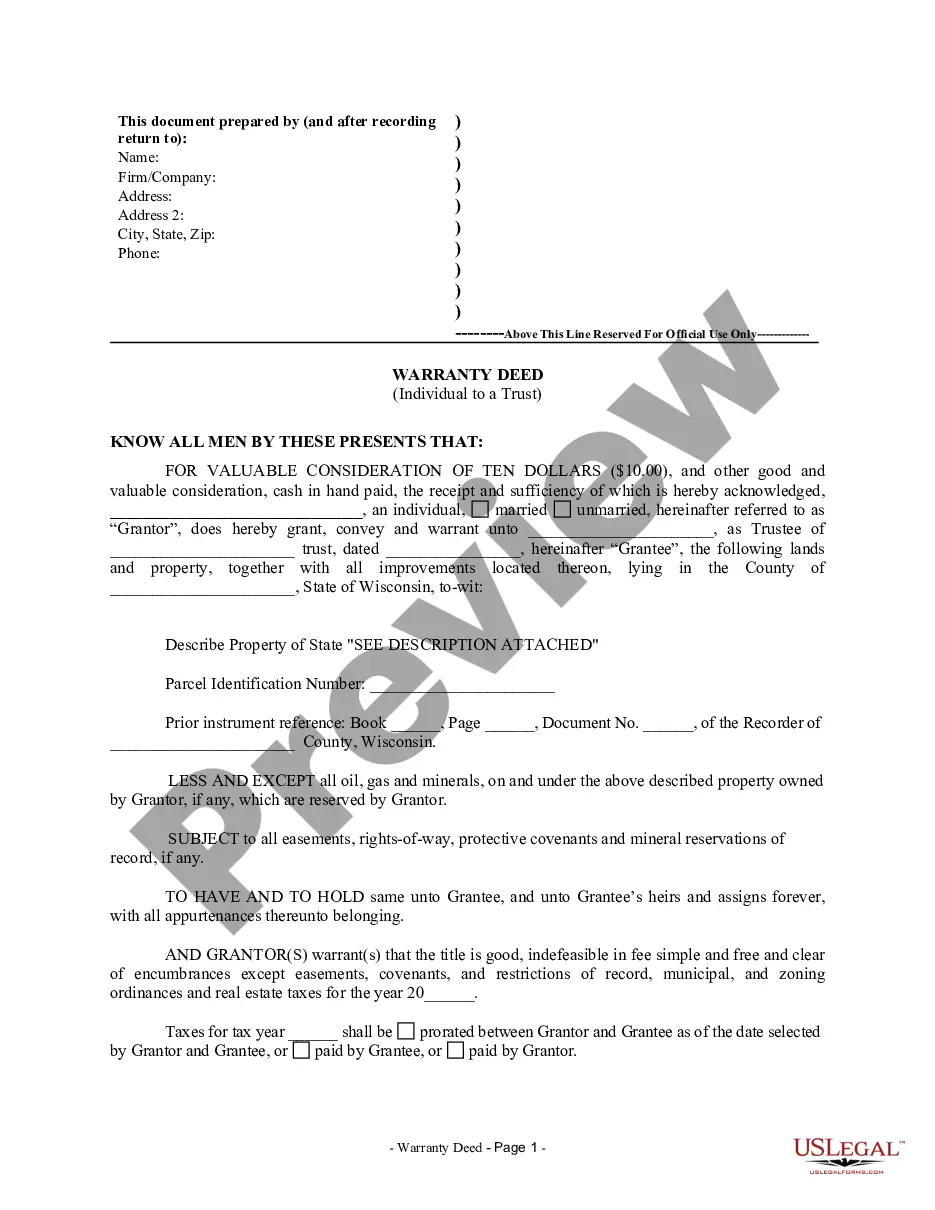

- Examine the page content thoroughly to ensure it includes the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

Legally, one party's failure to fulfill any of its contractual obligations is known as a "breach" of the contract. Depending on the specifics, a breach can occur when a party fails to perform on time, does not perform in accordance with the terms of the agreement, or does not perform at all.

The ability to withhold payment needs to be written out in the contract because, in most states, verbal agreements for commercial work are not binding and will not hold up in court. With a written contract that both parties agree to, it's safe for a contractor to withhold payment if a vendor becomes non-compliant.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Are you involved in a business dispute over the failure to pay resulting in a breach of contract? The failure to pay for contracted goods or services is absolutely a breach of contract.

Damages. The payment of damages payment in one form or another is the most common remedy for a breach of contract. There are many kinds of damages, including the following: Compensatory damages aim to put the non-breaching party in the position that they would have been in if the breach had not occurred.