Immovable Property Return Form For Central Government Employees

Description

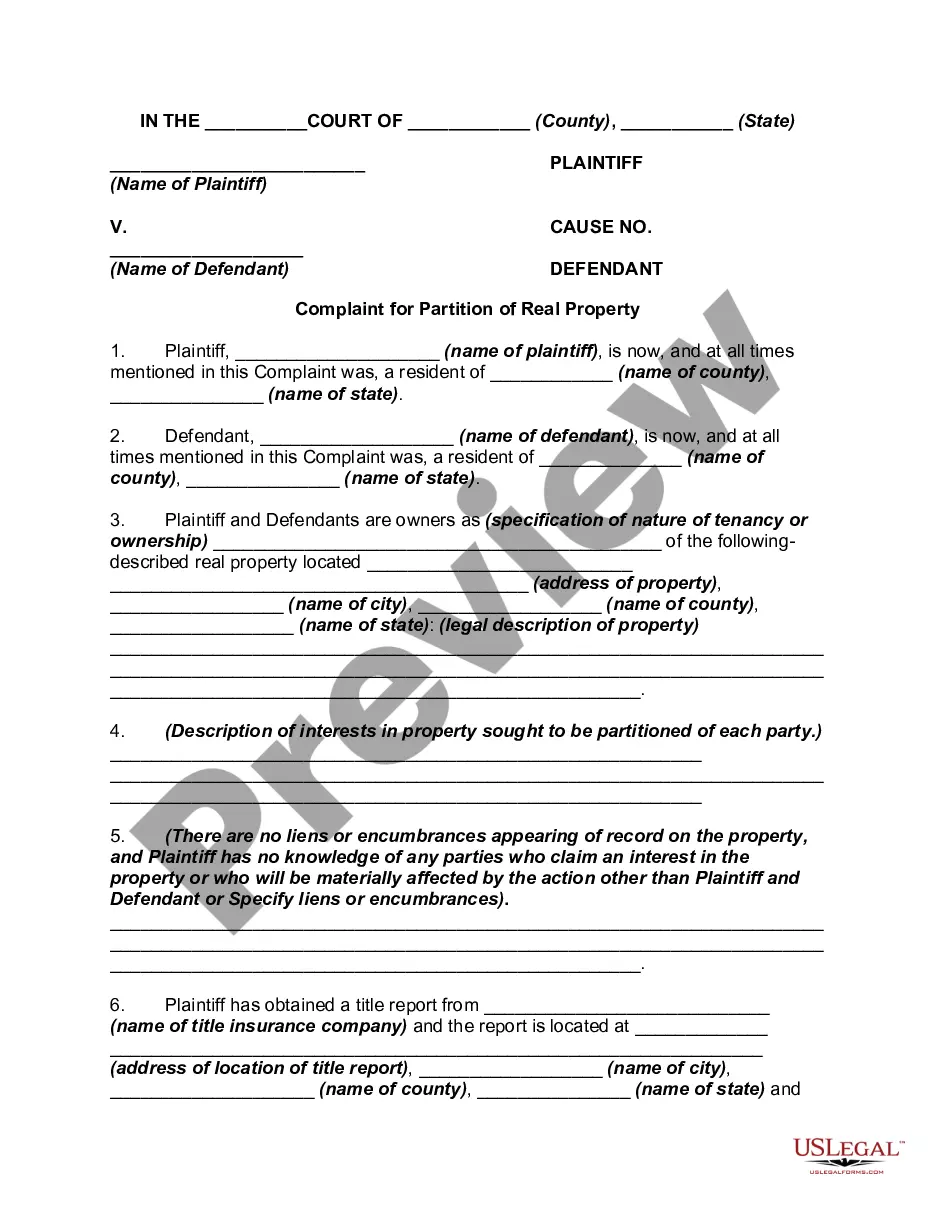

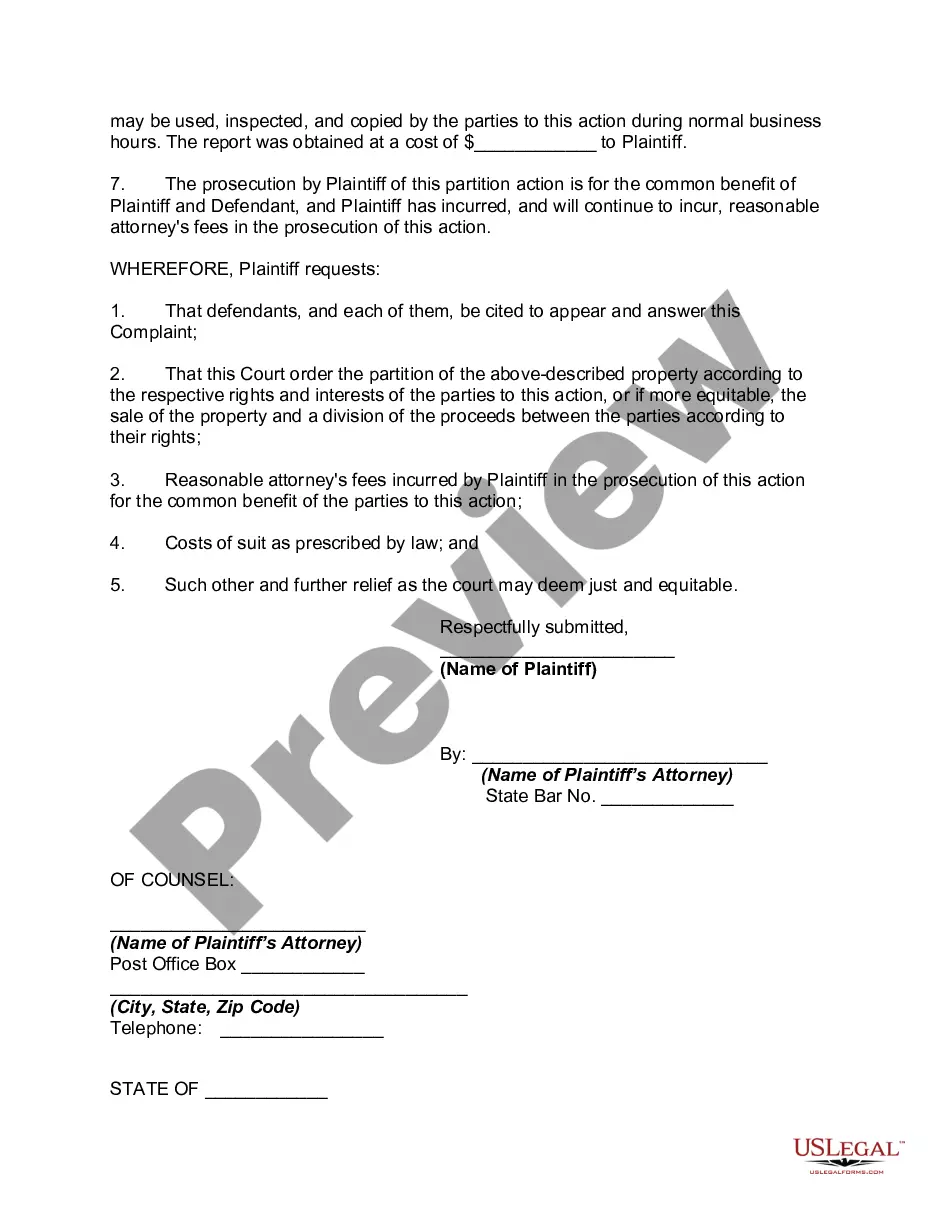

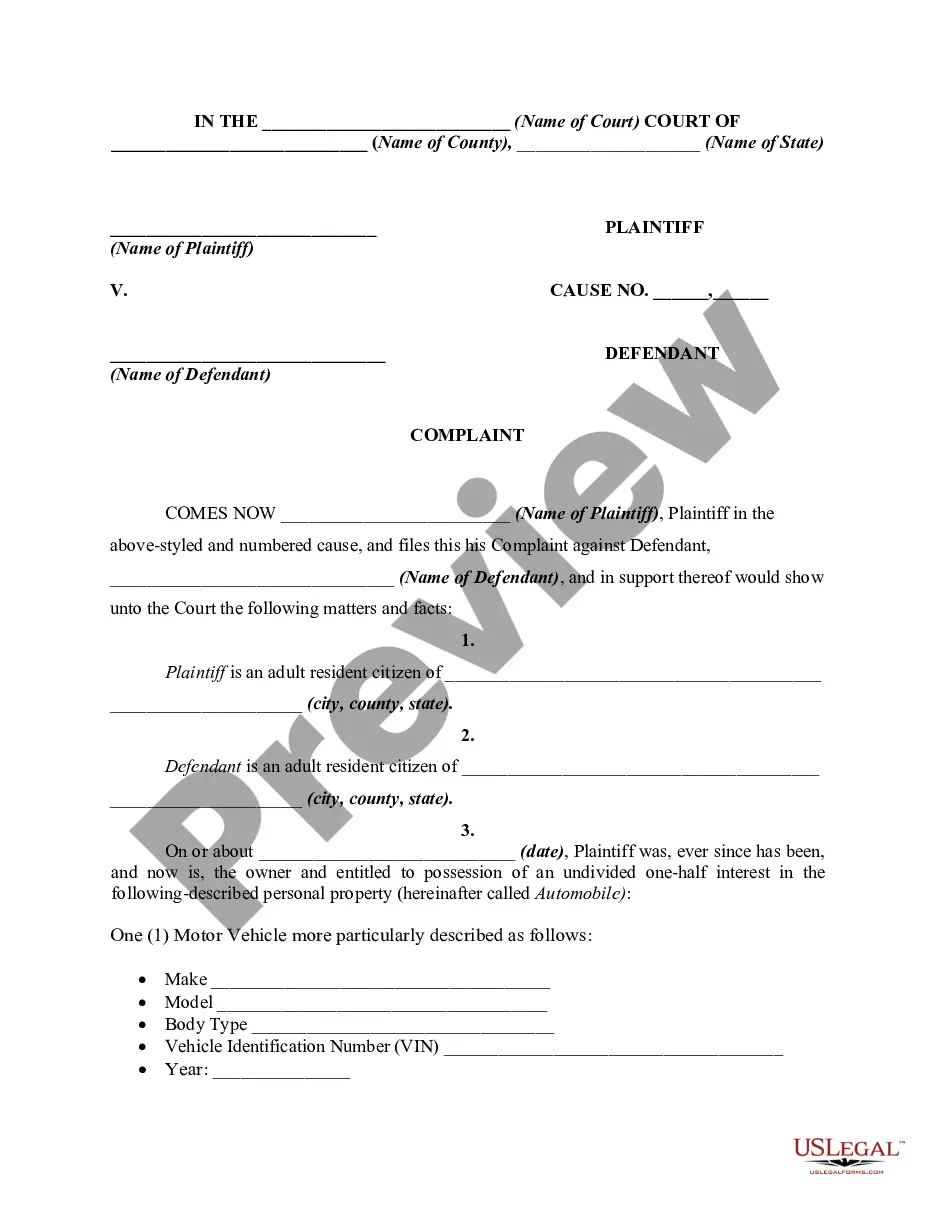

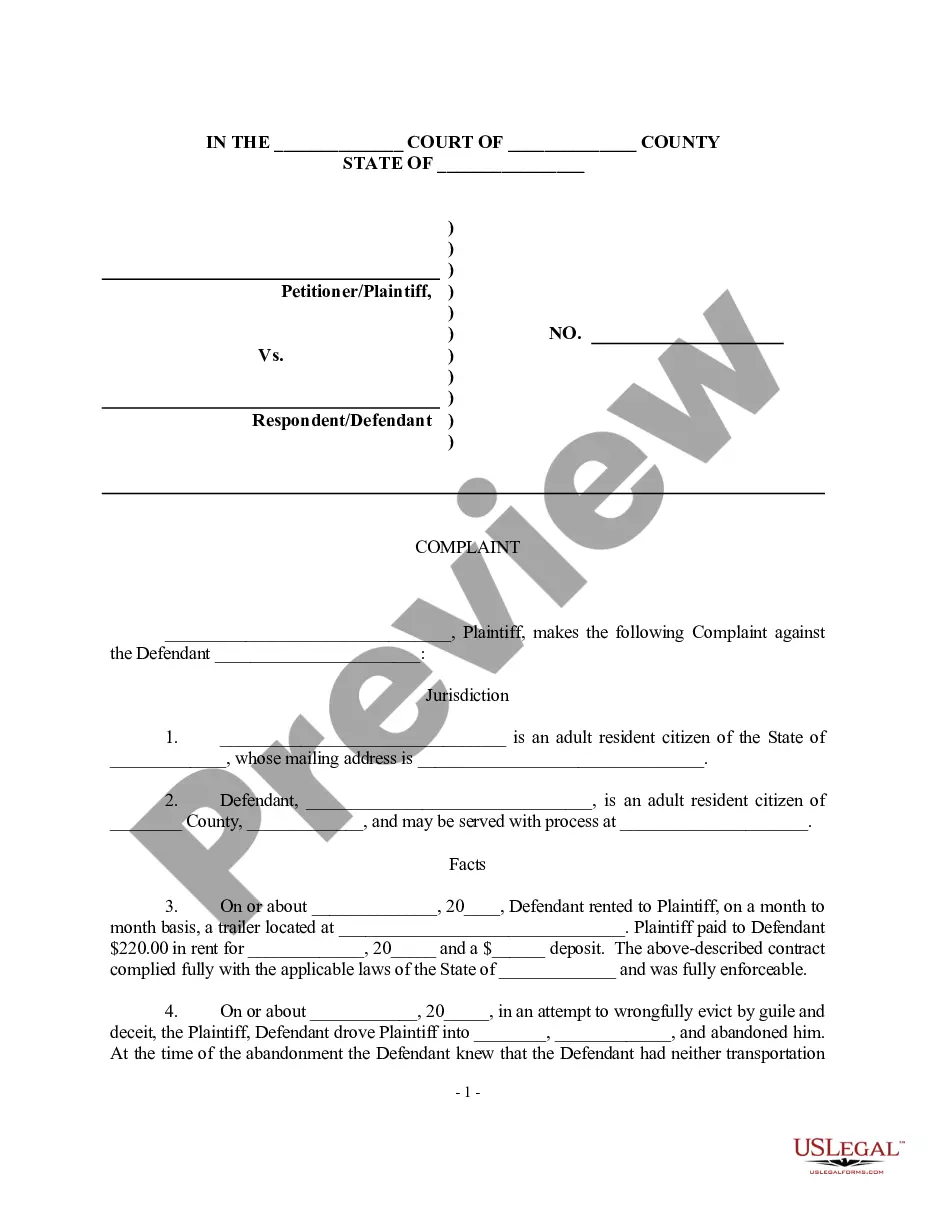

How to fill out Complaint For Partition Of Real Property?

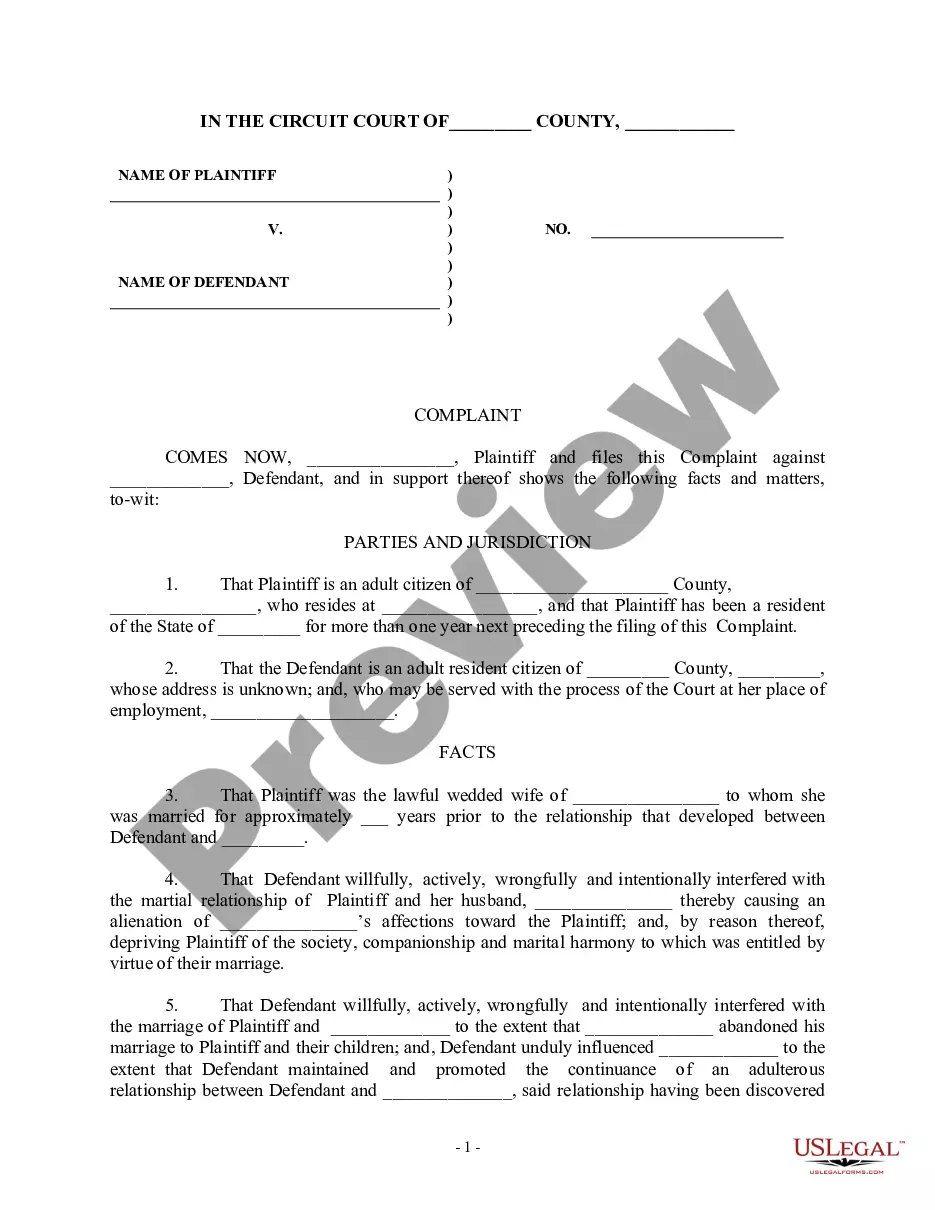

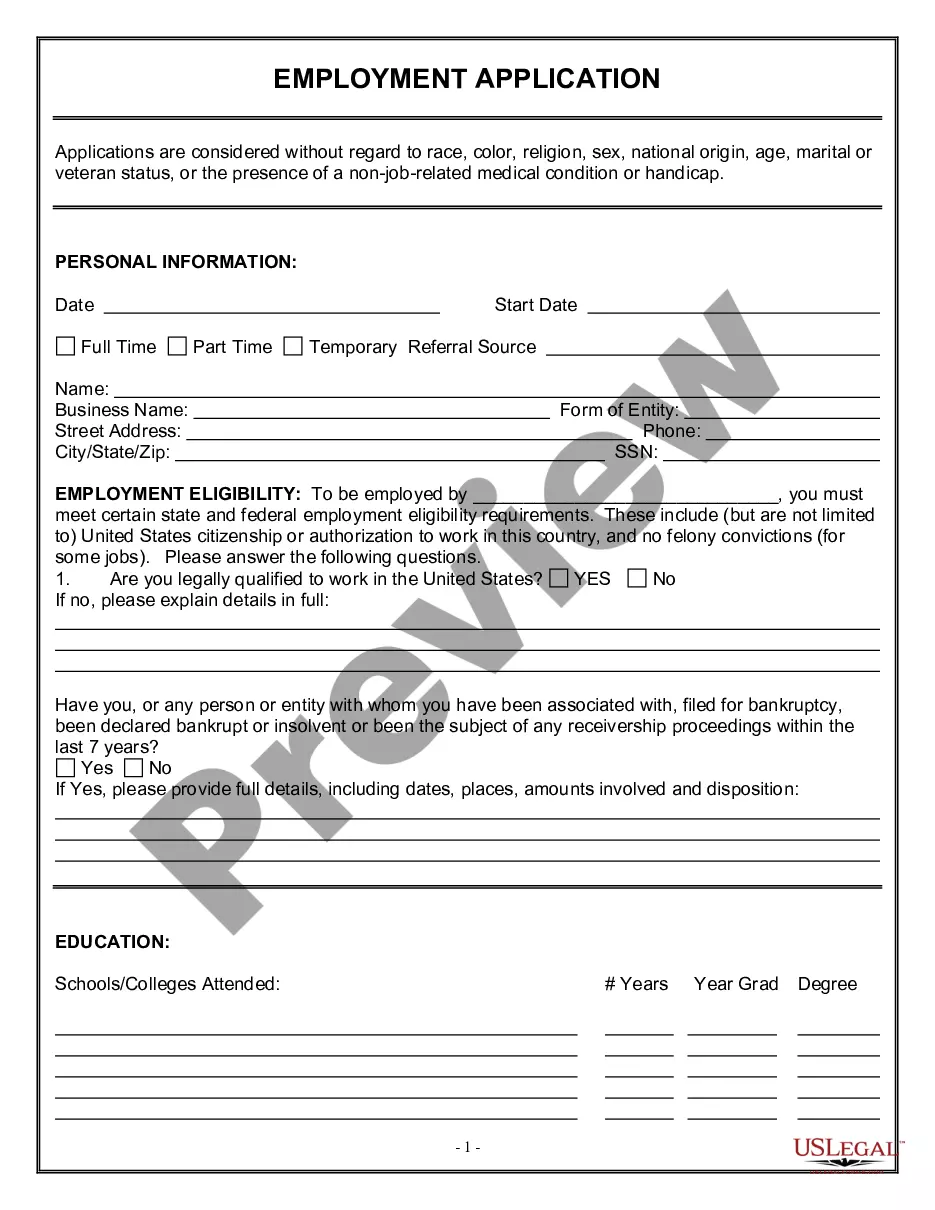

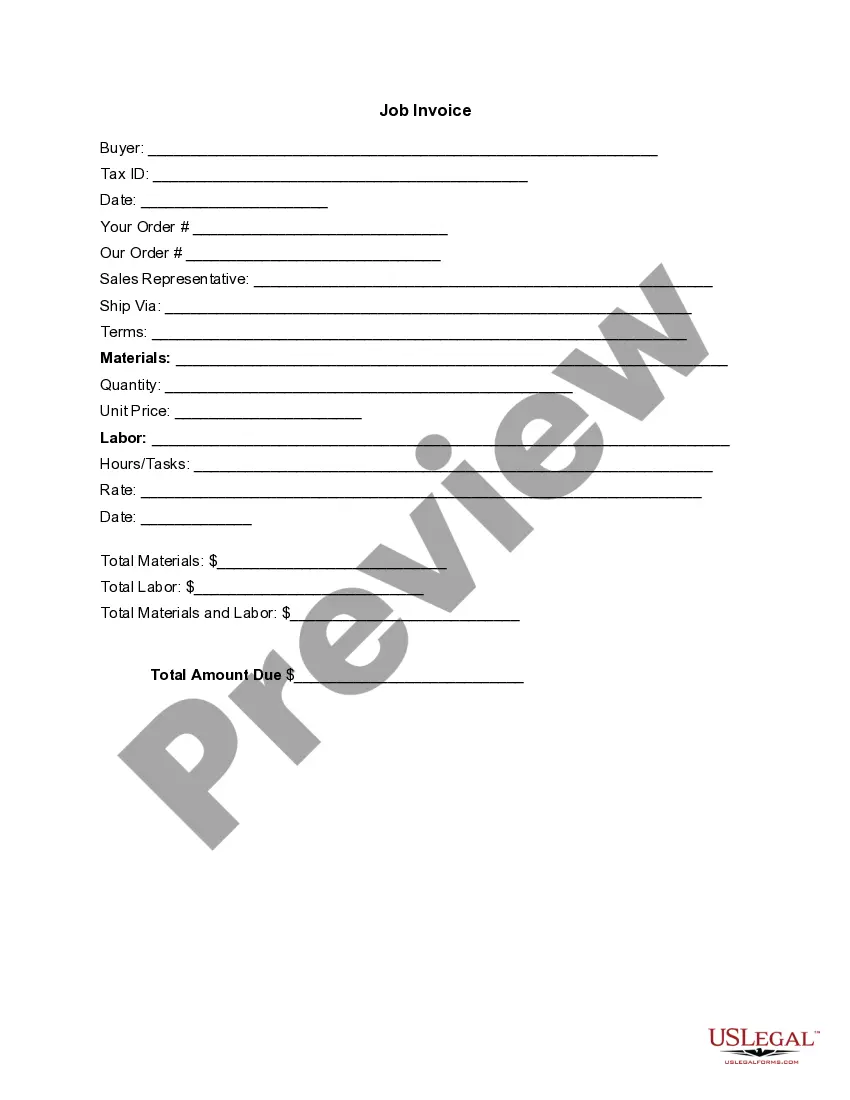

The Unmovable Property Return Document For Federal Government Employees displayed on this webpage is a versatile legal template created by experienced attorneys in compliance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, entities, and lawyers with over 85,000 validated, state-specific documents for any corporate and personal circumstance. It’s the fastest, simplest, and most trustworthy method to secure the paperwork you require, as the service ensures bank-grade data security and anti-malware safeguards.

Complete and sign the documents. Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your document with an electronic signature.

- Search for the document you require and evaluate it.

- Review the sample you searched and preview it or inspect the document description to confirm it meets your requirements. If it doesn’t, use the search feature to find the suitable one. Click Buy Now when you have found the template you want.

- Register and Log In.

- Choose the pricing option that best fits you and create an account. Use PayPal or a credit card to make an instant payment. If you already possess an account, Log In and verify your subscription to continue.

- Receive the editable template.

- Select the format you prefer for your Unmovable Property Return Document For Federal Government Employees (PDF, DOCX, RTF) and save the document on your device.

Form popularity

FAQ

The Accreditation in PR (AIPR) is a certification provided by the Public Relations Consultants Association of India. The initiative aims to elevate the public relations profession by recognizing those who have demonstrated the knowledge, skills, and professional calibre in the profession.

1964), on the first appointment to the service and thereafter at the interval of every twelve months, giving particulars of all immovable property owned, acquired or inherited by him or held by him in lease or mortgage, either in his own name or in the name of any members of his family or in the name of any other ...

The Public Relations Consultants Association of India (PRCAI) today launched India's first Accreditation Programme in Indian Public Relations (AIPR) for public relations professionals ? including young professionals and emerging leaders.

Immovable property is commonly referred to as real estate ? a residential house, a warehouse, a manufacturing unit or a factory. The plants or trees that are attached to the earth are referred to as immovable property. In reality, they remain liable to legal statutes and taxation.