The Medallion guarantee form, also known as a Medallion signature guarantee, is an important document provided by Wells Fargo Bank that ensures the authenticity and validity of a signature during transactions involving securities. This form is primarily used in cases where securities are being transferred or sold, such as stock certificates, mutual funds, or bond transactions. Wells Fargo Bank offers two main types of Medallion guarantee forms: the Medallion Signature Guarantee Program (MSGR) and the Securities Transfer Agents Medallion Program (STAMP). Both of these programs provide the necessary assurance to third-party financial institutions that the signature on the document is genuine and verifies the identity of the individual or entity involved in the transaction. The Medallion Signature Guarantee Program (MSGR) is specifically designed for individual investors, providing coverage for transactions involving domestic stocks and bonds, as well as mutual fund shares. It offers three levels of coverage: the Medallion level, the Gold Medallion level, and the Two-Step Level. The Securities Transfer Agents Medallion Program (STAMP), on the other hand, is primarily intended for corporations and institutional investors. STAMP provides coverage for both domestic and international transactions involving publicly-traded equities and bonds. To obtain a Medallion guarantee form from Wells Fargo Bank, customers are required to have an active account with the bank and provide the necessary documentation. This typically includes the original securities certificate or document, a valid government-issued identification, and proof of ownership or entitlement to the securities. By securing a Medallion guarantee from Wells Fargo Bank, customers can confidently complete financial transactions involving securities with other financial institutions, knowing that their signatures have been verified and validated. The Medallion guarantee form provides an added layer of security and helps prevent fraudulent activities in the transfer or sale of securities. In summary, the Medallion guarantee form for Wells Fargo Bank is a vital document that ensures the authenticity and validity of signatures during transactions involving securities. Wells Fargo offers two main types of Medallion guarantee forms: the Medallion Signature Guarantee Program (MSGR) for individual investors and the Securities Transfer Agents Medallion Program (STAMP) for corporations and institutional investors. Obtaining a Medallion guarantee form from Wells Fargo Bank provides customers with confidence and security when conducting transactions involving securities.

Medallion Guarantee Form For Wells Fargo Bank

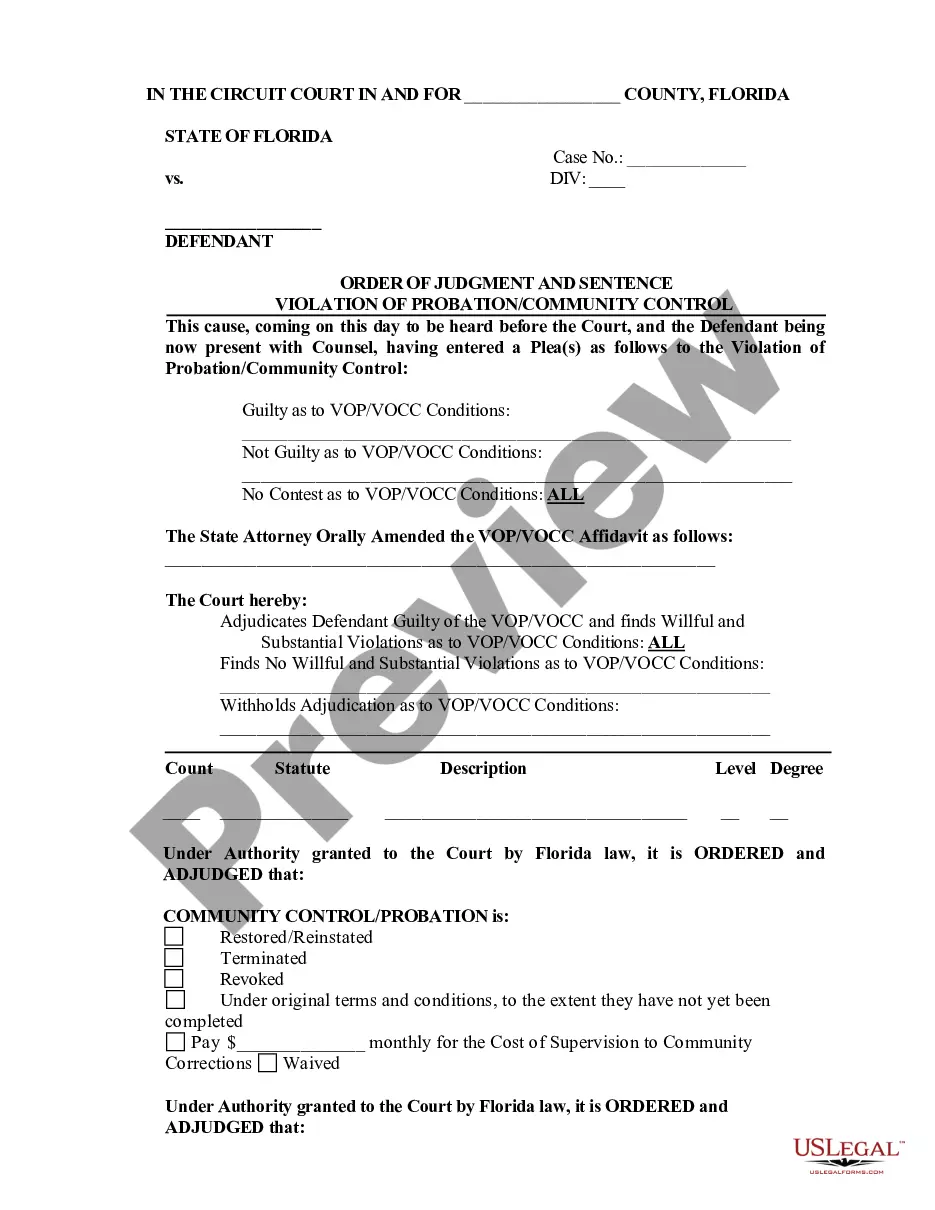

Description wells fargo medallion signature guarantee form

How to fill out Medallion Guarantee Form For Wells Fargo Bank?

Finding a go-to place to access the most current and appropriate legal samples is half the struggle of handling bureaucracy. Finding the right legal papers requirements precision and attention to detail, which is the reason it is very important to take samples of Medallion Guarantee Form For Wells Fargo Bank only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the details regarding the document’s use and relevance for the situation and in your state or county.

Take the listed steps to complete your Medallion Guarantee Form For Wells Fargo Bank:

- Use the library navigation or search field to locate your template.

- View the form’s description to see if it fits the requirements of your state and area.

- View the form preview, if available, to make sure the template is the one you are searching for.

- Get back to the search and find the right document if the Medallion Guarantee Form For Wells Fargo Bank does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that suits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by picking a payment method (bank card or PayPal).

- Select the document format for downloading Medallion Guarantee Form For Wells Fargo Bank.

- When you have the form on your device, you can alter it using the editor or print it and complete it manually.

Remove the hassle that accompanies your legal paperwork. Discover the comprehensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them immediately.

medallion guarantee stamp wells fargo Form popularity

wells fargo medallion signature guarantee locations Other Form Names

does wells fargo do medallion signature guarantee FAQ

We make it simple, fast, and easy to obtain a Medallion Guarantee. Odyssey offers convenient virtual appointments, eliminating the need for in-person meetings and courier fees.

Most large financial institutions, such as Bank of America, Chase, Wells Fargo, and Capital One provide the Medallion signature guarantee. If one of their branches does not have an on-site reviewer, the documents must be sent for review.

A Medallion Signature Guarantee stamp can be obtained at a bank, credit union, broker, or other financial firm. Individuals should contact the bank, credit union, broker, or other financial firm they have an account with and inquire if the institution participates in the Medallion Signature Guarantee program.

If you have been unable to obtain a medallion guarantee, you should contact the transfer agent or issuer corporation requiring the medallion signature for assistance.

What types of documents do I need to provide to get a medallion signature guarantee? All medallion requests require you to provide a valid government-issued photo ID, the document or documents being stamped and supporting documents (which vary depending on the request type).