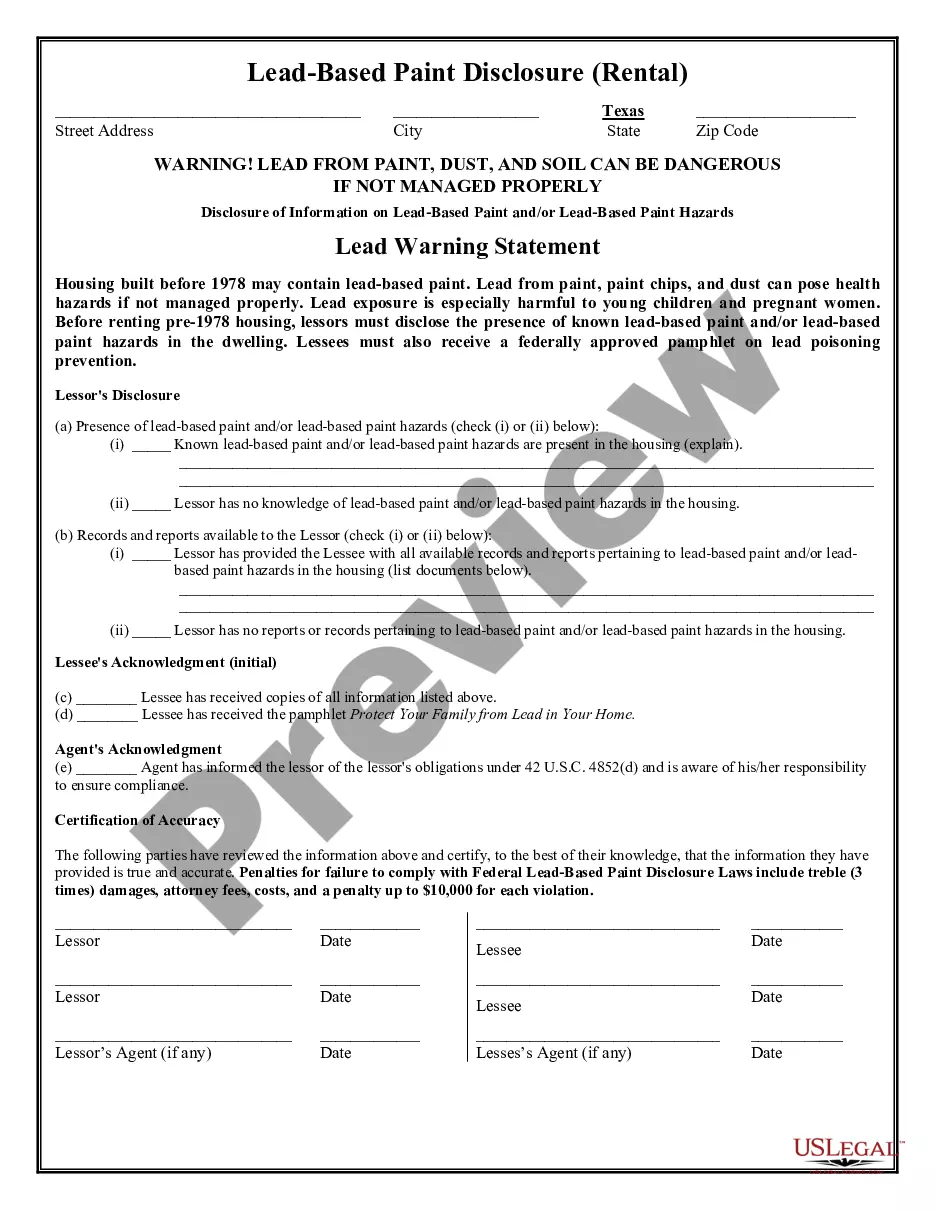

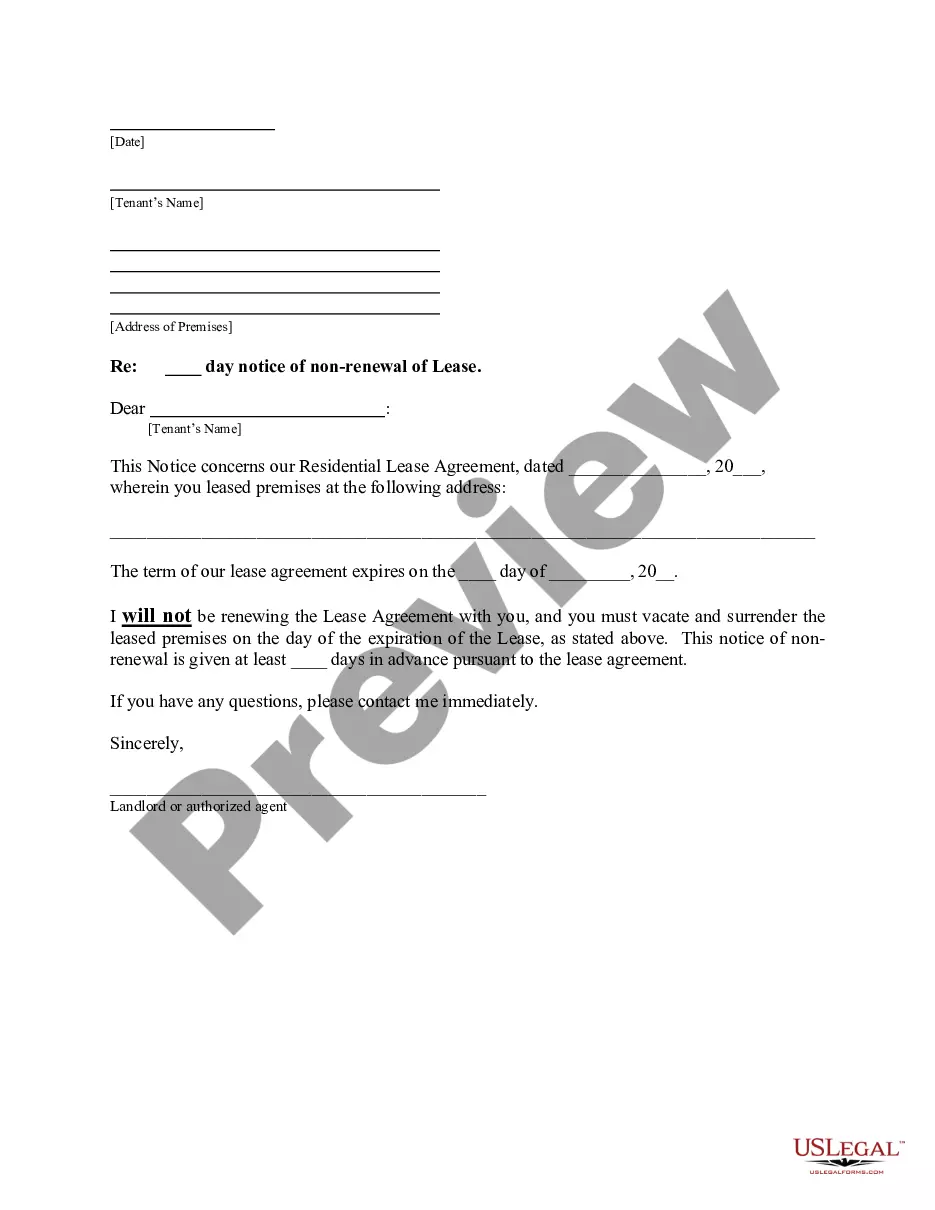

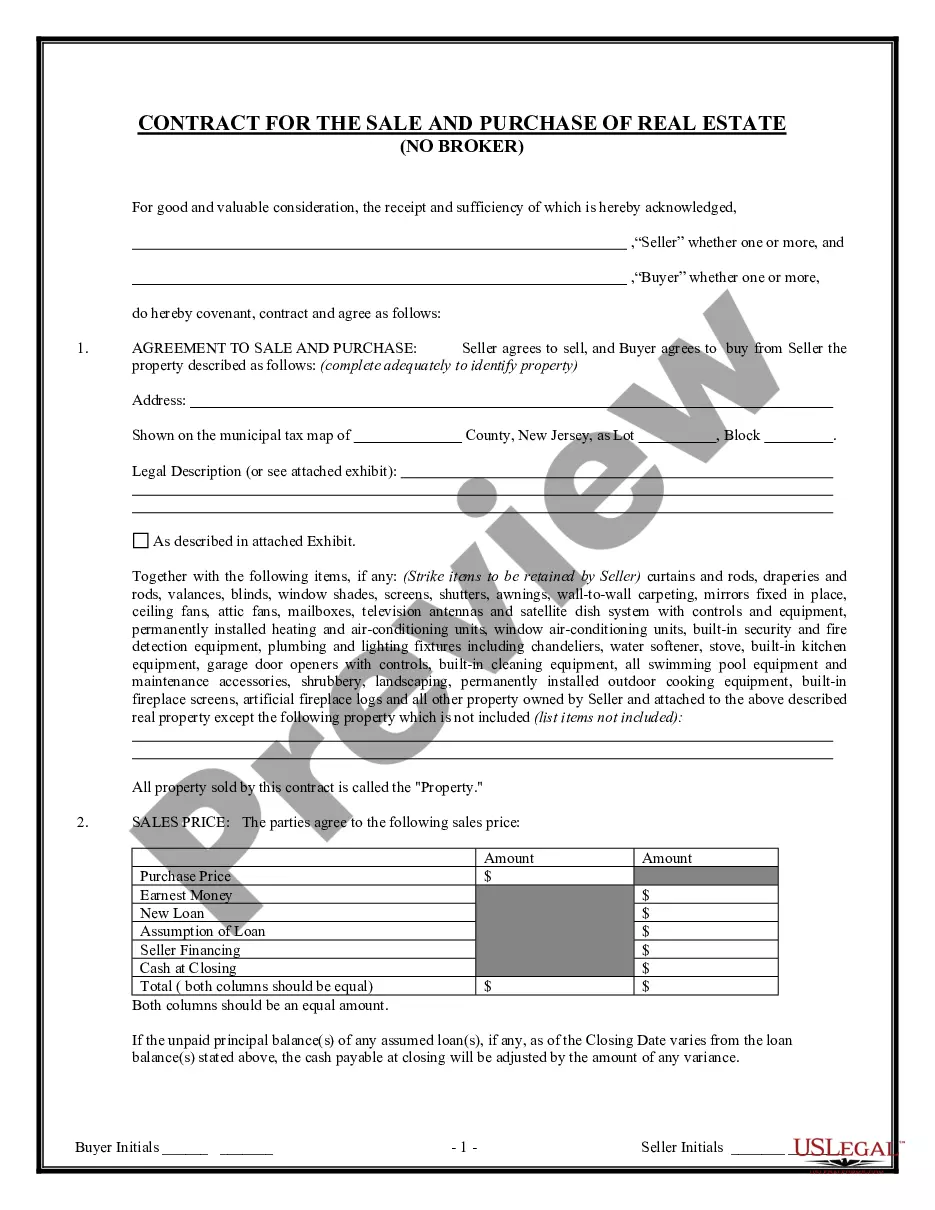

When establishing a Credit business, ensuring that you apply using an Employer Identification Number (EIN) is essential. An EIN functions as a unique identifier for your business, allowing you to navigate financial processes seamlessly. This comprehensive guide will delve into the various types of Credit business forms that require an EIN, outlining each one in detail: 1. Business Credit Card Application with EIN: Applying for a business credit card with an EIN provides entrepreneurs with the opportunity to separate their personal and business expenses. This form offers flexibility, allowing you to track expenditures, build business credit, and enjoy exclusive perks tailored to business needs. 2. Business Loan Application with EIN: Securing business loans is vital for startups and established companies alike. Completing a business loan application with an EIN simplifies the process, enabling financial institutions to evaluate your creditworthiness accurately. Loans can range from small, short-term options to substantial capital for business growth. 3. Business Line of Credit Application with EIN: A business line of credit allows you to access funds within a predetermined limit whenever necessary. This revolving credit form empowers entrepreneurs to tackle unforeseen expenses, manage cash flow fluctuations, and seize growth opportunities. Applying with your EIN streamlines the approval process and enhances credit availability. 4. Business Trade Credit Account Application with EIN: Trade credit accounts enable businesses to purchase goods or services from suppliers without upfront payment. Establishing such accounts assists with inventory management and cash flow optimization. Applying for a trade credit account with your EIN ensures accurate reporting and simplifies the credit approval procedure. 5. Business Lease/Rental Application with EIN: For ventures that require equipment, machinery, or office space, leasing or renting offers flexibility without a substantial upfront investment. When applying for a business lease or rental using your EIN, lessors can assess your creditworthiness and customize lease terms based on your business needs. 6. Merchant Account Application with EIN: A merchant account allows businesses to accept credit and debit card payments. Applying for a merchant account with your EIN is essential for seamless payment processing, increased sales opportunities, and establishing a professional image in the market. By utilizing an EIN during the credit application process, businesses can separate personal and professional finances while enjoying various benefits tailored specifically to their requirements. Whether it's applying for business credit cards, loans, lines of credit, trade credit accounts, leases/rentals, or merchant accounts, utilizing your EIN ensures smoother transactions, better credit evaluation, and improved business growth opportunities.

Loan Business Form Without Personal Guarantee

Description Loan Agreement Form Draft

How to fill out Loan Agreement Between Form?

Regardless of whether you deal with documents on a regular basis or you need to submit a legal document at times, it is crucial to get a resource in which all the samples are related and up to date. One thing you should do with a Loan Business Form Without Personal Guarantee is to ensure that it is its most recent edition, because it defines whether it is submittable. If you want your search for the latest samples of documents simplified, search for them on US Legal Forms.

US Legal Forms is a collection of legal forms containing nearly any document sample you can look for. Search for the templates you require, examine their relevance right away and learn more about their use. With US Legal Forms, you get access to around 85 000 form templates in numerous fields. Get the Loan Business Form Without Personal Guarantee samples in a few clicks and retain them anytime in your account.

A US Legal Forms account will allow you to access all of the samples you require with more comfort and less trouble. One only has to click Log In in the website header and open the My Forms section with all the forms you need on your hand, you will not need to invest time in either browsing for the appropriate template or checking out its validity. To obtain a form with no account, follow these steps:

- Use the search menu to find the form you want.

- View the Loan Business Form Without Personal Guarantee preview and description to ensure it is precisely the one you are looking for.

- After double-checking the form, click Buy Now.

- Pick a subscription plan that works for you.

- Register an account or log in to your existing one.

- Use your credit card details or PayPal account to complete the purchase.

- Choose the document format for download and confirm it.

Forget about confusion dealing with legal paperwork. All your templates will be organized and verified with an account at US Legal Forms.