Term Sheet For Real Estate Transaction

Description

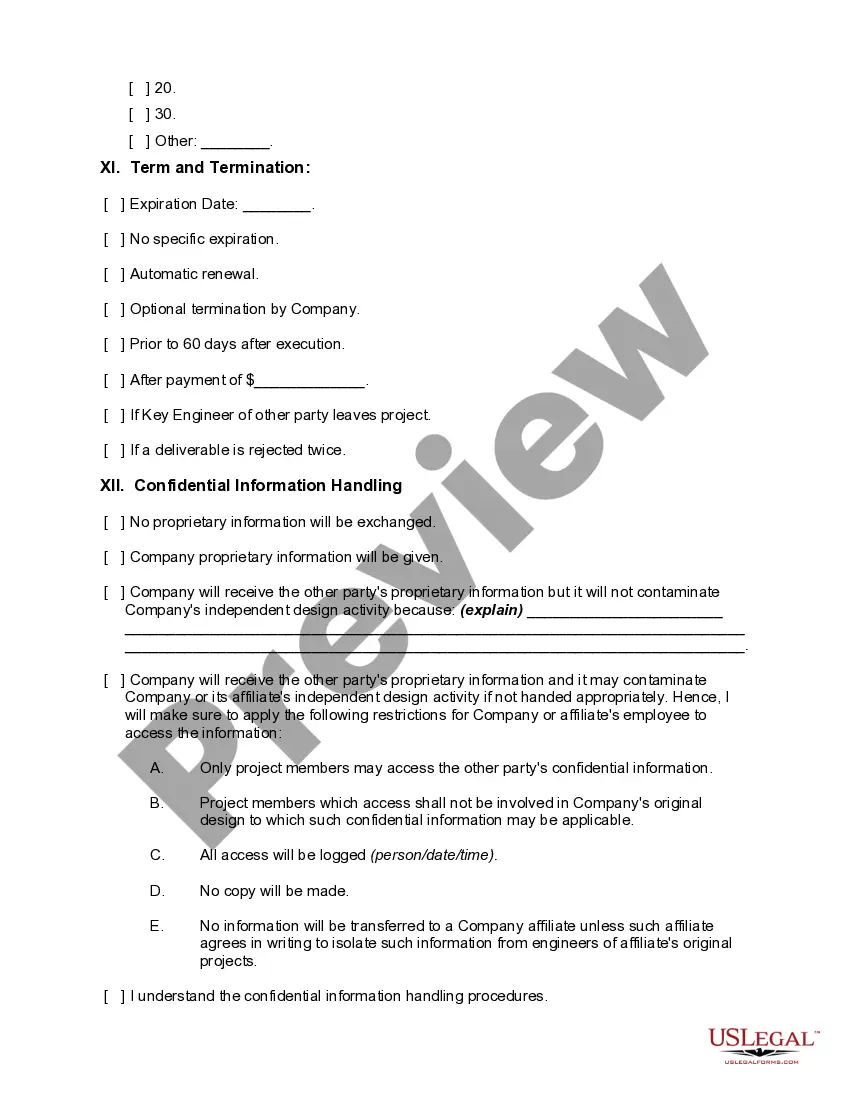

This form may be used to collect information necessary for the preparation of the most common forms of material contracts for a business. The term sheet may be used as a guide when conduct client interviews and should also be consulted during the drafting process. The items in the term sheet are also useful when reviewing contracts that may be drafted by other parties.

Form popularity

FAQ

The time it takes to receive a term sheet for a real estate transaction can vary based on several factors, including the lender's processing speed and the complexity of the deal. Typically, you might expect to receive a term sheet within a few days to a week after initial discussions. However, engaging a knowledgeable professional can help expedite this process and ensure all crucial terms are addressed effectively. Platforms like US Legal Forms may also offer resources to streamline communications and expedite your timing.

The term sheet for a real estate transaction is typically provided by the lender or financing party interested in the deal. This document outlines the key terms and conditions of the financing arrangement. You can expect your real estate attorney or broker to guide you through this process, ensuring that all relevant details are included in the term sheet. Using a platform like US Legal Forms can simplify this process by providing templates that cover necessary elements.

A term sheet in real estate is a preliminary agreement that outlines the basic terms and conditions of a property transaction. It includes details such as financing methods, timelines, and any contingencies that may apply. By having a term sheet for real estate transaction, stakeholders can ensure alignment on key points before proceeding with a formal contract. US Legal Forms offers customizable templates that can help you create a term sheet tailored to your needs.

Another name for a term sheet for real estate transaction is a letter of intent. This document serves similar purposes by indicating the preliminary understanding between interested parties. While the terminology may vary, both serve to outline essential deal terms and facilitate negotiations.

The main purpose of a term sheet for real estate transaction is to outline and clarify the key terms of an agreement before moving to a formal contract. This document serves to minimize misunderstandings and enhance communication between parties. By discussing and agreeing on these terms beforehand, both parties can proceed with confidence and reduce potential disputes.

A term sheet for real estate transaction outlines the key terms and conditions of a deal but does not serve as a legally binding contract. It acts as a preliminary agreement that helps both parties clarify their understanding before drafting a final contract. While a term sheet simplifies negotiations, a contract formalizes and enforces the agreed-upon terms.

In most cases, the lender or financing institution initiates the term sheet for a real estate transaction. However, the borrower may also propose terms that are vital for their needs. Initiating this document is important for both parties, as it sets the stage for negotiations and outlines essential conditions. By addressing preliminary terms upfront, both sides can work toward a successful transaction.

To make a term sheet for real estate transaction legally binding, both parties must sign the document, signaling their agreement to the outlined terms. It’s crucial that all necessary terms are included and clearly defined. Additionally, seeking legal advice can help ensure that the term sheet complies with applicable laws and regulations. A well-prepared term sheet acts as a foundation for a legally binding agreement in the future.

The preparation of the term sheet for real estate transaction often involves collaboration between the lender and the borrower’s legal or financial counsel. These professionals work together to ensure that all critical details are accurately captured in the document. It is essential that both sides have a clear understanding of the terms listed, as this helps facilitate smoother negotiations. If you need assistance in preparing a term sheet, platforms like US Legal Forms can provide valuable resources and templates.

Typically, term sheets for real estate transactions are drafted by financial professionals, such as attorneys or analysts working for the lending institution. Their goal is to create a clear and comprehensive document that addresses all pertinent aspects of the transaction. The process often involves collaboration with both parties to ensure that the most important terms are understood and agreed upon. Thus, having experienced professionals involved can greatly enhance the quality of the term sheet.