Commercial Real Estate Term Sheet Template With Price

Description

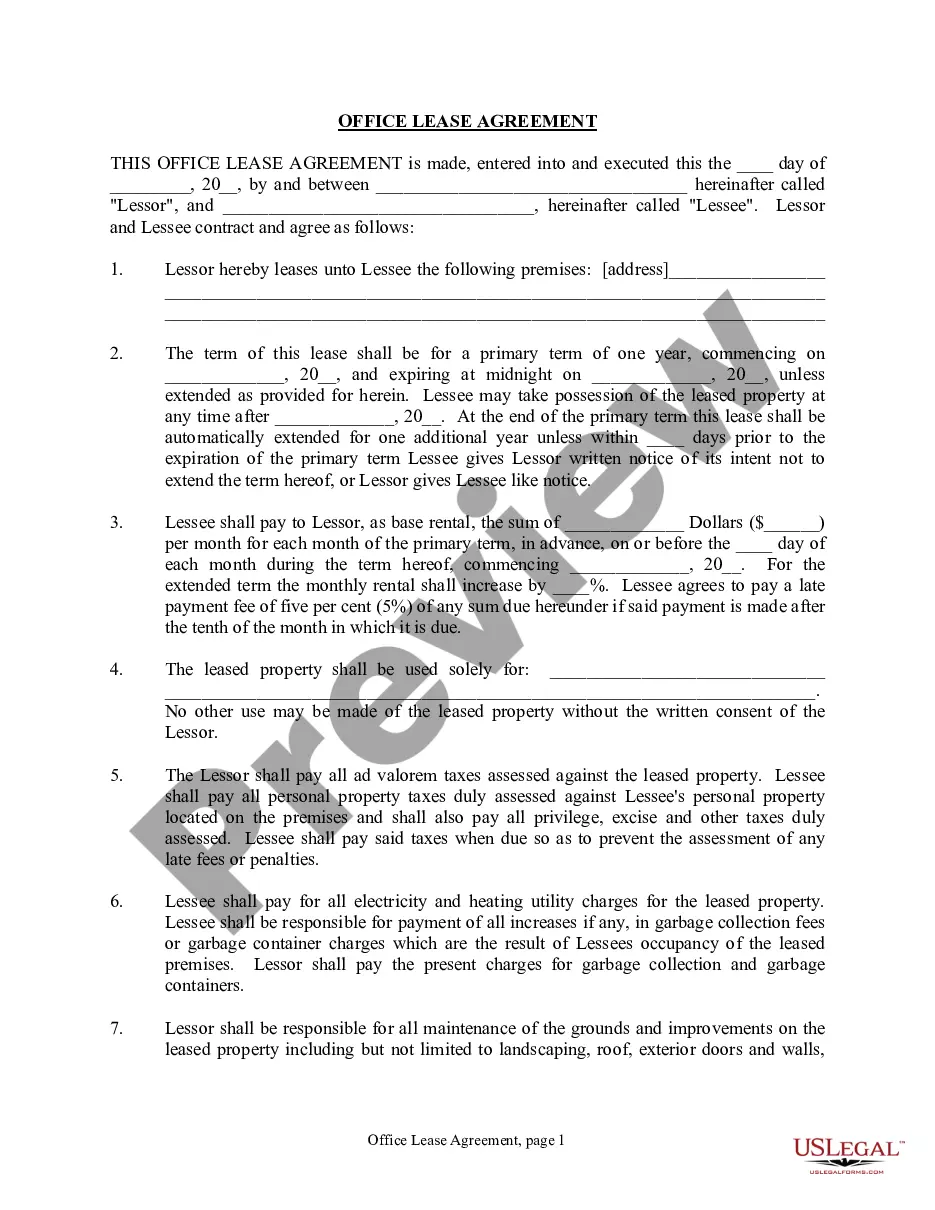

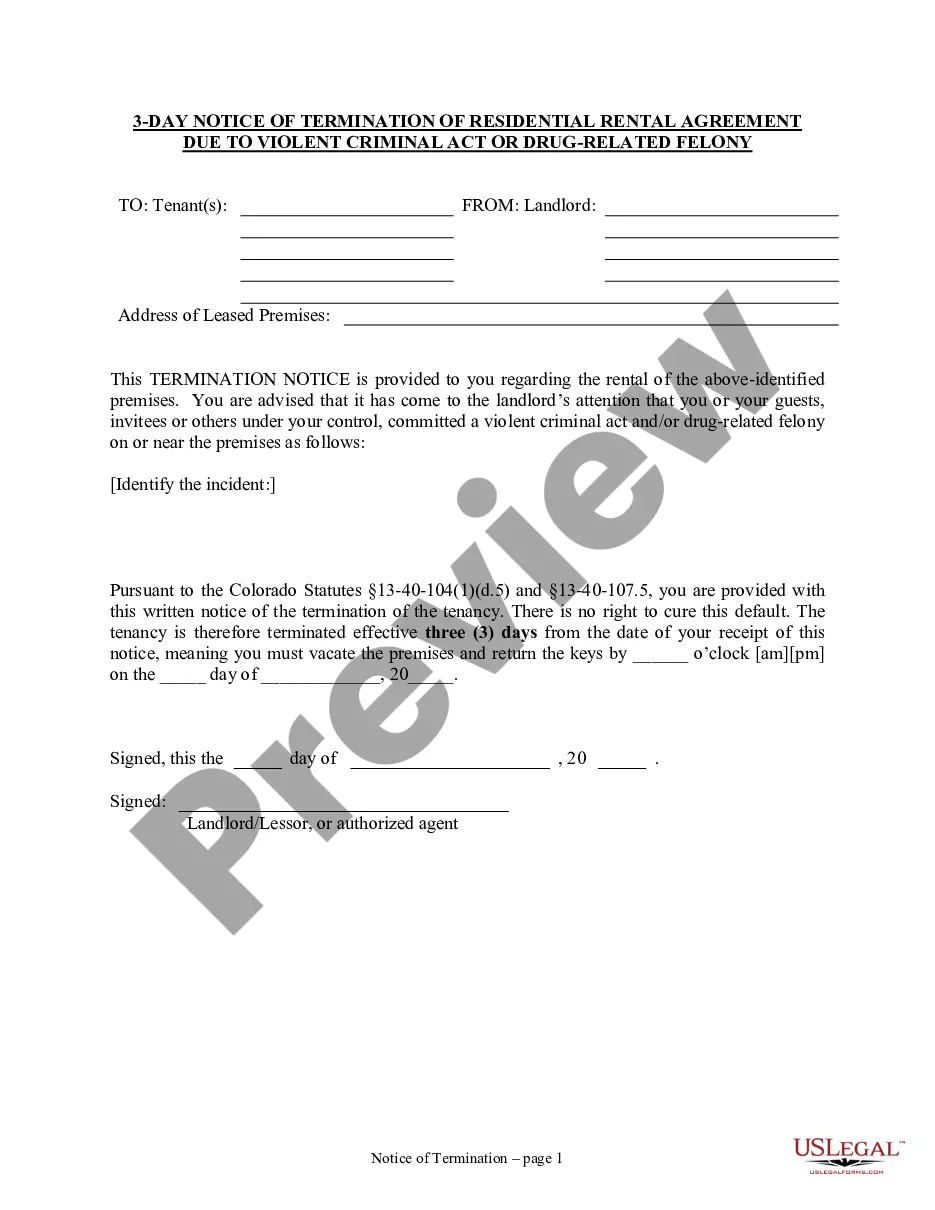

This form may be used to collect information necessary for the preparation of the most common forms of material contracts for a business. The term sheet may be used as a guide when conduct client interviews and should also be consulted during the drafting process. The items in the term sheet are also useful when reviewing contracts that may be drafted by other parties.

How to fill out Terms Sheet For Commercial Lease Agreement?

Utilizing legal document examples that comply with federal and state regulations is crucial, and the web provides numerous options to choose from.

However, what's the benefit of spending time searching for the appropriate Commercial Real Estate Term Sheet Template With Price on the internet when the US Legal Forms online library already has these templates collected in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates designed by attorneys for various business and personal circumstances. They are straightforward to navigate with all documents sorted by state and purpose of use. Our experts keep up with legal updates, so you can always trust that your paperwork is current and compliant when obtaining a Commercial Real Estate Term Sheet Template With Price from our site.

Create an account or Log In and complete your payment with PayPal or a credit card. Choose the suitable format for your Commercial Real Estate Term Sheet Template With Price and download it. All documents you find through US Legal Forms are reusable. To re-download and fill out previously purchased forms, access the My documents tab in your account. Enjoy the most extensive and user-friendly legal document service!

- If you already possess an account with an active subscription, Log In and download the necessary document sample in the appropriate format.

- If you are new to our site, follow the steps below.

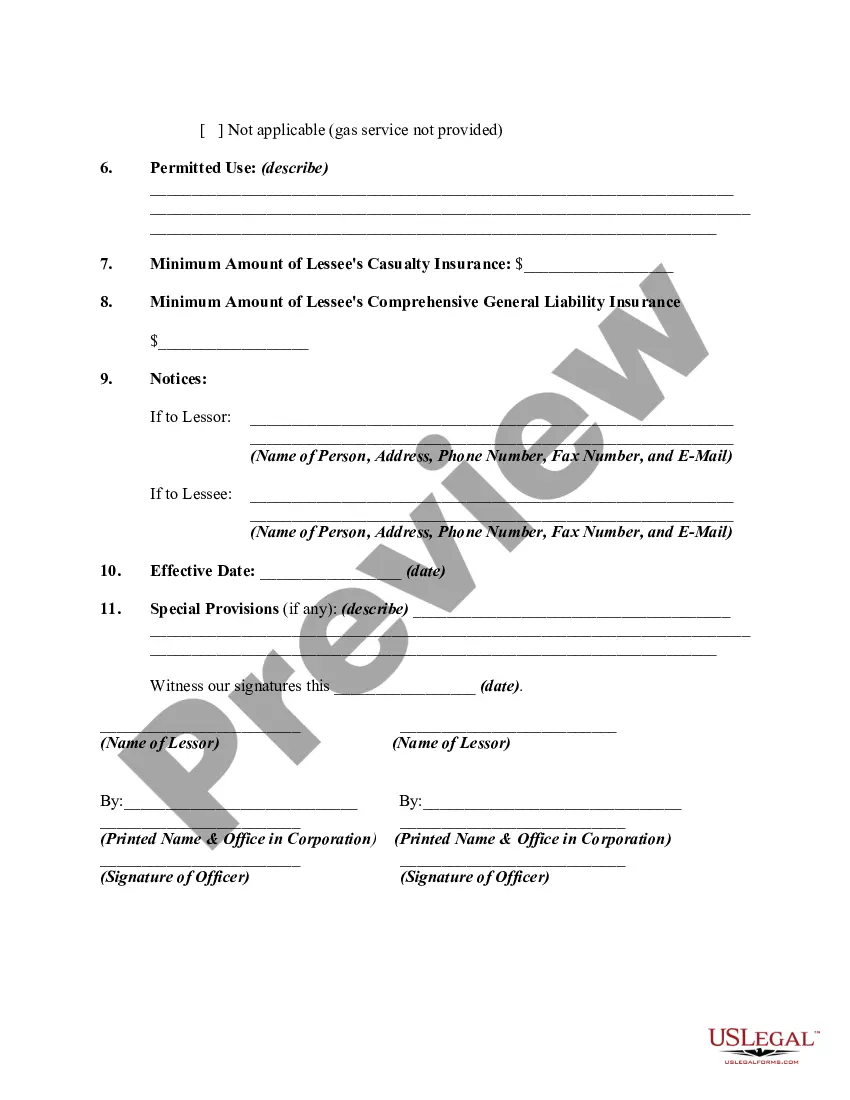

- Review the template using the Preview feature or through the textual outline to ensure it suits your requirements.

- Search for an alternative sample using the search tool at the top of the page if necessary.

- Click Buy Now when you find the correct form and choose a subscription plan.

Form popularity

FAQ

Dissolution, also called winding up, is a process that members of an LLC will go through in preparation to cancel with the secretary of state and terminate the existence of the LLC. Cancellation is on the secretary of state's side, which terminates the rights, privileges, and powers of an LLC.

LLCs will file the Statement of Dissolution, which lets the state know of its intention to dissolve. Once the LLC finishes winding up, it can file a Statement of Termination affirming that its affairs have all closed. You'll provide the name of the company and the date on which it dissolved.

Nebraska requires domestic corporations to publish notice of dissolution. The notice must include: the terms and conditions of dissolution, the names of the persons who are to wind up and liquidate its business and affairs and their official titles, and a statement of assets and liabilities of the corporation.

To dissolve an LLC in Nebraska you need to file the Statement of Dissolution with the Nebraska Secretary of State through mail or online for $10 + $5 per page.

LLC dissolution: California In fact, if you have a California LLC?that is, an LLC formed in California and therefore governed by California LLC laws?it's very important to accurately follow all the steps required to properly dissolve?or cancel, which is the term used in California?your LLC.