Real Estate Term Sheet Template With Cost

Description

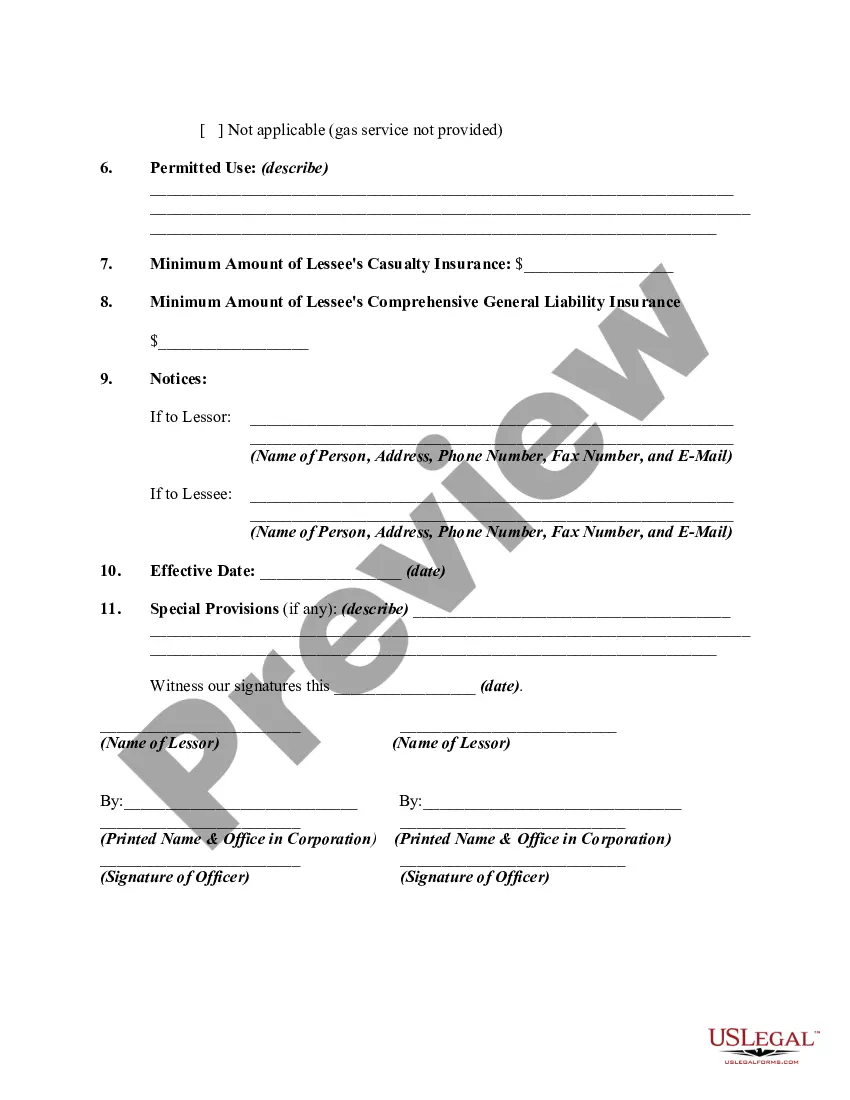

How to fill out Terms Sheet For Commercial Lease Agreement?

It’s no mystery that you cannot become a legal authority instantly, nor can you understand how to swiftly create a Real Estate Term Sheet Template With Cost without possessing a particular skill set.

Assembling legal documents is a labor-intensive endeavor that demands specific education and expertise. Therefore, why not entrust the development of the Real Estate Term Sheet Template With Cost to the professionals.

With US Legal Forms, one of the most extensive legal template repositories, you can access everything from court documents to templates for in-office correspondence. We recognize how vital compliance and adherence to federal and state laws and regulations are.

You can access your forms again from the My documents tab at any time. If you are an existing customer, you can simply Log In, and find and download the template from the same tab.

Irrespective of your forms' intention—be it financial, legal, or personal—our website has you covered. Give US Legal Forms a try now!

- Locate the document you need using the search bar at the top of the page.

- Preview it (if this option is available) and examine the supporting description to determine if the Real Estate Term Sheet Template With Cost is what you require.

- Initiate your search again if you need any additional template.

- Sign up for a free account and choose a subscription plan to purchase the form.

- Select Buy now. After the payment is finalized, you can download the Real Estate Term Sheet Template With Cost, fill it out, print it, and send or deliver it by mail to the appropriate individuals or entities.

Form popularity

FAQ

Writing a term sheet involves outlining the deal terms in a clear and concise manner. Start with the basic information, such as investor details and funding amounts. Applying a Real estate term sheet template with cost can guide you through this process and help you capture all necessary information. This structured approach improves clarity and facilitates better negotiations.

A term sheet usually presents key deal points in a clear and organized format. It includes sections for valuation, investment structure, and rights of investors. Utilizing a Real estate term sheet template with cost ensures that your document is professionally formatted and contains all necessary components. This visual clarity aids in discussions between parties.

Typically, the investor or the company's legal advisor drafts a term sheet. However, it can also be a collaborative effort. For those unfamiliar with the process, using a Real estate term sheet template with cost can provide a helpful starting point. This approach simplifies the drafting process, ensuring nothing gets overlooked.

Filling out a term sheet involves several steps. Start by gathering the necessary financial data and details about the parties involved. Then, use a Real estate term sheet template with cost to structure your information clearly. This template provides guidance on what to include, making the task much simpler.

A term sheet typically outlines crucial elements of a deal, including the valuation, investment amount, equity stake, rights of shareholders, and exit strategies. By using a Real estate term sheet template with cost, you can ensure that all these essential points are covered clearly. Understanding these components helps prevent misunderstandings later on. Focus on these elements for a comprehensive agreement.

Getting a term sheet does not have to be difficult. With the right tools, such as a Real estate term sheet template with cost, you can streamline the process. Many platforms, like US Legal Forms, offer easy-to-understand templates that simplify the experience. Just fill in the necessary information, and you’re on your way.

Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

6 Tips for Writing a Term Sheet List the terms. ... Summarize the terms. ... Explain the dividends. ... Include liquidation preference. ... Include voting agreement and closing items. ... Read, edit and prepare for signatures.

What Is a Term Sheet? A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

A real estate term sheet is a document that outlines the key terms and conditions of a real estate transaction, such as an investment opportunity or a loan. It may include information about the buyer's financial situation, the seller's economic situation, and the sold property.