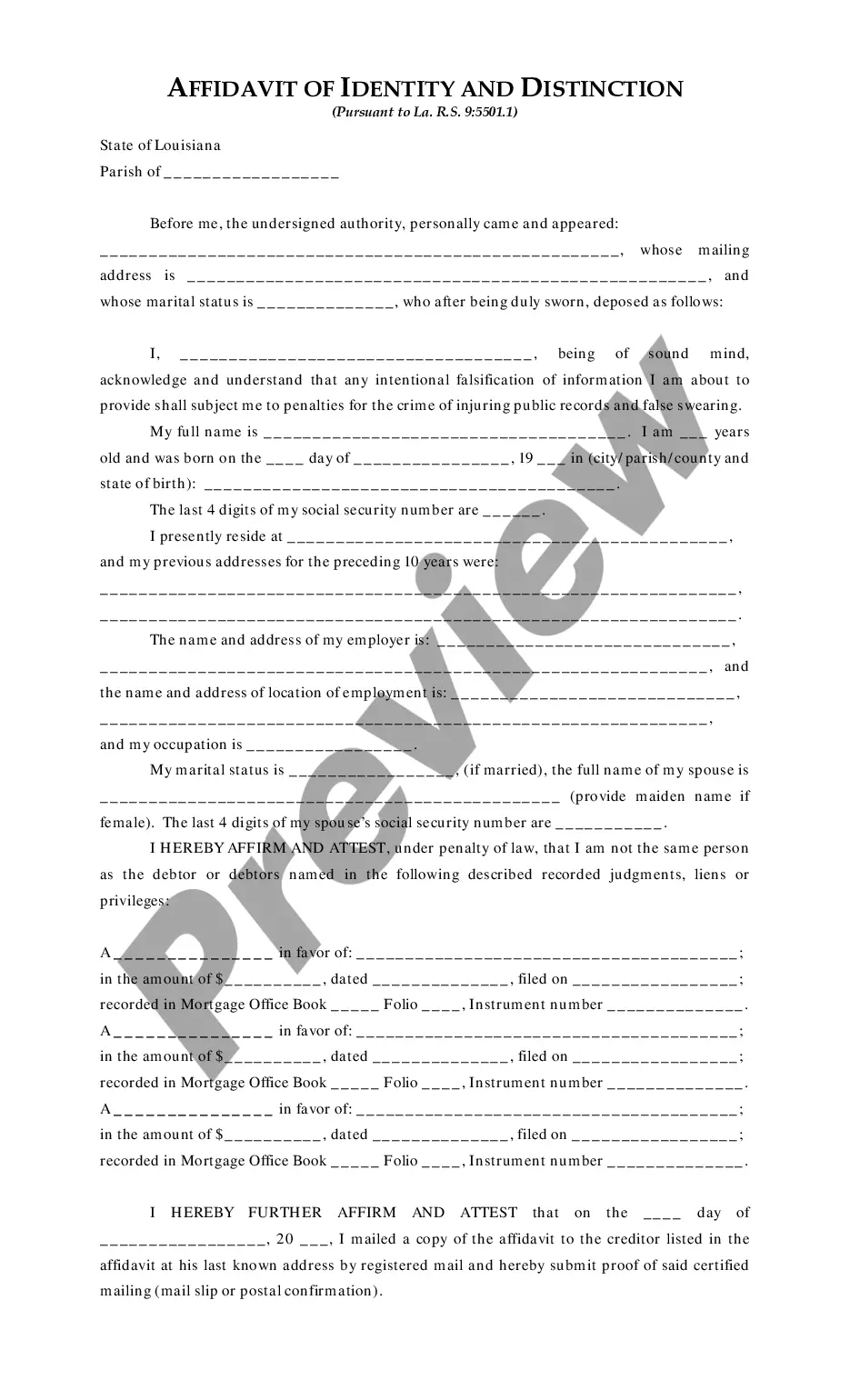

The mortgage note, also known as a promissory note, is a legal document that outlines the terms and conditions of a loan secured by a mortgage. It represents the borrower's promise to repay the loan amount to the lender along with the specified interest rate and any other applicable fees or charges. One type of mortgage note is the fixed-rate note. In this case, the interest rate remains constant throughout the loan term, ensuring predictable monthly payments for the borrower. For instance, a borrower may sign a mortgage note with a fixed interest rate of 3.5% for a 30-year loan term. Another type is the adjustable-rate note. With an adjustable-rate mortgage (ARM), the interest rate fluctuates based on market conditions, typically after an initial fixed-rate period. For instance, a borrower may sign a mortgage note with an ARM that has an initial fixed rate of 2.5% for five years, after which the interest rate adjusts annually based on an index such as the U.S. Prime Rate or the London Interbank Offered Rate (LIBOR). Balloon mortgage notes are also common. They feature lower monthly payments initially but require a large lump sum payment, referred to as the balloon payment, at the end of the loan term. For example, a borrower may sign a mortgage note with a balloon payment of $50,000 after a five-year term. Furthermore, there are interest-only mortgage notes where the borrower pays only the interest for a specified period, typically between five and ten years. After this period, the borrower must begin paying both principal and interest. For instance, a borrower may sign a mortgage note with an interest-only period of seven years followed by principal and interest payments for the remaining 23 years. A mortgage note also includes details about the repayment schedule, late payment penalties, default terms, prepayment options, and any special agreements between the borrower and the lender. It is crucial for both parties to review and understand the contents of the mortgage note before signing, as it legally binds them to the stated terms and conditions.

Select The Best Description Of The Mortgage Note With Examples

Description sample mortgage note

How to fill out Select The Best Description Of The Mortgage Note With Examples?

Handling legal paperwork and procedures might be a time-consuming addition to your day. Select The Best Description Of The Mortgage Note With Examples and forms like it often require you to search for them and understand the best way to complete them effectively. Consequently, if you are taking care of economic, legal, or individual matters, having a extensive and hassle-free online catalogue of forms close at hand will help a lot.

US Legal Forms is the number one online platform of legal templates, featuring over 85,000 state-specific forms and numerous tools that will help you complete your paperwork easily. Explore the catalogue of pertinent papers available to you with just one click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Protect your papers management processes having a high quality support that allows you to prepare any form within a few minutes without any additional or hidden charges. Just log in to the account, identify Select The Best Description Of The Mortgage Note With Examples and acquire it straight away from the My Forms tab. You can also gain access to previously saved forms.

Is it your first time utilizing US Legal Forms? Sign up and set up your account in a few minutes and you’ll gain access to the form catalogue and Select The Best Description Of The Mortgage Note With Examples. Then, follow the steps below to complete your form:

- Be sure you have found the correct form by using the Preview option and looking at the form information.

- Choose Buy Now when all set, and select the subscription plan that fits your needs.

- Press Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience assisting users control their legal paperwork. Obtain the form you need today and streamline any process without breaking a sweat.

mortgage note sample Form popularity

FAQ

The promissory note portion includes: The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.1.

First Mortgage Note means the promissory note of even date herewith from Maker to First Mortgage Lender in an original principal amount of $ . Maker means all of the undersigned. Maturity Date means the earliest to occur of one or more of the following dates.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

Mortgage Note Details The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount.