Buying Property Inspection For Child Under 18

Description

Home Inspection Checklist Comparisons: All home inspections are different and can vary dramatically from state to state, as well as across counties and cities. Much depends on the home inspector and which association, if any, to which the home inspector belongs.

How to fill out Buying Property Inspection For Child Under 18?

Individuals often connect legal documentation with a notion of intricacy that only an expert can manage.

In a certain respect, this is accurate, as creating a Buying Property Inspection For Child Under 18 necessitates significant knowledge in relevant criteria, encompassing state and local laws.

However, with US Legal Forms, matters have become simpler: ready-to-go legal templates for every personal and business scenario specific to state regulations are gathered in one online directory and are now accessible to all.

Print your document or upload it to an online editor for quicker completion. All templates in our catalog are reusable: once acquired, they are saved in your profile. You can access them whenever necessary via the My documents section. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and area of use, making the search for Buying Property Inspection For Child Under 18 or any other specific template quick and easy.

- Previously registered users with an active subscription must Log In to their account and select Download to acquire the form.

- Users who are new to the platform will first need to set up an account and subscribe prior to downloading any documentation.

- Here is the step-by-step guide on how to obtain the Buying Property Inspection For Child Under 18.

- Carefully review the page contents to ensure they meet your requirements.

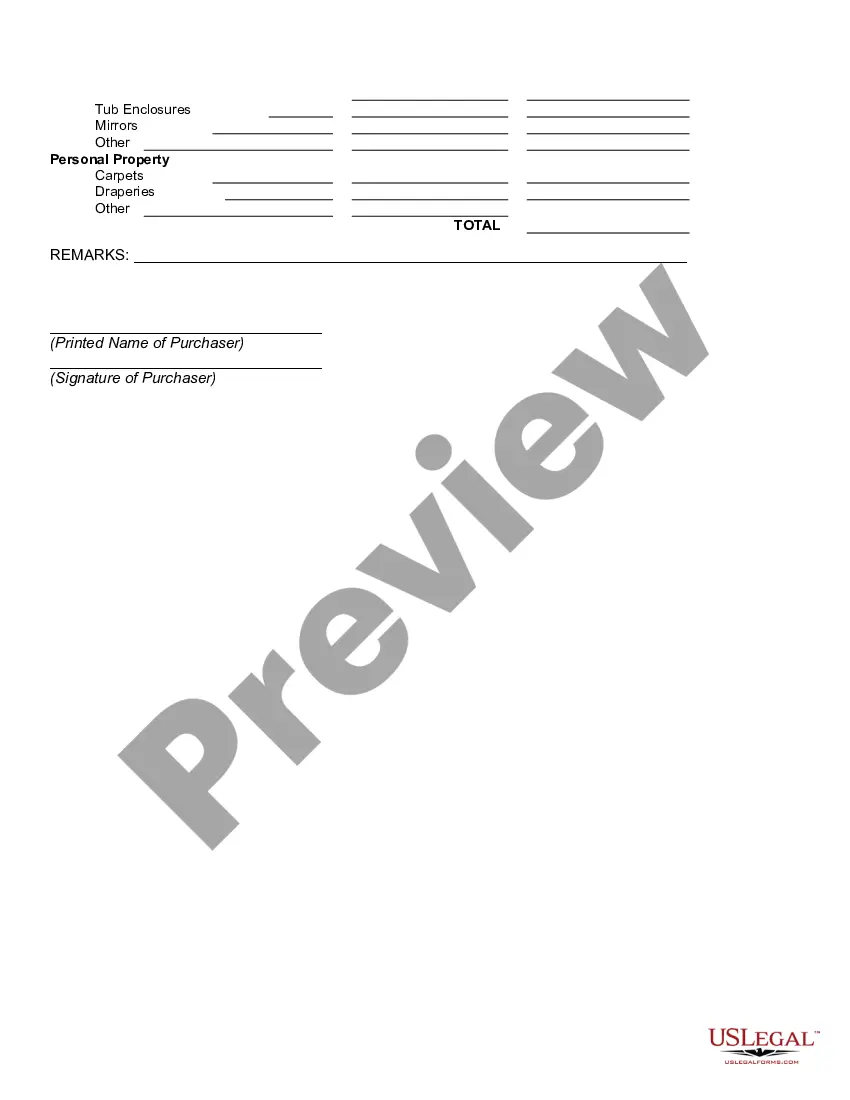

- Read the form description or inspect it using the Preview feature.

- If the prior one does not meet your needs, locate another sample using the Search field above.

- Press Buy Now when you find the appropriate Buying Property Inspection For Child Under 18.

- Choose a pricing plan that suits your needs and budget.

- Create an account or Log In to continue to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Select the format for your document and press Download.

Form popularity

FAQ

Parents have four options: they can buy a property in their own name, but let their children use it; they can buy it directly in their children's name; they can take a charge over the property; or they can set up a trust.

Gifting Money To Children For A House Or Down Payment It can also be more simple and not have strings attached, as a loan agreement does. By helping your child reach the typical 20% down payment, you can help them secure a better mortgage rate and lighten their financial load for years to come.

The gift-giver may need to provide bank statements from where the funds originated. They may also need a letter that states the money is a gift and does not need to be repaid. Gift letters should explain who the donor is, how much they're giving, and the date of the fund transfer.

A Legal And Practical Look At The Question. Share: In the United States, it is legal to buy a house without a co-signer at the age of majority, which is 18 years old in most states. Reaching the age of majority empowers individuals to sign legal agreements and complete real estate transactions.

You can choose to give your child enough money for a down payment, pay their monthly mortgage costs or even buy a home outright for them. There is no tax on cash gifts in Canada, but there are tax implications: If it's a gift you plan to leave your children in your will anyway, you will save them from paying probate.