An agreement to pay on behalf of someone is a legal arrangement wherein an individual or organization assumes financial responsibility for the debts or obligations owed by another party. This agreement is usually signed to ensure that the person or entity making the payment will cover the costs in case the original debtor fails to fulfill their financial obligations. This arrangement can arise in various situations, such as loans, contracts, leases, or even personal favors. There are several types of agreements to pay on behalf of someone, each tailored to specific circumstances: 1. Guarantor Agreement: In this type of agreement, a third party, known as the guarantor, promises to repay a debt if the original debtor defaults. The guarantor's creditworthiness is often evaluated as part of the agreement. 2. Co-Signer Agreement: Similar to a guarantor agreement, a co-signer agrees to repay the debt if the primary borrower cannot fulfill their financial obligations. This type of agreement is common in situations where an individual lacks established credit or has limited borrowing history. 3. Parental Guarantee: Frequently used in educational settings, this agreement is signed by parents or guardians who take on responsibility for paying the tuition fees of their children. The parents become legally liable for the educational expenses if the student fails to make payments. 4. Indemnity Agreement: This agreement serves to protect one party from potential losses or damages resulting from a specific transaction or event. The indemnifying party agrees to cover any financial consequences on behalf of the other party. 5. Letters of Credit: Often employed in international trade, letters of credit involve an agreement between a buyer and a seller where a financial institution guarantees payment to the seller on behalf of the buyer. This provides financial security and ensures timely payment for goods or services. 6. Employer Payment Agreements: In certain cases, employers may agree to pay debts or expenses on behalf of their employees, such as relocation costs or education reimbursements. These agreements outline the terms, conditions, and limitations of the employer's financial commitment. In conclusion, an agreement to pay on behalf of someone is a legal undertaking that can take various forms depending on the specific circumstances and parties involved. These agreements aim to provide financial security and ensure the fulfillment of monetary obligations when the original debtor is unable or unwilling to do so.

Agreement To Pay On Behalf Of Someone

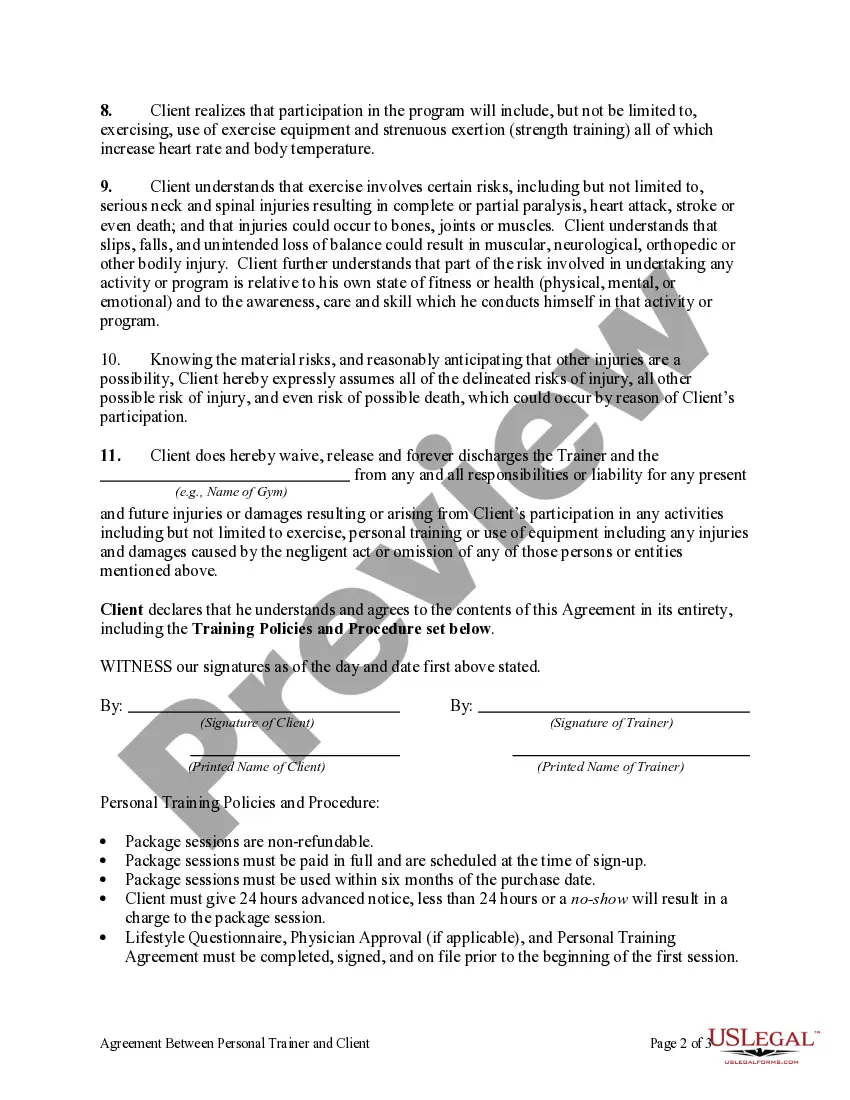

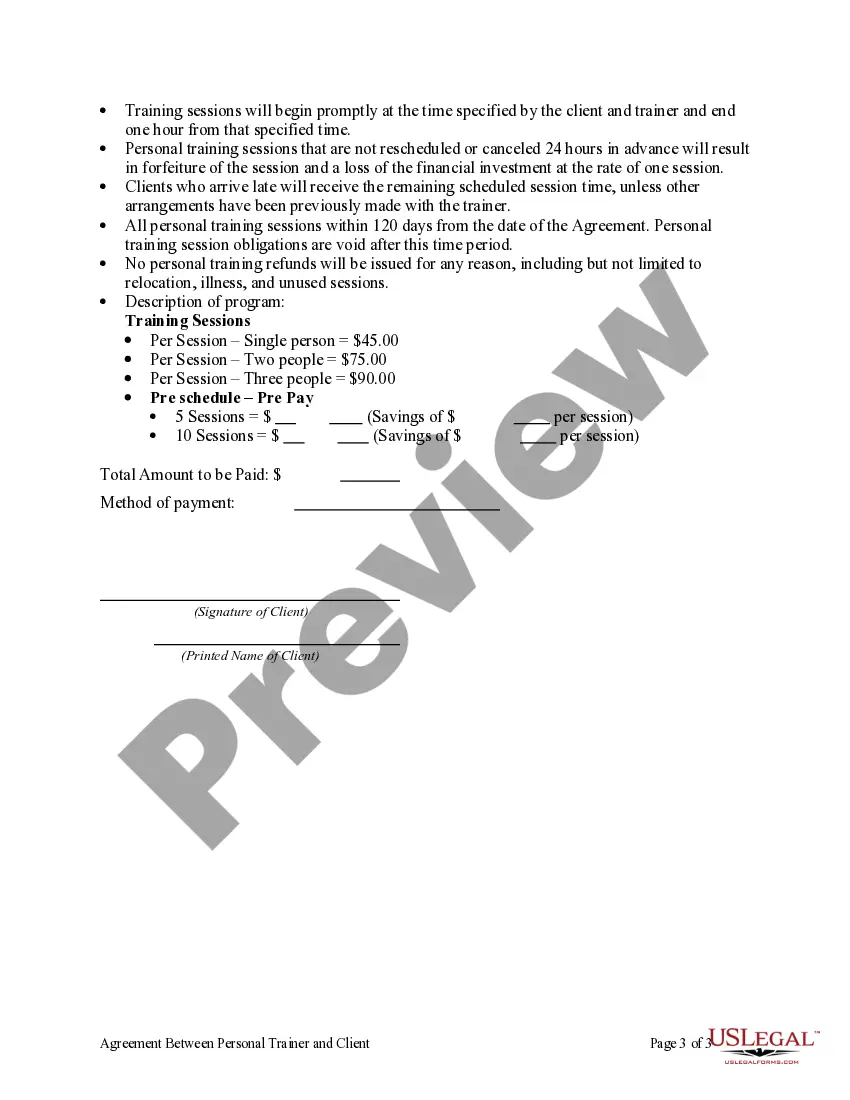

Description Agreement Personal Trainer

How to fill out Client Form Agree?

Drafting legal documents from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for a more straightforward and more cost-effective way of preparing Agreement To Pay On Behalf Of Someone or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of more than 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific templates diligently prepared for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Agreement To Pay On Behalf Of Someone. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to set it up and navigate the library. But before jumping directly to downloading Agreement To Pay On Behalf Of Someone, follow these recommendations:

- Review the form preview and descriptions to make sure you have found the document you are looking for.

- Make sure the template you select complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Agreement To Pay On Behalf Of Someone.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us now and turn form completion into something easy and streamlined!