Business With Credit For Meaning

Description

How to fill out Business With Credit For Meaning?

Individuals often link legal documentation with a level of difficulty that requires expertise to navigate.

In a sense, this is accurate, since preparing Business With Credit For Meaning requires considerable knowledge in relevant areas, such as regional and municipal statutes.

Nonetheless, with US Legal Forms, the process has been simplified: a collection of pre-designed legal templates for various personal and commercial situations, tailored to state laws, is now housed in one online repository and accessible to all.

You can print your document or upload it to an online editor for quicker completion. All templates in our collection can be reused: once purchased, they remain saved in your profile. Access them whenever necessary via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Sign up today!

- US Legal Forms provides over 85,000 current documents categorized by state and purpose, making it quick to find Business With Credit For Meaning or another specific template.

- Existing users with an active subscription must Log In to their account and click Download to receive the form.

- New users are required to create an account and subscribe before they can download any legal documents.

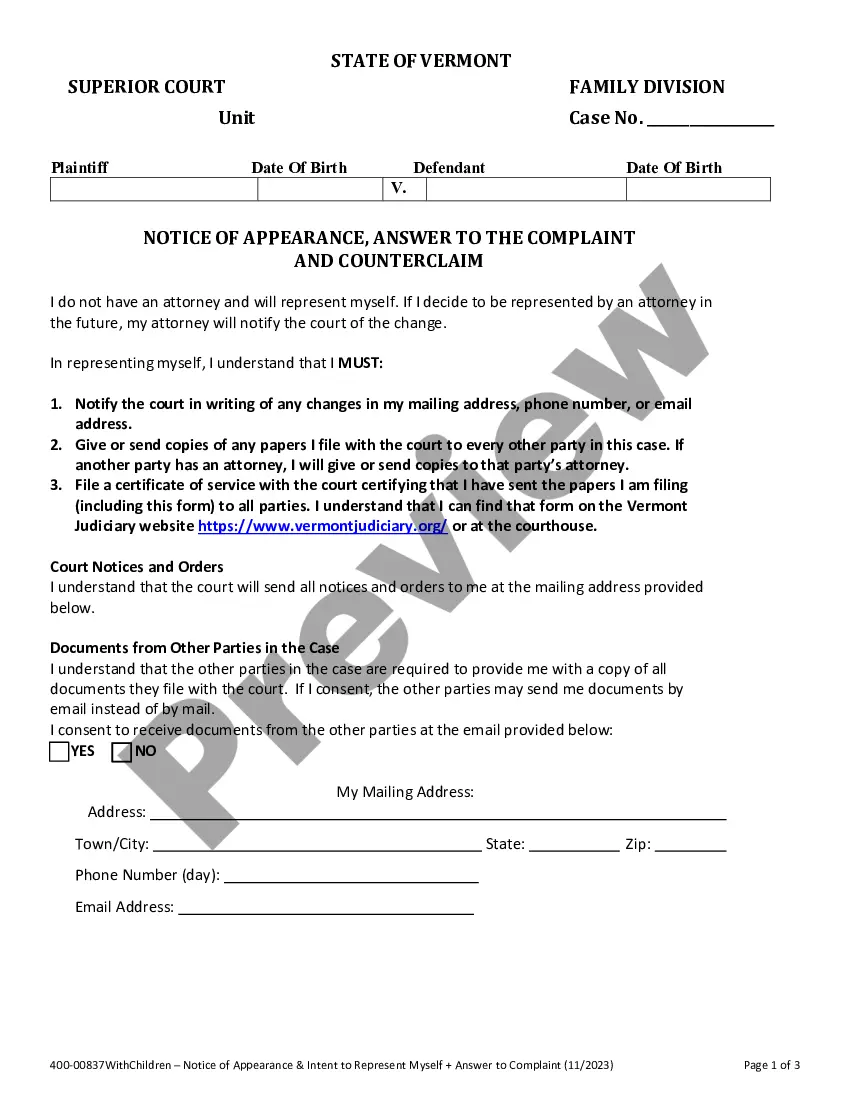

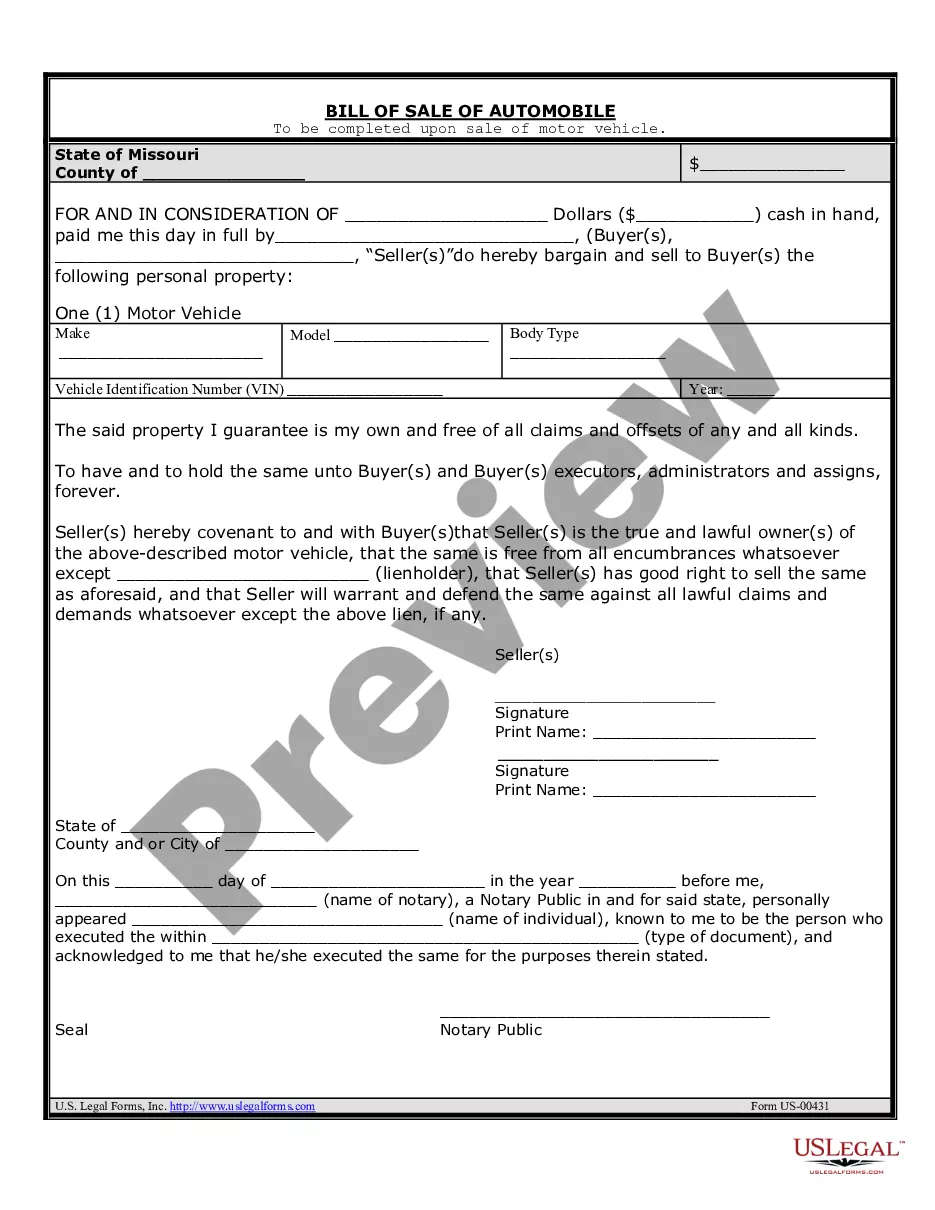

- Follow this step-by-step process to obtain the Business With Credit For Meaning.

- Carefully review the page content to confirm it aligns with your needs.

- Examine the form description or check it through the Preview feature.

- If the previous option doesn’t fit, use the Search bar above to find another sample.

- When you discover the appropriate Business With Credit For Meaning, click Buy Now.

- Select a subscription plan that meets your needs and budget.

- Log In to your account or register to continue to the payment page.

- Complete the payment for your subscription using PayPal or your credit card.

- Choose the file format and click Download.

Form popularity

FAQ

The credit of a business is a measure of its ability to borrow funds and repay obligations. This creditworthiness is assessed by looking at a company's financial history, including credit scores and liquidity ratios. A strong credit profile is vital for businesses, as it opens doors for better financing options and a more extensive range of capabilities, which is integral to the concept of business with credit for meaning.

The phrase 'on credit on account' implies a transaction where goods or services are provided with an invoice issued for future payment. It facilitates convenience for the buyer while ensuring the seller receives payment within a specified time. This concept embodies the business with credit for meaning by enhancing purchasing power and fostering growth.

The term 'credit business' refers to a model where businesses provide goods or services to customers with the understanding that payment will occur later. This approach enables companies to build customer loyalty and may increase sales, as customers can acquire products without immediate financial pressure. In the realm of business with credit for meaning, it creates a mutually beneficial situation for both parties involved.

To ask a supplier for credit, approach them professionally and express your interest in establishing a credit relationship. Clearly outline your business's financial stability and past purchasing history to build trust. You can also utilize resources from US Legal Forms to draft formal credit requests, ensuring your application is organized and professional.

Giving credit can boost sales and foster customer loyalty by allowing clients to make purchases without immediate payment. This practice can enhance your business reputation and encourage long-lasting relationships. Furthermore, it can lead to increased customer satisfaction, as clients often appreciate the flexibility that credit terms offer.

Giving a credit means allowing clients a reprieve on their financial obligations, often in the form of a refund or balance adjustment. This act can help maintain positive relationships and customer trust. Furthermore, understanding when and how to offer credits can be an essential aspect of effective business operations.

In business, the term credit refers to an agreement where a borrower receives something of value, with the promise to repay the lender at a later date. This could encompass loans, lines of credit, or trade credit from suppliers. Understanding credit is crucial for business growth and effective financial management.

Yes, you can build credit for a business, which is essential for securing loans and improving financing options. Establishing business credit involves registering your business with credit bureaus and taking steps to create a solid credit history. By utilizing tools like US Legal Forms, you can streamline the process and ensure you build strong credit efficiently.

Good credit references typically include reputable suppliers, long-time customers, or financial institutions that you have established a solid payment history with. Ensuring that these references can speak positively about your creditworthiness and reliability is critical. This credibility bolsters your business's image and improves your chances of securing credit.

Business credit is essential for separating your personal and business finances. It allows you to secure funding, obtain favorable terms with suppliers, and helps build your business reputation. Moreover, strong business credit can provide leverage when negotiating loans or credit lines. In short, understanding business credit for meaning can be a crucial step in ensuring your company's growth and stability.