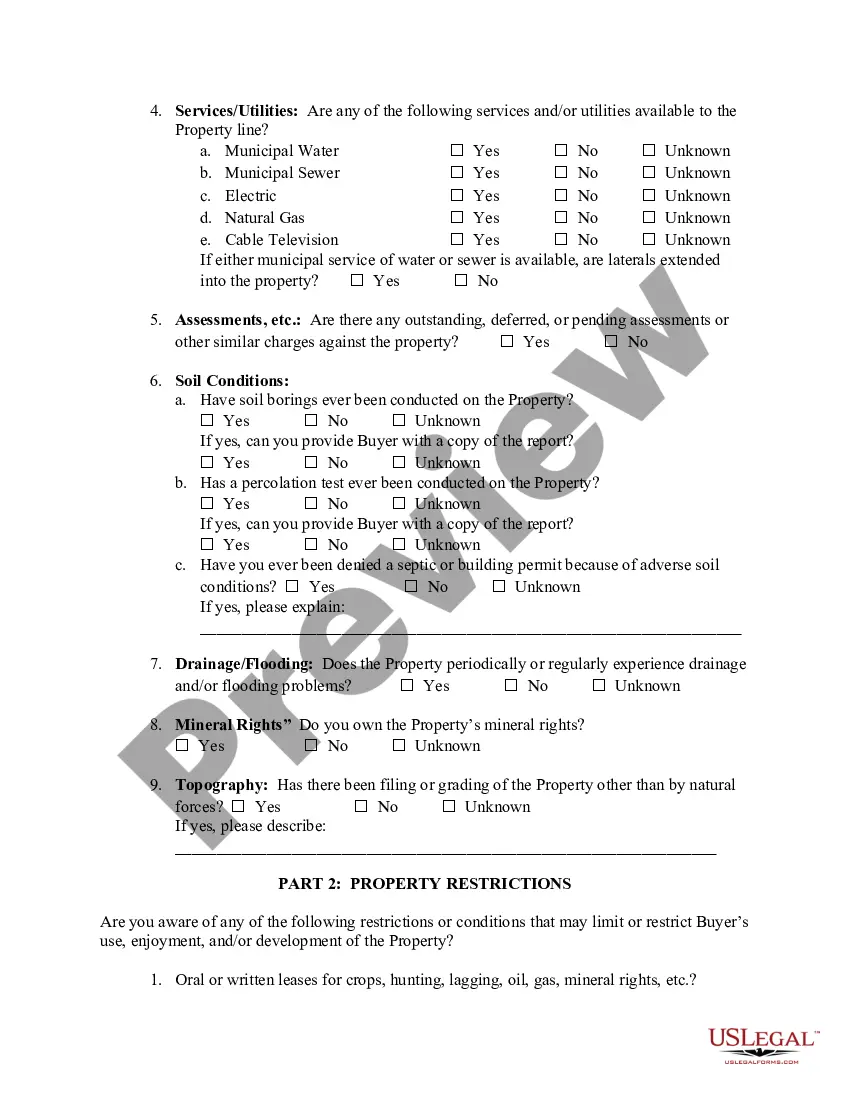

In some states, a seller is required to disclose known facts that materially affect the value of the property that are not known and readily observable to the buyer. The Seller is required to disclose to a buyer all known facts that materially affect the value of the property which are not readily observable and are not known to the buyer. That disclosure requirement exists whether or not the seller occupied the property. A

Vacant Land Disclosure Statement specifically designed for the disclosure of facts related to vacant land is used in such states.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The seller disclosure form for mutual funds is a comprehensive document that serves the purpose of providing potential investors with crucial information about the mutual fund they are interested in. This disclosure form acts as a legal document outlining key details regarding the mutual fund's objectives, risks, performance, fees, and other pertinent factors that potential investors need to consider before making an investment decision. The seller disclosure form plays a significant role in promoting transparency and ensuring that investors have access to all the necessary information to make well-informed choices. It typically contains information on the fund's investment objectives, such as income generation, capital appreciation, or a combination of both. Furthermore, it outlines the fund's investment strategies, such as whether it focuses on specific sectors, industries, or regions. The seller disclosure form also sheds light on the fund's historical performance, allowing potential investors to evaluate how the fund has performed over different time periods. This information may include performance data, benchmark comparisons, and insights into any past gains or losses. In terms of risk disclosure, the form delineates the potential risks associated with investing in the fund. These risks may include market fluctuations, interest rate changes, credit risks, concentration risks, or any other specific risks that may be relevant to the fund's investment approach. The seller disclosure form also covers the fees and expenses related to investing in the mutual fund, including management fees, administrative costs, and any other charges investors may incur. It typically presents this information in a clear and tabulated format, allowing investors to assess the impact of fees on their investment returns. Different types of seller disclosure forms may exist for mutual funds depending on various factors. Some key variations include: 1. Prospectus: This is the primary disclosure document provided to potential investors, and it typically includes detailed information about the fund's investment objectives, strategies, risks, performance, fees, and legal structure. 2. Key Investor Information Document (KIND): Commonly utilized in Europe, the KIND is a concise, standardized document that provides essential information about the fund in a user-friendly format. It focuses on highlighting key aspects such as objectives, performance history, risk indicators, and costs. 3. Summary Prospectus: This type of disclosure document provides a condensed version of the prospectus and contains a summary of the essential information required by investors. It aims to provide a brief overview of the fund's characteristics and serves as an initial source of information. In conclusion, the seller disclosure forms for mutual funds are crucial resources that enable potential investors to make informed investment decisions. These documents provide extensive details regarding the fund's objectives, risks, performance, fees, and other relevant factors that help investors determine whether the fund aligns with their investment goals and risk tolerance.