Explanation Letter for Late Payment for Mortgage An explanation letter for late payment for mortgage is a formal document that provides an account of the reasons behind the delay in making mortgage payments. This letter is essential when an individual or homeowner fails to submit their mortgage payments within the specified due date. Lenders usually require this letter to understand the circumstances of the late payment and to assess the borrower's commitment to fulfilling their financial obligations. The content of the explanation letter for late payment for mortgage should include crucial details such as the borrower's name, address, contact information, loan account number, and the specific time period or billing cycle affected by the late payment. It should be written in a professional and concise manner, with proper grammar, punctuation, and formatting. The letter should be addressed directly to the lender or the mortgage servicing company. Furthermore, the letter should explain the valid reasons associated with the late payment, such as unexpected financial hardships, medical emergencies, temporary loss of employment, family circumstances, or any other unforeseen events impacting the borrower's ability to make timely payments. Valid proof, such as medical reports, termination letters, or other supporting documents, should be attached to strengthen the explanation presented in the letter. Additionally, the borrower must express their sincere regret and commitment to rectify the late payment situation promptly. Assuring the lender of the intention to regularize future payments and avoid any further delays is crucial to maintaining a positive relationship with the lender and preserving one's financial standing. Different types of explanation letters for late payment for mortgages may include the following: 1. Late Payment Due to Unforeseen Financial Hardship: This type of letter explains how an unexpected financial hardship, such as a sudden job loss, reduction in income, or a major unforeseen expense, has affected the borrower's ability to make timely mortgage payments. 2. Late Payment Due to Health Emergency: This letter highlights how a medical emergency or serious illness has caused temporary financial constraints, making it difficult for the borrower to meet their mortgage payment obligations. 3. Late Payment Due to Family Circumstances: This type of letter explains how significant family events, such as divorce, death in the family, or other family emergencies, have disrupted the borrower's financial stability and resulted in late mortgage payments. 4. Late Payment Due to Administrative Errors: In certain situations, the late payment may have occurred due to administrative errors made by the lender or mortgage servicing company. This letter seeks to rectify any misunderstandings and explain how the delay was not the borrower's fault. Remember, an explanation letter for late payment for mortgage should always be honest, concise, and well-written. It is crucial to provide supporting evidence and express genuine remorse while assuring the lender of the borrower's commitment to fulfilling their financial obligations.

Explanation Letter For Late Payment For Mortgage

Description late mortgage payment letter

How to fill out Explanation Letter For Late Payment For Mortgage?

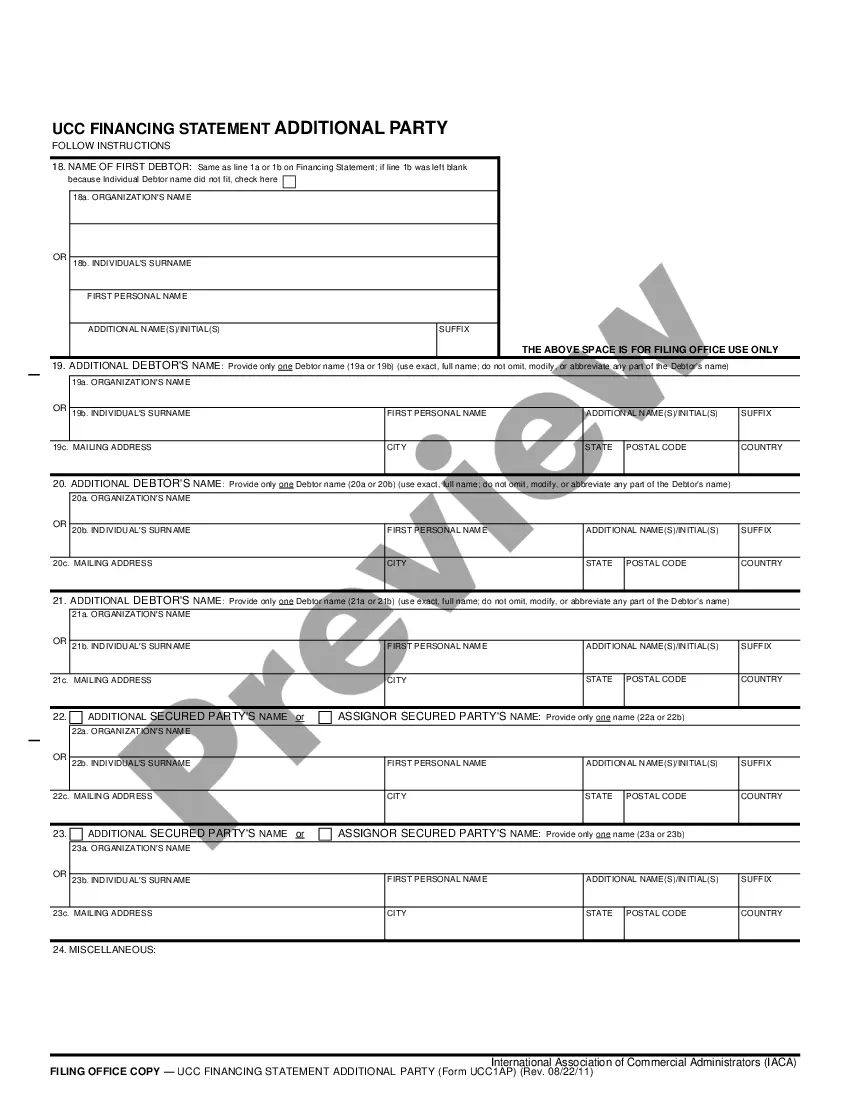

Using legal document samples that meet the federal and state laws is a matter of necessity, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the right Explanation Letter For Late Payment For Mortgage sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are simple to browse with all documents grouped by state and purpose of use. Our experts stay up with legislative changes, so you can always be sure your paperwork is up to date and compliant when getting a Explanation Letter For Late Payment For Mortgage from our website.

Getting a Explanation Letter For Late Payment For Mortgage is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template using the Preview feature or via the text description to make certain it meets your needs.

- Locate another sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Explanation Letter For Late Payment For Mortgage and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

letter of explanation mortgage Form popularity

sample letter of explanation for late payments for mortgage Other Form Names

FAQ

A letter of explanation for a mortgage is a document that provides further details about a borrower's credit or financial circumstances. The letter of explanation might describe why you were unemployed for a period of time, for example, or why there's an unpaid balance on your credit report.

90 days late Your lender will likely send another, more serious notice, known as a ?Demand Letter? or ?Notice to Accelerate.? It's essentially a notice to bring your mortgage current or face foreclosure proceedings. The process and timeline for foreclosure varies from state to state.

It's best when writing a letter of explanation to make it short and to the point. You'll want it to provide the recipient with the information they need, however. Be clear and offer as much relevant detail as possible since the person reading the letter will need to understand your situation.

Next, you should write a letter of explanation that and include it in your application for the underwriter to review. This letter should include a thorough explanation of why you missed a payment, what you've done to remedy the situation, and how you've managed your finances since the late payment occurred.