A letter of explanation for a mortgage is a document that is typically required by lenders when there are certain discrepancies or unusual circumstances of a borrower's financial situation or loan application. It serves as a way for the borrower to provide further information or clarification to the lender, ensuring transparency and enhancing their chances of loan approval. There are various types of letters of explanation for mortgages, each with its own purpose and focus: 1. Credit History Explanation: This type of letter is used when there are negative entries on the borrower's credit report, such as late payments, collections, or bankruptcies. It allows the borrower to explain the circumstances that led to the adverse credit history and highlights any accompanying measures taken to rectify the situation. 2. Employment History Explanation: When there are gaps or frequent job changes in the borrower's work history, a letter of explanation is often required. It provides an opportunity for the borrower to provide reasons for such instances, such as personal circumstances, industry-specific factors, or career advancements. 3. Income Explanation: In cases where the borrower's income exhibits fluctuations or irregularities, a letter of explanation is necessary to shed light on the situation. Factors such as seasonal employment, commission-based income, or self-employment income can be explained in detail, ensuring the lender has a complete understanding of the borrower's financial stability. 4. Source of Funds Explanation: When the borrower is utilizing funds for the down payment, closing costs, or reserves from sources other than their regular income, a letter of explanation becomes essential. This letter clarifies the origin of the funds, ensuring the lender is aware of any gifts, loans, or transfers from other accounts. 5. Property Explanation: Sometimes, the property being financed might have unique attributes or require an explanation. For example, if there are previous renovations, non-standard features, or zoning restrictions, a letter of explanation can provide the necessary details to the lender. 6. Large Deposits Explanation: If there are sudden and significant deposits made into the borrower's bank accounts, the lender may require an explanation. This letter ensures that any large deposits can be properly sourced and are not an undisclosed loan or debt. These different types of letters of explanation for mortgages play a crucial role in the loan approval process, allowing borrowers to address any discrepancies or concerns proactively. By providing detailed and transparent explanations, borrowers can strengthen their application and provide reassurance to lenders.

Letter Of Explanation For Mortgage

Description sample letter of explanation for mortgage lender

How to fill out Letter Of Explanation For Mortgage?

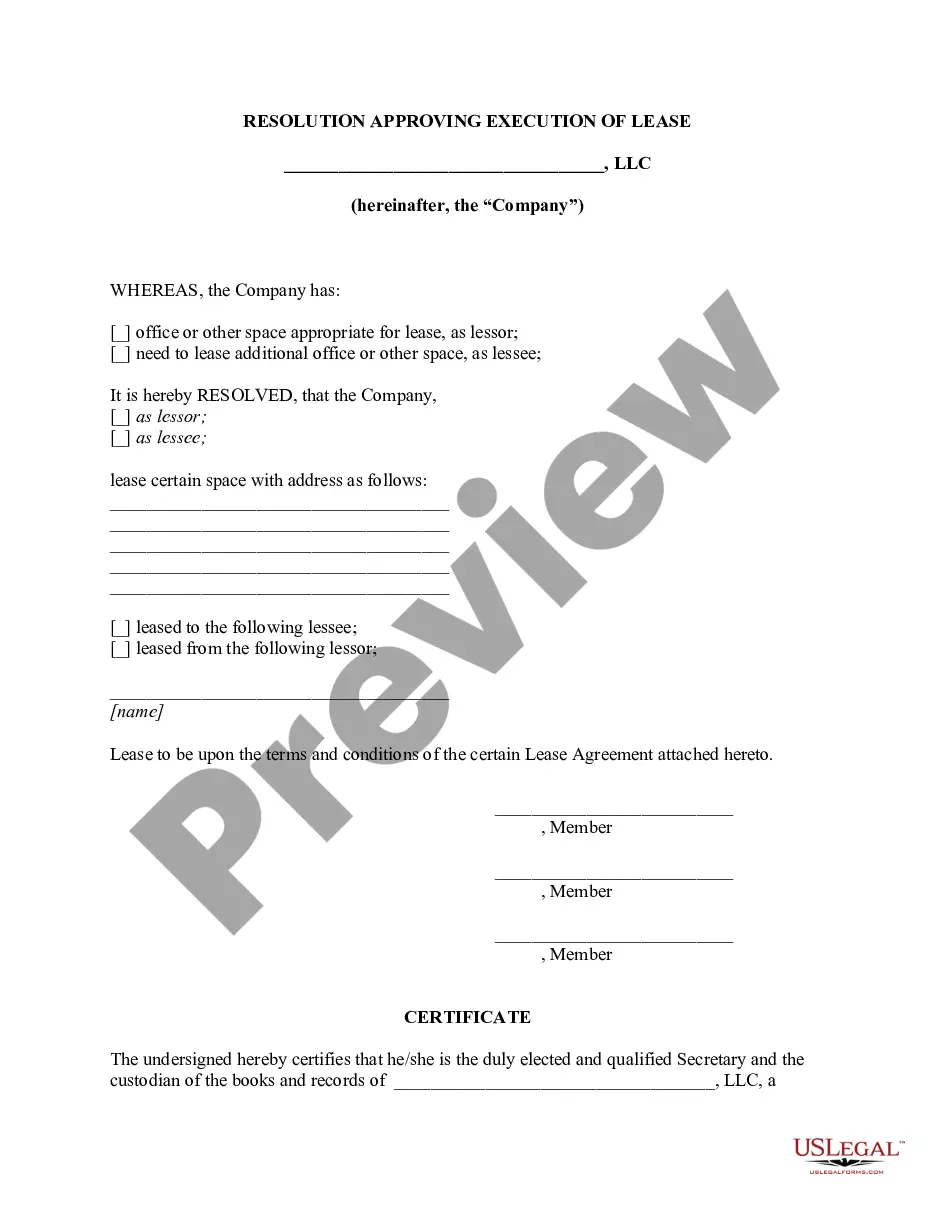

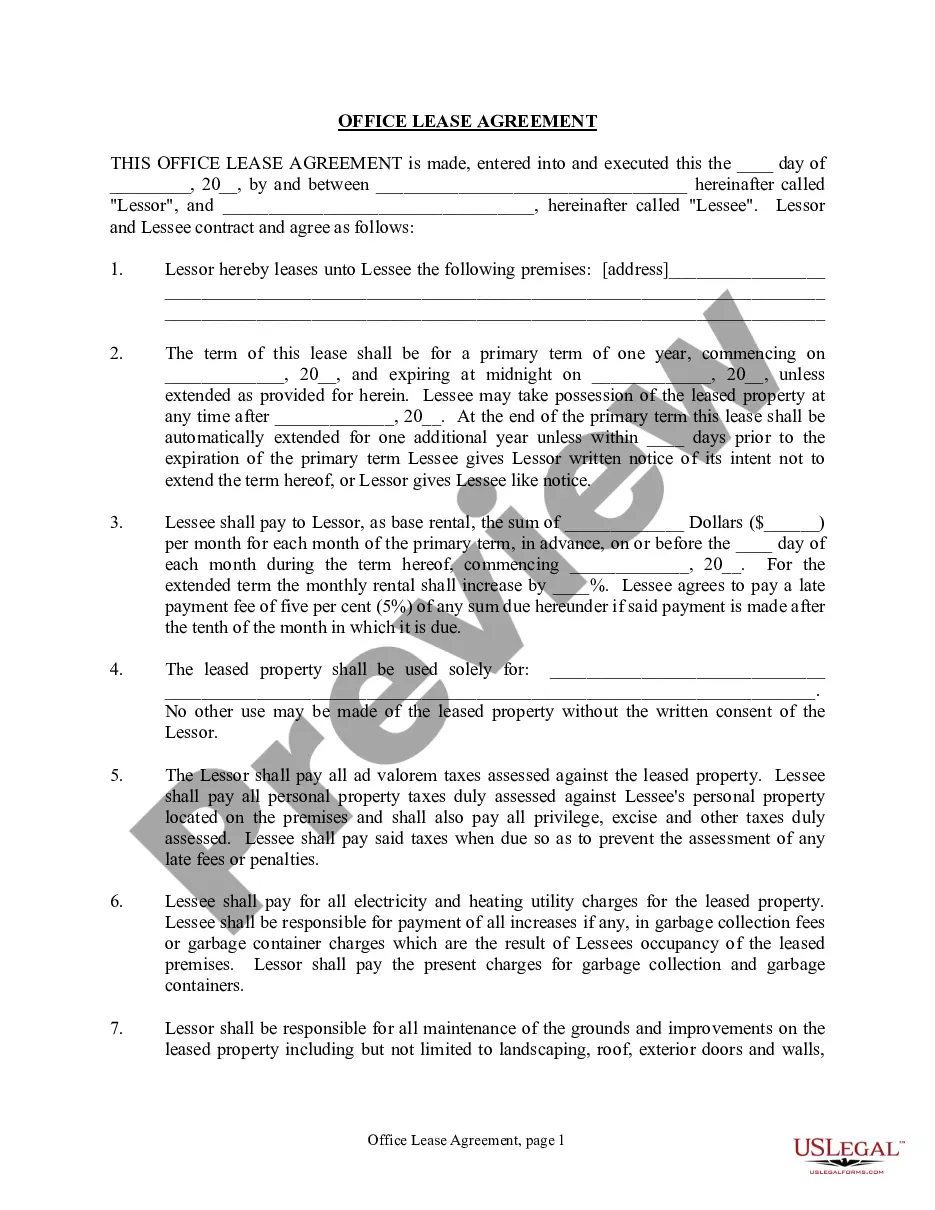

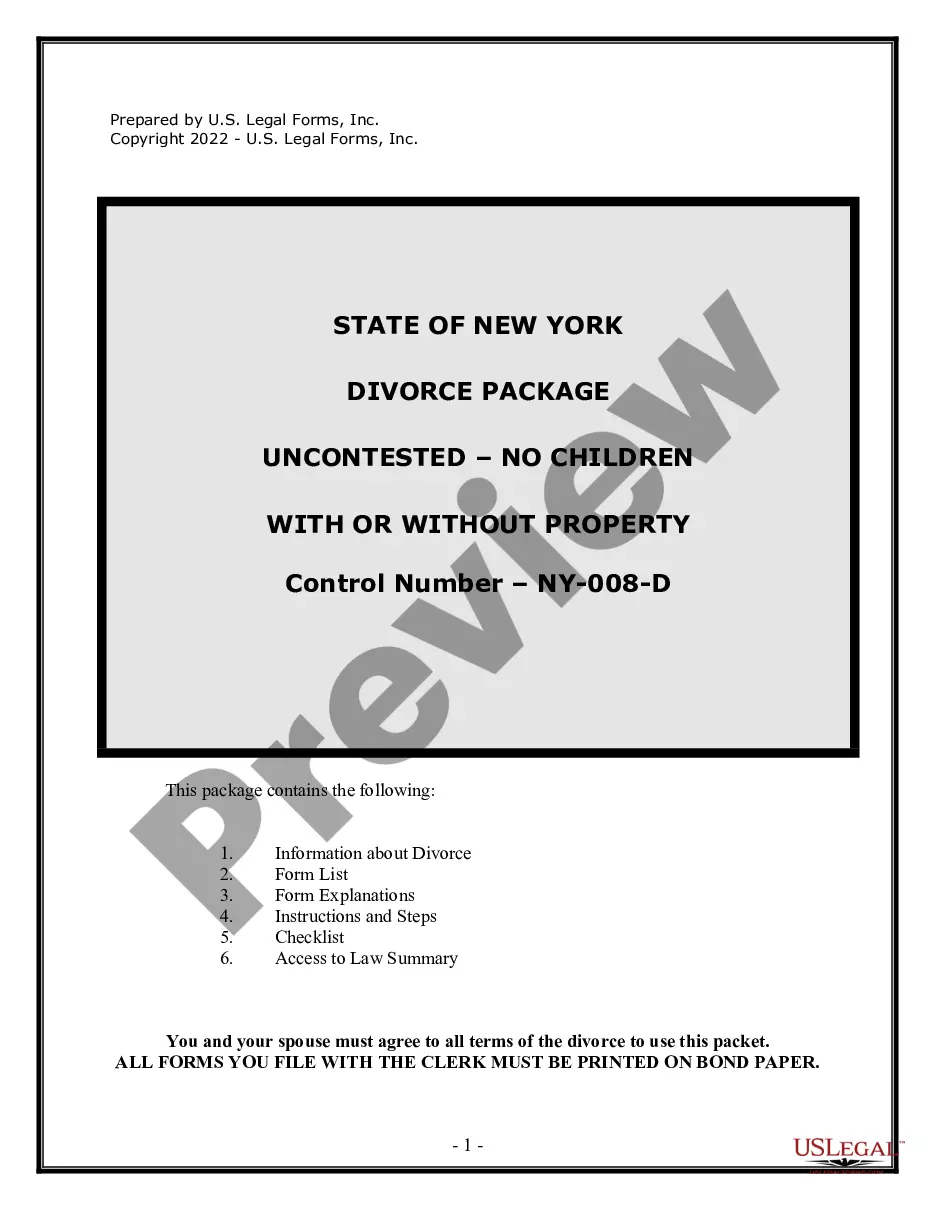

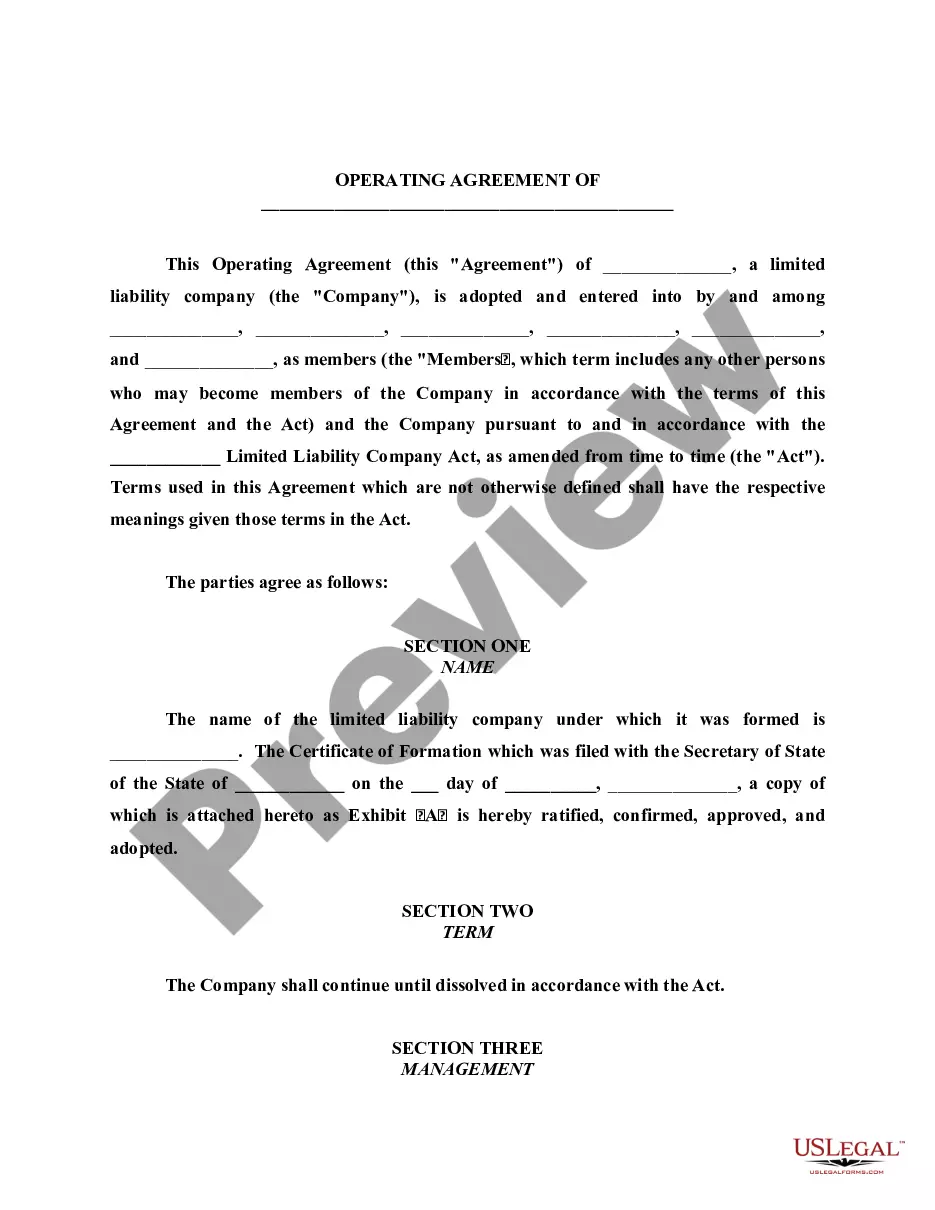

Legal management can be mind-boggling, even for the most skilled professionals. When you are looking for a Letter Of Explanation For Mortgage and don’t get the a chance to commit in search of the appropriate and up-to-date version, the procedures might be stress filled. A strong web form library might be a gamechanger for everyone who wants to manage these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any needs you might have, from personal to organization documents, in one spot.

- Make use of innovative tools to accomplish and deal with your Letter Of Explanation For Mortgage

- Gain access to a resource base of articles, tutorials and handbooks and resources relevant to your situation and needs

Help save time and effort in search of the documents you need, and make use of US Legal Forms’ advanced search and Review feature to discover Letter Of Explanation For Mortgage and download it. If you have a membership, log in for your US Legal Forms profile, look for the form, and download it. Take a look at My Forms tab to view the documents you previously saved and also to deal with your folders as you can see fit.

Should it be your first time with US Legal Forms, register an account and have unlimited access to all advantages of the platform. Listed below are the steps to take after downloading the form you want:

- Verify it is the proper form by previewing it and reading through its information.

- Ensure that the sample is recognized in your state or county.

- Pick Buy Now when you are all set.

- Select a monthly subscription plan.

- Pick the formatting you want, and Download, complete, sign, print out and send your papers.

Benefit from the US Legal Forms web library, supported with 25 years of expertise and stability. Transform your everyday papers management in a smooth and easy-to-use process today.

letter of explanation for mortgage template Form popularity

what is a letter of explanation for mortgage Other Form Names

letter of explanation mortgage template FAQ

The vehicle has been subject to repair four or more times by the manufacturer or its authorized dealers for the same nonconformity, but the nonconformity continues to exist, or. The vehicle is out of service by reason of repair of one or more nonconformity for a cumulative total of 20 or more business days.

In most instances to qualify under a lemon law your vehicle must only have an unreasonable repair history under the warranty, including (but not limited to) 3-4 repair attempts for the same problem, 6 repairs total on the vehicle, or 30 days out of service by reason of repair.

20-351), applies to new passenger cars, pick-up trucks, motorcycles and most vans bought in North Carolina. It requires manufacturers to repair defects that affect the use, value, or safety of a new motor vehicle within the first 24 months or 24,000 miles (whichever comes first).

Yes, private party sales are covered under the federal Lemon Law as well as most states' lemon laws so long as the vehicle was sold with some type of warranty, which may simply be the duration of the original manufacturer's warranty.

A contract is binding. There is no three-day right to cancel nor any other ?cooling off? period. Make sure the contract states that you can void the agreement and get back your down payment if the dealer does not meet any part of the agreement.

Although North Carolina's Lemon Law does not apply to used cars, you may still have potential legal remedies. The federal law known as the Magnuson-Moss Warranty Act applies to used vehicles that are still under the original manufacturer's warranty.

The North Carolina lemon law requires that to be eligible, a BBB AUTO LINE claim must be filed within four years from the date the defect is discovered. However, some manufacturers could limit this time period to as soon as one year from the date the defect is discovered.

The North Carolina Lemon Law, also known as the New Motor Vehicles Warranties Act (N.C.G.S. 20-351), applies to new passenger cars, pick-up trucks, motorcycles and most vans bought in North Carolina.