In most states, the process for forming a nonprofit corporation is different from the process for forming a for-profit corporation. A nonprofit corporation must file additional documentation with state and federal authorities to be recognized and obtain the advantages of nonprofit status. You can complete and file the paperwork yourself, or use an online document preparation website. Recognition as a nonprofit corporation confers three main advantages: tax breaks for the corporation, tax breaks for donors, and the legal right to solicit donations. In most states, nonprofit corporations are governed by the Model Nonprofit Corporation Act.

Corporation Tax For Unincorporated Organisations

Description

How to fill out Corporation Tax For Unincorporated Organisations?

Properly drafted official documentation is one of the fundamental guarantees for avoiding issues and litigations, but getting it without a lawyer's assistance may take time. Whether you need to quickly find an up-to-date Corporation Tax For Unincorporated Organisations or any other templates for employment, family, or business occasions, US Legal Forms is always here to help. It's a user-friendly platform comprising over 85k legal templates organized by state and area of use verified by specialists for compliance with regional laws and regulations.

If you want to know how to obtain the Corporation Tax For Unincorporated Organisations in a matter of clicks, follow the guide below:

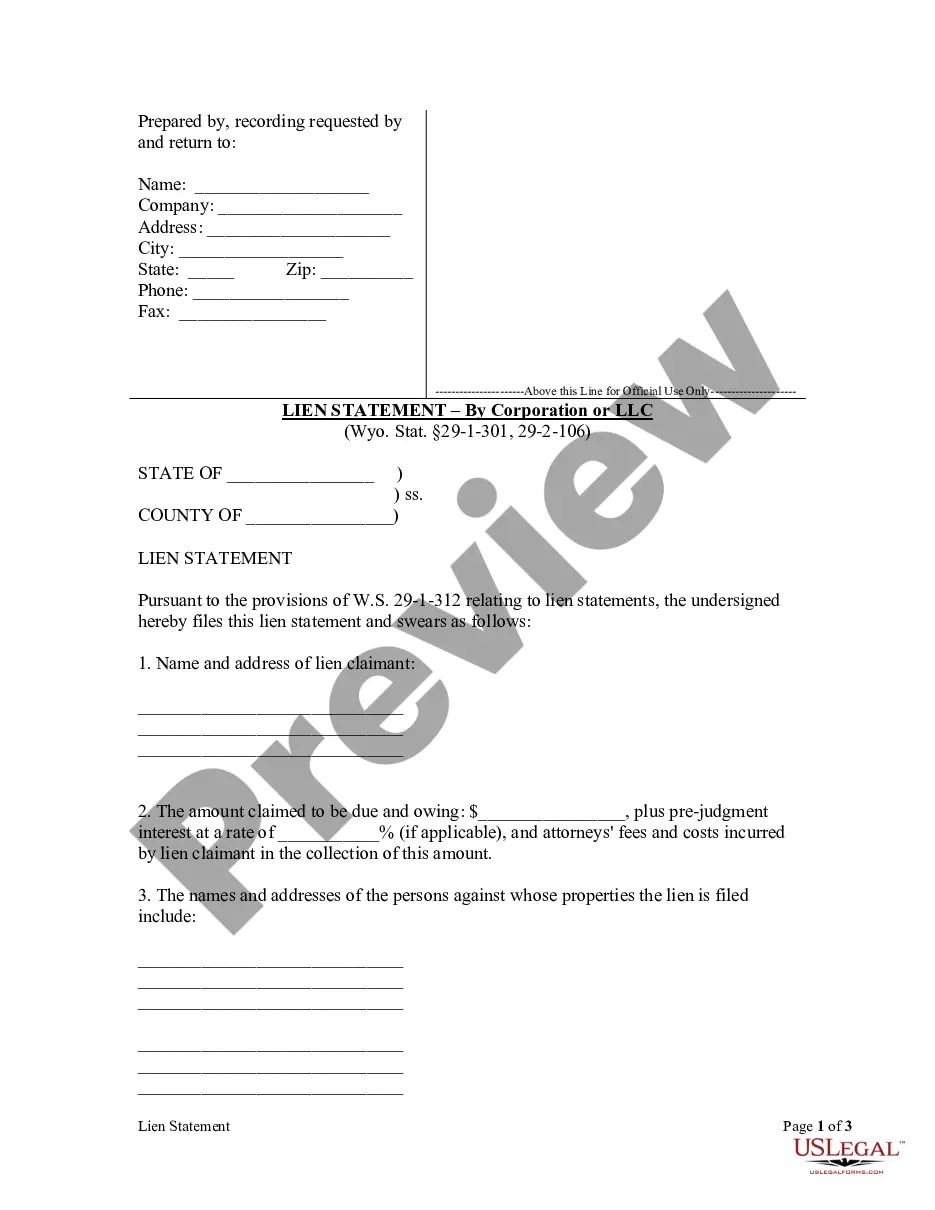

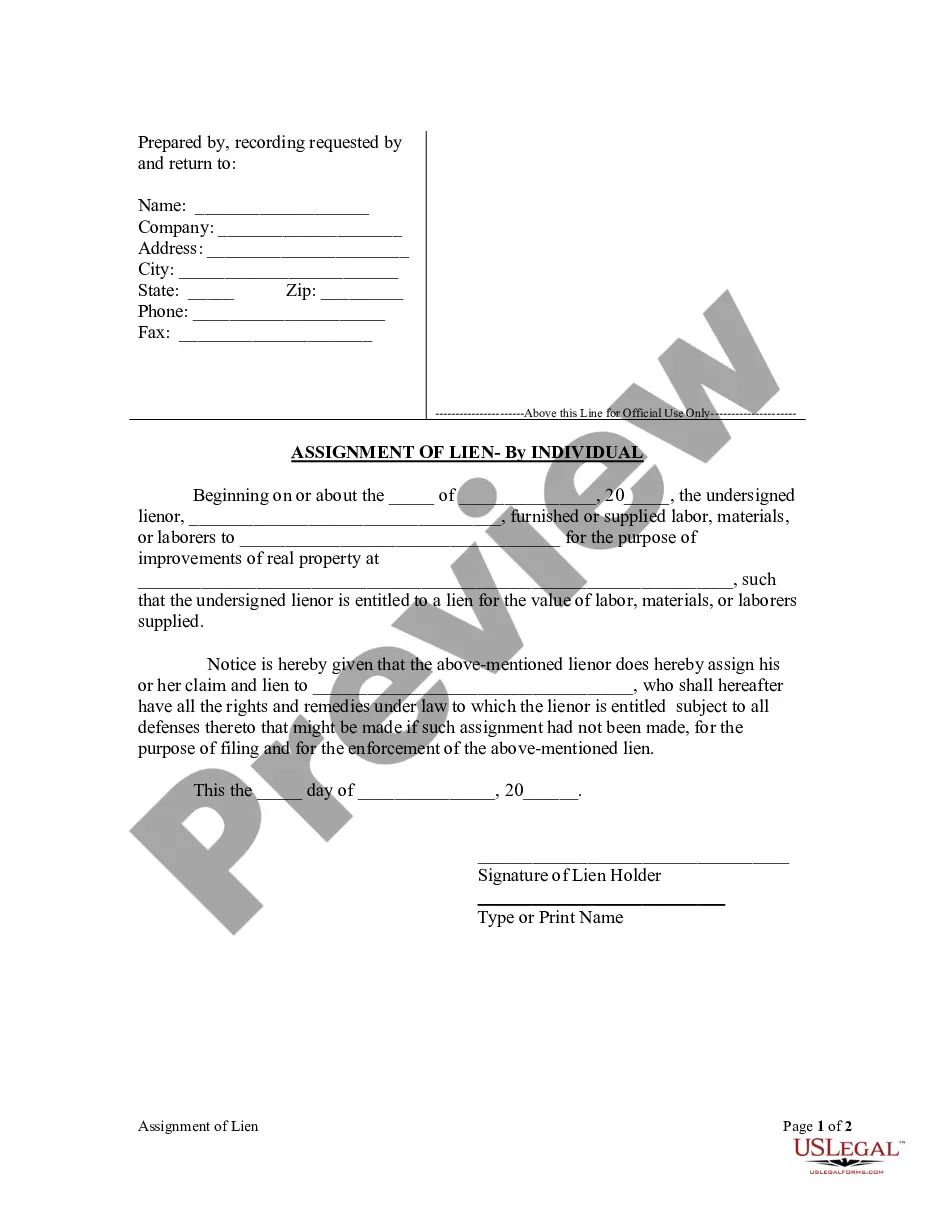

- Make sure that the form is suitable for your situation and region by checking the description and preview.

- Look for another sample (if needed) via the Search bar in the page header.

- Click Buy Now once you locate the corresponding template.

- Decide on the pricing plan, log in to your account or register a new one.

- Pick the payment method you like to buy the subscription plan (via a credit card or PayPal).

- Select PDF or DOCX file format for your Corporation Tax For Unincorporated Organisations.

- Click Download, then print the sample to fill it out or add it to an online editor.

The process is even simpler for current users of the US Legal Forms library. If you subscription active, you only need to log in to your account and click the Download button next to the selected file. Besides, you can access the Corporation Tax For Unincorporated Organisations later at any time, as all the documentation ever acquired on the platform is available within the My Forms tab of your profile. Save time and money on preparing official documents. Try US Legal Forms today!