Sample Letter Employment Template for Mortgage A sample letter employment template for a mortgage is a professionally crafted document that provides a detailed description of an individual's employment history and income source. This template is specifically designed to support mortgage applications and assist mortgage lenders in evaluating the borrower's financial stability and ability to repay the loan. The sample letter employment template typically includes the following sections: 1. Header: This section includes the borrower's name, address, contact information, and the date the letter is being written. 2. Introduction: The introduction briefly explains the purpose of the letter, which is to verify the borrower's employment and income details for mortgage approval. 3. Employment Details: This section requires information about the borrower's current employment. It includes the name and address of the employer, job title or position, length of employment, and whether the employment is full-time, part-time, or contractual. 4. Income Details: This part outlines the borrower's income information. It includes their current gross monthly income, any additional income sources if applicable (such as bonuses, commissions, or rental income), and the stability of income (permanent, temporary, or seasonal). 5. Employment Verification: In this section, the letter provides contact information for a representative at the borrower's workplace who can verify the provided employment details, such as the human resources department or a direct supervisor. 6. Signature and Contact Information: The letter concludes with the borrower's signature, printed name, and contact information, including phone number and email address. Different Types of Sample Letter Employment Templates for Mortgage: 1. Self-Employed Borrower Letter: This type of template is specifically designed for self-employed individuals who need to provide detailed information about their business, income, and finances in order to secure a mortgage. 2. Letter for Employment Gap: This template caters to individuals who have gaps in their employment history and need to provide explanations for such gaps to the mortgage lender. 3. Salary Increase Letter: This template is suitable for individuals who have recently received a salary increase or a promotion and want to demonstrate their improved financial stability to the mortgage lender. 4. Letter for Multiple Jobs: This type of template is helpful for borrowers who have more than one source of employment and need to provide information for each job. These sample letter employment templates for mortgages are highly customizable according to individual needs. They serve as valuable tools in the mortgage application process, making it easier for borrowers to present accurate and comprehensive employment and income details to lenders, increasing the chances of mortgage approval.

Sample Letter Employment Template For Mortgage

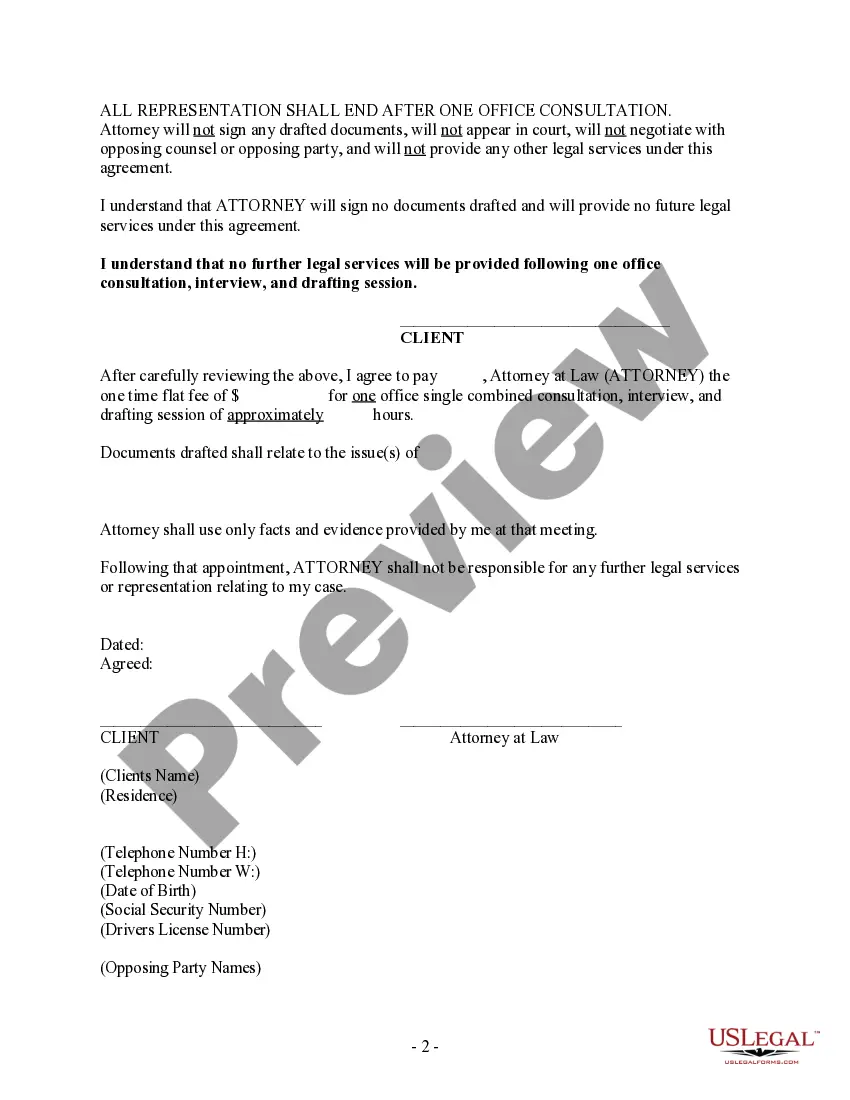

Description letter of employment format

How to fill out Sample Letter Employment Template For Mortgage?

Dealing with legal papers and operations might be a time-consuming addition to your entire day. Sample Letter Employment Template For Mortgage and forms like it typically need you to look for them and navigate the best way to complete them properly. Consequently, regardless if you are taking care of financial, legal, or individual matters, using a thorough and hassle-free online catalogue of forms when you need it will help a lot.

US Legal Forms is the number one online platform of legal templates, boasting over 85,000 state-specific forms and a number of resources to assist you complete your papers easily. Explore the catalogue of appropriate documents accessible to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered at any moment for downloading. Shield your document management processes with a top-notch support that allows you to prepare any form within minutes without any extra or hidden charges. Just log in to your profile, identify Sample Letter Employment Template For Mortgage and download it right away within the My Forms tab. You can also access previously downloaded forms.

Could it be the first time making use of US Legal Forms? Register and set up up your account in a few minutes and you will get access to the form catalogue and Sample Letter Employment Template For Mortgage. Then, stick to the steps below to complete your form:

- Make sure you have discovered the correct form using the Review option and looking at the form description.

- Select Buy Now once ready, and choose the monthly subscription plan that fits your needs.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of expertise assisting consumers deal with their legal papers. Find the form you require today and improve any operation without having to break a sweat.

job letter for mortgage Form popularity

FAQ

On motion and upon such terms as are just, the court may relieve a party or a party's legal representative from a final judgment, order, or proceeding for the following reasons: (1) Mistake, inadvertence, surprise, or excusable neglect; (2) Newly discovered evidence which by due diligence could not have been discovered ...

If you are in possession of a will of a deceased person, you must either file it with the appropriate court or deliver it to the person named in the will as executor, as under Rhode Island law the will is to be filed within 30 days after death.

Rule 23 - Trial by Jury or by the Court. (a)Trial by Jury. Cases required to be tried by jury shall be so tried unless the defendant in open court waives a jury trial in writing with the approval of the court. (b)Jury of Less Than Twelve (12).

Where to File Your Rhode Island Divorce. You'll file in the family court in the county where you (the filing spouse) live. If you don't live in Rhode Island, you can file the complaint in Providence County or the county where your spouse (the "defendant") lives.

Rule 12 - Pleadings and Motions before Trial-defenses and Objections. (a)Pleadings and Motions. Pleadings in criminal proceedings shall be the indictment, information, or complaint, and the pleas of not guilty, guilty and nolo contendere.

Failure by any person without adequate excuse to obey a subpoena served upon that person may be deemed a contempt of the court in which the action is pending.

Motions may be filed in paper, or alternatively, may be sent electronically via email to our Helpdesk at: rib_helpdesk@rib.uscourts.gov. The subject line of the email must state, "Motion For Excusal".

To finalize your will in Rhode Island: you must sign your will in front of two witnesses at the same time, and. your witnesses must sign your will.