Request letter format for bank is a formal written communication addressed to a bank seeking information, assistance, or an action on a specific matter. The format typically consists of the following elements: 1. Date: The letter should start with the current date. 2. Bank's Address: Include the complete postal address of the bank, including the branch name if applicable. This is usually mentioned on the bank's website or official correspondence. 3. Sender's Information: Provide your full name, postal address, contact number, and email address. This enables the bank to respond and reach out to you easily. 4. Salutation: Begin the letter with the appropriate salutation, such as "Dear Branch Manager" or "To Whom It May Concern." 5. Subject Line: Clearly state the purpose of the letter in a concise and specific manner. For example, "Request for Bank Statement" or "Application for Loan Modification." 6. Body of the Letter: In a polite and professional tone, explain the purpose of your request. Provide context, details, and any supporting documents or references if necessary. It is crucial to clearly articulate what you expect from the bank. 7. Closing: Conclude the letter by expressing appreciation for the bank's attention and including a polite closing, such as "Yours sincerely" or "Best regards." 8. Signature: Sign your name above your full typed name. If the letter is sent via email, you may include a scanned image of your signature or use an electronic signature. Types of request letter formats for banks: 1. Request for Account Statement: This letter format is used when an individual or a business requires a detailed summary of their bank account transactions for a specific period. 2. Request for Loan Application: This format is used to request an application for a loan, which includes details such as loan amount, purpose, and repayment terms. 3. Request for Account Closure: When closing a bank account, this format is utilized to formally request the account closure and to specify where the remaining balance should be transferred. 4. Request for Change of Address/Contact Details: This letter format is used when an account holder wants to inform the bank about a change in their address, phone number, or email address. 5. Request for Credit Card Limit Increase: If an individual desires to raise the credit limit on their credit card, this format is employed to make the request and provide reasoning for the increase. 6. Request for Stop Payment: In case a check or any other payment needs to be stopped due to loss or other reasons, this format is used to inform the bank and prevent the payment from being processed. By following the appropriate request letter format for banks, individuals and businesses can effectively communicate their needs and expectations while maintaining professionalism.

Request Letter Format For Bank

Description request letter to bank manager

How to fill out Request Letter Format For Bank?

Dealing with legal paperwork and procedures can be a time-consuming addition to the day. Request Letter Format For Bank and forms like it typically require you to search for them and navigate how you can complete them effectively. As a result, whether you are taking care of financial, legal, or personal matters, using a thorough and convenient web catalogue of forms at your fingertips will go a long way.

US Legal Forms is the best web platform of legal templates, featuring over 85,000 state-specific forms and numerous tools to assist you to complete your paperwork effortlessly. Check out the catalogue of relevant documents available to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Shield your document managing operations having a top-notch service that lets you prepare any form in minutes without additional or hidden fees. Simply log in to your account, identify Request Letter Format For Bank and download it straight away from the My Forms tab. You can also gain access to formerly downloaded forms.

Is it your first time making use of US Legal Forms? Sign up and set up up your account in a few minutes and you will have access to the form catalogue and Request Letter Format For Bank. Then, stick to the steps below to complete your form:

- Be sure you have the right form using the Preview option and reading the form information.

- Choose Buy Now once ready, and select the monthly subscription plan that suits you.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of expertise helping consumers manage their legal paperwork. Obtain the form you need today and enhance any process without having to break a sweat.

letter for bank Form popularity

request letter to the bank Other Form Names

bank request letter FAQ

Tips For Loan Request Letter Review the loan guidelines and understand how they apply. ... Describe the reason for the loan in detail. ... Attach the necessary supporting documentation. ... Identify the amount of money you need. ... Be polite and professional when addressing the reader. ... Be sure to include a repayment plan.

Dear Sir/Madam, I am writing to request a bank statement for my savings account with your esteemed bank. My account number is X and the account is in the name of John Doe. I would like to request the bank statement for the past six months, starting from September 2022 to February 2023.

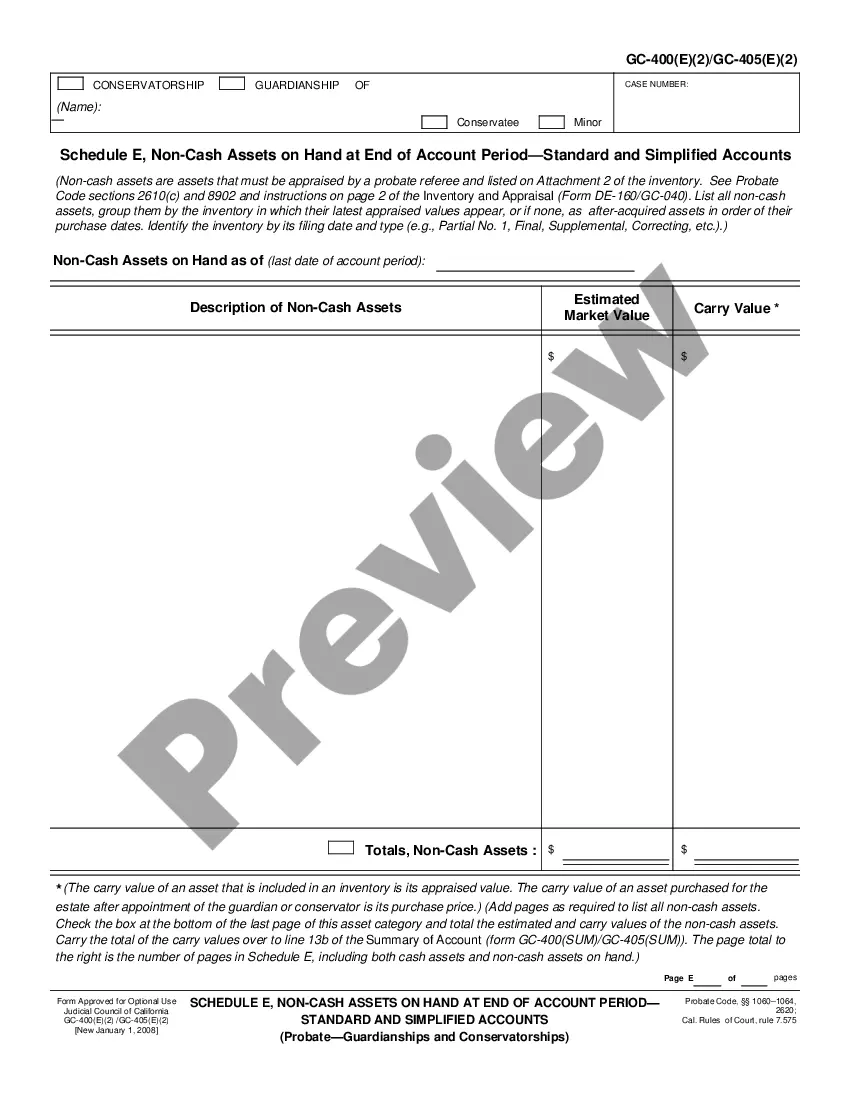

Parts of a bank statement include information about: The bank's address and contact information. Account information. The statement date. Total number of days in the statement period, or the period's beginning and ending dates. Beginning and ending balance of the account.

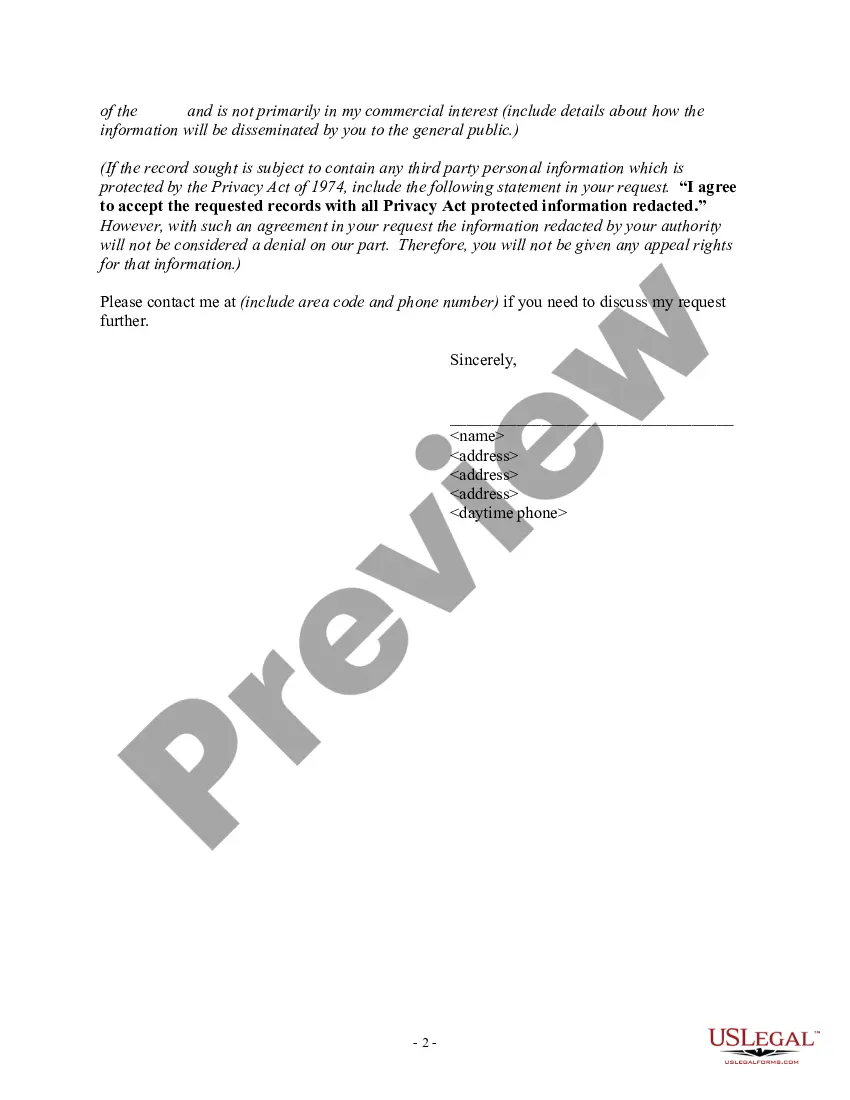

What is the format of a letter of request? Sender's name and contact details, unless shown on a letterhead. Date. The recipient's name and contact details. Greeting. Purpose of the letter. Body of the letter. Professional closing. Signature.

Here is how to write a request letter in 7 steps: Collect information relating to your request. ... Create an outline. ... Introduce yourself. 4. Make your request. ... Explain the reason for the request. ... Offer to provide additional information. ... Show your gratitude and conclude the letter. ... Use a professional format.