Collateral Document Meaning — Explained with Different Types Collateral documents refer to legal paperwork or agreements that are created to secure a loan or debt by using assets as collateral. These documents play a significant role in various financial transactions and help protect lenders in case of borrower default. The collateral document meaning may vary depending on the context and type of assets involved. Here are a few types of collateral documents: 1. Mortgage Deed: A mortgage deed is a type of collateral document used in real estate transactions. It provides the lender with a security interest in the property being used as collateral. In case the borrower fails to repay the loan, the lender can initiate foreclosure proceedings to recover the outstanding debt. 2. UCC Financing Statement: This type of collateral document is governed by the Uniform Commercial Code (UCC) and is typically used for securing loans involving movable assets like inventory, equipment, or vehicles. UCC financing statements establish a lien on the specified assets, enabling the lender to take possession of them if the borrower defaults. 3. Pledge Agreement: A pledge agreement is a collateral document used in loans involving securities or stocks. It specifies the terms and conditions of pledging the securities as collateral to secure the loan. If the borrower fails to repay, the lender can sell the pledged securities to recover the outstanding debt. 4. Security Agreement: A security agreement is a comprehensive collateral document that outlines the terms and conditions for securing a loan with personal property, such as vehicles, equipment, or valuable assets. It establishes the lender's rights over the collateral and ensures their ability to repossess and sell it to recover the debt. 5. Guaranty Agreement: While not directly a collateral document, a guaranty agreement acts as additional security for a loan. It involves a third-party guarantor who promises to repay the debt in case the primary borrower defaults. While the guarantor's assets may not be pledged as collateral, their creditworthiness and financial standing add an extra layer of security for the lender. In summary, collateral documents serve as vital legal tools to protect lenders by providing security for loans or debts. These documents can take various forms depending on the type of asset involved, whether its real estate, movable assets, securities, or personal property. Understanding the collateral document meaning and significance is crucial for borrowers and lenders to ensure transparency and enforceability in financial transactions.

Collateral Document Meaning

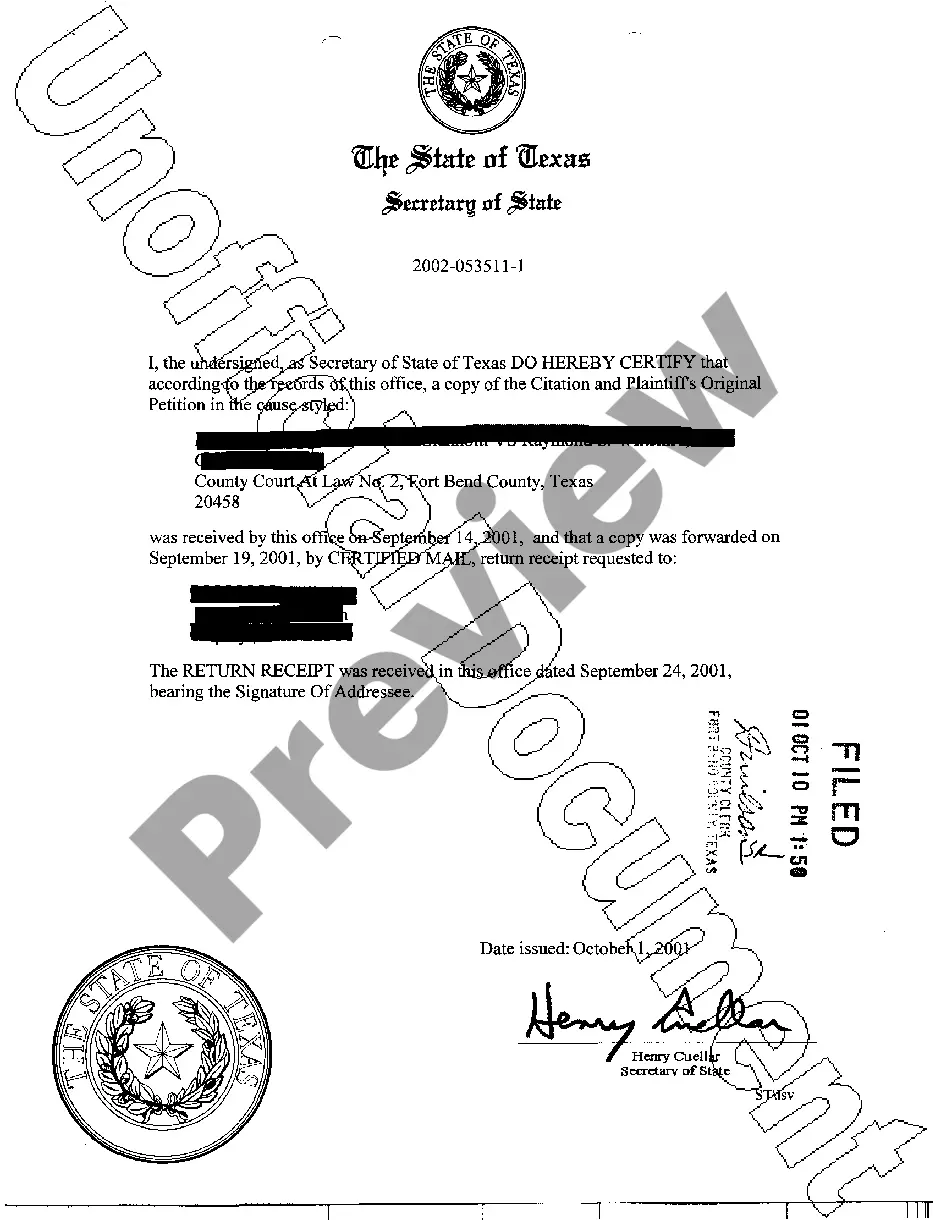

Description collateral document

How to fill out Collateral Document Meaning?

Whether for business purposes or for personal matters, everybody has to handle legal situations at some point in their life. Completing legal documents needs careful attention, beginning from selecting the correct form template. For example, when you select a wrong edition of a Collateral Document Meaning, it will be rejected when you send it. It is therefore essential to have a dependable source of legal documents like US Legal Forms.

If you need to obtain a Collateral Document Meaning template, stick to these easy steps:

- Get the template you need using the search field or catalog navigation.

- Check out the form’s information to ensure it fits your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect document, get back to the search function to find the Collateral Document Meaning sample you need.

- Get the file if it meets your needs.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Select your payment method: use a bank card or PayPal account.

- Select the document format you want and download the Collateral Document Meaning.

- Once it is saved, you are able to fill out the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time seeking for the right template across the internet. Make use of the library’s easy navigation to get the proper template for any occasion.

Form popularity

FAQ

Collateral is personal property offered up as security for a debt or other obligation owed to sellers, financiers or other secured parties. COLLATERAL TYPE. Personal property held by an individual and not for any use in a business with an ABN. CONSUMER PROPERTY.

Collateral is something a borrower promises to a lender in case they can't repay the loan. For home, personal, or business loans, lenders usually require collateral. If the borrower defaults on the loan, the lender can claim the assets offered as collateral.

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

Collateral is an asset or form of physical wealth that the borrower owns like house, livestock, vehicle etc. It is against these assets that the banks provide loans to the borrower. The collateral serves as a security measure for the lender.