Special needs trust rules in Tennessee play a crucial role in ensuring the financial well-being and support of individuals with disabilities. These trusts are designed to safeguard the assets of individuals with special needs, while also allowing them to qualify for government benefits such as Medicaid and Supplemental Security Income (SSI). It is essential to understand the specific rules and regulations governing special needs trusts in Tennessee to effectively plan for the future care of loved ones with disabilities. Tennessee follows the federal guidelines established by the Social Security Administration (SSA) when it comes to special needs trusts. There are primarily three types of special needs trusts recognized in Tennessee: 1. Third-Party Special Needs Trust: This type of trust is created by a third party, typically parents or grandparents, for the benefit of an individual with special needs. It enables family members to leave an inheritance or make financial contributions to a trust that will supplement the government benefits received by the beneficiary. 2. Self-Funded Special Needs Trust: In situations where an individual with special needs has personal assets, such as a settlement or inheritance, a self-funded special needs trust can be established. This trust allows the individual to maintain eligibility for government benefits while utilizing the assets for their care and support. 3. Pooled Special Needs Trust: This type of trust is managed by a nonprofit organization that combines the assets of multiple beneficiaries into a single trust fund. The funds are then invested collectively, and each beneficiary's share is individually accounted for. Pooled special needs trusts are a suitable option when a family does not want to establish a separate trust. Regardless of the type of special needs trust established, there are specific rules in Tennessee that must be followed: 1. Qualified Beneficiary: The individual with special needs must meet the eligibility criteria to be considered a qualified beneficiary for a special needs trust. This typically includes having a disability that meets the SSA's definition and qualifying for government benefits. 2. Trustee Selection: Careful consideration should be given to selecting a trustee who will manage the trust, make decisions in the best interest of the beneficiary, and comply with all legal requirements. It is recommended to choose someone with experience in managing special needs trusts. 3. Trust Administration: Special needs trusts must be administered according to the guidelines set forth by federal and state laws. This includes accounting for all income and expenditures, ensuring funds are used for the beneficiary's intended purpose, and avoiding resources that may jeopardize government benefit eligibility. 4. Medicaid Payback Provision: Special needs trusts in Tennessee must include a Medicaid payback provision, stipulating that upon the beneficiary's death, any remaining funds in the trust must first reimburse the state for Medicaid benefits received during the individual's lifetime. Understanding and adhering to these special needs trust rules in Tennessee is crucial to protect the financial future of individuals with disabilities. Consulting with an experienced attorney specializing in special needs planning can provide invaluable guidance in navigating the complex regulations and creating an effective and valid trust.

Special Needs Trust Rules Tennessee

Description

How to fill out Special Needs Trust Rules Tennessee?

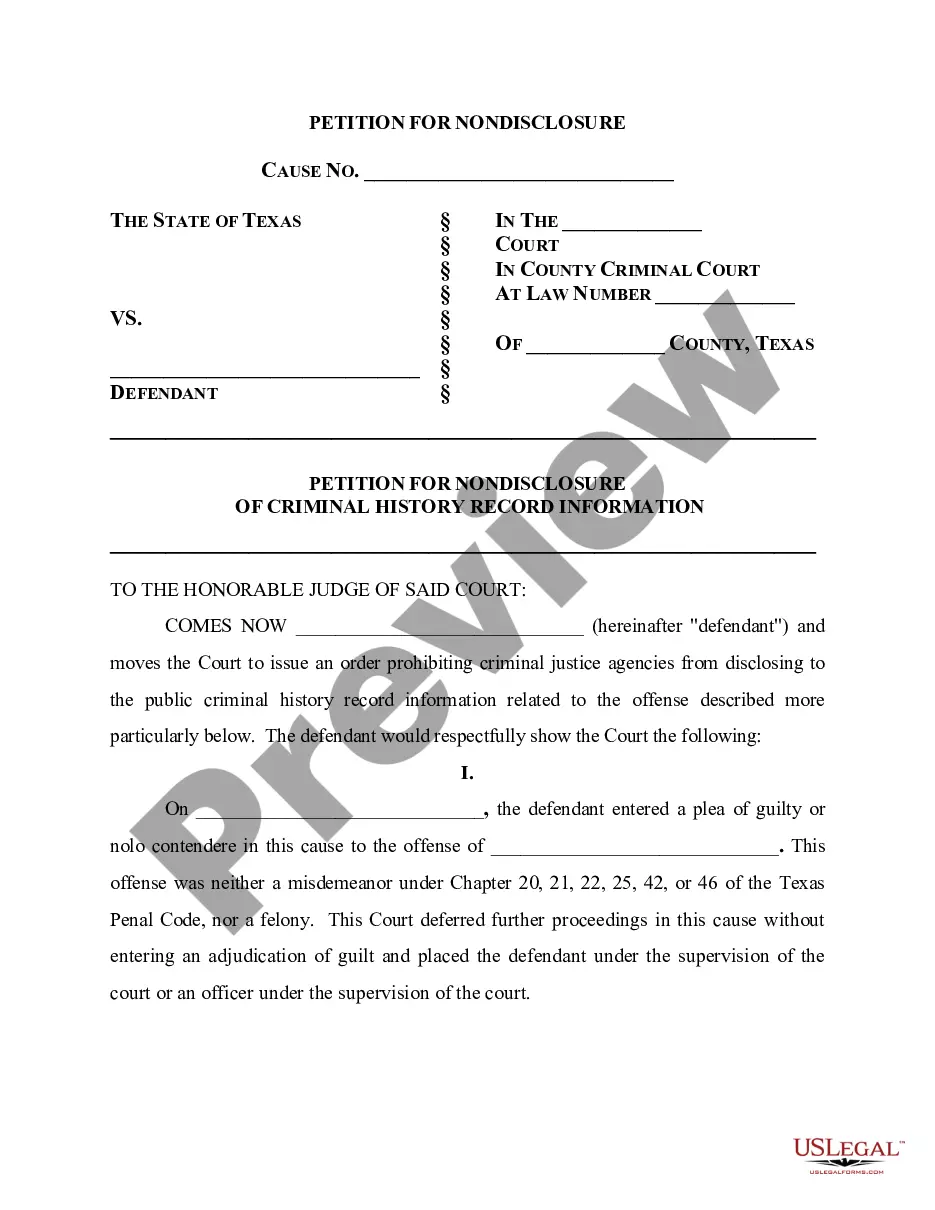

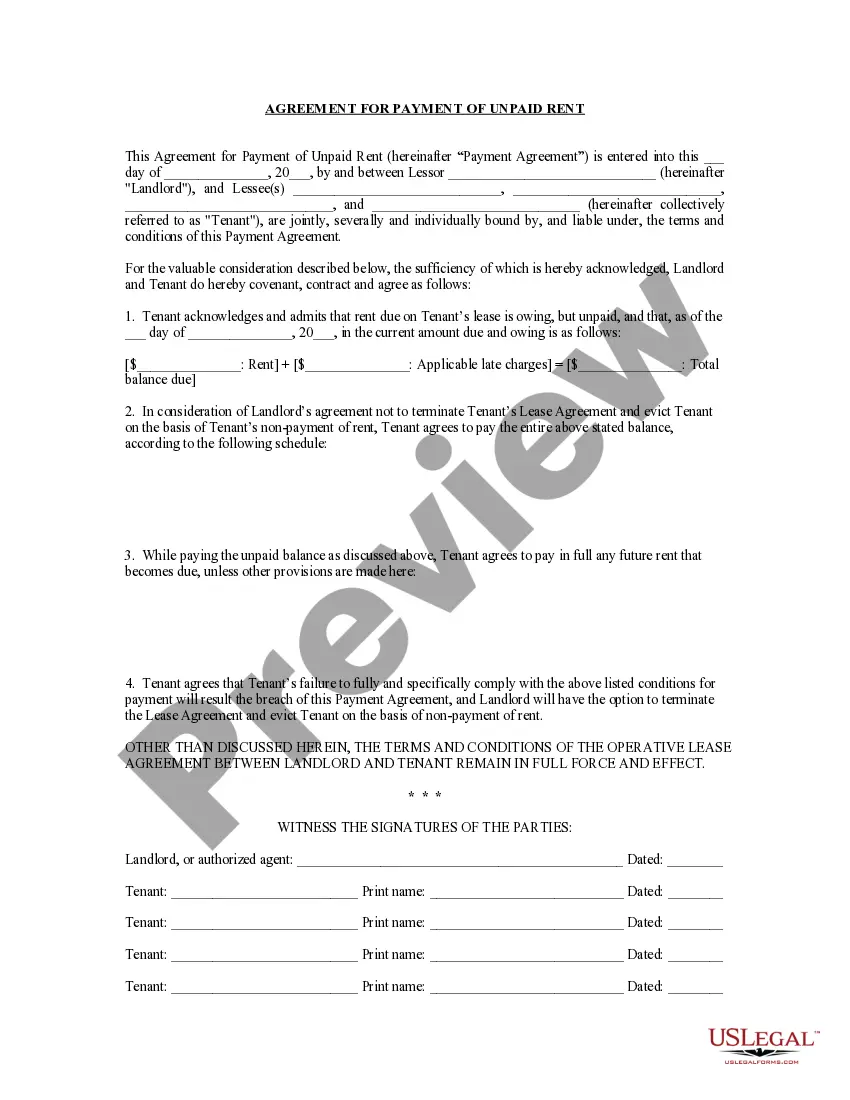

Using legal templates that meet the federal and local laws is a matter of necessity, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the appropriate Special Needs Trust Rules Tennessee sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and life scenario. They are easy to browse with all files grouped by state and purpose of use. Our experts stay up with legislative updates, so you can always be sure your form is up to date and compliant when getting a Special Needs Trust Rules Tennessee from our website.

Obtaining a Special Needs Trust Rules Tennessee is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, follow the instructions below:

- Examine the template utilizing the Preview feature or via the text description to make certain it fits your needs.

- Browse for another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Special Needs Trust Rules Tennessee and download it.

All templates you locate through US Legal Forms are reusable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Key estate planning documents that might be impacted include trusts, wills, living wills, and durable or healthcare power of attorney. All of these legal documents require the signatory, witnesses, and notary to be physically present in order to execute the document.

What are the Initial Costs of Setting Up a Special Needs Trust? Initially, the legal fee to get a trust up and running can be anywhere from $2,000 to $3,000. These estimates include getting the trust drafted and implemented. In some cases, a court approval process is required as part of the settlement.

A third party Special Needs Trust (SNT) is a trust established by one person for the benefit of another person who has a disability. The assets that fund the trust belong to someone other than the person with a disability. That is why we call it a ?third party? SNT.

The state of Tennessee requires that the trust agreement must be signed and notarized in person. The process of notarizing your revocable trust provides a layer of security and helps to prevent fraud. It also helps to confirm validity after the grantor dies.

Only a parent, grandparent, conservator, or court can establish a special needs trust on behalf of the person with disability; the person who has a disability is not allowed to create his or her own trust, even if he or she is fully capable of doing so.