A Conflict of Interest Waiver Form for tax preparers is an important document that addresses conflicts of interest that may arise during the process of preparing taxes for clients. This form is designed to ensure transparency and protect the interests of both the tax preparer and the client. It acknowledges any potential conflicts that could compromise the tax preparer's objectivity or professional independence. Keywords: Conflict of Interest Waiver Form, tax preparers, conflicts of interest, transparency, protect interests, tax preparation, objectivity, professional independence. Different types of Conflict of Interest Waiver Forms for tax preparers may include: 1. General Conflict of Interest Waiver Form: This form covers a broad range of potential conflicts that may arise during tax preparation, including situations where the tax preparer has a personal or financial interest in certain deductions or credits claimed by the client. 2. Family-Related Conflict of Interest Waiver Form: This form specifically addresses conflicts that may arise when the tax preparer is related to the client or has a personal or financial interest in the client's family or business. 3. Business Conflict of Interest Waiver Form: This form focuses on conflicts that may occur when the tax preparer holds a financial or ownership stake in a business that is being serviced or advised by the tax preparer. It ensures that the tax preparer remains objective and does not give preferential treatment to their own business interests. 4. Dual Representation Conflict of Interest Waiver Form: This form is used when the tax preparer represents both parties in a conflict, such as in the case of divorced or separated couples who jointly file taxes. It acknowledges the potential conflict and confirms the tax preparer's commitment to fair and unbiased tax preparation. 5. Professional Conflict of Interest Waiver Form: This form addresses conflicts that may arise between the tax preparer and their professional affiliations, such as membership in an organization or partnership that could influence the tax preparation process. It ensures that the tax preparer maintains their professional integrity and does not allow external pressures to affect their work. These different types of Conflict of Interest Waiver Forms aim to create a clear understanding between the tax preparer and the client regarding potential conflicts, promoting transparency, ethical practices, and maintaining the tax preparer's objectivity and professional independence throughout the tax preparation process.

Conflict Of Interest Waiver Form For Tax Preparers

Description

How to fill out Conflict Of Interest Waiver Form For Tax Preparers?

Legal management may be overpowering, even for knowledgeable experts. When you are interested in a Conflict Of Interest Waiver Form For Tax Preparers and don’t have the a chance to commit trying to find the appropriate and up-to-date version, the processes may be demanding. A strong web form library can be a gamechanger for anyone who wants to manage these situations effectively. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and business forms. US Legal Forms covers any demands you may have, from personal to enterprise papers, in one spot.

- Utilize innovative resources to finish and handle your Conflict Of Interest Waiver Form For Tax Preparers

- Access a useful resource base of articles, guides and handbooks and resources related to your situation and requirements

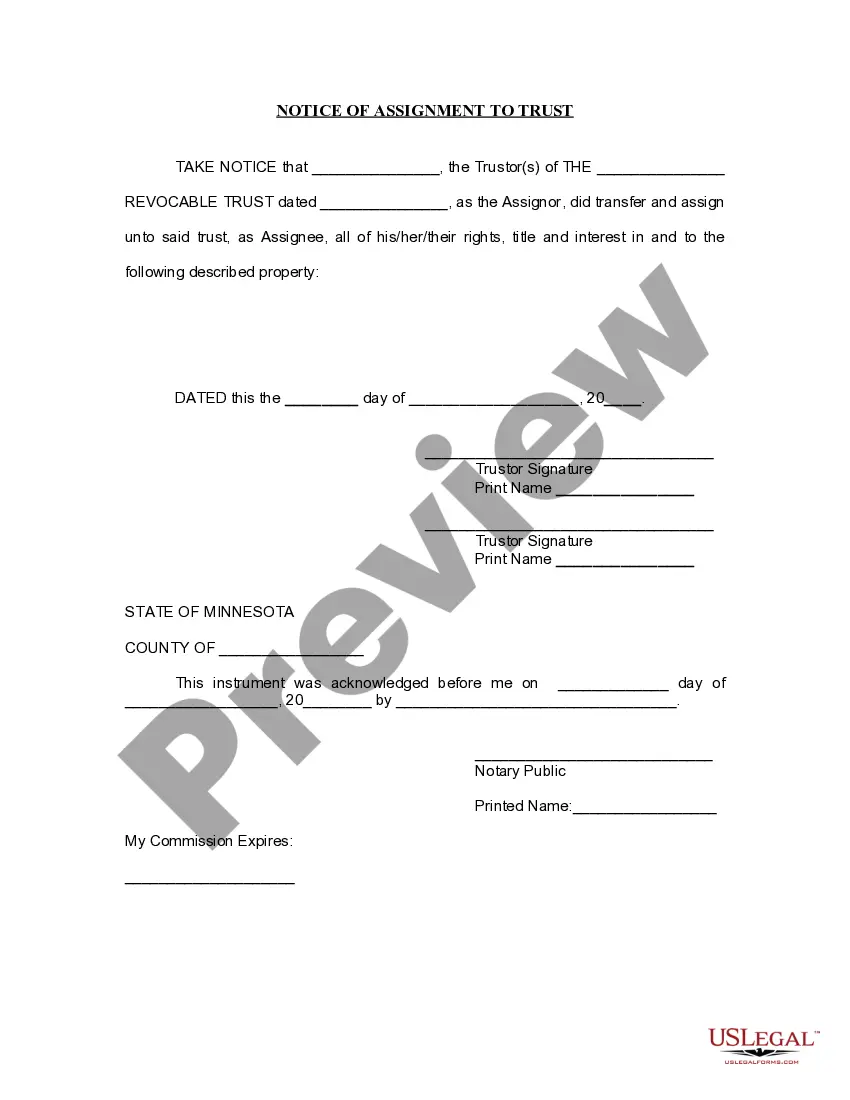

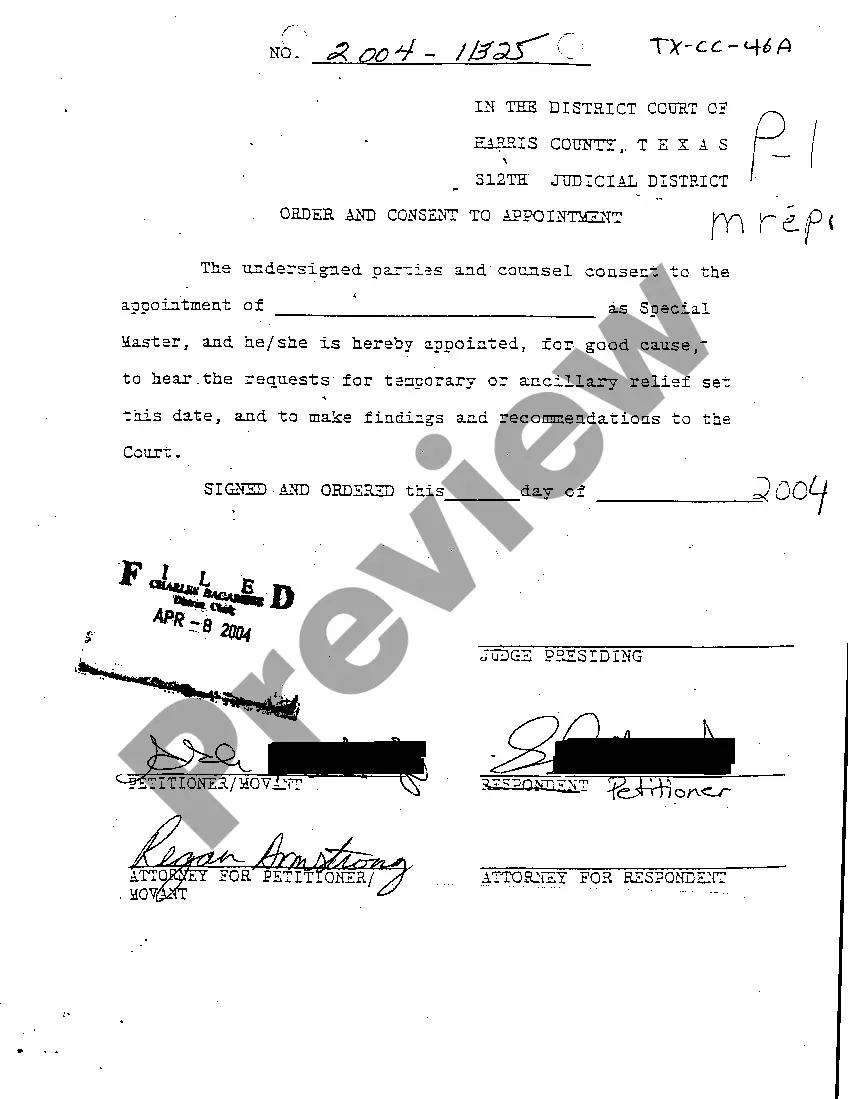

Save effort and time trying to find the papers you need, and utilize US Legal Forms’ advanced search and Preview feature to find Conflict Of Interest Waiver Form For Tax Preparers and download it. In case you have a membership, log in for your US Legal Forms account, search for the form, and download it. Review your My Forms tab to see the papers you previously saved as well as handle your folders as you see fit.

If it is the first time with US Legal Forms, create a free account and obtain limitless use of all advantages of the platform. Listed below are the steps for taking after getting the form you want:

- Confirm this is the correct form by previewing it and reading through its information.

- Ensure that the sample is acknowledged in your state or county.

- Choose Buy Now when you are ready.

- Choose a subscription plan.

- Find the file format you want, and Download, complete, sign, print out and deliver your document.

Enjoy the US Legal Forms web library, backed with 25 years of expertise and stability. Change your everyday document administration in to a easy and easy-to-use process right now.

Form popularity

FAQ

SELLER AND BUYER MUST COMPLETE THE ENTIRE DOCUMENT, SIGN, AND HAVE IT NOTARIZED. THE OWNERSHIP STATUS OF THE VEHICLE, TRAILER, OR BOAT NAMED HEREIN, WILL NOT CHANGE UNTIL THE BUYER APPLIES FOR AND IS ISSUED A CERTIFICATE OF TITLE.

Anyone can write a bill of sale in West Virginia. As long as the bill of sale is signed by both the buyer and seller, it can be legally binding. Having a notary sign the bill of sale can help it hold up in court. In some cases, notarization can be a legal requirement.

Parts of a Business Sale Agreement Parties. The names and locations of the buyer and seller will be clearly stated in the first paragraph or two of the contract. ... Assets. The agreement will detail the specific assets being transferred. ... Liabilities. ... Terms. ... Disclosures. ... Disputes. ... Notifications. ... Signatures.

What You'll Need to Transfer your Vehicle Title in West Virginia The completed signed original title. If the car is less than 10 years old, the odometer reading must be noted and both parties must sign. Your driver's license. Completed Application for Certificate of Title. Payment for $10 title transfer fees and taxes.

Virginia does not require a bill of sale to transfer ownership of a vehicle unless the purchase price cannot be listed on the original title. Purchase price documentation is an important step in documenting ownership transfer.

If the vehicle is purchased from an individual and the purchase price is below 50% of the current NADA Clean Loan Book value, a notarized bill of sale must accompany the application for title, or the tax will be assessed on the NADA Clean Loan Book value.

SELLER AND BUYER MUST COMPLETE THE ENTIRE DOCUMENT, SIGN, AND HAVE IT NOTARIZED. THE OWNERSHIP STATUS OF THE VEHICLE, TRAILER, OR BOAT NAMED HEREIN, WILL NOT CHANGE UNTIL THE BUYER APPLIES FOR AND IS ISSUED A CERTIFICATE OF TITLE.

West Virginia requires a bill of sale to be filled out by the buyer and the seller for private vehicle purchases. The official form for this is form DMV-7-TR which records information like the purchase price, the odometer reading, and the VIN of the vehicle in question.