Requesting a payoff amount for Newer is an essential step when it comes to mortgage loans. Whether you plan to refinance your loan, sell your property, or simply want to pay off your mortgage early, understanding the concept of payoff amount is crucial. Here's a detailed description of what a Request payoff amount for Newer entails: The payoff amount is the total sum required to completely satisfy your mortgage loan with Newer. It encompasses the remaining principal balance of the loan, any outstanding interest calculated up until the payoff date, as well as any applicable fees or charges. It is important to note that interest on mortgage loans accumulates daily, so the payoff amount may vary depending on the date of the request. Requesting a payoff amount from Newer is a straightforward process. You can typically make the request online through their official website or by contacting their customer service. To ensure accuracy, you will need to provide essential information such as your loan account number, property address, and possibly your social security number for identification purposes. Different types of payoff amount requests for Newer may include: 1. Regular Payoff Request: This type of request involves obtaining the current payoff amount, including principal balance and accrued interest, for the scheduled loan term. 2. Payoff for Refinance: If you plan to refinance your mortgage with a different lender, you will need a payoff amount that includes the principal balance, accrued interest, and any applicable prepayment penalties or fees. This specific request ensures that the refinancing process proceeds smoothly. 3. Payoff for Home Sale: When selling your property, you will need a payoff amount that covers the remaining principal, accrued interest, and any additional fees. It's important to request this type of payoff amount in advance to properly plan the financial aspects of the home sale transaction. 4. Early Payoff Request: Some homeowners may wish to pay off their mortgage loan before the scheduled end date. This request requires a payoff amount inclusive of the outstanding principal balance, accrued interest, and any prepayment penalties or fees that may be applicable. This option allows borrowers to save on interest payments and become mortgage-free sooner. Remember, it is essential to specify the purpose of your payoff request to ensure that the correct amount is provided by Newer. Whether you are refinancing, selling, or simply aiming for an early payoff, requesting a payoff amount is a crucial step in managing your mortgage obligations effectively.

Request Payoff Amount For Newrez

Description

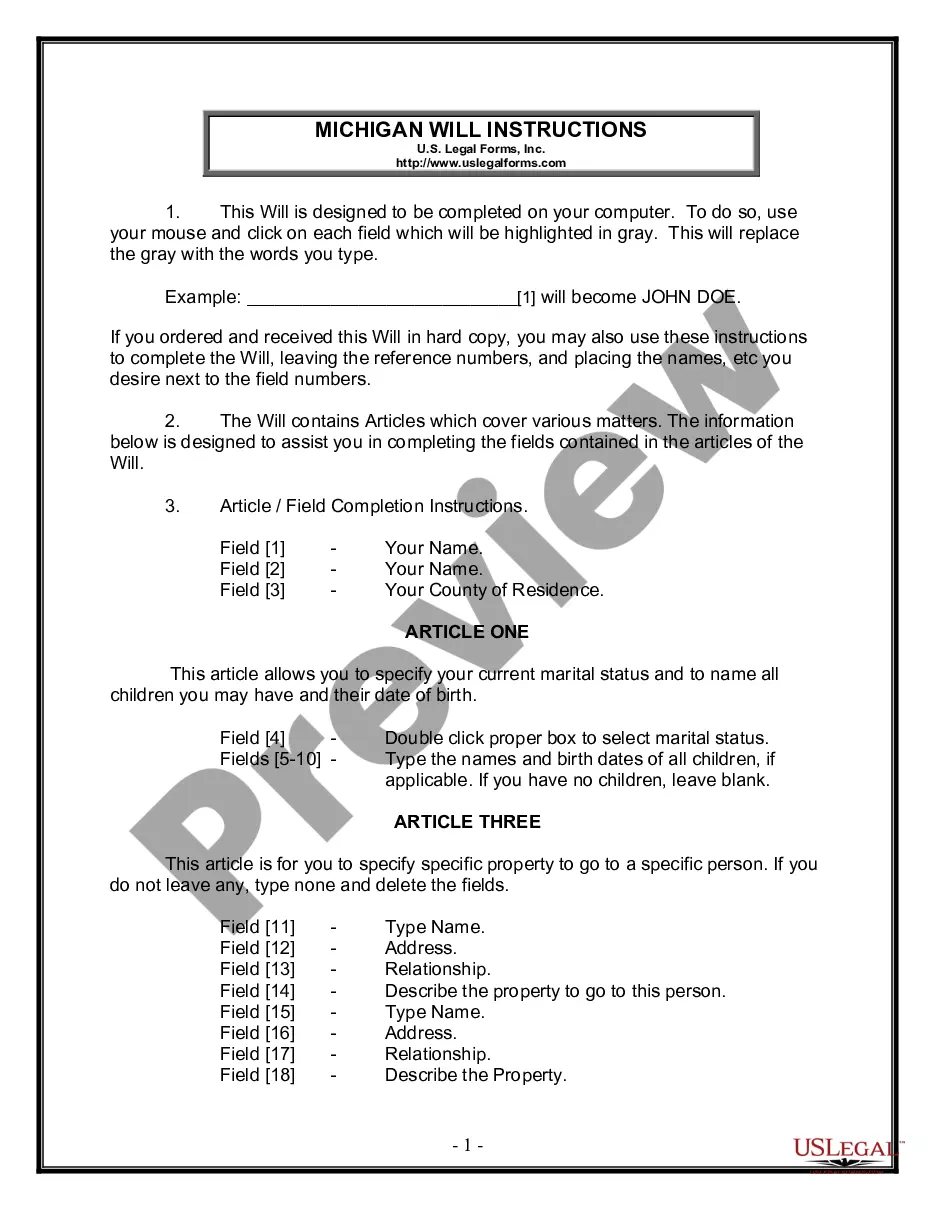

How to fill out Request Payoff Amount For Newrez?

Finding a go-to place to access the most current and appropriate legal templates is half the struggle of handling bureaucracy. Choosing the right legal files needs accuracy and attention to detail, which is the reason it is crucial to take samples of Request Payoff Amount For Newrez only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and view all the information concerning the document’s use and relevance for the situation and in your state or county.

Take the following steps to finish your Request Payoff Amount For Newrez:

- Make use of the library navigation or search field to find your sample.

- Open the form’s description to check if it fits the requirements of your state and area.

- Open the form preview, if available, to make sure the template is the one you are looking for.

- Resume the search and look for the proper template if the Request Payoff Amount For Newrez does not suit your needs.

- When you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that fits your requirements.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by picking a payment method (bank card or PayPal).

- Select the document format for downloading Request Payoff Amount For Newrez.

- When you have the form on your gadget, you can modify it with the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal documentation. Discover the extensive US Legal Forms collection to find legal templates, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

Here's a quick summary of what's involved in making your final mortgage payment. Request a payoff quote from your mortgage servicer. Make the final payment in the amount of the quote, following any special instructions such as paying via wire transfer. ... Receive documents verifying your loan repayment.

Use a shellpoint mortgage payoff request 2021 template to make your document workflow more streamlined. 55 Beattie Place Ste 110 MS 152 Greenville, SC 29601Phone Number: 8003657107 Fax: 8664671137 eMail: Loanservicing@shellpointmtg.comMonday Tuesday: AM12AM EST Wednesday Friday: AM10PM EST Saturday:...

The Newrez Family of Companies, f/k/a Shellpoint Partners, is a group of companies comprised of Newrez LLC (f/k/a New Penn Financial, LLC, a national mortgage lender specializing in the residential real estate market), Avenue 365 (a 45-state provider of title services to the real estate and mortgage industry) and E- ...

Sign in to your online account and click on Account Details to go to your dashboard. Click on Payments and then click on Request Payoff and choose Formal Payoff Quote to request a payoff. Your quote will have an expiration date, so act quickly after you receive it.

Click on Payments and then click on Request Payoff. Depending on local and state laws, we may charge you a fee of up to $30 to prepare your payoff quote, which we'll let you know in advance. To request your quote by phone, call our Customer Service team at 800-365-7107.