Complex Trust With Simple Trust

Description

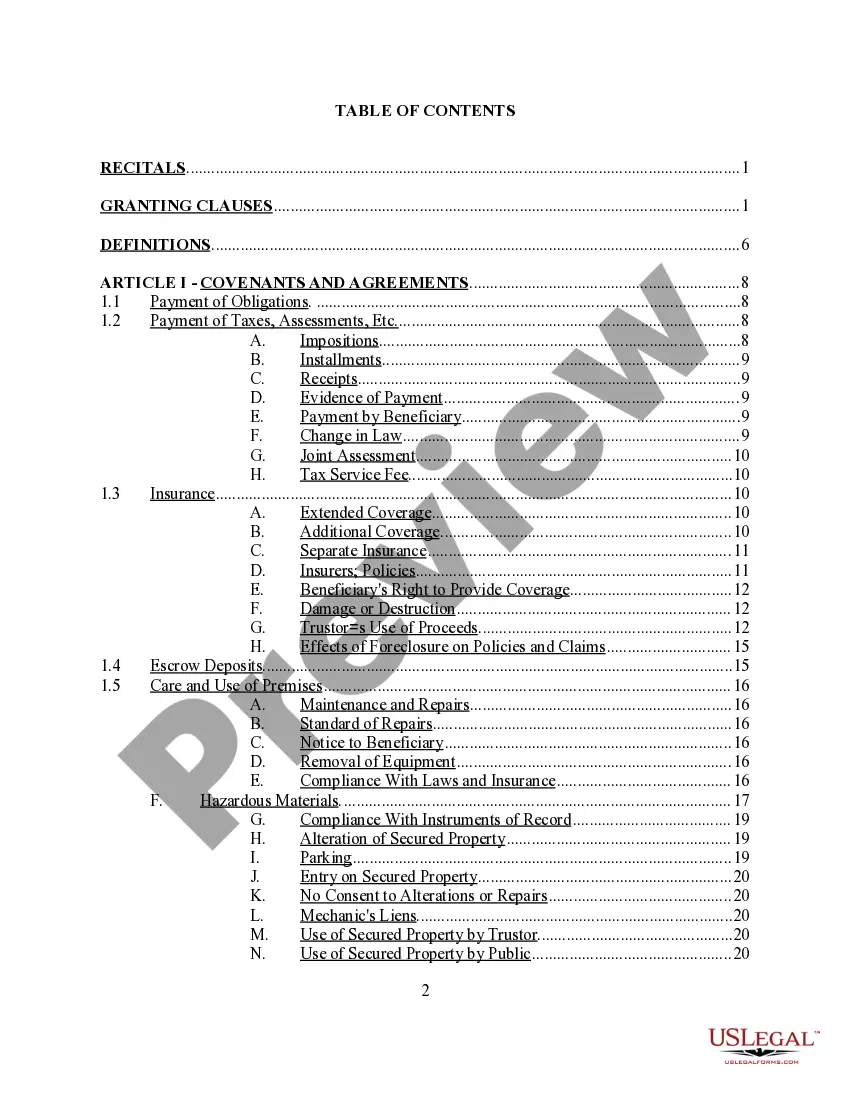

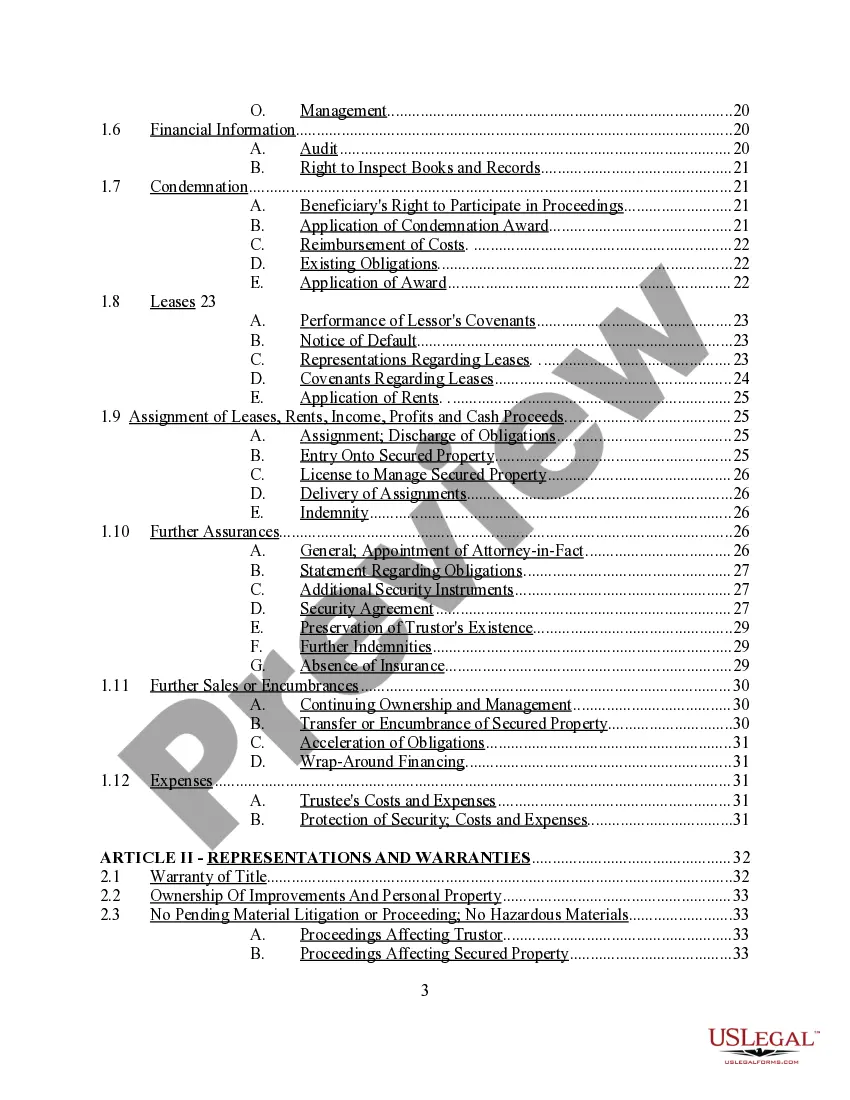

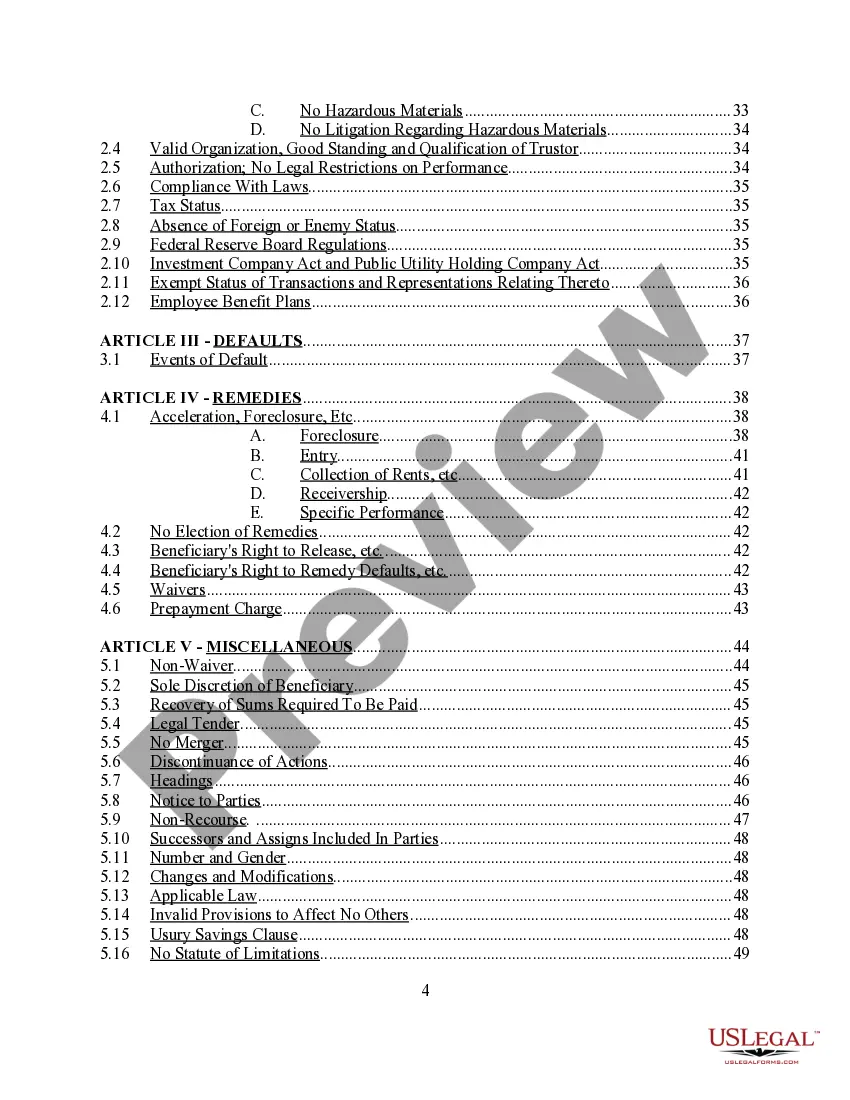

How to fill out Complex Deed Of Trust And Security Agreement?

It’s widely acknowledged that you cannot instantly become a legal expert, nor can you quickly learn to formulate a Complex Trust With Simple Trust without possessing a specialized knowledge.

Drafting legal documents is an extensive undertaking that necessitates specific education and competencies. So why not entrust the creation of the Complex Trust With Simple Trust to the professionals.

With US Legal Forms, one of the most extensive collections of legal templates, you can discover everything from court documents to frameworks for internal business communication.

If you require a different document, start your search anew.

Establish a free account and choose a subscription plan to acquire the template. Click Buy now. After completing the payment, you can access the Complex Trust With Simple Trust, fill it out, print it, and deliver it to the appropriate individuals or organizations.

- We understand the significance of compliance and following federal and state regulations.

- That’s why all forms on our platform are location-specific and timely.

- Begin your journey with our website and obtain the document you need within moments.

- Utilize the search bar at the top of the page to locate the form you require.

- If this option is available, preview it and review the accompanying description to see if Complex Trust With Simple Trust matches your needs.

Form popularity

FAQ

To determine if a trust is complex, evaluate its income distribution practices and provisions. A complex trust typically permits discretionary distributions or retains income, which distinguishes it from a simple trust that must distribute all income annually. Consulting with a legal expert can provide clarity and ensure compliance with relevant laws.

A simple trust does not automatically become a complex trust in its final year; it retains its classification until the final distributions are made. If the trust decides to distribute all income, it may maintain its simple status. However, if it accumulates income or allows for discretionary distributions, it may take on the characteristics of a complex trust.

A trust cannot be both simple and complex at the same time according to IRS definitions. However, it can transition between these statuses based on its income distribution practices. Understanding how these characteristics interact is crucial for effective trust management and tax planning.

Yes, a trust can be classified as complex one year and simple the next, depending on its income distribution and management. This flexibility allows trust creators to adjust the trust's structure based on changing financial circumstances or goals. Regularly reviewing the trust's terms can help ensure it serves its intended purpose effectively.

A simple trust cannot be a complex trust simultaneously due to their distinct definitions and tax implications. However, a simple trust can adopt complex trust characteristics if it amends its terms to allow for discretionary distributions. Knowing when to make this change can enhance your trust's flexibility, ensuring it meets your financial goals.

To change a simple trust to a complex trust, you need to amend the trust document, ensuring it allows for discretionary distributions of income. This amendment must comply with state laws and the original intent of the trust creator. For assistance in navigating this process, consider using a resource like USLegalForms to access templates and guidance.

Yes, a Qualified Subchapter S Trust (QSST) does file a Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This form is essential for reporting income, deductions, and credits. If you are managing a QSST and transitioning between a complex trust with simple trust elements, consulting with a tax advisor can clarify your filing obligations.

The 2 year rule for trusts refers to a provision that affects how income is taxed when a trust is established. Specifically, this rule states that if a trust is deemed a complex trust with simple trust characteristics, it must distribute all income within two years to avoid being taxed at higher rates. Understanding this rule helps trust creators make informed decisions about trust management and tax implications.