Husband And Wife Llc Operating Agreement With Profits Interest

Description husband wife llc operating agreement

How to fill out Llc With Profits?

There’s no further justification to squander hours searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and made them easy to access.

Our platform offers more than 85k templates for various business and personal legal situations categorized by state and type of use.

Utilize the search field above to look for another template if the current one isn’t suitable.

- All documents are professionally crafted and verified for authenticity, allowing you to feel confident in acquiring an up-to-date Husband And Wife LLC Operating Agreement With Profits Interest.

- If you are already acquainted with our platform and possess an account, ensure that your subscription is active before obtaining any templates.

- Log In to your profile, choose the document, and click Download.

- You can also return to all saved documents whenever needed by accessing the My documents tab in your account.

- If you haven’t used our platform previously, the process will require a few more steps to finalize.

- Here’s how newcomers can find the Husband And Wife LLC Operating Agreement With Profits Interest in our library.

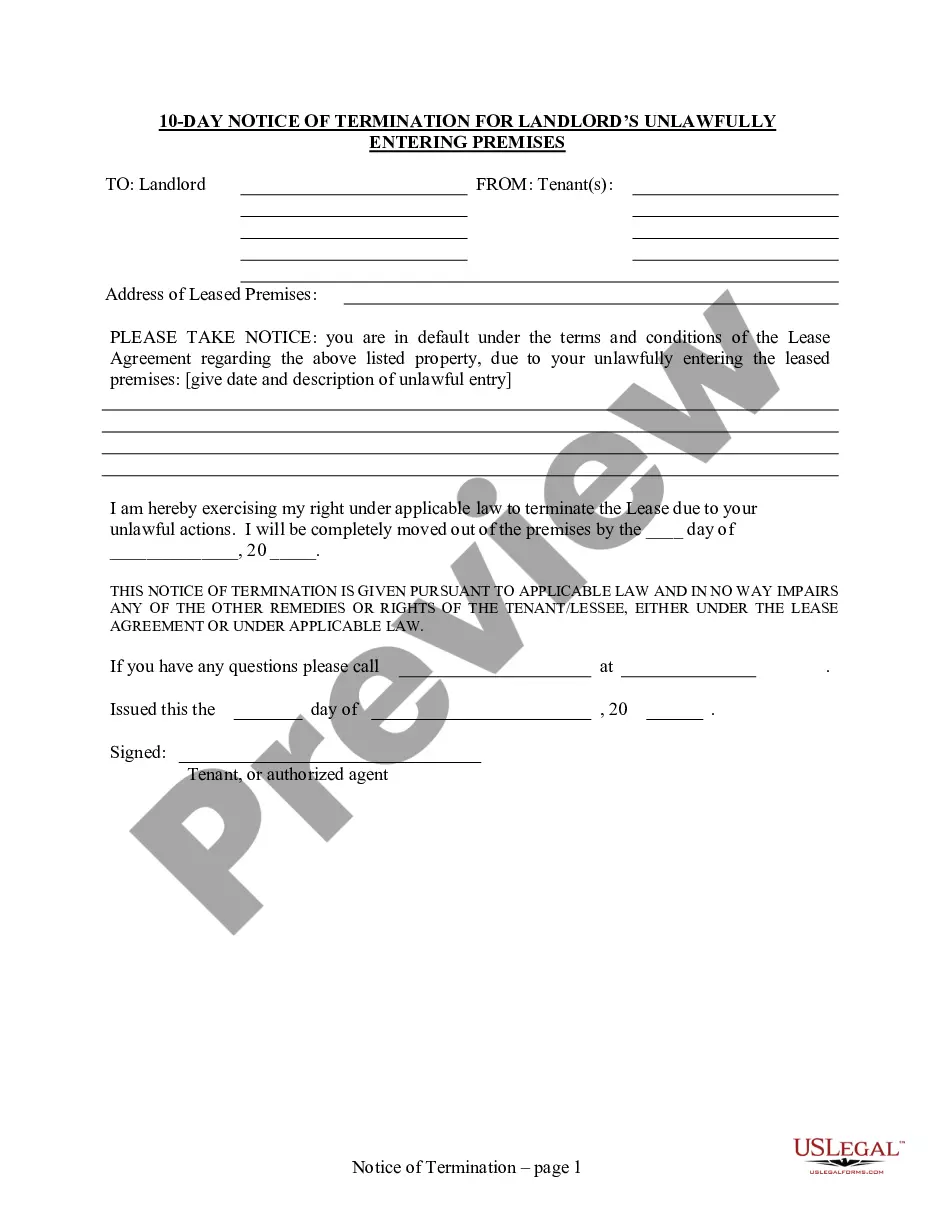

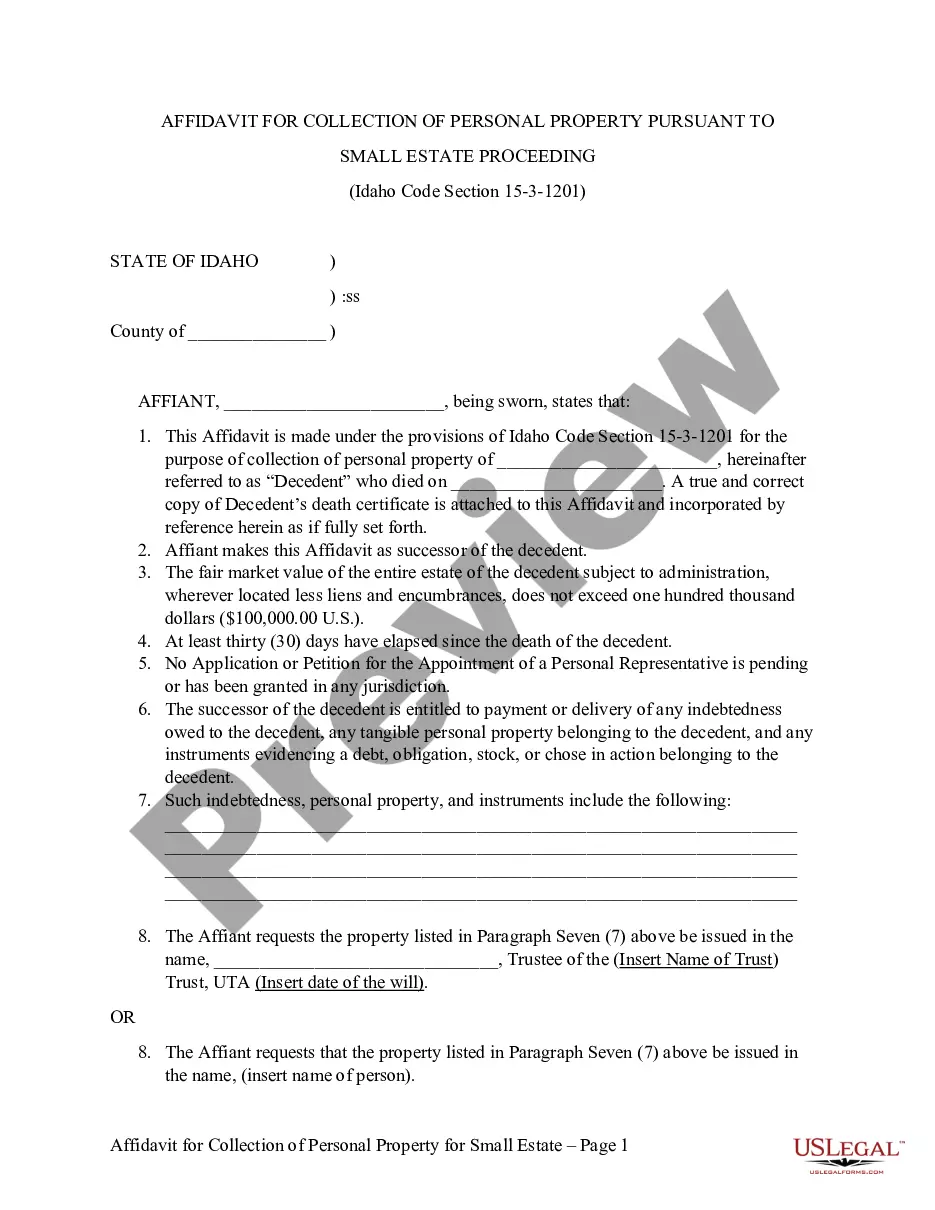

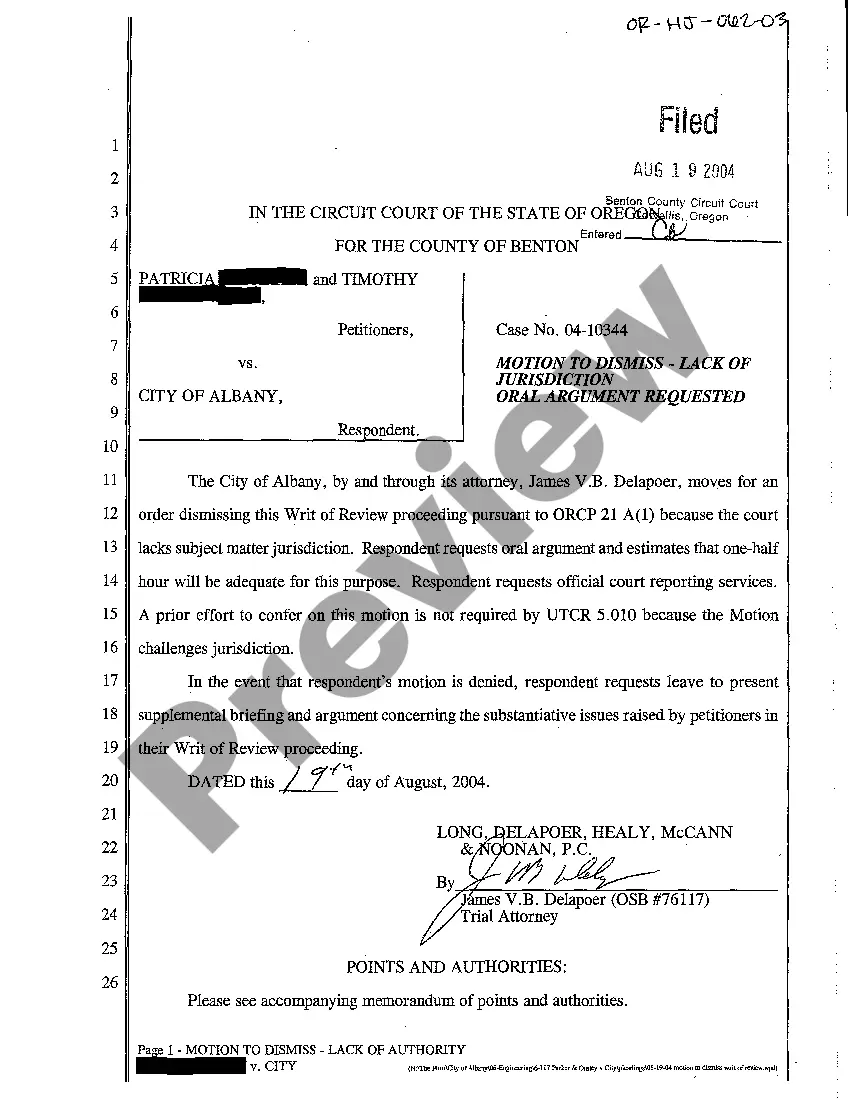

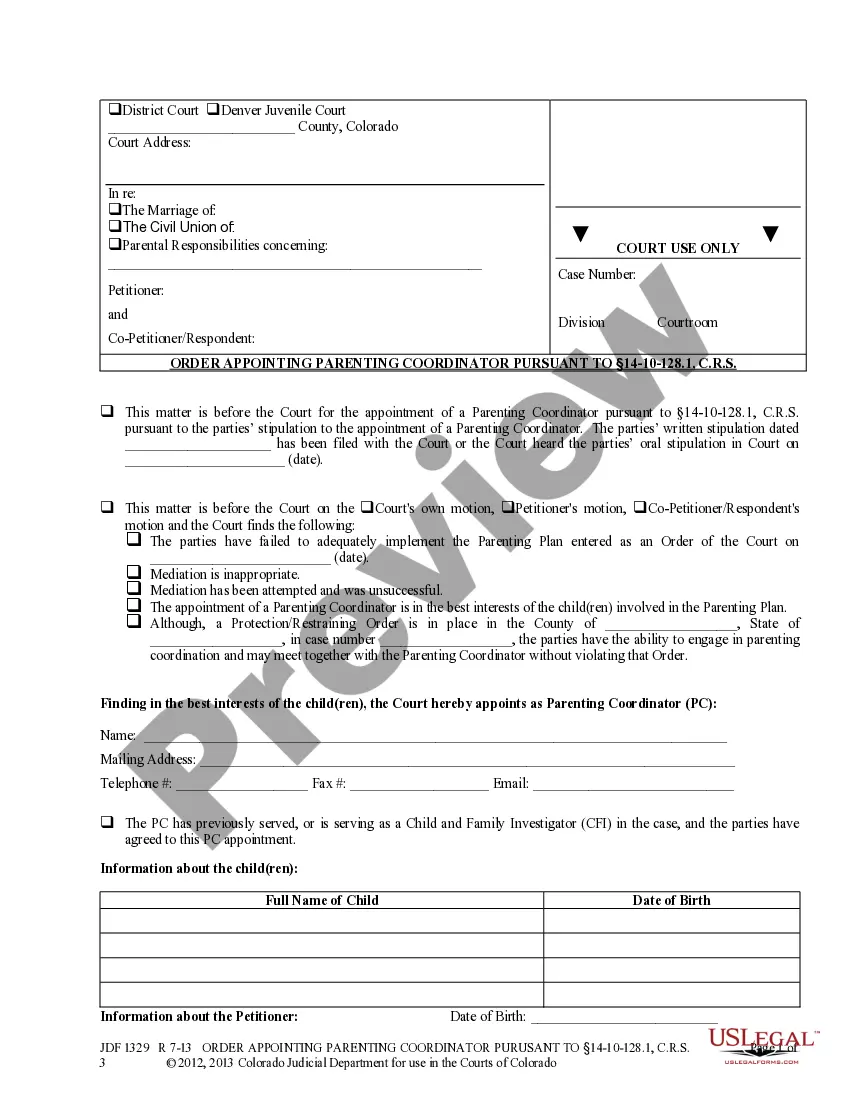

- Examine the page content thoroughly to confirm it includes the sample you need.

- Utilize the form description and preview options if available.

llc operating with Form popularity

limited liability company operating agreement Other Form Names

limited liability company interest FAQ

If you choose to set up your LLC with just one spouse as a member, you can classify it as a sole proprietorship or a corporation. If your LLC has more than one member, you can classify it as a partnership or corporation.

In most cases, the company will divide profits and losses based on ownership interests. A partner will receive shares of profits and losses depending on their financial contribution. For example, partner A has a 50% membership stake. Meanwhile, partner B has 30%, and partner C holds 20%.

Divide ownership of the LLC by calculating total cash investment by the members. Give each member an ownership stake equal to his cash investment. Four members contributing $25,000 apiece would each receive a 25 percent stake in the company.

Your options are: Partnership, with each spouse having a partnership share. Limited Liability Company (LLC), with each spouse having a membership share, or. Corporation (with the possibility of electing to be an S corporation)., and each spouse as a shareholder.

The LLC is wholly owned by the husband and wife as community property under state law. no one else would be considered an owner for federal tax purposes, and. the business is not otherwise treated as a corporation under federal law.