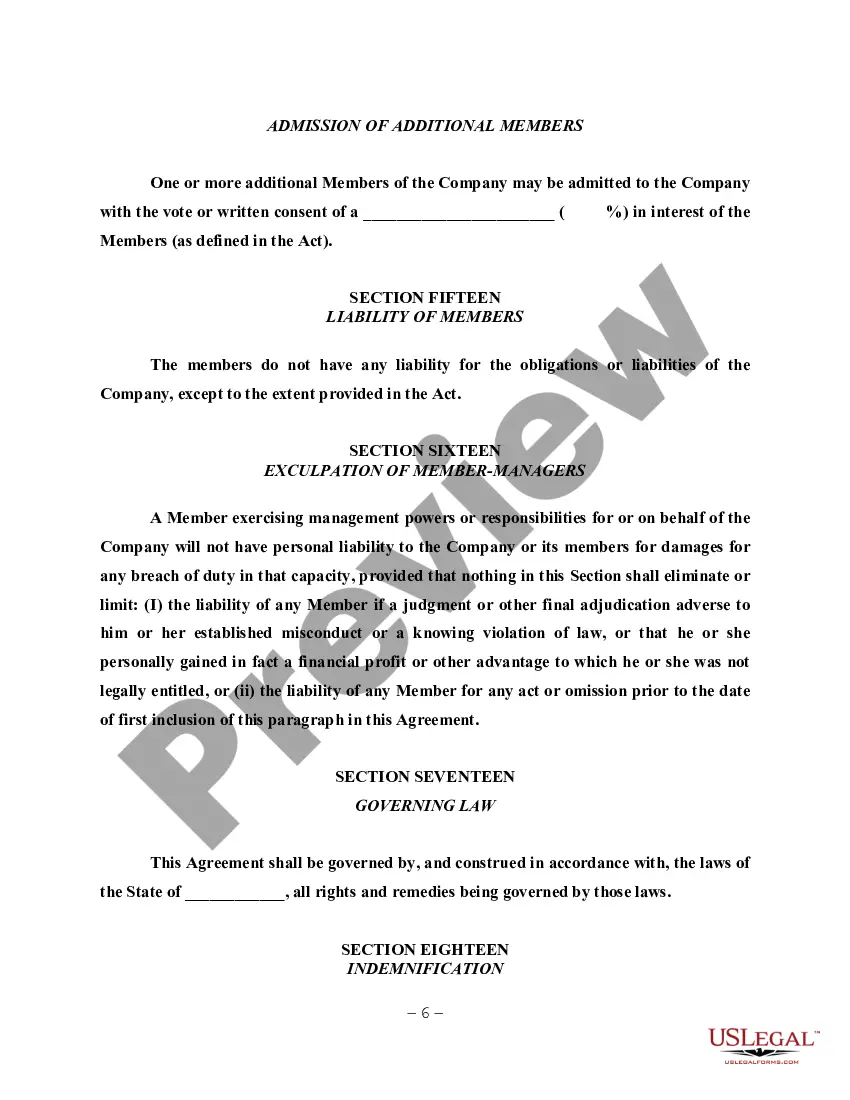

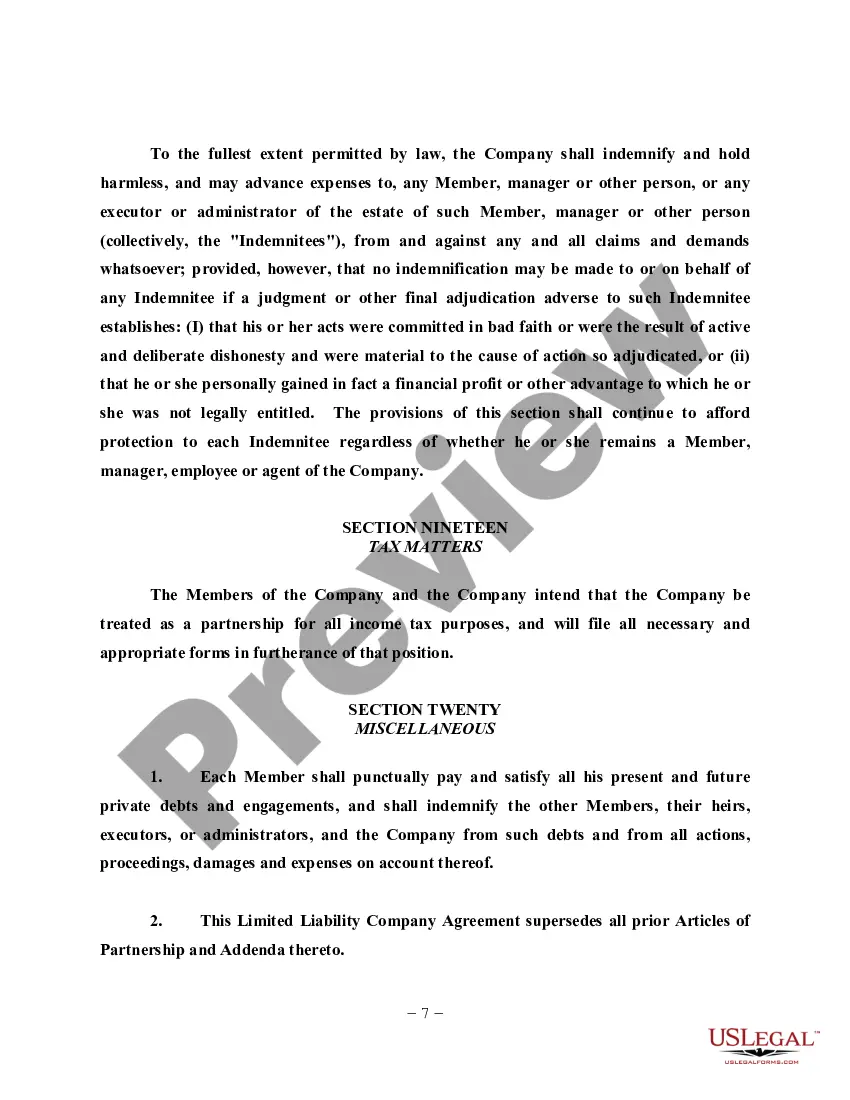

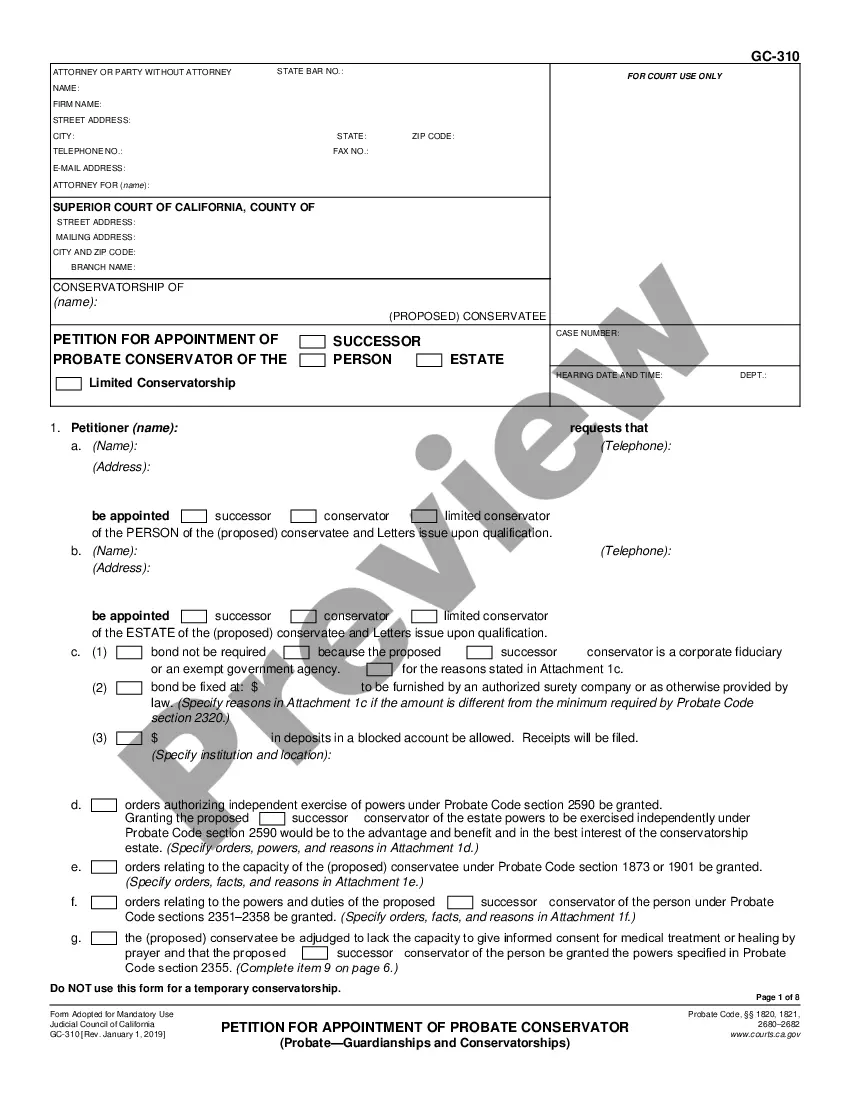

A sample operating budget for an assisted living facility is a financial plan that outlines the expected expenses and revenues associated with operating such a facility. This budget serves as a crucial tool for administrators and investors to estimate the financial feasibility and sustainability of the assisted living facility. It also helps in making strategic decisions, managing costs, and ensuring the provision of quality care and services to residents. The following are key components often included in a sample operating budget for an assisted living facility: 1. Personnel Expenses: This category includes salaries, wages, benefits, and training costs for the facility's staff, such as nurses, caregivers, administrators, and support personnel. Personnel expenses are a significant part of the budget as they directly impact the quality and quantity of services provided. 2. Facility Costs: These expenses include rent, property taxes, utilities (such as electricity, water, gas), insurance, maintenance, repairs, and general upkeep of the facility. Facility costs also encompass any lease or mortgage payments associated with the property. 3. Resident Services: This section covers various services provided to residents, such as meals, transportation, recreational activities, housekeeping, laundry, and social services. The budget should account for the cost of procuring or outsourcing these services, as well as any necessary equipment or supplies. 4. Medical Supplies and Equipment: Many assisted living facilities offer medical services to their residents. The budget should allocate funds for medical supplies (medications, first aid materials, disposable items) and equipment (wheelchairs, medical beds, monitoring devices) necessary for resident care. 5. Administrative and Office Expenses: This includes costs related to administrative functions like accounting, legal fees, office supplies, communication, marketing, and insurance. It also covers licensing and certification fees associated with running an assisted living facility. 6. Staff Training and Development: Investing in continuous training and education for staff members ensures the provision of quality care and keeps the facility up-to-date with industry best practices. Funds should be allocated for various training programs, certifications, and professional development opportunities. 7. Ancillary Services: Some facilities may offer additional services like beauty and salon services, therapy, or specialized programs. These services require separate budgeting to account for their specific expenses, including staffing and supplies. Different types of sample operating budgets for assisted living facilities may include: 1. Basic Operating Budget: A comprehensive budget that includes all the essential expenses and revenues associated with running an assisted living facility. 2. Expansion or Renovation Budget: A budget specifically designed for facilities undergoing expansion or renovation projects. It estimates costs related to construction, equipment purchase, hiring additional staff, and any potential revenue changes during the construction phase. 3. Start-up Budget: For new establishments, this budget anticipates initial investment costs, equipment purchases, marketing expenses, and the projected timeline for revenue generation. 4. Cost Containment Budget: This budget focuses on identifying cost-saving measures within the facility, optimizing resource allocation, reducing waste, and exploring financial efficiencies while maintaining quality care standards. In conclusion, a sample operating budget for an assisted living facility is a detailed financial plan that encompasses various cost categories enabling effective management and decision-making. It ensures efficient allocation of resources, optimal resident care, financial stability, and long-term success for the facility.

Sample Operating Budget For Assisted Living Facility

Description

How to fill out Sample Operating Budget For Assisted Living Facility?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Discovering the right legal papers demands precision and attention to detail, which is the reason it is very important to take samples of Sample Operating Budget For Assisted Living Facility only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the details about the document’s use and relevance for your situation and in your state or region.

Take the following steps to complete your Sample Operating Budget For Assisted Living Facility:

- Use the library navigation or search field to locate your sample.

- Open the form’s information to see if it fits the requirements of your state and region.

- Open the form preview, if available, to make sure the form is the one you are searching for.

- Go back to the search and locate the appropriate template if the Sample Operating Budget For Assisted Living Facility does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (bank card or PayPal).

- Choose the document format for downloading Sample Operating Budget For Assisted Living Facility.

- Once you have the form on your gadget, you may change it using the editor or print it and finish it manually.

Get rid of the inconvenience that accompanies your legal documentation. Discover the extensive US Legal Forms collection to find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Examples of commonly used operating budgets are sales, production or manufacturing, labor, overhead, and administration. Once budgets are in place, companies can use them to manage activities, compare how they are earning or spending against these budgets, and prepare for future business cycles.

An operating budget consists of all revenues and expenses over a period of time (typically a quarter or a year) that a corporation, government (see the U.S. 2017 Budget), or organization uses to plan its operations.

As the name suggests, an annual operating budget is a detailed statement of an organization's estimated revenue and expenses over a year. The budget acts as a reference point for all your activities over the next twelve months.

An operating budget is a detailed projection of what a company expects its revenue and expenses will be over a period of time. Companies usually formulate an operating budget near the end of the year to show expected activity during the following year.

The Annual Operating Budget provides financial information regarding anticipated revenue and anticipated expenses. Anticipated revenue and expenses reflect the expected revenue and expenses for the next year of operations and constitute the working budget for the facility.