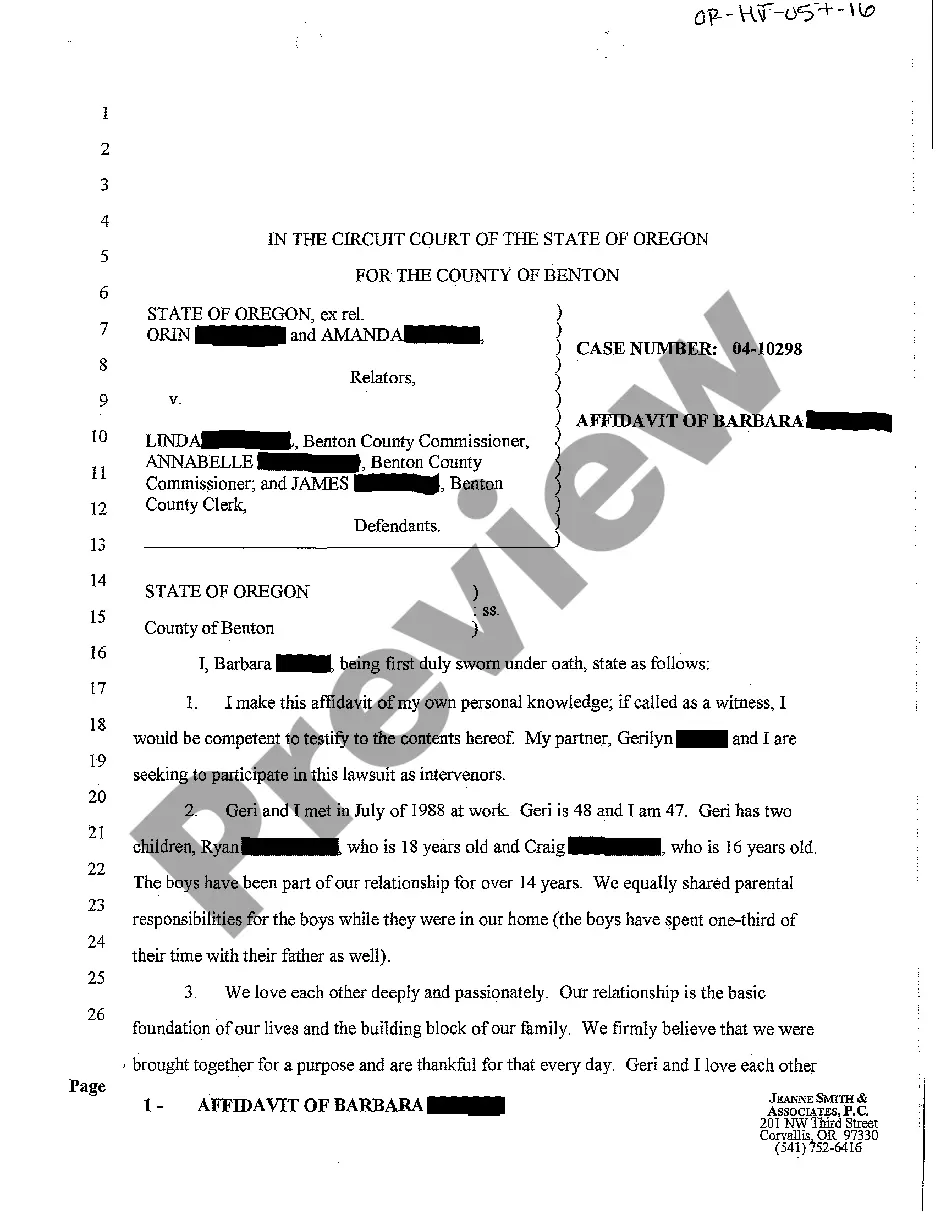

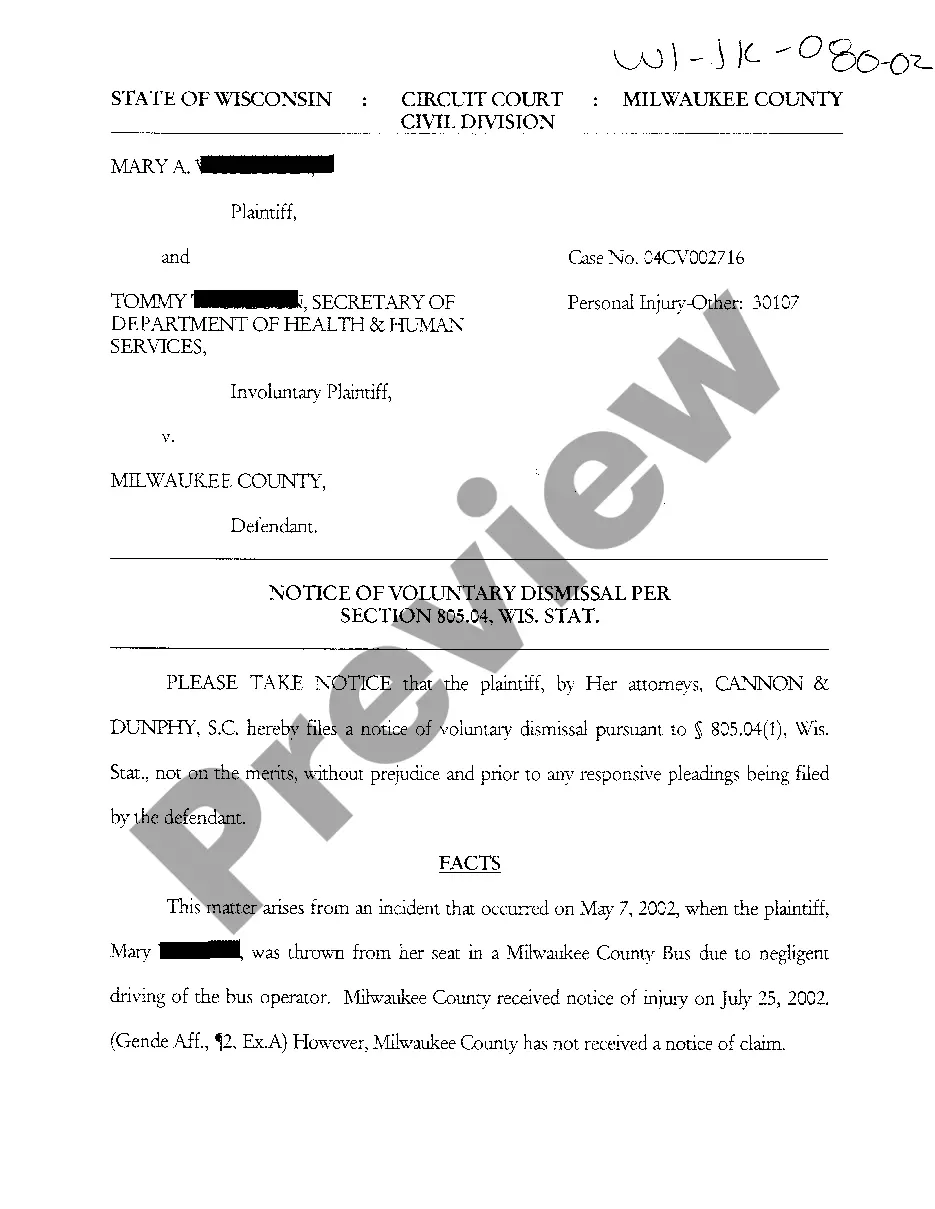

A payoff letter, also known as a request for payoff letter or a mortgage payoff letter, is a formal document that individuals or organizations send to their loan provider or lender to request the total amount required to pay off a loan or mortgage. It is an essential tool for borrowers who wish to settle their outstanding loan balance. Sample request for payoff letters typically include specific information and are tailored to the unique circumstances of the borrower. They may vary based on the type of loan or mortgage being paid off, such as a home loan, auto loan, student loan, or credit card debt. When composing a sample request for payoff letter, it is crucial to include key details and use appropriate keywords to ensure clarity and accuracy. The letter should typically include the following information: 1. Header: Write the date, lender's name, and complete contact information (address, phone number, and email) at the beginning of the letter. 2. Borrower's Information: Provide your full name, address, contact details, and any account or reference numbers associated with the loan. 3. Loan Details: Include specifics about the loan or mortgage, such as the loan number, origination date, current balance, and interest rate. 4. Request for Payoff Amount: Clearly state your intention to pay off the loan and request the outstanding balance required to settle the loan completely. Use keywords like "payoff amount," "total sum due," or "final payment." 5. Payment Method: Indicate how you plan to make the payment, whether it is through a cashier's check, wire transfer, or any other preferred method. Include relevant account details if necessary. 6. Confirmation and Documentation: Request the lender to provide written confirmation of the payoff amount and specify any additional documentation or forms required to complete the process. 7. Contact Information: Reiterate your contact information and request the lender to reach out to you with any questions or concerns regarding the payoff process. Different types of sample requests for payoff letters can arise depending on the purpose and specific loan involved. Some common variations include: 1. Home Loan Payoff Letter: Specific to mortgages, this request outlines the remaining principal, interest, and any additional fees associated with the loan. 2. Auto Loan Payoff Letter: Pertaining to car loans, this request includes details on the remaining balance, interest, and any outstanding charges. 3. Student Loan Payoff Letter: Geared towards educational loans, this request provides information regarding the remaining outstanding balance, interest, and any accrued fees. 4. Credit Card Debt Payoff Letter: For credit card debts, this request states the total balance, interest rates, and any applicable fees. By tailoring the content of your sample request for payoff letter to the type of loan or mortgage involved, you can ensure its relevance and increase the likelihood of an accurate and timely response from your lender.

Sample Request For Payoff Letter

Description sample loan payoff letter

How to fill out Mortgage Payoff Request Letter?

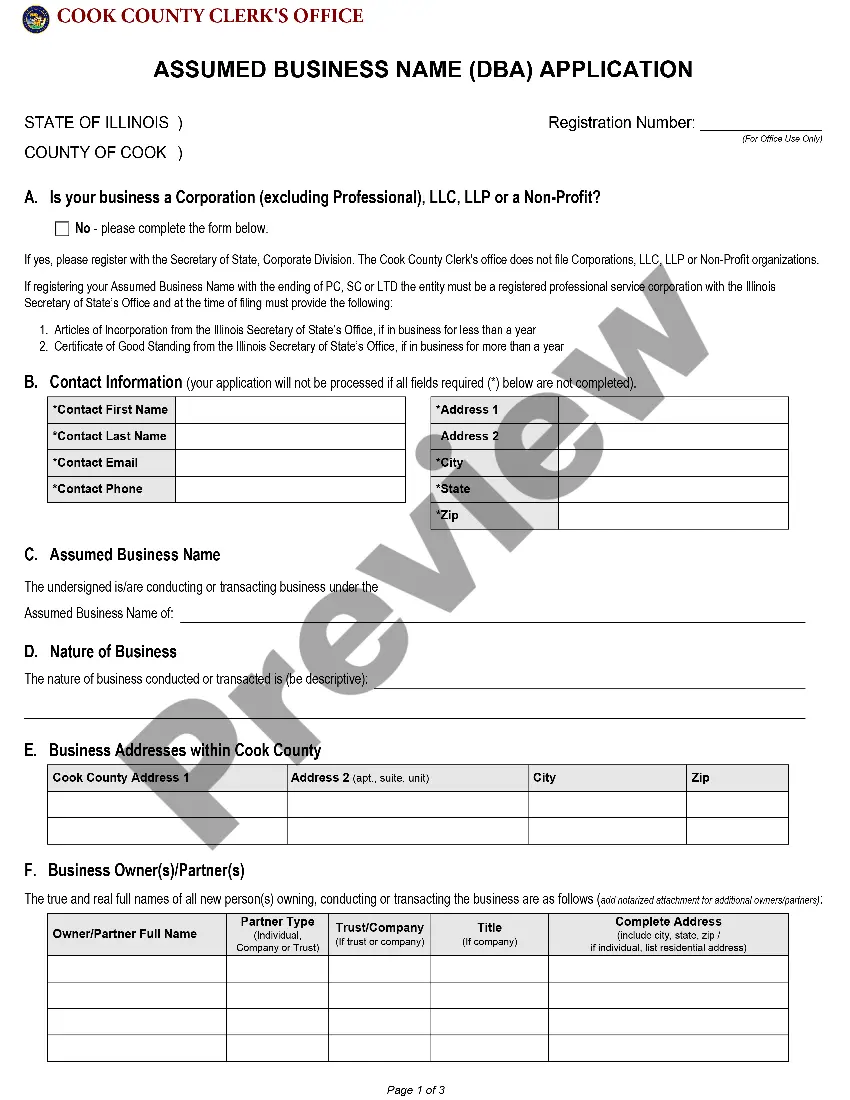

Whether for business purposes or for personal affairs, everyone has to manage legal situations at some point in their life. Completing legal documents requires careful attention, beginning from picking the proper form sample. For instance, when you choose a wrong version of a Sample Request For Payoff Letter, it will be declined once you send it. It is therefore important to have a trustworthy source of legal documents like US Legal Forms.

If you need to obtain a Sample Request For Payoff Letter sample, stick to these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it fits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to find the Sample Request For Payoff Letter sample you need.

- Get the template if it meets your requirements.

- If you have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the account registration form.

- Select your transaction method: use a bank card or PayPal account.

- Pick the document format you want and download the Sample Request For Payoff Letter.

- When it is saved, you can fill out the form by using editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time looking for the appropriate template across the internet. Make use of the library’s simple navigation to get the correct form for any situation.

payoff demand letter Form popularity

payoff statement template word Other Form Names

wells fargo payoff letter FAQ

Typically, a 10-day payoff letter includes: The 10-day payoff date and payoff quote for your loan. Your loan account number(s) Individual loans and their payoff amounts (if you're refinancing multiple loans) Instructions on how to pay off your current loan servicer.

In order to create an effective payoff letter, it is important to include key information such as: contact information for all relevant parties; details regarding the loan or mortgage; expected date of receipt for payment; any additional terms or conditions related to repayment; and signatures from both borrower and ...

What is a 10-day payoff and where can I get it? A 10-day payoff statement is a document from your lender that gives us the payoff amount to purchase your vehicle, including 10 days worth of interest. We need this document in order to finalize your trade-in or sale.

A payoff letter is typically requested by a borrower from its lender in connection with the repayment of the borrower's outstanding loans to the lender under a loan agreement and termination of the loan agreement and related security and guaranties.

A payoff request is a statement prepared by your lender which details the payoff amount for prepayment of your mortgage loan. The payoff statement will typically be the remaining balance on your mortgage loan, but it might also include any accrued interest or late charges/fees that could be owed.