A request letter format for a bank is a formal document used to make inquiries or requests to a bank, seeking information, assistance, or specific action regarding banking services. It is an essential tool for customers to communicate their requirements clearly and formally. Below is a detailed description of the request letter format for a bank: 1. Heading: Begin the letter with your name, address, contact details, and the current date in the top right corner. Skip a line and then mention the bank's name, branch address, and the date on the left side. 2. Salutation: Use a proper salutation such as "Dear Sir/Madam" if you do not have a specific person to address. 3. Subject: Clearly specify the purpose of your request in the subject line to help the bank quickly understand the nature of your letter. For example, "Request for Account Statement." 4. Body: The body of the letter should be divided into three parts: introduction, explanation, and closing. a. Introduction: Start the letter by politely addressing the recipient and introducing yourself. Clearly state your customer identification information (account number, customer code, etc.) to help the bank locate your details quickly. b. Explanation: Provide a clear and detailed explanation of your request. Mention any relevant details, such as specific dates, account numbers, or transactions to help the bank address your request accurately. c. Closing: Conclude the letter politely by expressing gratitude for the assistance and mentioning your availability for any further information or clarification that the bank may require. End with a formal closing, such as "Yours faithfully" or "Sincerely." 5. Enclosures: If you need to attach any supporting documents, mention them in the letter and list them in the enclosure section, just below the closing. 6. Signature: Leave space for your handwritten signature, followed by your printed name. If the letter is being sent via email, type your name instead. Types of Request Letter Formats for the Bank: 1. Bank Account Opening Request: A request letter format used when a customer wants to open a new bank account. It includes personal information, required documents, and any specific account requirements, such as a current account, savings account, or fixed deposit account. 2. Loan Application Request: This format is used to request a loan from the bank. It includes details about the loan amount, purpose, repayment terms, and supporting documents like income proof, credit history, business plans, etc. 3. Bank Statement Request: This format is used to request bank statements for a specified period. It includes the account number, duration for which statements are required, and may require additional information for verification. 4. Address Change Request: This format is used when a customer wants to update their address details in the bank's records. It includes the old and new address information along with supporting documents like an updated utility bill or identification proof. 5. Account Closure Request: A request letter format used to close an existing bank account. It requires the account holder's details, account number, and signatures. It may also request instructions for transferring the remaining funds, if any. Remember to keep the request letter concise, polite, and relevant. Use clear and specific language to ensure effective communication with the bank.

Request Letter Format For Bank

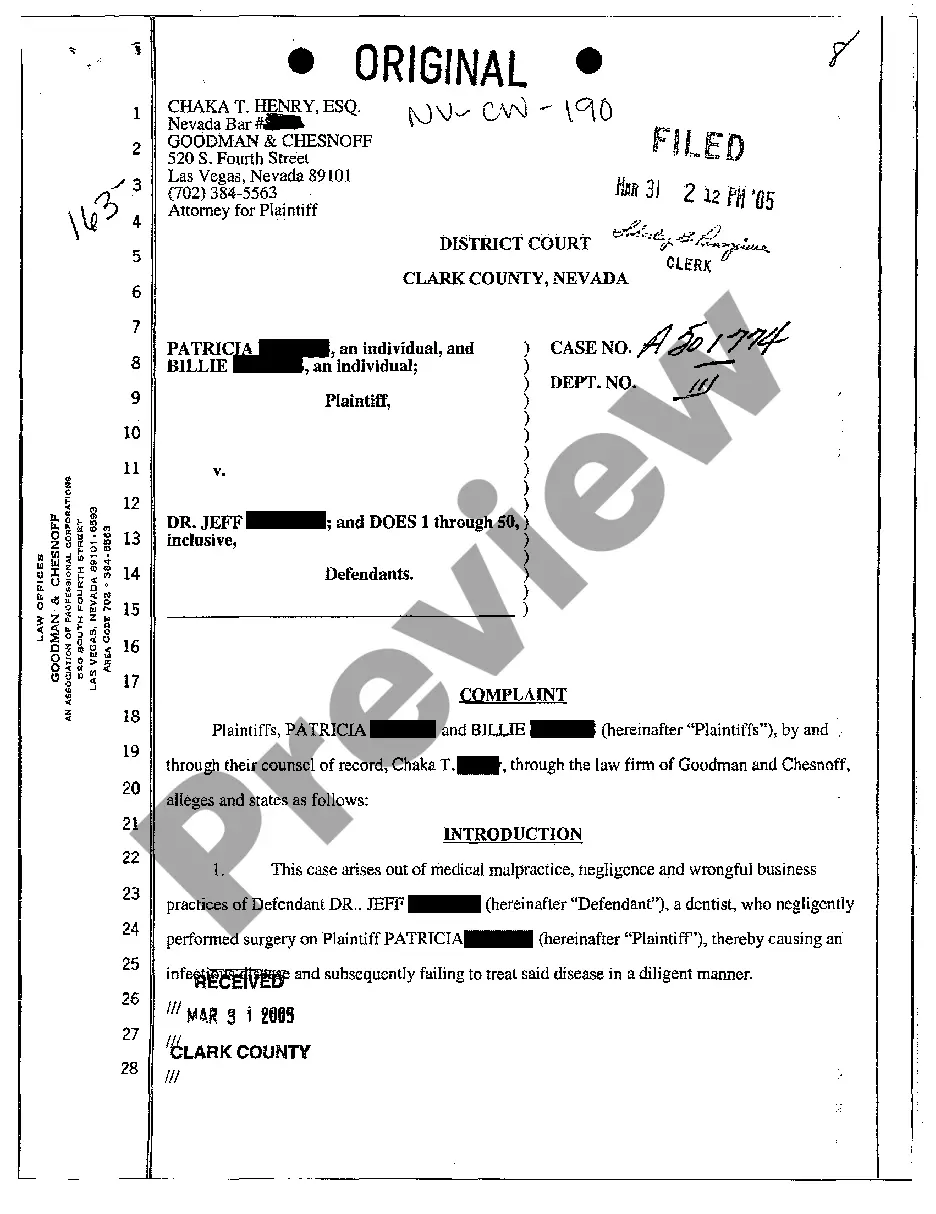

Description bank account opening request letter from company

How to fill out Foreclosure Letter Format For Bank?

It’s no secret that you can’t become a legal expert overnight, nor can you figure out how to quickly prepare Request Letter Format For Bank without having a specialized set of skills. Putting together legal forms is a long venture requiring a specific education and skills. So why not leave the preparation of the Request Letter Format For Bank to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court papers to templates for internal corporate communication. We understand how important compliance and adherence to federal and local laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and get the form you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Request Letter Format For Bank is what you’re searching for.

- Start your search over if you need any other template.

- Register for a free account and choose a subscription option to purchase the template.

- Choose Buy now. As soon as the transaction is complete, you can get the Request Letter Format For Bank, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

bank request letter format Form popularity

request mail format Other Form Names

request letter to bank format FAQ

Tips For Loan Request Letter Review the loan guidelines and understand how they apply. ... Describe the reason for the loan in detail. ... Attach the necessary supporting documentation. ... Identify the amount of money you need. ... Be polite and professional when addressing the reader. ... Be sure to include a repayment plan.

Dear Sir/Madam, I am writing to request a bank statement for my savings account with your esteemed bank. My account number is X and the account is in the name of John Doe. I would like to request the bank statement for the past six months, starting from September 2022 to February 2023.

Parts of a bank statement include information about: The bank's address and contact information. Account information. The statement date. Total number of days in the statement period, or the period's beginning and ending dates. Beginning and ending balance of the account.

What is the format of a letter of request? Sender's name and contact details, unless shown on a letterhead. Date. The recipient's name and contact details. Greeting. Purpose of the letter. Body of the letter. Professional closing. Signature.

Here is how to write a request letter in 7 steps: Collect information relating to your request. ... Create an outline. ... Introduce yourself. 4. Make your request. ... Explain the reason for the request. ... Offer to provide additional information. ... Show your gratitude and conclude the letter. ... Use a professional format.