A partnership withdrawal agreement is a legal document that outlines the procedures and terms for a partner to withdraw from a partnership. This agreement is essential in protecting the interests of all parties involved and ensuring a smooth transition. One example of a partnership withdrawal agreement is the "Buyout Agreement." In this type of agreement, the withdrawing partner agrees to sell their share of the partnership to the remaining partners or the partnership itself. The buyout price may be determined by a previously agreed-upon formula, a third-party appraisal, or through negotiations between the parties. Another example is the "Capital Account Adjustment Agreement." This type of agreement is used when a partner's withdrawal affects the capital accounts of the remaining partners. It outlines the procedures for adjusting the partners' capital accounts to reflect the withdrawing partner's capital contribution and any profits or losses allocable to them. A "Goodwill Buyout Agreement" is another type of partnership withdrawal agreement. It specifically focuses on the treatment of goodwill, which represents the intangible assets and reputation of a partnership. The agreement outlines how the withdrawing partner's share of goodwill will be determined and compensated. Additionally, there is the "Non-Compete Agreement" that may be included in a partnership withdrawal agreement. This agreement prohibits the withdrawing partner from engaging in similar business activities or competing with the partnership for a specified period and within a defined geographical area. Overall, a partnership withdrawal agreement should cover various aspects such as the purchase price, payment terms, transfer of assets, liabilities, and possible restrictions on the withdrawing partner's future activities. It aims to provide clarity and minimize disputes during the withdrawal process, ensuring the continued success and stability of the partnership.

Partnership Withdrawal Agreement Example

Description partner withdrawal from partnership

How to fill out Partnership Withdrawal Agreement Example?

Legal document managing might be overpowering, even for the most skilled specialists. When you are looking for a Partnership Withdrawal Agreement Example and don’t get the a chance to spend in search of the appropriate and up-to-date version, the procedures can be stress filled. A robust web form library can be a gamechanger for anyone who wants to take care of these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available at any moment.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any requirements you could have, from individual to enterprise paperwork, all-in-one place.

- Employ advanced tools to complete and deal with your Partnership Withdrawal Agreement Example

- Access a resource base of articles, tutorials and handbooks and resources related to your situation and requirements

Save time and effort in search of the paperwork you need, and use US Legal Forms’ advanced search and Preview tool to locate Partnership Withdrawal Agreement Example and get it. If you have a membership, log in to the US Legal Forms account, look for the form, and get it. Take a look at My Forms tab to see the paperwork you previously downloaded as well as deal with your folders as you can see fit.

If it is the first time with US Legal Forms, make an account and have unlimited access to all advantages of the platform. Listed below are the steps to take after downloading the form you need:

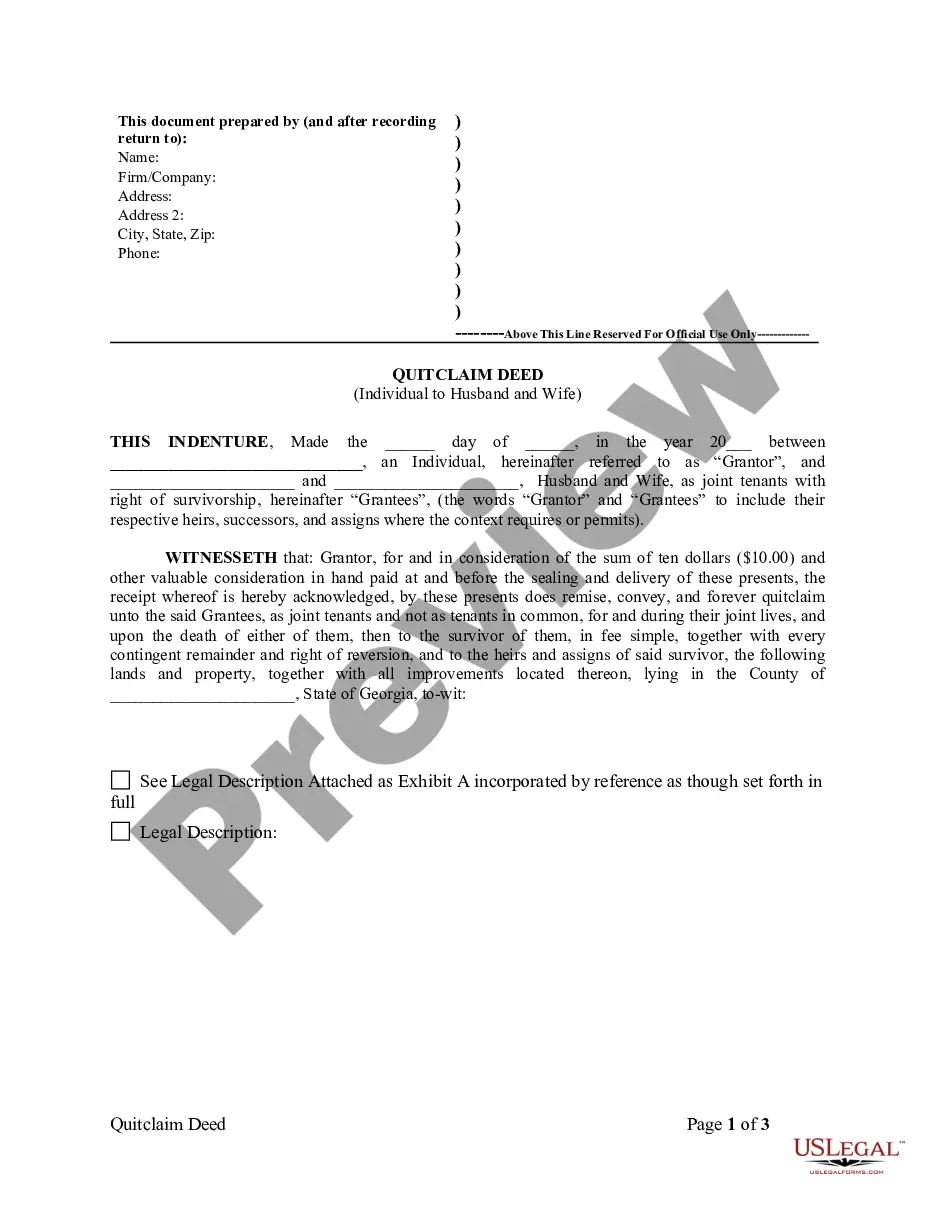

- Validate it is the right form by previewing it and reading its description.

- Ensure that the sample is recognized in your state or county.

- Pick Buy Now once you are ready.

- Select a monthly subscription plan.

- Pick the format you need, and Download, complete, sign, print and send your document.

Enjoy the US Legal Forms web library, supported with 25 years of experience and stability. Enhance your day-to-day document administration into a easy and intuitive process today.

Form popularity

FAQ

How do I create a Notice of Withdrawal From Partnership? Specify who is leaving the partnership. ... Provide your location. ... Provide the partnership's and the withdrawing partner's details. ... Include details about the withdrawal. ... Include any additional clauses. ... Specify the signing details.

The dissolution of the partnership and distribution of the assets is a separate matter and the rules which apply would also be set out in a partnership agreement. Often if a partner leaves, the remaining one(s) will continue the business or form an LLC. The remaining partner(s) simply buy out the withdrawing one.

As we said, simply leaving the partnership is almost never sufficient. Usually, you cannot remove your own liability without cancelling or renegotiating the relevant loan, lease, or contract. We like straightforward contracts that clearly release you from any and all obligations, and will pursue those when possible.

Ing to Investopedia, the document should include the following: Name of your partnership. ... Contributions to the partnership and percentage of ownership. ... Division of profits, losses and draws. ... Partners' authority. ... Withdrawal or death of a partner.

How do I create a Partnership Agreement? Provide partnership details. Start by specifying the industry you're in and what type of business you'll run. ... Detail the capital contributions of each partner. ... Outline management responsibilities. ... Prepare for accounting. ... Add final details.