Commitment Agreement Letter Withdrawal

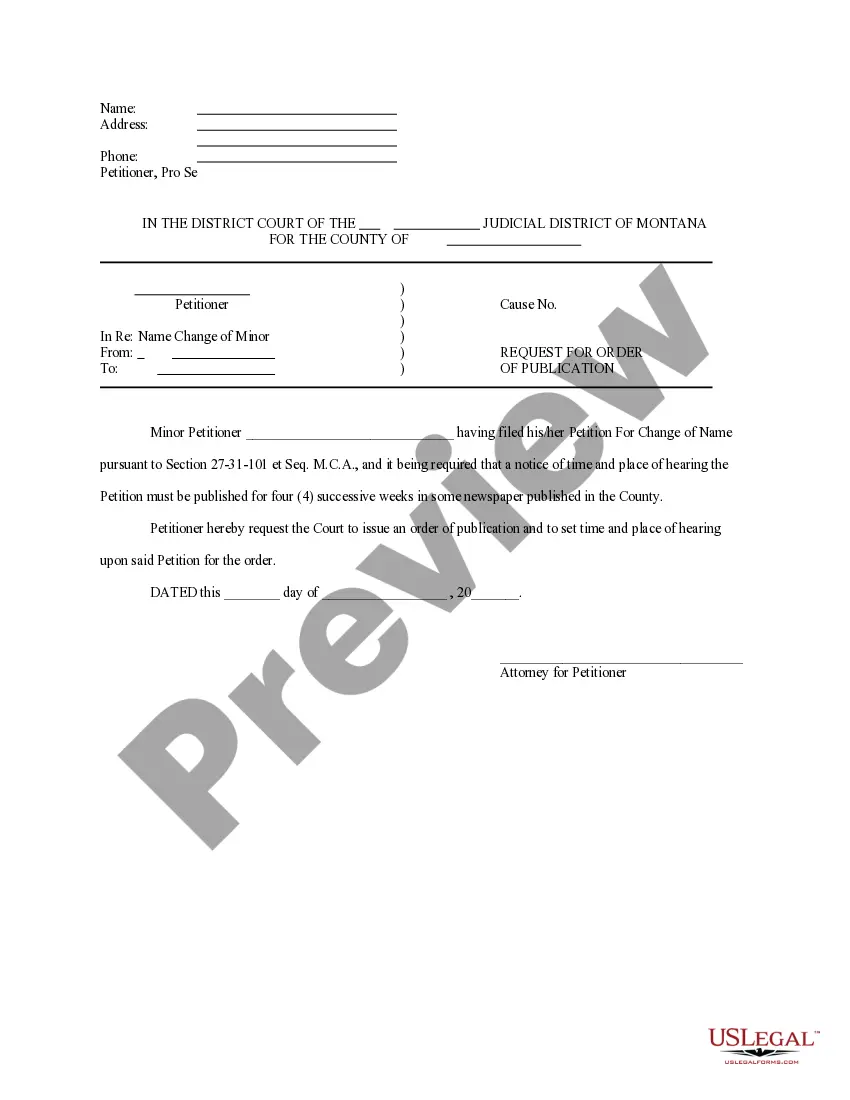

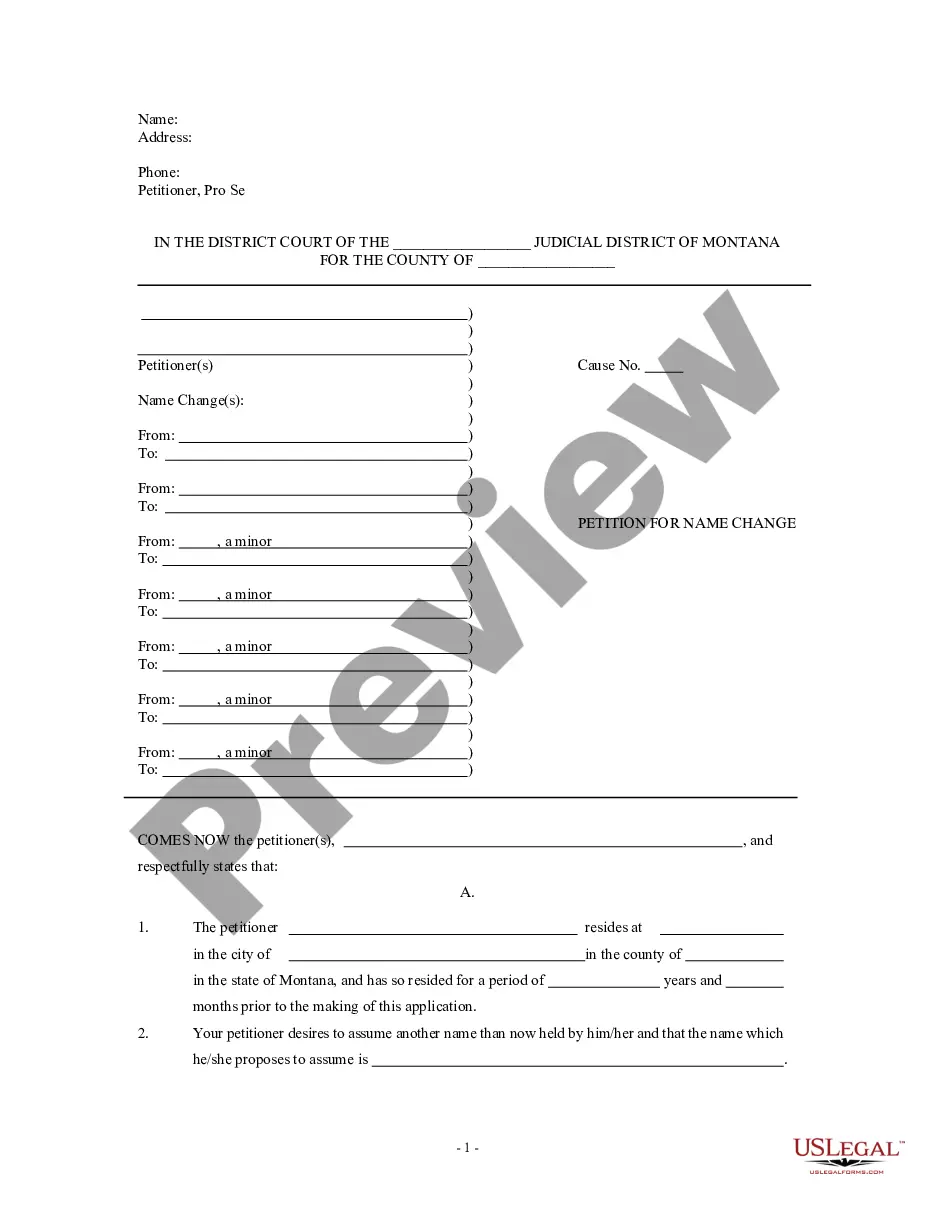

Description Loan Commitment Letter Sample

How to fill out How To Write An Agreement Letter For Borrowing Money?

What is the most reliable service to obtain the Commitment Agreement Letter Withdrawal and other recent versions of legal documentation? US Legal Forms is the solution! It's the most extensive collection of legal documents for any occasion. Every sample is expertly drafted and verified for compliance with federal and local laws and regulations. They are collected by field and state of use, so locating the one you need is is a simple thing.

Experienced users of the platform only need to log in to the system, check if their subscription is valid, and click the Download key next to the Commitment Agreement Letter Withdrawal to obtain it. Once saved, the sample remains available for future use within the My Forms tab of your profile. If you still don't have an account with us, here are the steps that you need to take to get one:

- Form compliance study. Before you acquire any template, you must check whether it satisfies your use case terms and your state or county's regulations. Read the form description and use the Preview if available.

- Alternative form search. If there are any inconsistencies, utilize the search bar in the page header to find another sample. Click Buy Now to pick the correct one.

- Registration and subscription acquisition. Opt for the most suitable pricing plan, log in or create your account, and pay for your subscription via PayPal or credit card.

- Downloading the paperwork. Decide on the format you want to save the Commitment Agreement Letter Withdrawal (PDF or DOCX) and click Download to get it.

US Legal Forms is a great solution for everyone who needs to manage legal documentation. Premium users can get even more as they complete and sign the earlier saved papers electronically at any time within the integrated PDF editing tool. Give it a try now!