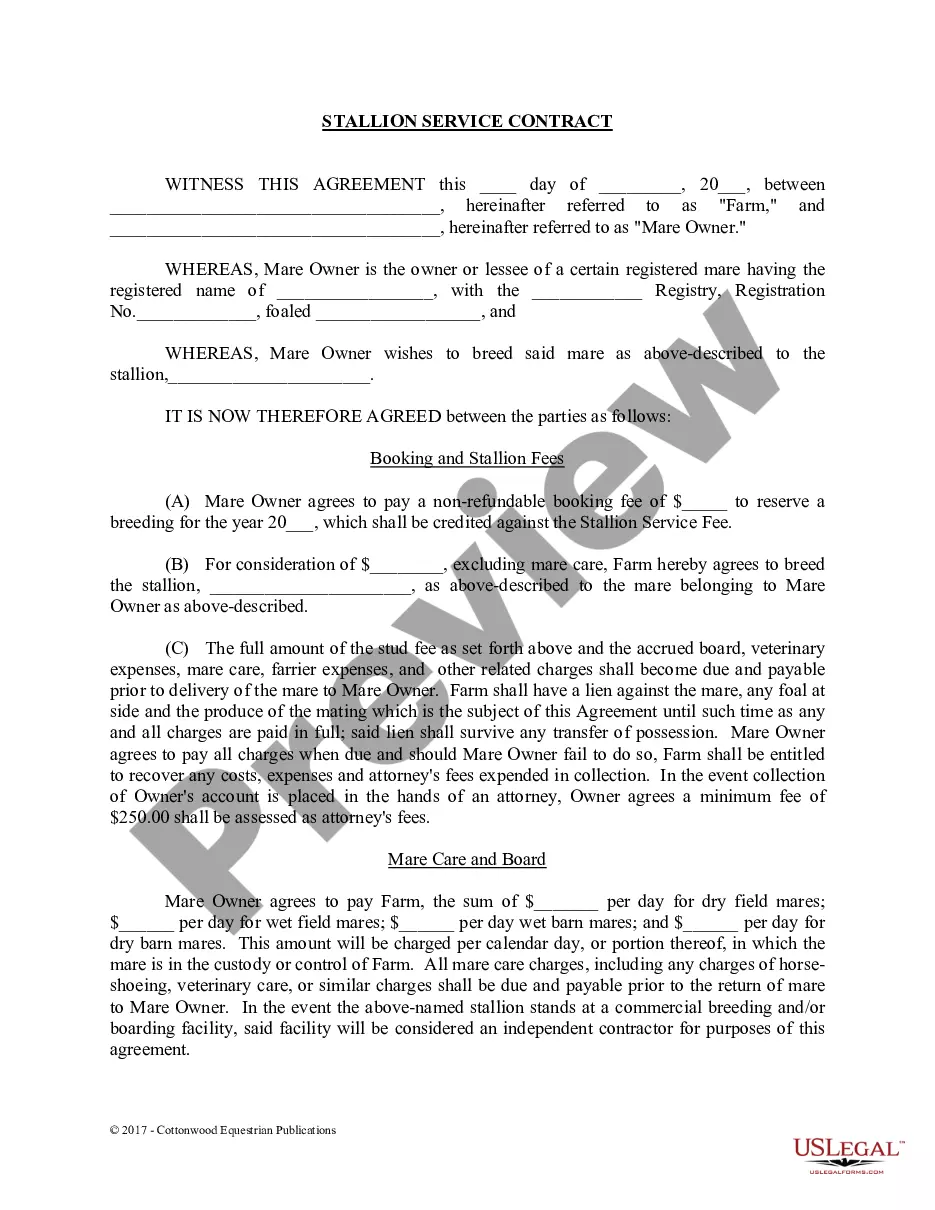

A debt collection letter for a previous tenant is a written notification sent by a landlord or property management company to recover unpaid rent or other outstanding financial obligations owed by the tenant. It serves as an official reminder and formal request for payment. Keywords: debt collection, letter, previous tenant, unpaid rent, outstanding financial obligations, landlord, property management company, notification, recover, reminder, formal request, payment. Types of debt collection letters for previous tenants may include: 1. Initial Notice: This letter is typically the first communication sent to the tenant after they have moved out and have left unpaid rent or other expenses. It provides a clear statement of the outstanding amount, a deadline for payment, consequences of non-payment, and contact information to address any concerns. 2. Reminder Letter: If the initial notice does not result in payment, a reminder letter may be sent as a follow-up. This letter reiterates the details from the initial notice and emphasizes the urgency of resolving the debt. It may offer alternative payment arrangements or direct the tenant to a collection agency if necessary. 3. Final Demand Letter: When previous notices fail to elicit a response or payment, a final demand letter is sent. This letter emphasizes that it represents the final opportunity for the tenant to settle the debt before escalated legal actions. It typically includes a firm deadline, potential legal implications, and further steps that might be taken to reclaim the debt. 4. Settlement Offer Letter: If the previous tenant shows willingness to negotiate or demonstrates financial hardship, a settlement offer letter may be sent. This letter proposes a reduced amount or payment plan to resolve the debt, providing an opportunity for the tenant to settle the matter without legal involvement. 5. Legal Action Warning Letter: In situations where all attempts to obtain payment have been unsuccessful, a legal action warning letter may be sent. This letter notifies the tenant that if the debt is not resolved promptly, legal proceedings, such as filing a lawsuit, may be initiated to recover the outstanding amount. It's important to note that the exact terminology and format of debt collection letters may vary depending on the jurisdiction and the policies of the landlord or property management company.

Debt Collection Letter For Previous Tenant

Description

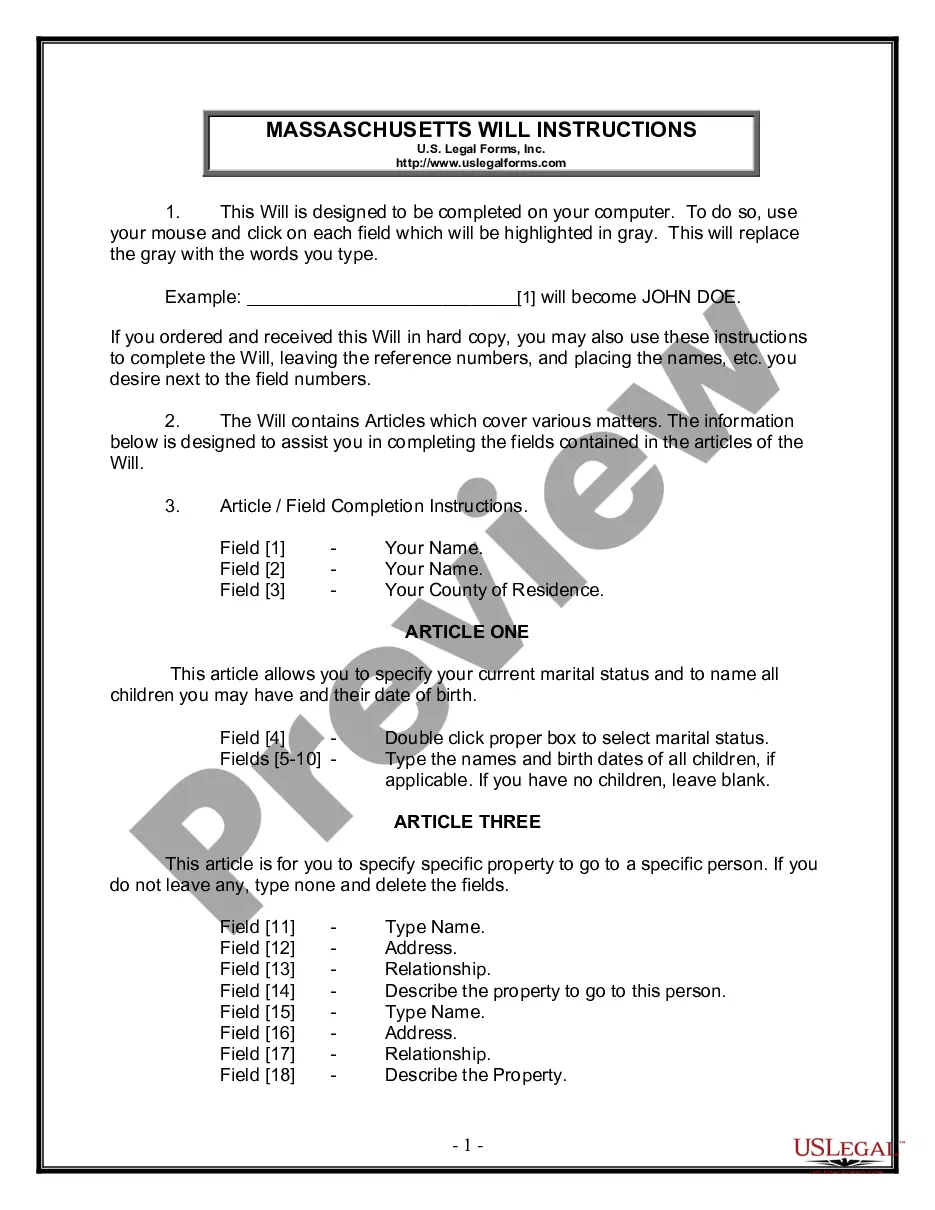

How to fill out Debt Collection Letter For Previous Tenant?

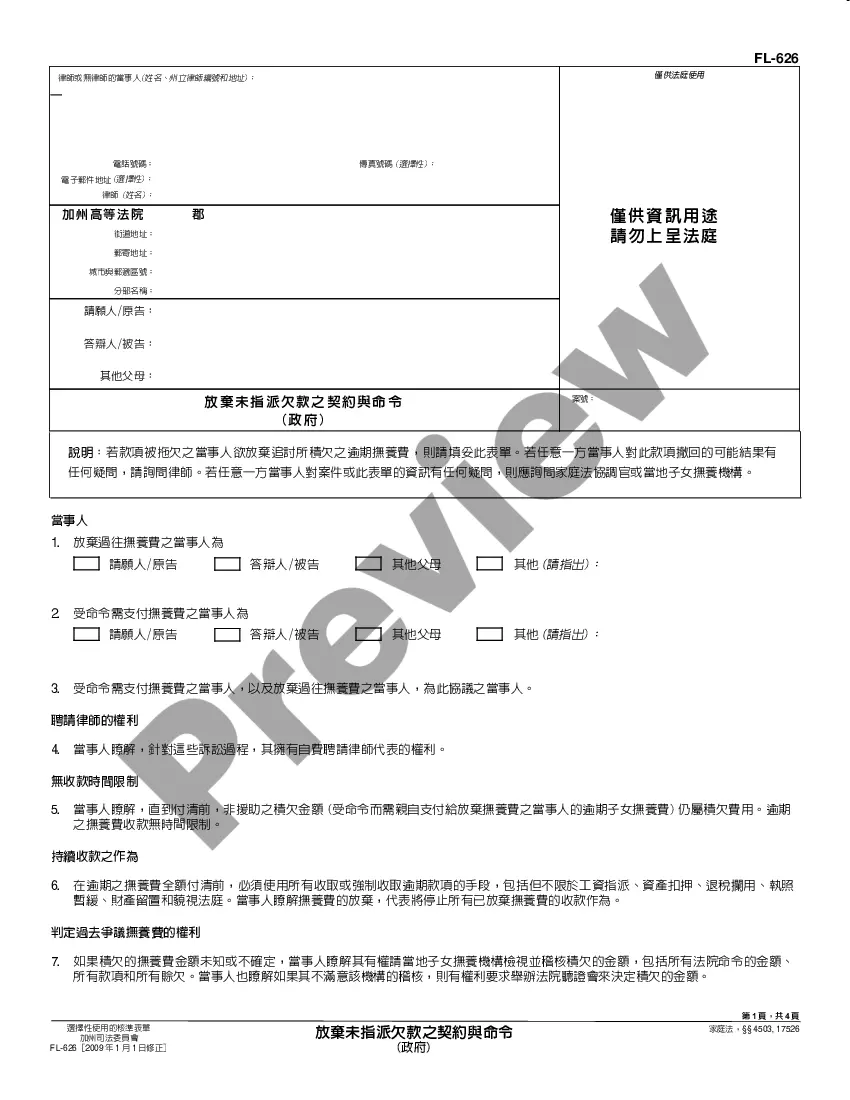

Drafting legal paperwork from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re looking for a a simpler and more cost-effective way of creating Debt Collection Letter For Previous Tenant or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of over 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-specific forms diligently prepared for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can easily locate and download the Debt Collection Letter For Previous Tenant. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No worries. It takes little to no time to set it up and explore the library. But before jumping directly to downloading Debt Collection Letter For Previous Tenant, follow these tips:

- Review the document preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the template you choose complies with the requirements of your state and county.

- Choose the right subscription option to purchase the Debt Collection Letter For Previous Tenant.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us now and transform document execution into something easy and streamlined!

Form popularity

FAQ

By Phone: 866-255-4370 Before calling, learn more about eligibility, as well as the intake process and how to prepare. If you have a hearing impairment, please use the 7-1-1 WV Relay.

If your lawsuit is for more than $200, the filing fee is $26, plus $12 for each person or business you are suing. If your lawsuit is for $200 or less, the filing fee is $21, plus $12 for each person or business you are suing. If you win the judgment will include your filing & service fees.

Tuesday Legal Connect- 1-800-642-3617- Call on Tuesday evenings from 6 to 8 p.m. to get general legal information from voluneer lawyers of the West Virginia State Bar.

Go to the Magistrate Clerk's office in the county where your problem is located and ask for a Civil Complaint. You can also find the Civil Complaint online. Fill in your name and address. Then fill in the defendant's name and address.

In West Virginia, small claims court is called magistrate court. You may file in magistrate court on your own for anything that is $10,000 or less.

Go to the Magistrate Clerk's office in the county where your problem is located and ask for a Civil Complaint. You can also find the Civil Complaint online. Fill in your name and address. Then fill in the defendant's name and address.

State Tax Department To check for name availability for the following structures call the Business Registration Unit at (304) 558-3333 or 1-800-982-8297.

If the plaintiff is seeking only a money judgment, he or she should prepare and file a warrant in debt (Form DC-402 Warrant in Debt - Small Claims Division) (Instructions for Completing Form DC-402). In preparing a warrant in debt, the claim must specify a dollar amount and the reason for the claim.