Debt collection letters for previous tenants are formal correspondence sent by landlords, property owners, or collection agencies to tenants who have outstanding debts related to their tenancy. These letters aim to remind, notify, and request payment for the owed amount. Keywords: debt collection letters, previous tenant, outstanding debts, formal correspondence, landlords, property owners, collection agencies, tenancy, reminder, notification, payment. Types of Debt Collection Letters for Previous Tenants: 1. Initial Reminder Letter: This type of letter serves as the first communication to remind the previous tenant about the outstanding debt. It typically includes details such as the amount owed, reasons for the debt, and a polite request for immediate payment. 2. Follow-Up Letter: If the initial reminder letter does not elicit a response or payment, a follow-up letter may be sent. This letter reiterates the debt, presents any additional information or evidence, emphasizes the importance of resolving the issue, and sets a deadline for payment before further action is taken. 3. Final Notice Letter: If the previous tenant continues to neglect the payment after receiving the follow-up letter, a final notice letter is typically sent. This letter informs the tenant about the consequences of further non-payment, such as legal actions, credit score impact, or involvement of a debt collection agency. It urges the tenant to settle the debt immediately to avoid such consequences. 4. Settlement Offer Letter: In some cases, landlords or collection agencies may offer a settlement to incentivize tenants to pay off their debts. This letter outlines a reduced amount or payment plan options, providing an opportunity for tenants to resolve the matter without facing severe financial consequences. 5. Legal Action Letter: If all previous attempts to obtain payment fail, landlords or collection agencies may send a legal action letter. This type of letter notifies the previous tenant that legal action will be pursued, which could include filing a lawsuit or initiating a collection process through the court system if the debt remains unpaid. 6. Credit Bureau Reporting Letter: A credit bureau reporting letter is sent when the debt collection agency or landlord decides to report the unpaid debt to credit reporting agencies. This letter serves as a warning to the tenant regarding the negative impact on their credit history and score if the debt remains unresolved. Each of these debt collection letters aims to communicate with the previous tenant effectively, emphasize the urgency of payment, and outline potential consequences if the debt remains unpaid.

Debt Collection Letters For Previous Tenant

Description

How to fill out Debt Collection Letters For Previous Tenant?

Getting a go-to place to access the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents calls for precision and attention to detail, which is why it is very important to take samples of Debt Collection Letters For Previous Tenant only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the information concerning the document’s use and relevance for your circumstances and in your state or county.

Consider the following steps to complete your Debt Collection Letters For Previous Tenant:

- Use the catalog navigation or search field to find your sample.

- View the form’s information to ascertain if it suits the requirements of your state and region.

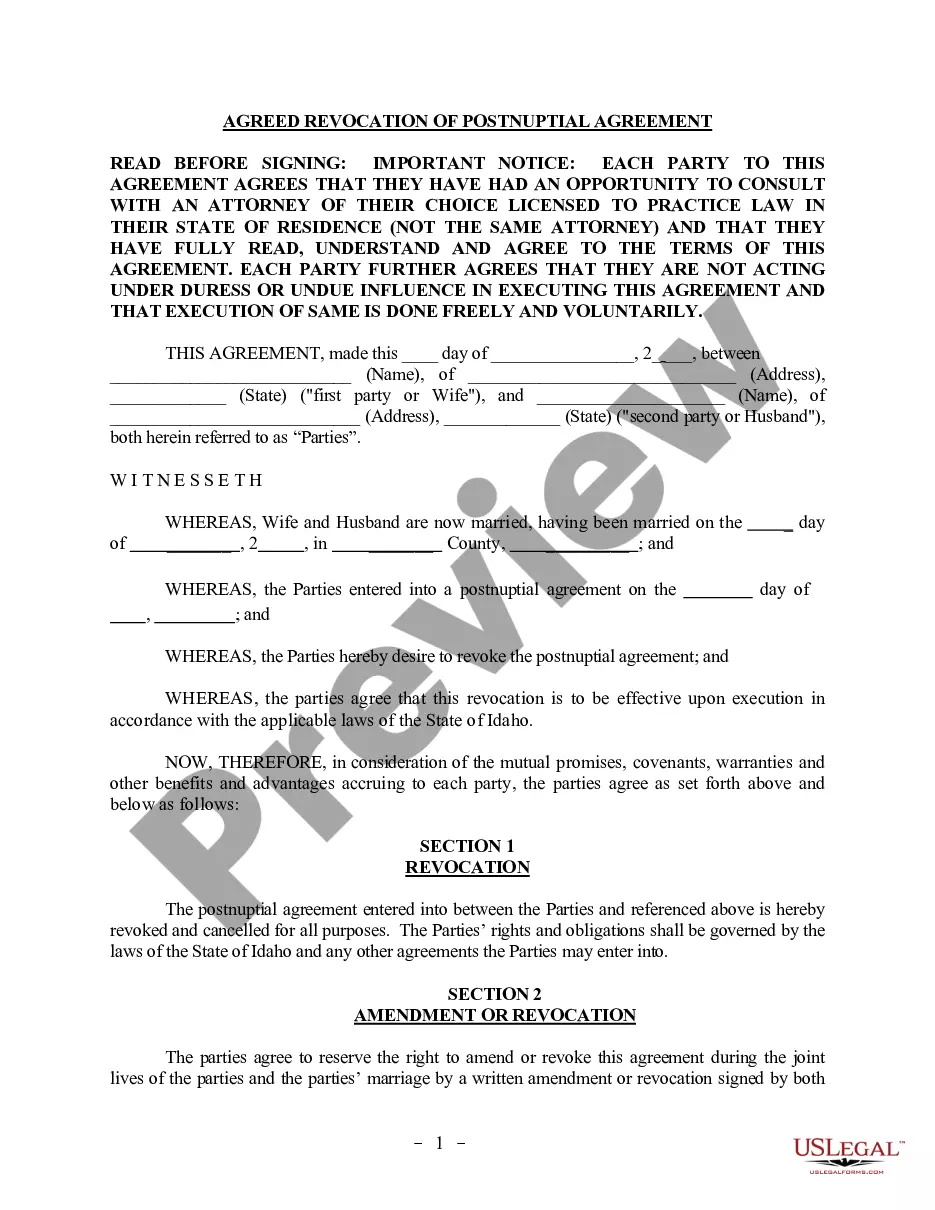

- View the form preview, if there is one, to make sure the form is definitely the one you are looking for.

- Get back to the search and locate the proper document if the Debt Collection Letters For Previous Tenant does not suit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that fits your preferences.

- Go on to the registration to complete your purchase.

- Complete your purchase by choosing a transaction method (bank card or PayPal).

- Select the document format for downloading Debt Collection Letters For Previous Tenant.

- When you have the form on your gadget, you may alter it with the editor or print it and finish it manually.

Remove the headache that comes with your legal documentation. Check out the comprehensive US Legal Forms catalog where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Examples of these documents include birth certificates, contracts, deeds, leases, titles, wills, etc. During a trial or in preparation of a trial, documents such as a complaint or a summons can also be referred to as legal papers.

Legal documents, such as contracts and agreements, are mutual promises between two or more parties. They can be seen everywhere ? from business deals and employee contracts to residential leases and settlement agreements.

Defining a Legal Document A legal document is typically characterized by its structure, content, and language. It's meticulously crafted, often by legal professionals, to ensure precision and accuracy. The language used is formal and specific, adhering to legal terminologies and protocols to avoid ambiguity.

The 4 legal documents every adult should have A will. Also known as: a last will and testament. ... A living will. Also known as: an advance directive. ... Durable health care power of attorney. It appoints: a health care proxy. ... Durable financial power of attorney. It appoints: an attorney-in-fact or agent.

There are many types of legal documents, but here, we will focus on some of the most common ones, including contracts, wills, deeds, power of attorney, affidavits, and deposition.