Debt Letters For Someone Else

Description

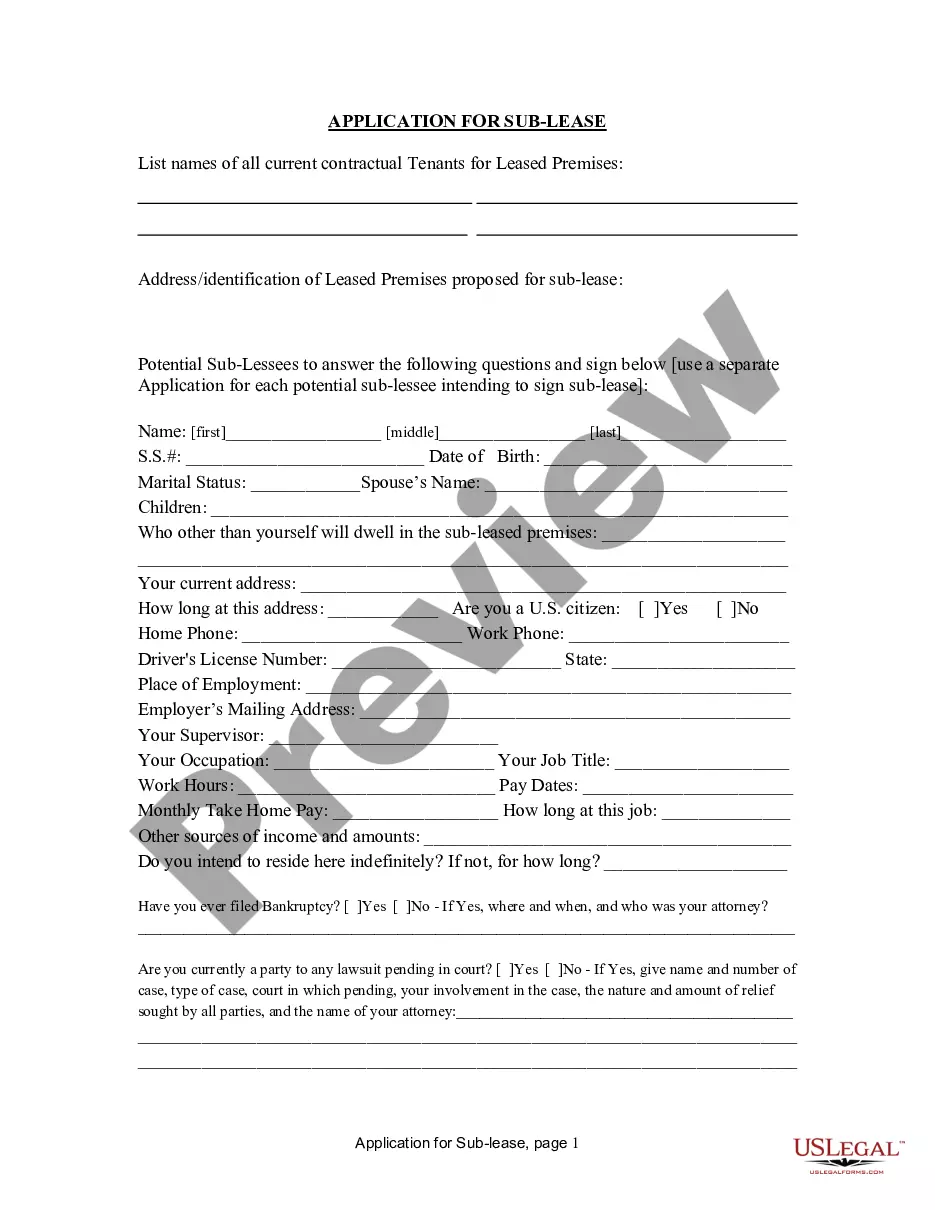

How to fill out Sample Letter For Debt Collection?

Red tape necessitates exactness and correctness.

Unless you handle completing forms like Debt Letters For Someone Else daily, it might lead to some misunderstanding.

Selecting the appropriate sample from the outset will ensure that your document submission will proceed seamlessly and avert any hassles of resubmitting a file or redoing the entire process from the beginning.

Obtaining the correct and updated samples for your documentation is a matter of minutes with an account at US Legal Forms. Eliminate the red tape uncertainties and simplify your paperwork.

- Locate the template by utilizing the search field.

- Confirm the Debt Letters For Someone Else you’ve located is applicable for your state or county.

- Examine the preview or review the description containing the details about the usage of the template.

- If the outcome meets your search criteria, click the Buy Now button.

- Choose the suitable option among the available pricing plans.

- Log In to your account or create a new one.

- Complete the purchase using a credit card or PayPal payment option.

- Download the document in the file format of your preference.

Form popularity

FAQ

The 777 rule is a guideline for debt collectors that suggests they should cease contact after seven days of non-response. This rule provides consumers with some relief from persistent communications. If you receive debt letters for someone else, understanding this rule can help you effectively manage unwanted communications.

To prove a debt is not yours, gather any documentation that supports your claim, such as bank statements or ownership records. You may also want to request validation from the creditor to confirm that the debt belongs to them. This process helps clarify which debt letters for someone else are mistakenly attributed to you.

If you start receiving letters intended for someone else, it's important to take action quickly. Begin by returning the letters to the sender to prevent further communication. Ignoring such debt letters for someone else could result in complications, so it's best to handle them promptly.

Legally transferring debt to another person is generally not straightforward and often requires consent from all parties involved, including the creditor. Most creditors do not allow debt letters for someone else to be transferred without following proper protocols. It's essential to review the terms of your agreement to understand your options.

Upon receiving a letter intended for someone else, first confirm that you don't know the person. Next, write 'Not at this address' on the envelope and return it to the mailbox. This helps avoid confusion with debt letters for someone else while keeping the sender informed.

When you get someone else's letter, check to see if it contains personal information or sensitive data. If it does, you should securely destroy the letter to protect their privacy. For debt letters for someone else, consider informing the sender that the individual no longer resides at your address.

If you receive mail that isn't yours, start by inspecting the envelope to confirm it belongs to someone else. Then, you can return it to the sender by marking it 'Return to Sender' or simply leave it in your mailbox. This ensures that debt letters for someone else are sent back to the correct person.

To dispute a debt that does not belong to you, gather any evidence, such as proof of your identity and your address history. Write a formal dispute letter to the debt collector, clearly stating that the debt is not yours and including any documentation that supports your claim. Utilizing platforms like US Legal Forms can help you create professional dispute letters for these situations. Timely action is essential; stay proactive about these debt letters for someone else to protect your financial reputation.

If you receive debt letters for someone else, the first step is to verify the information before taking any action. You can return the unopened letters to the sender marked 'Return to Sender: Not at this Address'. Additionally, you should consider contacting the sender directly to inform them that you are not the intended recipient. It is crucial to address these debt letters for someone else promptly to prevent any negative effects on your credit.

The 777 rule for debt collection refers to the process where a debt collector can make seven attempts to contact the debtor within a 7-day period before taking any further action. Understanding this rule is important when considering debt letters for someone else, as it helps ensure compliance with the law. Utilizing this knowledge can protect you as a consumer and guide you in handling communications effectively. If you need assistance in crafting effective debt letters for someone else, uslegalforms can provide the necessary resources to navigate this sensitive process.