Independent Contractor Agreement For Chef

Description

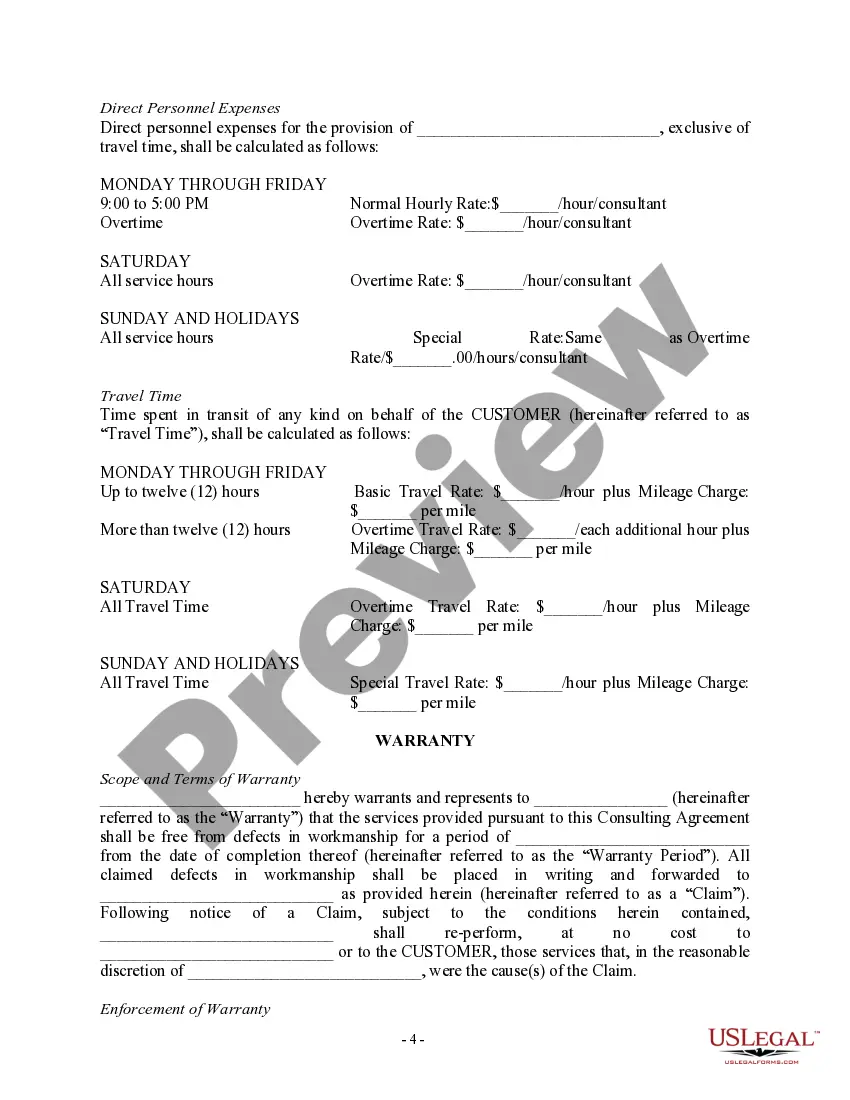

How to fill out Self-Employed Independent Contractor Consulting Agreement - Detailed?

Maneuvering through the red tape of official documents and models can be challenging, particularly if one does not engage in this professionally.

Even selecting the correct template for an Independent Contractor Agreement for a Chef will be labor-intensive, as it must be accurate and precise down to the last detail.

However, you will require significantly less time locating a suitable template from a source you can trust.

Obtain the correct document in a few straightforward steps: Enter the document title in the search field. Identify the appropriate Independent Contractor Agreement for Chef in the result list. Review the outline of the sample or access its preview. If the template meets your requirements, click Buy Now. Next, select your subscription plan. Utilize your email and set a password to register an account with US Legal Forms. Choose a credit card or PayPal payment method. Download the template file to your device in your preferred format. US Legal Forms will save you considerable time determining whether the form you found online meets your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the task of locating the appropriate documents online.

- US Legal Forms serves as a single destination for accessing the latest document samples, verifying their use, and downloading these samples for completion.

- It comprises a repository of over 85K forms applicable in various domains.

- When searching for an Independent Contractor Agreement for Chef, you won't have to question its relevance, as all documents are authenticated.

- Creating an account with US Legal Forms will guarantee that you have all necessary samples at your fingertips.

- You can store them in your history or add them to the My documents directory.

- Your saved documents can be accessed from any device simply by clicking Log In on the library site.

- If you do not yet have an account, you can always search for the template you require.

Form popularity

FAQ

A chef is integral to the business of preparing food and would not be considered an independent contractor. A specialist chef, who prepares food for a one-time event for the restaurant, could be considered an independent contractor.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The entire agreement should cover the following:General information about the contractor and client.Services and scope of work.Permission to hire subcontractors.Equipment and facilities.Compensation for the services provided.Expenses, travel, and reimbursement policies.Effective date of the agreement.More items...?

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.