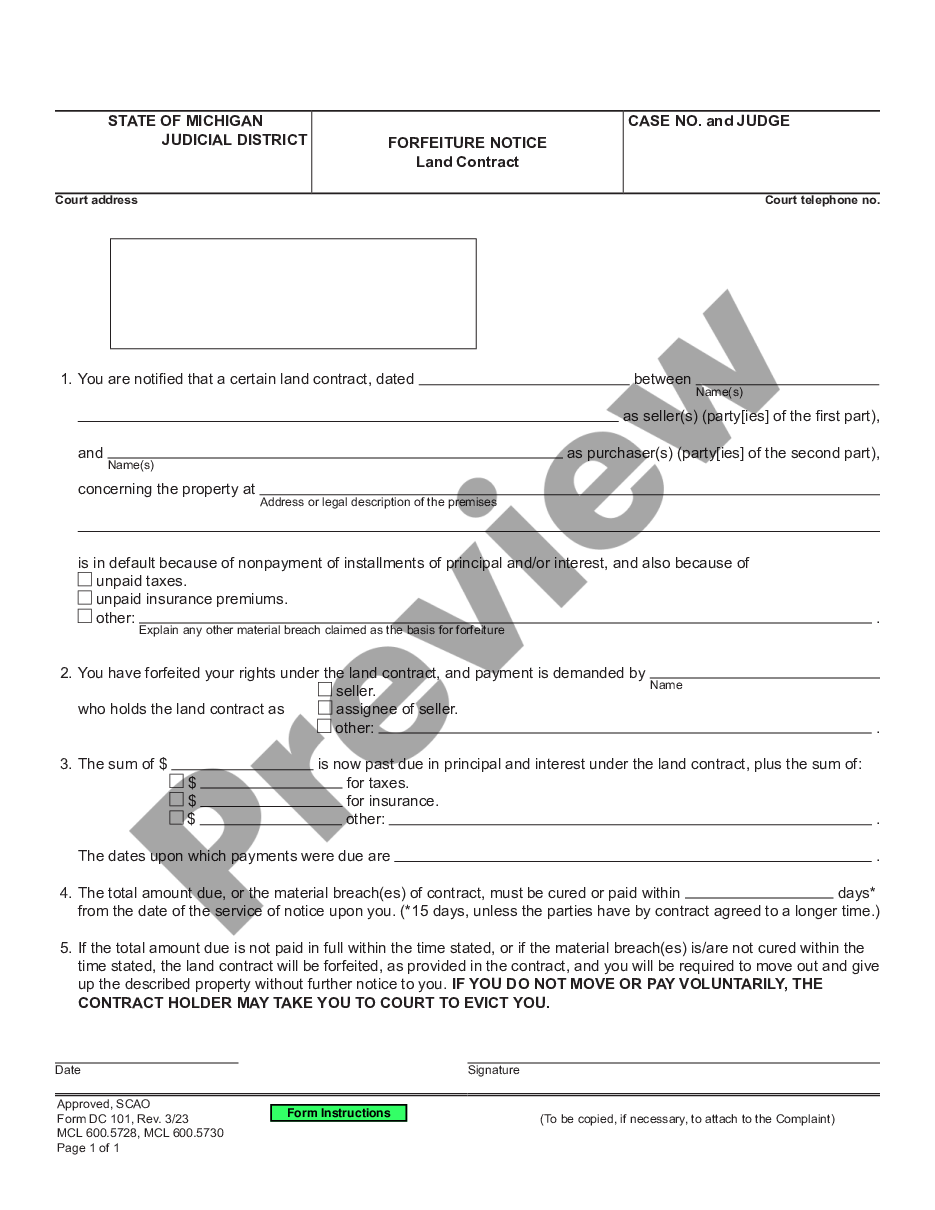

Title: Form to Remove Member from LLC Texas: A Comprehensive Guide Introduction: Removing a member from a Limited Liability Company (LLC) in Texas requires a proper legal process. This detailed description explains the process and provides relevant information about the various forms used to remove a member from an LLC in Texas. 1. Reasons for Removing a Member from an LLC: Before diving into the forms, it's important to understand the reasons for removing a member from an LLC in Texas. These may include voluntary withdrawal, death, expulsion, or any other circumstances specified in the LLC's operating agreement. 2. Types of Forms: a) Form 310: LLC Certificate of Termination: The Form 310 is a crucial document that needs to be completed and filed with the Texas Secretary of State's office when an LLC is terminating. This form will remove the LLC from the official state records, cancel its status as an active entity, and remove the members' liability. b) Form 411: Certificate of Amendment: When removing a member results in a change of the LLC's structure or membership percentage, a Certificate of Amendment (Form 411) must be filed with the Texas Secretary of State. This is necessary to ensure accurate representation of the LLC's ownership. c) Operating Agreement Amendment: If the LLC's operating agreement specifies a process for removing members, an operating agreement amendment may be necessary. This amendment would outline the new membership structure, revised distribution of profits, and management responsibilities. While not a specific form, it holds legal weight and must be prepared in accordance with the Texas LLC laws. d) Consent to Remove Member Form: In cases where a member voluntarily withdraws or the operating agreement requires a member vote for removal, a Consent to Remove Member Form is used. This form captures the consent of the remaining members, agreed-upon terms, and the effective date of removal. It helps maintain transparency and serves as evidence of mutual agreement. 3. Filing Procedures: To properly remove a member and complete the required forms in Texas, follow these general steps: a) Review the LLC's operating agreement and note any specific requirements. b) Prepare the appropriate form(s) based on the circumstances and type of removal. c) Ensure the form(s) are accurately completed, including required information like the LLC's name, registered agent details, and member information. d) Pay the necessary state filing fees associated with each form. e) Submit the form(s) to the Texas Secretary of State's office per their guidelines (online, mail, or in-person). f) Maintain a copy of the filed form(s) and any receipts or confirmation from the state office for future records. Conclusion: Removing a member from an LLC in Texas involves specific forms to ensure legal compliance, accurate record-keeping, and appropriate changes to the LLC's structure. By understanding the different types of forms and following the necessary procedures, the LLC can successfully remove a member while maintaining its integrity and legal standing. Always consult with a legal professional or trusted advisor for precise guidance depending on your unique situation.

Form To Remove Member From Llc Texas

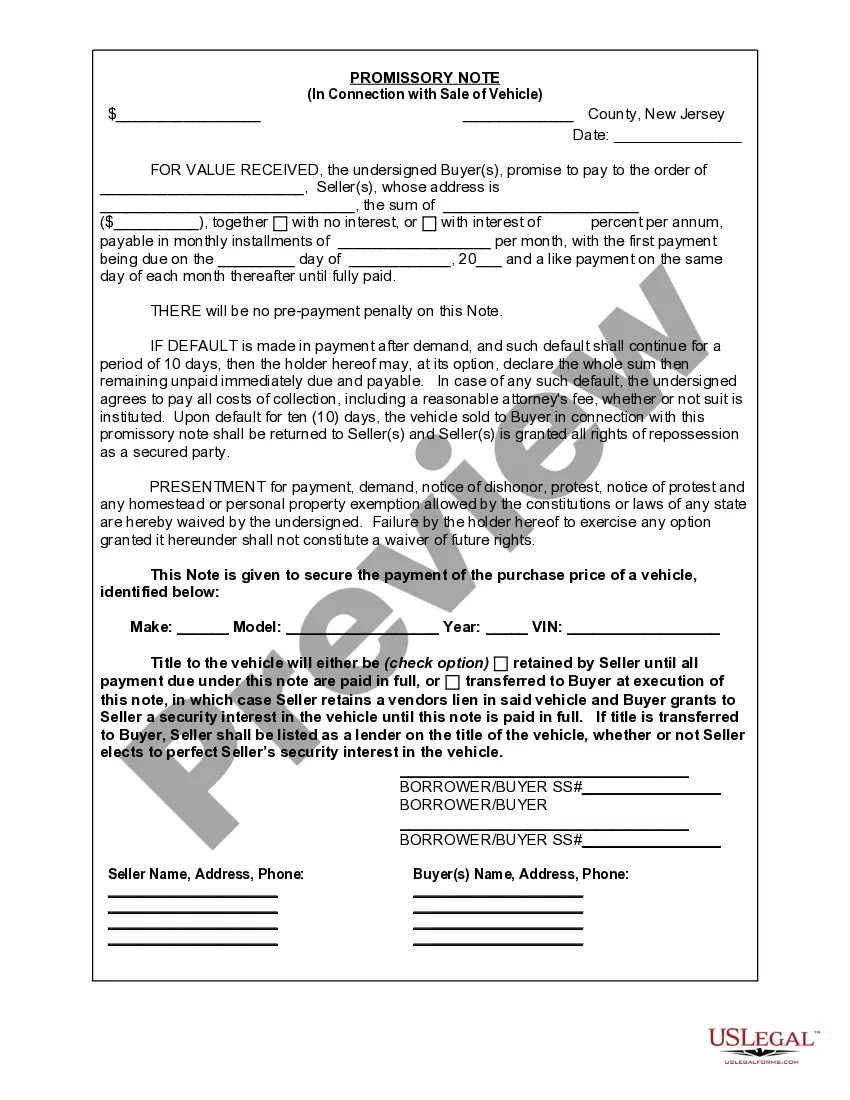

Description how to remove a member from an llc in texas

How to fill out Form To Remove Member From Llc Texas?

Whether for business purposes or for personal affairs, everybody has to manage legal situations at some point in their life. Completing legal documents needs careful attention, beginning from choosing the right form template. For example, if you select a wrong version of a Form To Remove Member From Llc Texas, it will be rejected when you send it. It is therefore essential to have a reliable source of legal files like US Legal Forms.

If you have to obtain a Form To Remove Member From Llc Texas template, follow these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s information to ensure it suits your case, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong document, get back to the search function to find the Form To Remove Member From Llc Texas sample you need.

- Get the template when it meets your requirements.

- If you already have a US Legal Forms profile, simply click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Select the proper pricing option.

- Finish the profile registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Select the file format you want and download the Form To Remove Member From Llc Texas.

- Once it is saved, you are able to fill out the form by using editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time looking for the right sample across the internet. Utilize the library’s easy navigation to get the right template for any situation.

remove member from llc texas Form popularity

form to remove member from llc texas Other Form Names

removing a member from an llc FAQ

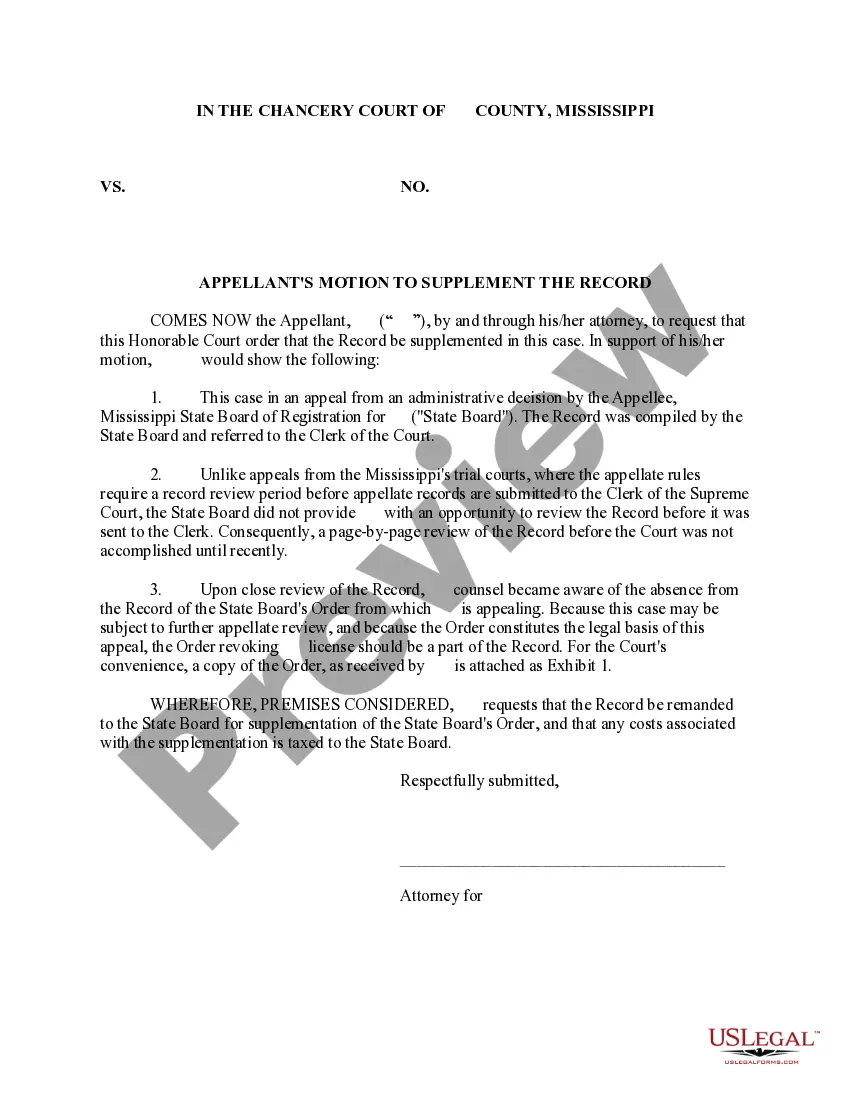

In South Dakota, the standard parenting guidelines will set out the custody arrangement to be followed by the parents. You can object to the standard guidelines and the judge will order a hearing within thirty days.

Pictured left to right are: Justice Lori Wilbur (2011-2017); Justice Mark Salter (2018-present); Chief Justice Roger Wollman (1971-1985); Justice Steven Jensen (2017-present); Justice Richard Sabers (1986-2008); Justice Glen Severson (2009-2018); Justice Robert Amundson (1991-2002); Justice Janine Kern (2014-present); ...

Serving Your Spouse in South Dakota You can't serve your spouse yourself; you must have someone who's at least 18 years of age and not a party to the case do it. If your spouse will agree to accept service, you can hand deliver the documents or mail them.

Under South Dakota law a divorce may be granted for any of these grounds: adultery, extreme cruelty (including bodily injury or grievous mental suffering), willful desertion, willful neglect, habitual intemperance, conviction of a felony, chronic mental illness or irreconcilable differences.

You can get a divorce in South Dakota without claiming that your spouse is at fault (a ?no-fault? divorce). The judge can grant you a no-fault divorce if the judge finds that there are irreconcilable differences between you and your spouse.

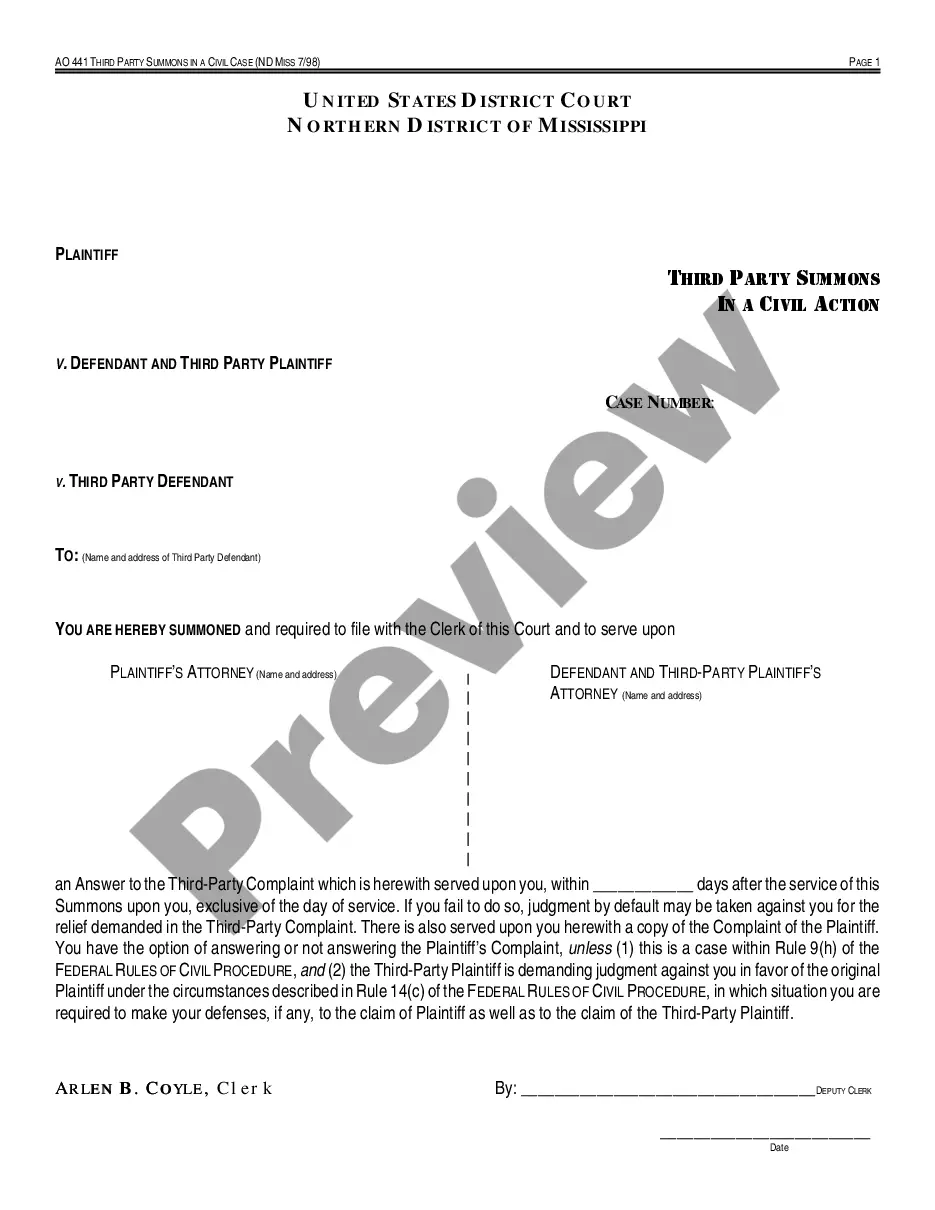

What are the basic steps in filing a lawsuit? File the Summons and Complaint. The person starting the case is called the Petitioner or Plaintiff. ... File the Answer. The person being sued is either called the Defendant or the Respondent. ... Prepare the case. ... The judge holds a hearing. ... The judge makes a decision.

A party in the case can never serve legal papers, like a Summons and Complaint, a Notice of Petition and Petition, or a Motion, unless a Judge says it is o.k. A process server can be paid to serve the papers. Process servers are listed in the Yellow Pages or on the internet.

The "waiting period" refers to the time between the start of the divorce proceedings and the court decree granting the final divorce. The waiting period in a South Dakota divorce is a minimum sixty (60) days after your spouse is served with the divorce papers.