Llc Resolution To Open Bank Account

Description

How to fill out Resolution Of Meeting Of LLC Members To Approve Execution Of Lease?

Utilizing legal templates that comply with federal and state regulations is essential, and the web provides countless alternatives to choose from.

However, why squander time searching for the properly formulated Llc Resolution To Open Bank Account template online when the US Legal Forms online repository already compiles such templates in one location.

US Legal Forms is the largest online legal database with over 85,000 fillable templates crafted by legal professionals for any business and personal situation.

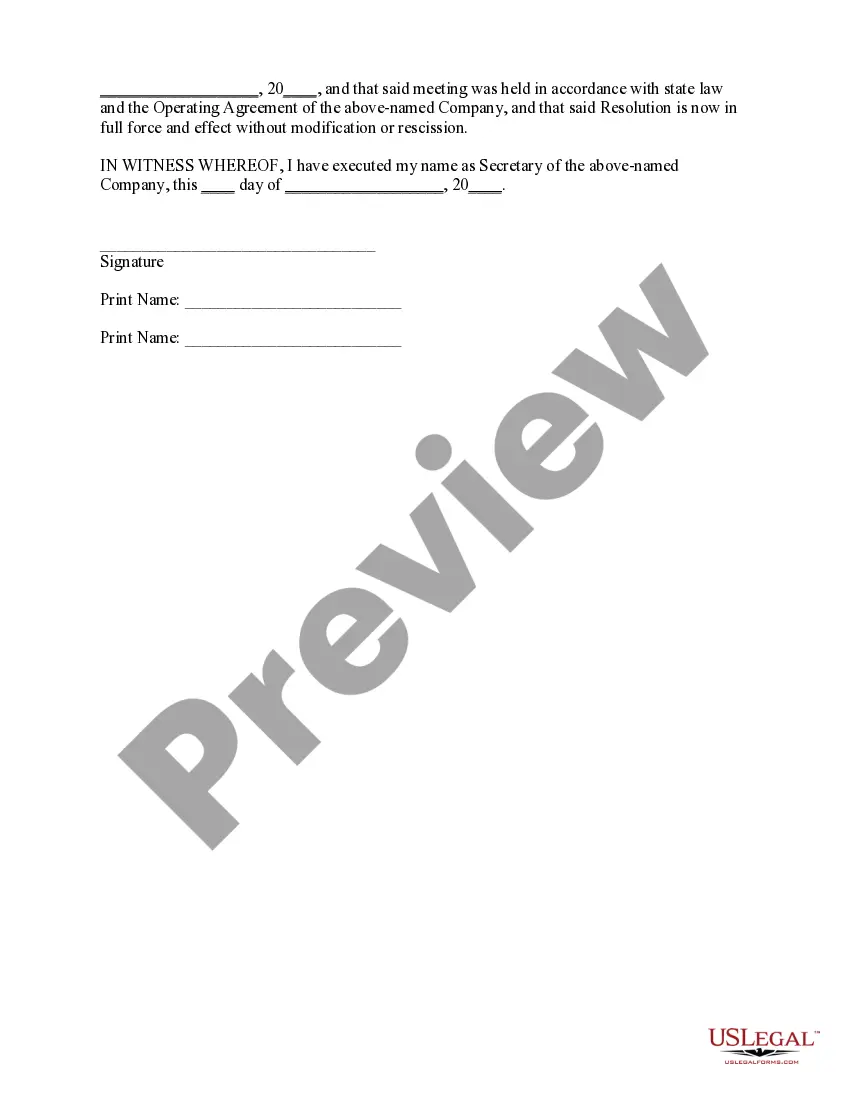

Review the template using the Preview option or via the text description to confirm it fits your needs.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay informed about legislative updates, ensuring your form is always current and compliant when obtaining a Llc Resolution To Open Bank Account from our site.

- Acquiring a Llc Resolution To Open Bank Account is straightforward and quick for both existing and new users.

- If you have an account with an active subscription, Log In and save the document sample you require in the appropriate format.

- If you are new to our platform, follow the steps below.

Form popularity

FAQ

The LLC resolution to open a bank account is a specific document that designates individuals who have permission to open and operate the bank account on behalf of the LLC. It outlines the roles and responsibilities related to the banking activities of the company. This resolution protects both the business and the members by clarifying authority. Using services like uslegalforms makes it easy to draft this essential document, ensuring your LLC is prepared for banking activities.

To obtain a resolution for your LLC, you'll first need to convene a meeting among your company members or managers. During this meeting, you will discuss and draft a resolution outlining the authority regarding banking matters. Once you have finalized the document, make sure all necessary parties sign it. Platforms like uslegalforms can help streamline creating an LLC resolution to open a bank account, ensuring compliance and clarity.

A banking resolution for an LLC is a formal document that authorizes certain individuals to act on behalf of the company in banking matters. This resolution typically specifies who can open, manage, and close bank accounts. It provides banks with assurance that the individuals listed have the authority to conduct transactions. Understanding the LLC resolution to open a bank account simplifies the process of managing finances for your business.

To create an LLC resolution to open a bank account, begin by drafting a document that outlines your LLC's decision. This document should include the date, the name of the LLC, and a statement declaring the intention to open a bank account. Each member or manager should sign the resolution to signify their agreement. Utilizing US Legal Forms can simplify this process by providing templates that ensure your resolution meets legal standards.

Yes, a banking resolution for your LLC is often necessary to ensure that specific individuals have the authority to manage the LLC's bank account. This resolution helps establish a formal record of who can sign checks and conduct transactions. Utilizing platforms like US Legal Forms can streamline the process of creating the necessary document.

It is advisable to have a resolution to open a bank account for your LLC. This document outlines who is authorized to manage the account, which protects the interests of the LLC and its members. Most banks will request this resolution as part of their standard procedures, ensuring that everything is in legal order.

Filling out a company resolution to open a bank account involves stating the purpose of the resolution clearly. Include the LLC's name, the date, and names of members voting for the resolution. After drafting the resolution, ensure it is signed by the authorized members to validate it, which provides clarity and authority for banking transactions.

You'll need several key documents from your LLC to open a bank account, including the LLC's formation documents, an EIN, and a resolution to open the account. Additionally, having the operating agreement and identification for authorized representatives can help. Gathering these documents proactively ensures a smooth banking experience.

To open a bank account for an LLC, you generally need an Employer Identification Number (EIN), the LLC's operating agreement, and a resolution to open a bank account. Banks may require identification for the authorized signers as well. Having these documents in order simplifies the process and establishes your LLC’s credibility.

To write a resolution for an LLC, start by clearly stating the purpose of the resolution. Include details like the date, the names of the members involved, and a statement authorizing specific individuals to open a bank account. It’s important to sign the resolution by all relevant members to validate it, ensuring you have the proper documentation for banking procedures.