Fmla Tracking Excel With Data

Description

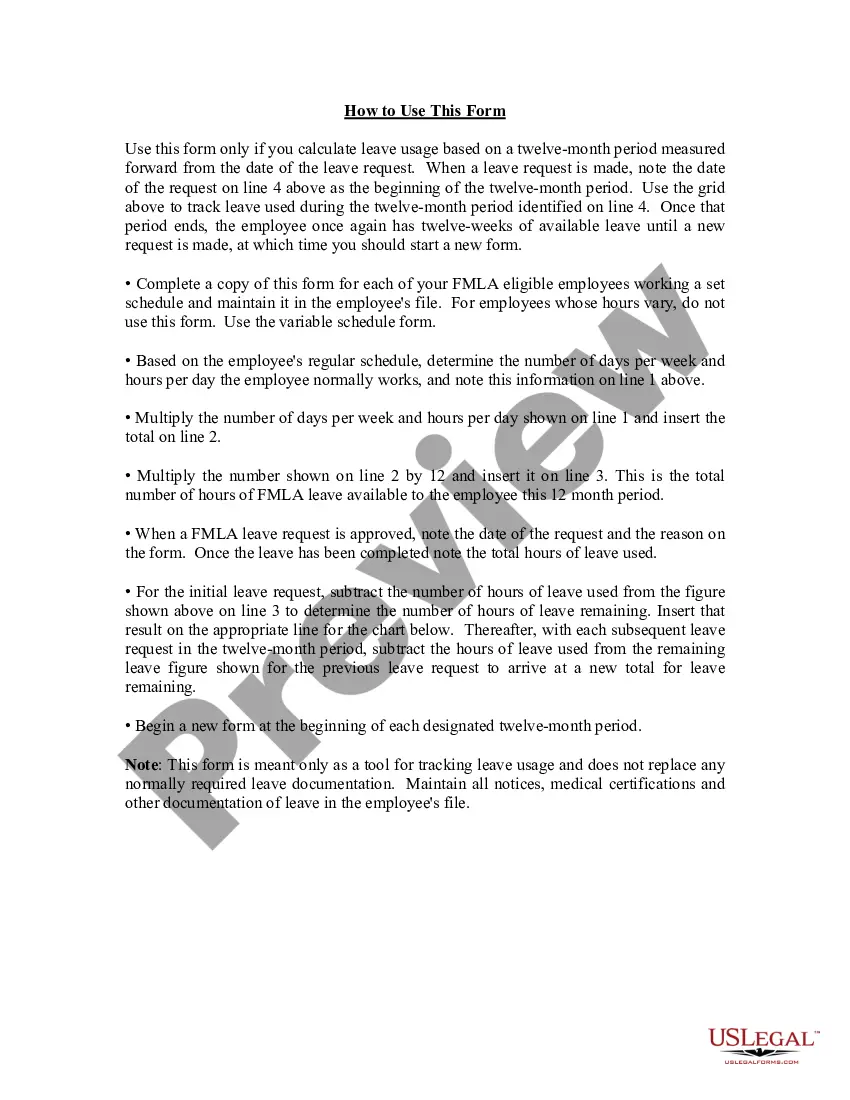

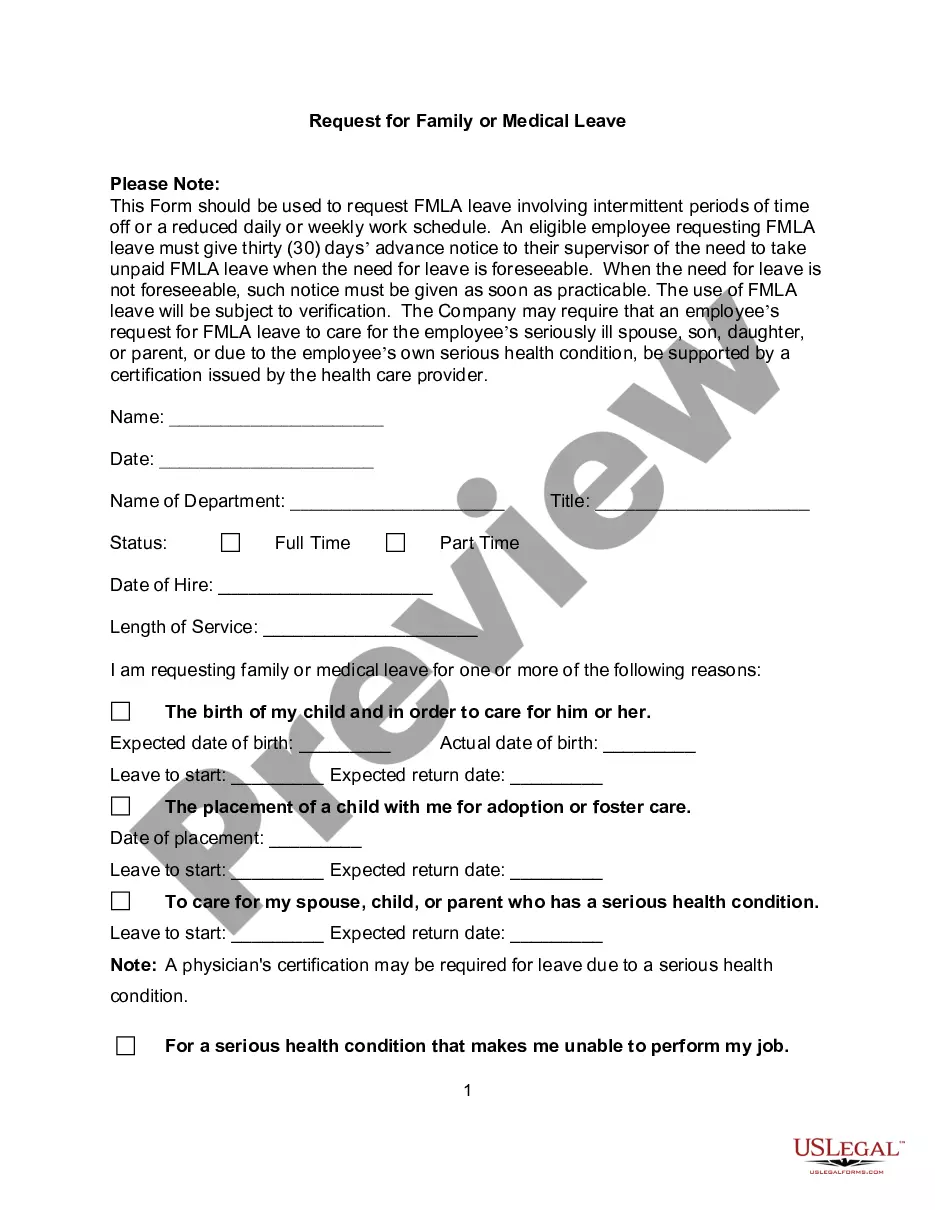

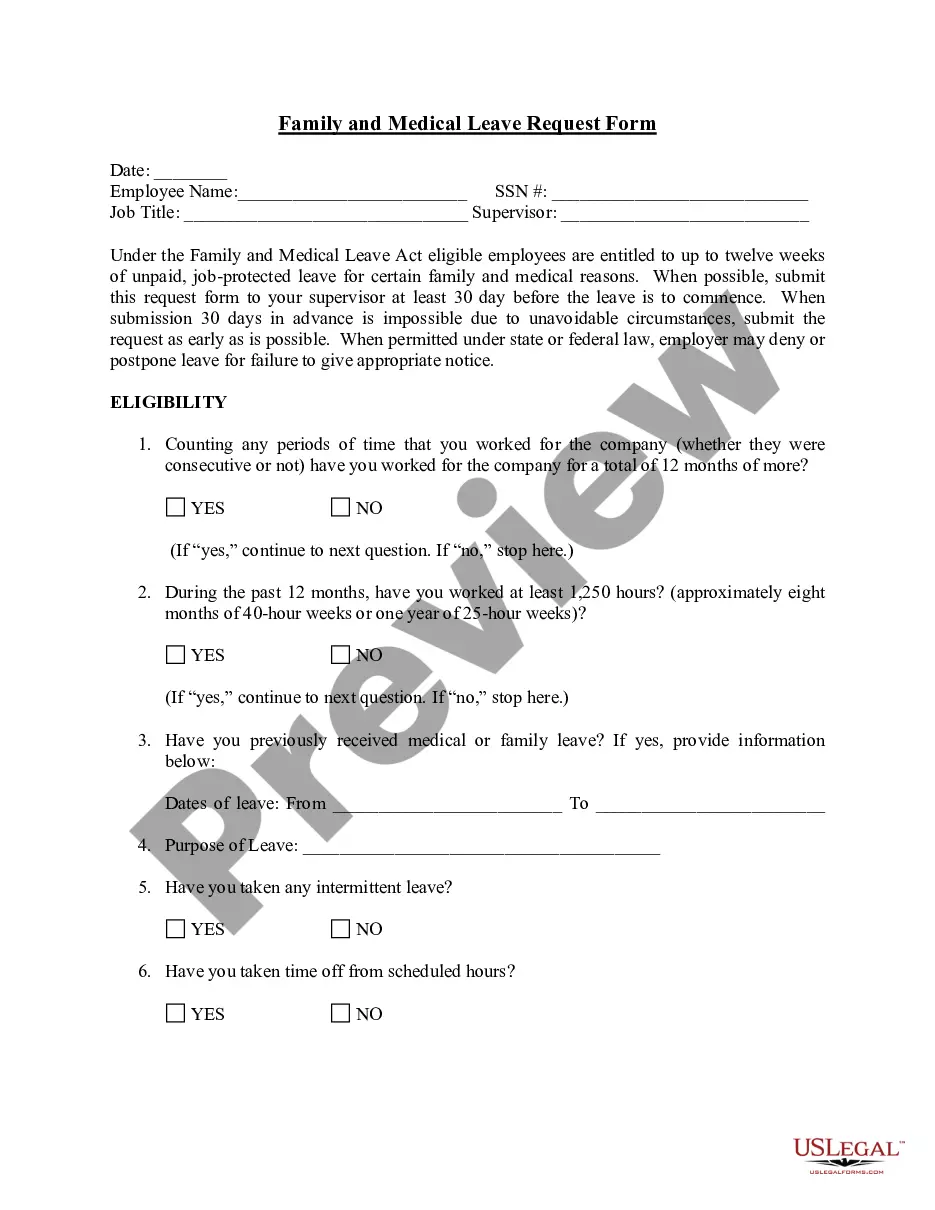

How to fill out FMLA Tracker Form - Year Measured From Date Of Request - Employees With Set Schedule?

It’s widely recognized that you cannot instantly become a legal expert, and you also cannot swiftly master how to draft Fmla Tracking Excel With Data without possessing a specialized skill set.

Creating legal documents is an extensive undertaking that necessitates specific training and expertise. Therefore, why not entrust the preparation of the Fmla Tracking Excel With Data to the professionals.

With US Legal Forms, which boasts one of the most extensive collections of legal documents, you can find anything ranging from court forms to templates for internal communications.

If you need a different template, feel free to start your search anew.

Create a free account and choose a subscription plan to purchase the form. Click Buy now. After completing the payment, you can download the Fmla Tracking Excel With Data, fill it in, print it, and send or deliver it to the appropriate parties.

- We recognize the importance of being compliant with federal and state regulations.

- Our website features templates that are tailored to specific locations and kept current.

- To get started with our site and obtain the document you require in just a few minutes.

- Locate the document you seek using the search feature at the top of the page.

- If available, preview it and review the accompanying description to determine if Fmla Tracking Excel With Data is what you are looking for.

Form popularity

FAQ

The North Dakota (ND) state sales tax rate is currently 5%. Depending on local municipalities, the total tax rate can be as high as 8.5%. North Dakota assesses local tax at the city and county levels, but does not assess local tax for special jurisdictional areas such as school districts or transportation authorities.

Contact information for clerks of district court is available at ndcourts.gov/court-locations. File your completed name change documents with the Clerk of District Court in the North Dakota county where you have resided for at least 6 months before filing the Petition. Note: You'll be asked to pay an $80.00 filing fee.

A North Dakota vehicle power of attorney form is utilized to convey a vehicle owner's authority to make decisions related to the vehicle to an agent. This paperwork will entitle the agent to manage issues involving motor vehicles in North Dakota.

North Dakota has a 5.00 percent state sales tax rate, a max local sales tax rate of 3.50 percent, and an average combined state and local sales tax rate of 6.97 percent. North Dakota's tax system ranks 17th overall on our 2023 State Business Tax Climate Index.

State Car Registration Fees #StateCar Registration Fees33North Dakota$4934Texas$50.7535Massachusetts$6036Idaho$6942 more rows

Changing Your Name After Divorce Publish a Notice of Petition for Name Change in a newspaper. ... Receive Affidavit of Publication from the newspaper. Complete remaining name change documents. Compile any written objections you may receive from the publication.

How much sales tax do I pay when I buy a vehicle? The tax laws impose an excise tax at the rate of 5% on all vehicles purchased either in or outside the State of North Dakota. The tax is payable to the Motor Vehicle Division at the time title application for the vehicle is made.

The North Dakota 5 percent sales tax and 3 percent rental surcharge are imposed on rentals of motor vehicle for periods less than 30 days in this state.