UnitedHealthcare COBRA insurance is a crucial benefit offered to individuals who experience a loss of job or other qualifying events that result in the termination of their employer-sponsored health coverage. COBRA, which stands for Consolidated Omnibus Budget Reconciliation Act, allows eligible individuals to continue their health insurance coverage for a limited period. UnitedHealthcare is a prominent provider of COBRA insurance, offering comprehensive coverage and benefits. COBRA insurance through UnitedHealthcare ensures that individuals can maintain the same level of health insurance coverage they were receiving while employed. This coverage includes various medical services such as doctor visits, hospital stays, prescription drugs, and preventive care. By choosing UnitedHealthcare COBRA insurance, individuals can protect themselves and their families from the potential financial burdens associated with unexpected medical expenses during this transitional period. To maintain UnitedHealthcare COBRA insurance, individuals must meet certain eligibility criteria. These criteria typically include being enrolled in their employer-sponsored health plan before the qualifying event, such as job loss, reduction in work hours, or certain life events like divorce or death of the covered employee. Additionally, individuals must pay the full premium amount, including the portion previously covered by the employer, along with an administrative fee. The duration of COBRA coverage varies depending on the type of qualifying event, but it generally lasts for up to 18 or 36 months. It's important to note that UnitedHealthcare offers various types of COBRA insurance policies tailored to meet different needs. These different types may include: 1. UnitedHealthcare COBRA Standard Plan: This plan provides comprehensive coverage that closely resembles the health plan individuals had while working. It encompasses a wide range of medical benefits and services, ensuring individuals have access to necessary healthcare during their transition period. 2. UnitedHealthcare COBRA Extended Plan: In some cases, qualified beneficiaries may be eligible for an extended COBRA coverage period beyond the standard timeframe. UnitedHealthcare offers an extended plan, allowing individuals to have continuous coverage for a longer duration, if they meet the eligibility criteria. 3. UnitedHealthcare COBRA Dental and Vision Plans: In addition to medical coverage, UnitedHealthcare also provides COBRA insurance for dental and vision needs. These plans ensure individuals can maintain access to important dental and vision services, further safeguarding their overall well-being. By offering a range of COBRA insurance options, UnitedHealthcare aims to provide peace of mind and continuity of coverage for individuals experiencing the loss of employer-sponsored health benefits. Understanding the different types of UnitedHealthcare COBRA insurance allows individuals to choose the most suitable plan to meet their specific needs during this transitional period.

Unitedhealthcare Cobra Insurance

Description

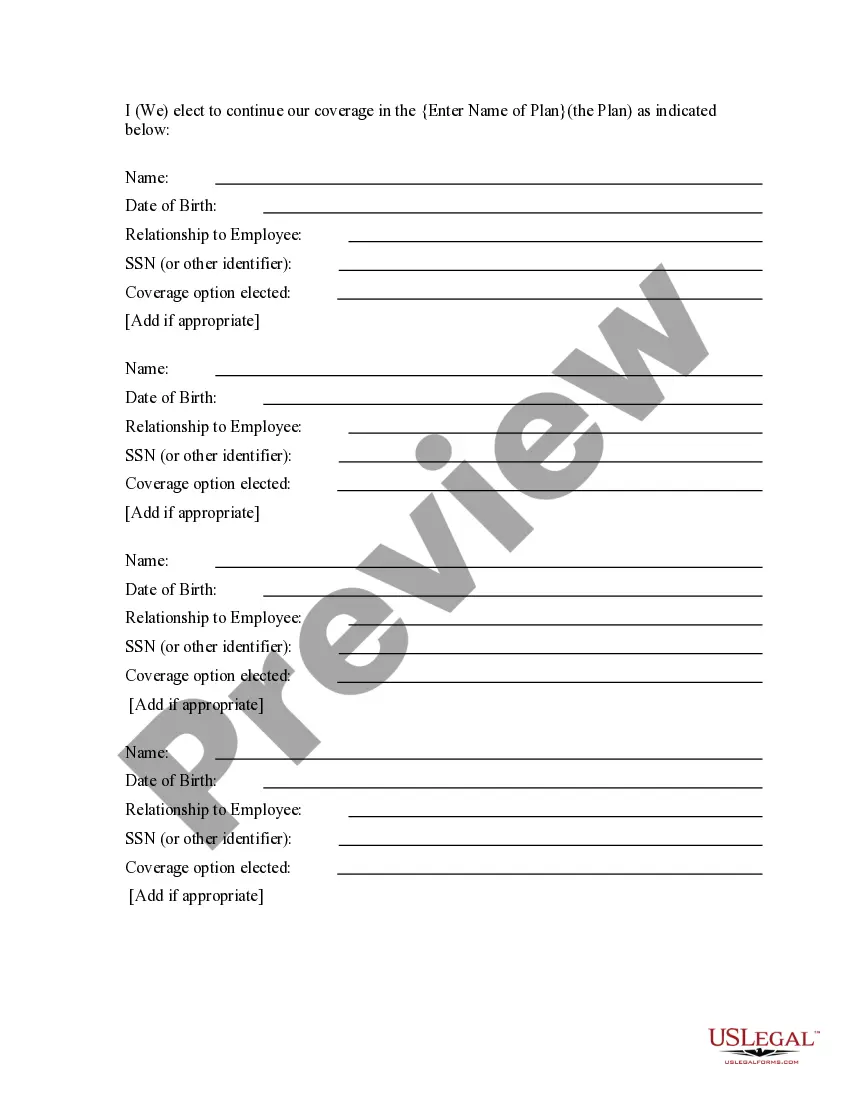

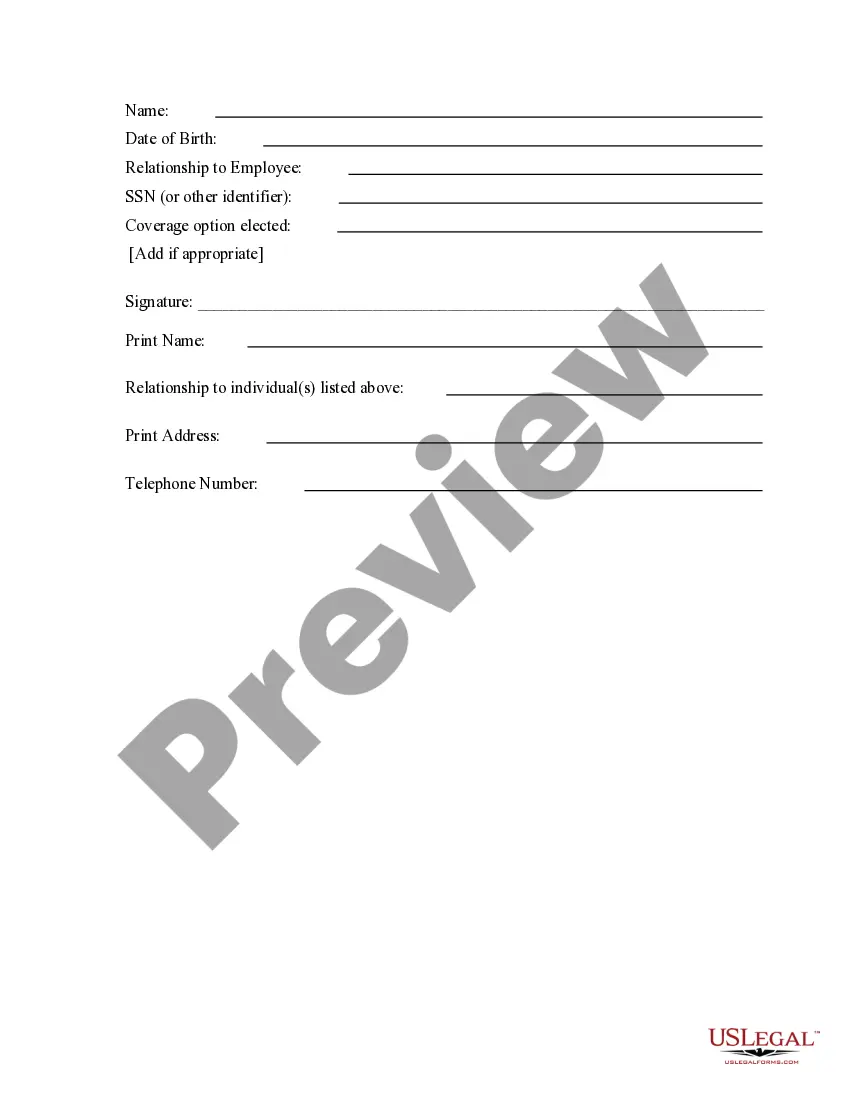

How to fill out Unitedhealthcare Cobra Insurance?

Using legal document samples that meet the federal and state regulations is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the appropriate Unitedhealthcare Cobra Insurance sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are easy to browse with all papers organized by state and purpose of use. Our professionals keep up with legislative updates, so you can always be confident your form is up to date and compliant when obtaining a Unitedhealthcare Cobra Insurance from our website.

Getting a Unitedhealthcare Cobra Insurance is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, follow the guidelines below:

- Take a look at the template using the Preview option or via the text outline to ensure it meets your needs.

- Look for another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Unitedhealthcare Cobra Insurance and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Getting started with COBRA insurance involves a few simple steps. First, confirm your eligibility through your employer’s notification. Next, choose UnitedHealthcare COBRA insurance for your coverage needs and fill out the necessary application. If you find this process overwhelming, you can visit USLegalForms, where you can access templates and guides that make starting your COBRA insurance easy and efficient.

To start your COBRA coverage, first, you must receive a notice from your previous employer informing you of your eligibility. After that, you typically have 60 days to enroll in UnitedHealthcare COBRA insurance. Complete the enrollment forms included in the notice and submit them along with your first premium payment. Make sure to follow the instructions carefully to ensure there are no delays in your coverage.

If you need to contact UnitedHealthcare regarding your COBRA insurance, you can reach their customer service team at 1-800-327-7970. They are equipped to assist you with questions about your policy, coverage options, and any issues you may encounter. Keep your policy details nearby to help them assist you more effectively. Having your membership information ready will make your experience smoother.

To submit a claim to UnitedHealthcare electronically, visit their official website and log into your member account. Once logged in, navigate to the claims section where you can upload your documents and submit your claim for UnitedHealthcare COBRA insurance. Ensure that you have all necessary information handy, such as your policy number and details of your healthcare services. After submission, you will receive confirmation of your claim status.

UnitedHealthcare COBRA is a continuation of health coverage provided through the UnitedHealthcare network when you qualify under COBRA regulations. This insurance allows you to maintain your existing plan benefits even after losing your job or experiencing other qualifying events. It provides peace of mind by ensuring continued access to necessary healthcare services during transitional periods.

Many individuals find that Unitedhealthcare COBRA insurance is worth it due to the ability to retain their current health care providers and plan benefits. It offers continuity, which is crucial during transitions, such as job changes or family expansions. However, it is important to assess your financial situation and health needs to determine if COBRA is the best choice for you.

Generally, once you elect your UnitedHealthcare COBRA insurance and submit your payment, your benefits should begin shortly thereafter. The timeline may vary slightly depending on processing times, but coverage often kicks in within a few days of enrollment. It is advisable to check directly with your benefits administrator for specific details on your start date.

To initiate COBRA coverage, first confirm your eligibility following a qualifying event. Then, reach out to your former employer or their benefits administrator for the necessary paperwork. You will need to complete the forms and submit them along with your premium payments to activate your UnitedHealthcare COBRA insurance coverage.

COBRA insurance does not start automatically. After you experience a qualifying event, such as losing your job, you must be notified of your COBRA eligibility. Then, you can choose to enroll in UnitedHealthcare COBRA insurance within a specified time frame. It is essential to act quickly to ensure you get the coverage you need.

Yes, you can fill out the COBRA forms online through the UnitedHealthcare website. This digital option streamlines the process and allows for easy submission of your application. Using the online platform also helps you keep track of your status for UnitedHealthcare COBRA insurance.