The Appraisal Form 1025 with 216 is a widely-used document in the real estate industry for evaluating the market value of residential properties. This form is specifically designed to assess multifamily properties containing five or more units. Appraisal Form 1025 is the standard form utilized by appraisers to complete a thorough analysis of the property's characteristics, condition, and market conditions. It consists of various sections that allow for a comprehensive evaluation, including property description, income analysis, cost approach, and sales comparison approach. The form requires appraisers to provide detailed information about the property, such as its location, size, and physical features. Additionally, it includes sections for assessing the income potential of the property, including rental income, other income sources, and operating expenses. Furthermore, Appraisal Form 1025 with 216 incorporates the 216 operating income statement. This section is crucial for estimating the income-producing capabilities of the property. It includes a breakdown of both prospective and historical income and expenses, enabling the appraiser to assess the property's financial viability accurately. Different variations or types of Appraisal Form 1025 with 216 may include updates or revisions to the form to accommodate changing industry standards or regulatory requirements. These revisions ensure the form remains up-to-date with the latest appraisal guidelines and practices. When completing Appraisal Form 1025 with 216, appraisers must conduct thorough research, analyze historical data, and consider current market trends to determine an accurate and fair market value for the property. This information is vital for various purposes, such as mortgage lending, property transactions, taxation, and investment decision-making. In conclusion, the Appraisal Form 1025 with 216 is a comprehensive document used to evaluate multifamily residential properties. By utilizing this form, appraisers can effectively assess the market value of a property based on its characteristics, income potential, and market conditions.

Appraisal Form 1025 With 216

Description what is a 1025 appraisal

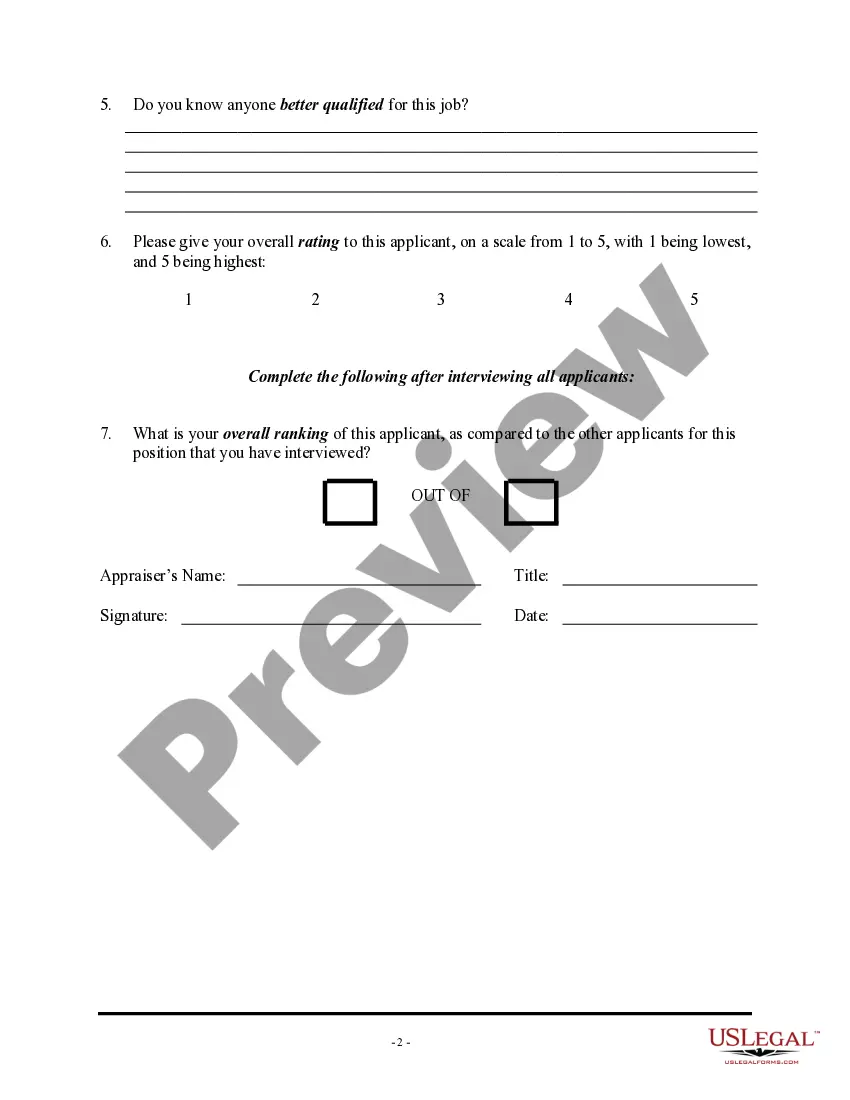

How to fill out Appraisal 1025?

Accessing legal document samples that meet the federal and state laws is essential, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the right Appraisal Form 1025 With 216 sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are easy to browse with all papers organized by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your form is up to date and compliant when getting a Appraisal Form 1025 With 216 from our website.

Obtaining a Appraisal Form 1025 With 216 is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the steps below:

- Examine the template utilizing the Preview option or via the text description to make certain it meets your needs.

- Look for another sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Appraisal Form 1025 With 216 and download it.

All templates you locate through US Legal Forms are reusable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

form 1025 Form popularity

what is a 1025 form Other Form Names

1073 form in us mortgage FAQ

Form 216 - Application for Foreign-Trade Zone Activity Permit | U.S. Customs and Border Protection.

What is the difference between 1007 and 216? Fannie Mae Form 1007 is used to provide an estimated market rent for the subject. Fannie Mae Form 216 is used to estimate the operating income associated with income-producing property.

Description of Operating Income Statement Report-216 Form: Income and Expense projections are provided by the applicant to be used in determining income approach to value.

2-4 Unit Residential Appraisal (Form 1025) This report provides an income analysis based on comparable rental properties, cost approach, and the sales comparison analysis. Included in the attachments is a completed operating income statement (Form 216).

Description: This report is similar in all respects to the standard Single Family Residential Appraisal with the following additions: A completed Single Family Rent Schedule (form 1007) and an Operating Income Statement (form 216). 1004, w216 and 1007 - PCV Murcor PCV Murcor ? ... ? Appraisal Product List PCV Murcor ? ... ? Appraisal Product List