Sample Independent Contractor Agreement With 1099 Form

Description with 1099 download

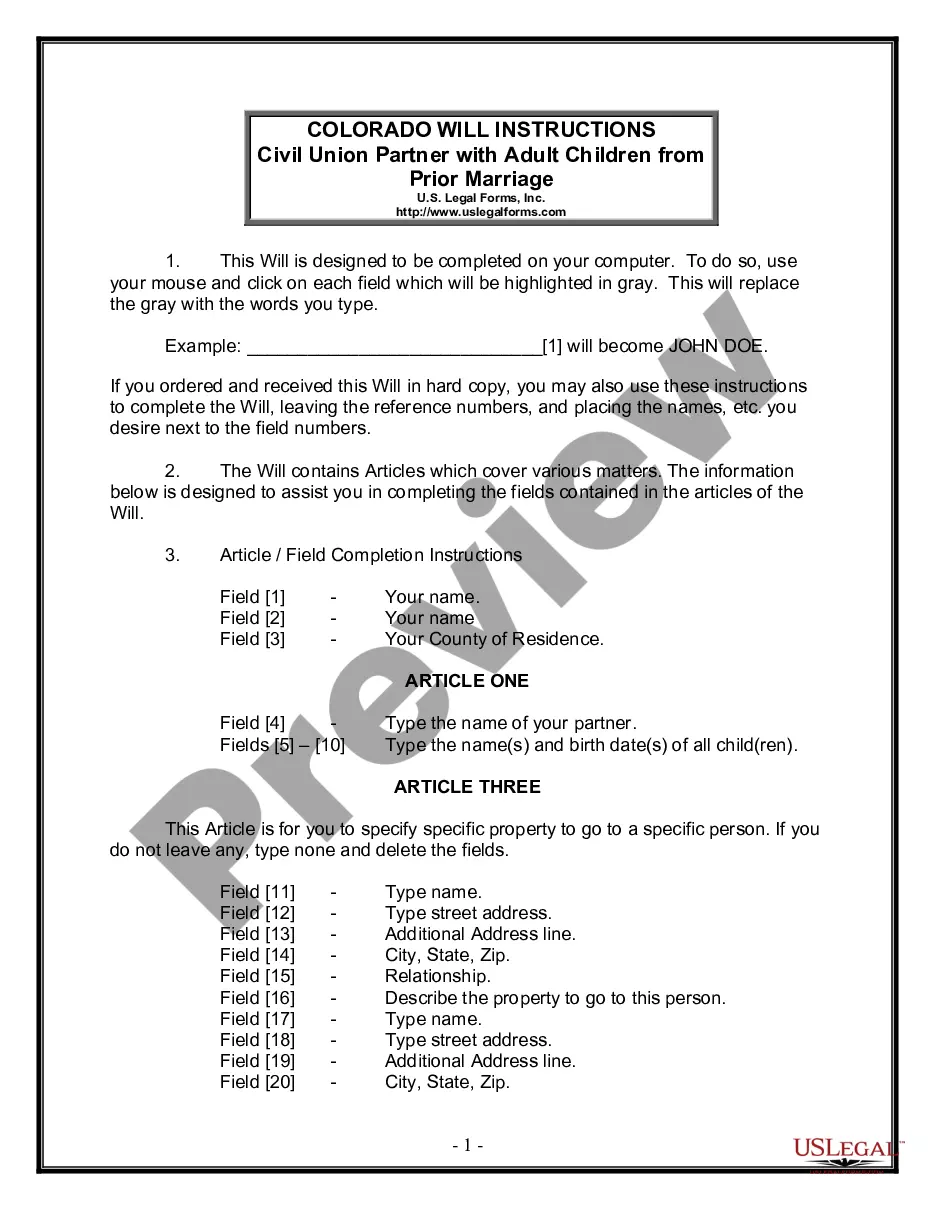

How to fill out Sample Contractor Agreement?

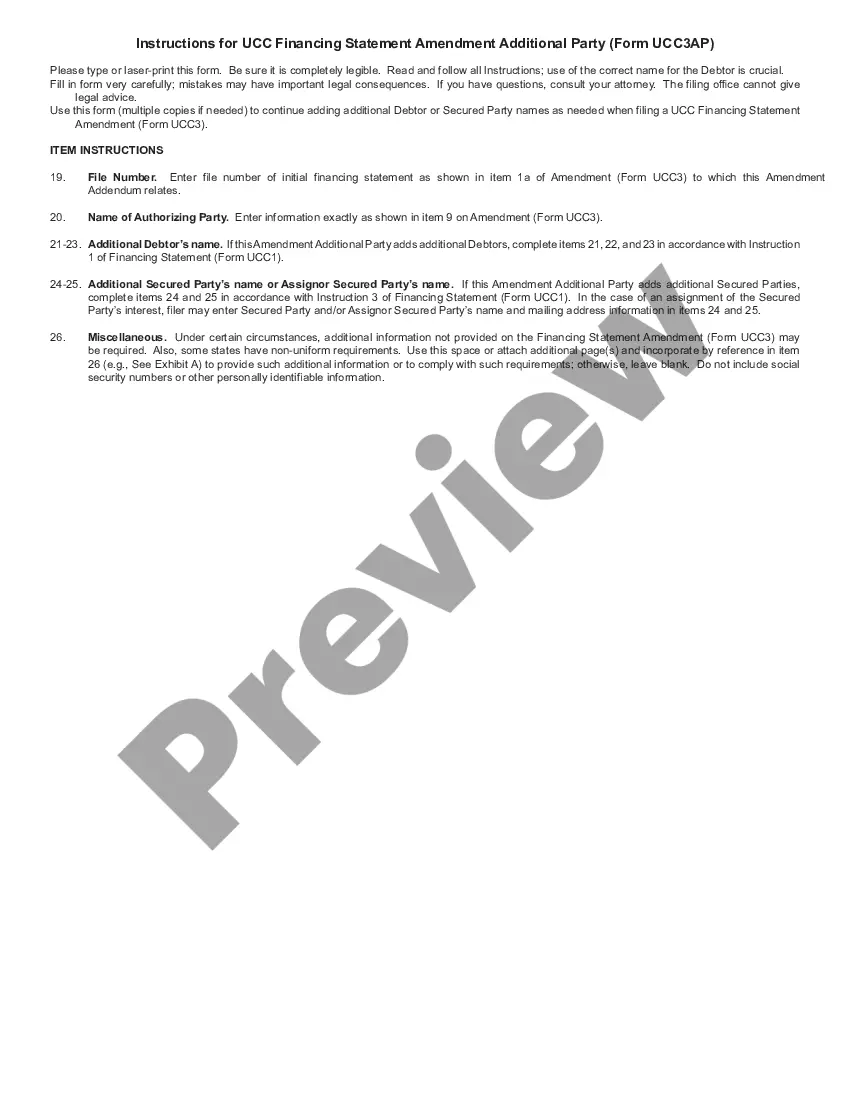

When you need to finalize a Sample Independent Contractor Agreement With 1099 Form that adheres to your local state's laws, there can be numerous options to choose from.

There's no need to check every document to ensure it fulfills all legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

- US Legal Forms is the largest online catalog with a collection of more than 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's laws and regulations.

- Thus, when downloading the Sample Independent Contractor Agreement With 1099 Form from our platform, you can be confident that you possess a valid and current document.

- Acquiring the necessary sample from our site is very simple.

- If you already have an account, just Log In to the system, verify that your subscription is active, and save the selected file.

- Later, you can visit the My documents tab in your profile and maintain access to the Sample Independent Contractor Agreement With 1099 Form anytime.

- If it's your first time using our library, kindly follow the instructions below.

- Browse the suggested page and verify it for conformity with your criteria.

sample 1099 contract Form popularity

with 1099 pdf Other Form Names

contractor agreement with FAQ

The entire agreement should cover the following:General information about the contractor and client.Services and scope of work.Permission to hire subcontractors.Equipment and facilities.Compensation for the services provided.Expenses, travel, and reimbursement policies.Effective date of the agreement.More items...?

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.